- India

- International

Local lockdowns cushion impact of second wave but deeper fear hits spending, demand

The absence of a stringent nationwide lockdown has been a silver lining, it has ensured that industrial economic activity continued even if at a reduced level.

Streets of Delhi remain deserted owing to the ongoing lockdown. (Express Photo: Amit Mehra)

Streets of Delhi remain deserted owing to the ongoing lockdown. (Express Photo: Amit Mehra)AS states begin cautiously calibrating how to unwind their lockdowns beginning June, they face a double challenge. Key indicators show that industry and business activities may not be as adversely hit by the second Covid wave as they were by a national lockdown last year, but they are still very vulnerable given the low vaccination levels among the larger, younger population.

And at the individual and household level, public fear and anxiety this time are deeper and have hit consumption and demand harder than last year on several accounts.

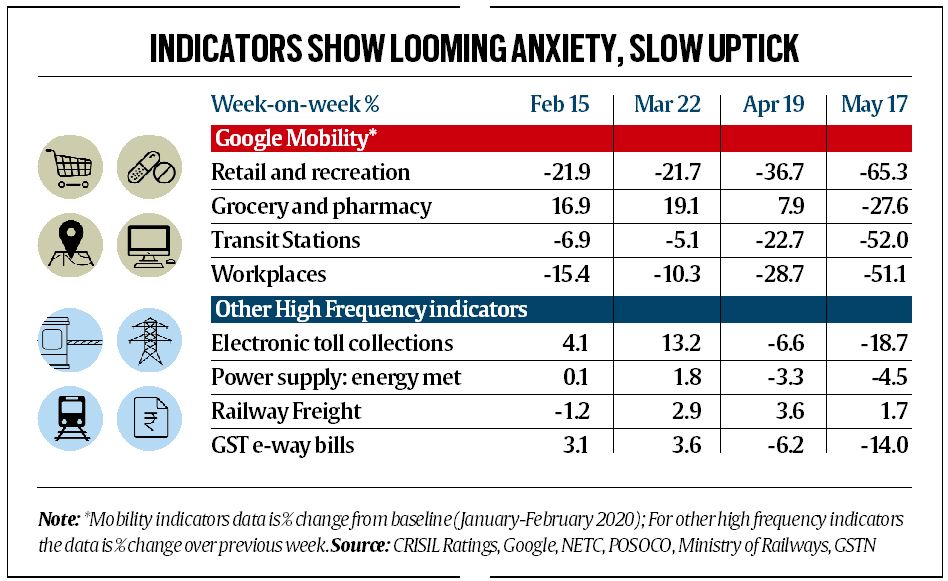

So Google mobility and other high-frequency data, until third week of May (see chart), point towards decline in activity on all fronts including retail, grocery, transit stations and toll collections as compared to March and April.

For example, according to Google mobility data, visits on May 18, 2020 (Monday), to grocery and pharmacy stores were down 21% compared to a pre-Covid base line. This year, on May 17, 2021 (Monday), the corresponding decline was sharper at 27.6%. Similarly, for workplaces, visits were down 45% on May 18 last year but down 51% this year.

Experts attribute this to a deeper sense of anxiety given the intensity of the wave, the death toll and the sense of vulnerability exacerbated by the shortage of vaccines.

The absence of a stringent nationwide lockdown has been a silver lining, it has ensured that industrial economic activity continued even if at a reduced level. So while several auto manufacturers and their vendors shut their plants in the first half of May, they have gradually started production — though in most cases in only one shift.

“The adverse impact on sequential growth is less severe than in the June 2020 quarter (-24% QoQ), as lockdowns are more targeted and localised,’’ said Tanvee Gupta Jain, Economist, UBS Securities India.

“A few states have started announcing limited relaxation…which bodes well for a sequential pick-up in economic activity from June onward. Still, it is increasingly possible that normalcy returns only by July.”

Some key data points indicate that the fall in activity in April and May this year was less severe and so a pick up-is expected to be sooner rather than later. Port container traffic at JNPT (Jawaharlal Nehru Port Container Terminal) was down 9% MoM (month-on-month) in April 2021; this is compared with a decline of 36% MoM registered at the same time last year.

While traffic congestion is down close to 20% as on May 23, the state-wise trend indicates improvement in cities, including Mumbai and Pune.

“Power demand has continued to contract (-7.6% week-on-week as on May 23) but the decline in railway freight seems to have plateaued. Vehicle registrations, which had a marked decline (-42% since April), have started improving sequentially (+3.4% WoW),” said UBS Securities India.

At the individual and household level, though, concerns remain.

While constraints on manufacturing are easing, the challenge is to restore economic activities across service sectors that employ many more people, said Naushad Forbes, co-chairman, Forbes Marshall.

Indicators, including GST e-way bill collections, power consumption and electronic toll collections mostly indicate a sharp fall in May. Sectors like pharma, IT, financial services continue to show relative resilience when compared to high-contact sectors like restaurants, cinemas, hospitality, aviation and automobiles, among others.

“We must see how we can restore the retail sector — small shops that employ people. If that remains closed, not only the people employed there will be without jobs, it will hurt demand as people won’t be buying and that impacts the supply chain and demand. I think we can restore retail in a safe manner. What we can’t do safely is restaurants, movies and other areas that involve public gatherings,” said Forbes.

Some industry leaders do not see a sharp uptick in economic activity over the next “two to three months” and urge caution in opening up. Speaking to The Indian Express,Uday Kotak, CII president and MD of Kotak Mahindra Bank said ramping up vaccination to around 15 crore a month by August would provide a cushion for gradual opening up.

CJ George, MD of Geojit Financial Services, said fear is pervasive and economic activity needs the booster shot. “Only vaccination can provide the confidence. The speed at which we vaccinate is the speed at which the risk-taking will go up. Migration of labour has to start and that will also pick up with vaccination,” said George.

That’s a challenge. Forbes said that although companies are organising vaccination for workers between 18 and 45, many would “not feel safe until they get the second shot and that can happen only after a long gap of, say, three months as there has been a change in rules.” That can be a new constraint,” said Forbes.

As the lockdown duration differs from state to state, the economic impact will also be varied. Maharashtra, which accounts for 14% in India’s GDP and clocks the highest Covid case count, has not seen a very sharp decline in mobility, despite being the first major state to announce lockdown-style restrictions.

States such as Karnataka, Kerala, and Delhi, among the most affected during the second wave, have seen large declines in mobility during this period. Having higher dependency on contact-based services in their output, this makes them more vulnerable, Crisil has noted.

In Andhra Pradesh, Madhya Pradesh, Punjab, and Rajasthan, the higher output share of agriculture may cushion the second wave’s shock.

“There is more fear this time around and people are more cautious in spends and are saving more which will have an impact on consumer behaviour…It is clearly an area of concern and this is where I believe that the time has come for the state to get more active and I would strongly support fiscal support coming in for protecting livelihood and minimum requirement of individuals and households,” said Kotak.

May 07: Latest News

- 01

- 02

- 03

- 04

- 05