Unwrapped Unwrapped |

Paytm and the art of going public

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.

Good morning,

Hi, Ashwin and Digbijay here. Earlier this week, we reported that Paytm’s board has given a go-ahead for an IPO by November. The news got almost everyone questioning the timeline drawn up by the company, along with the reported valuation it could fetch when it lists.

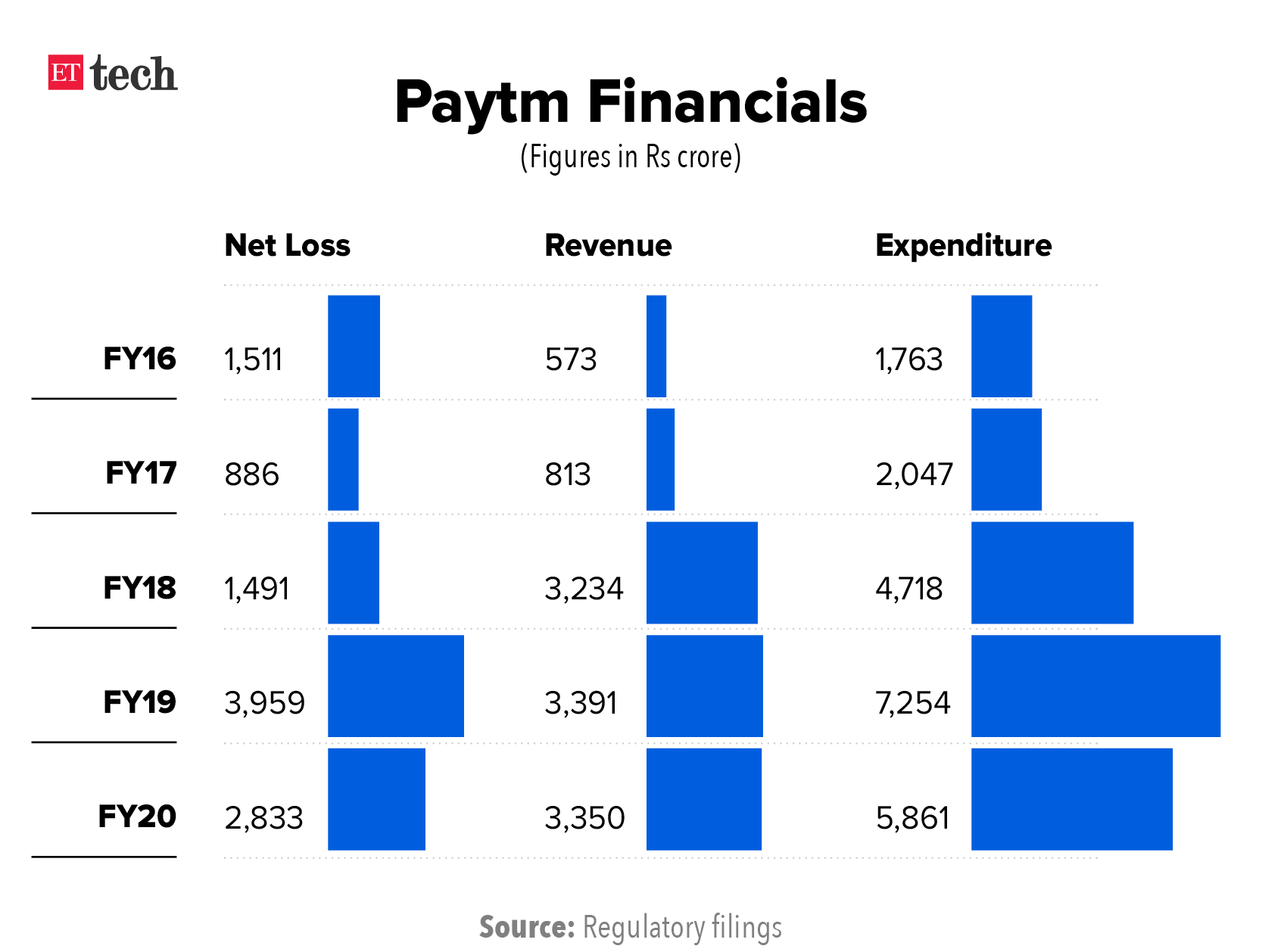

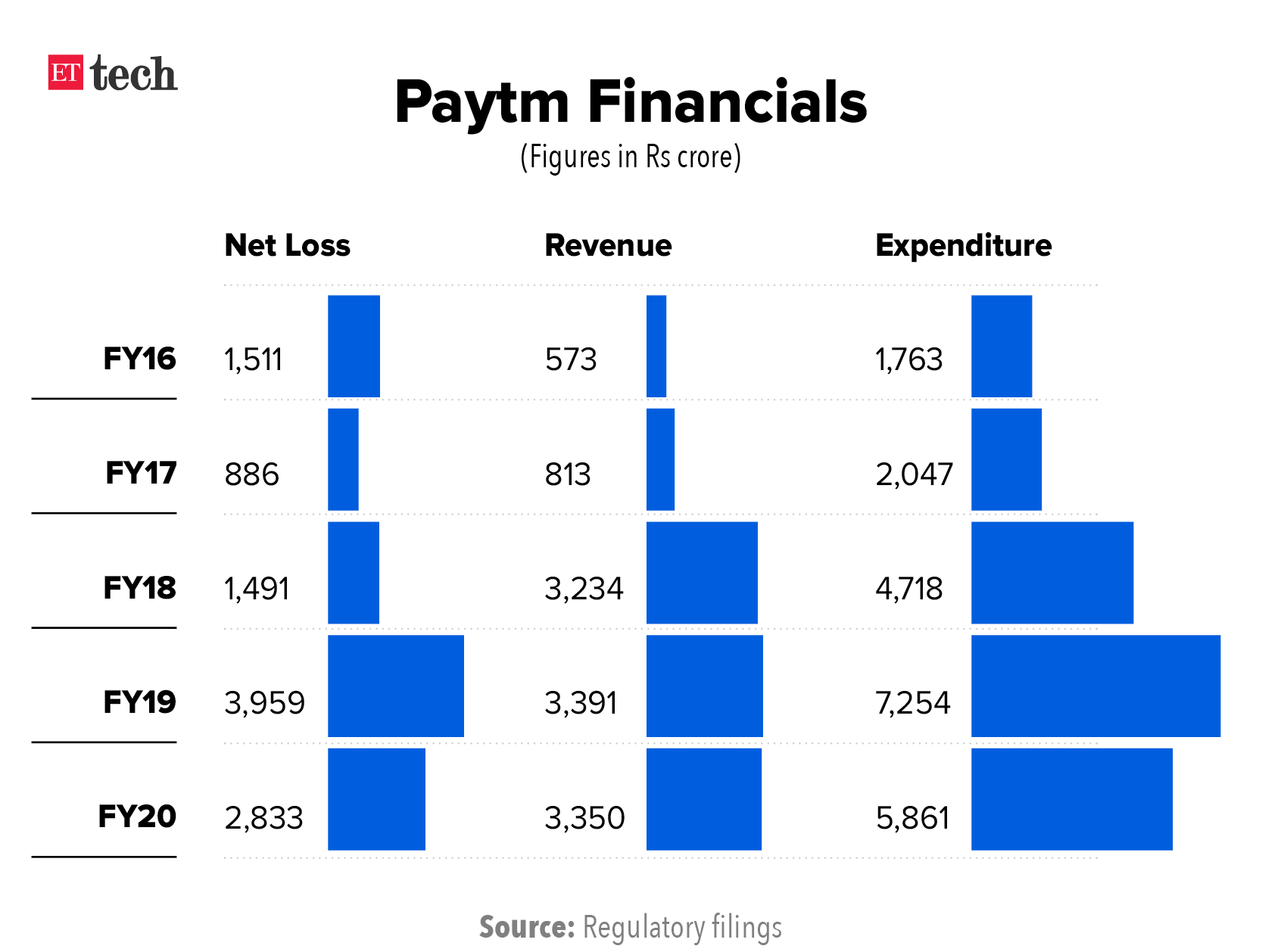

Drop the notion that IPOs are just about raising money and you might understand why a loss-making company with flattish revenues, and competition from Google, Amazon, Walmart-backed PhonePe and Facebook’s WhatsApp, just gave itself six months to go public.

Paytm founder Vijay Shekhar Sharma

Paytm founder Vijay Shekhar Sharma

An IPO is more than just a money-raising exercise. It’s an invitation to public scrutiny every quarter, a commitment to age-old regulatory codes, and more significantly, a vote of public confidence in a company.

A successful IPO, therefore, automatically elevates a company’s reputation and brings in a certain degree of legitimacy to its operations in the public eye -- and also in the eyes of the regulator. A publicly listed company has stringent disclosure norms, a corporate governance code and a perpetual obligation to deliver returns to its retail and institutional owners.

Some facts about IPOs in India:

1) There are only four companies in India to date that have raised a public issue of over Rs 10,000 crore.

2) The country’s largest IPO was that of Coal India, which raised Rs 15,200 crore in 2010.

3) The next four mega IPOs were those of Reliance Power, GIC, ONGC and New India Assurance.

4) Four out of India’s five largest IPOs were those of state-owned companies.

So, when headlines emerged that Paytm, owned partly by Jack Ma’s Ant Financial (now renamed Ant Group) – will attempt to raise $3 billion (about Rs 24,000 crore) from the public market at a $25-30 billion valuation, more than a few eyebrows were raised.

Remember, this is not the first time Vijay Shekhar Sharma-led One97 Communications is planning an IPO. In 2010, when it was a telecom VAS firm (and nowhere close to Paytm's current avatar) it had filed a draft red herring prospectus with Sebi with plans to raise Rs 120 crore but postponed it to later in the year citing volatile markets.

The company, as we have reported, wants to go public in October-November, during the festive season. This would mean that it is already operating in highly constrained timelines. It will have to:

1) File the draft red herring prospectus by July.

2) Conduct roadshows and rallies by August.

3) Finish the compliance processes, down to last detail, by September.

It’s a Herculean task. Why would Paytm want to rush this, especially when company insiders confidently claim that it still has a big chunk of the $1 billion from its 2019 funding round in the bank.

This begs the question: What could be the deeper, more significant purpose of this IPO? Let’s look at where Paytm currently stands.

The company is in the midst of an ambitious pivot from the digital payments poster child of yesteryear to a financial services conglomerate that doesn’t just aggregate and distribute financial products of other licensed companies but also manufactures its own products, from loans to insurance policies. In short, think Ant Group and its model.

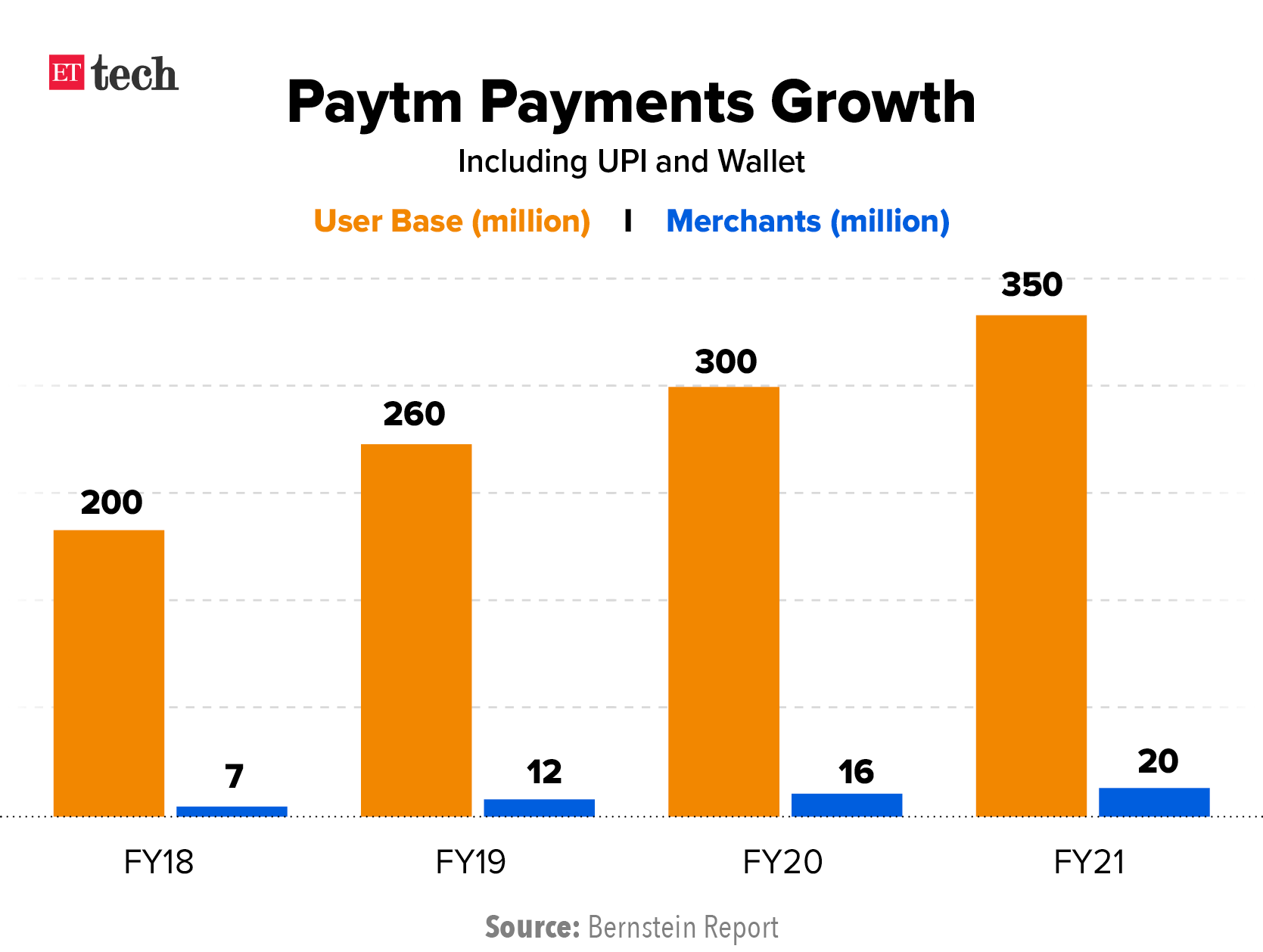

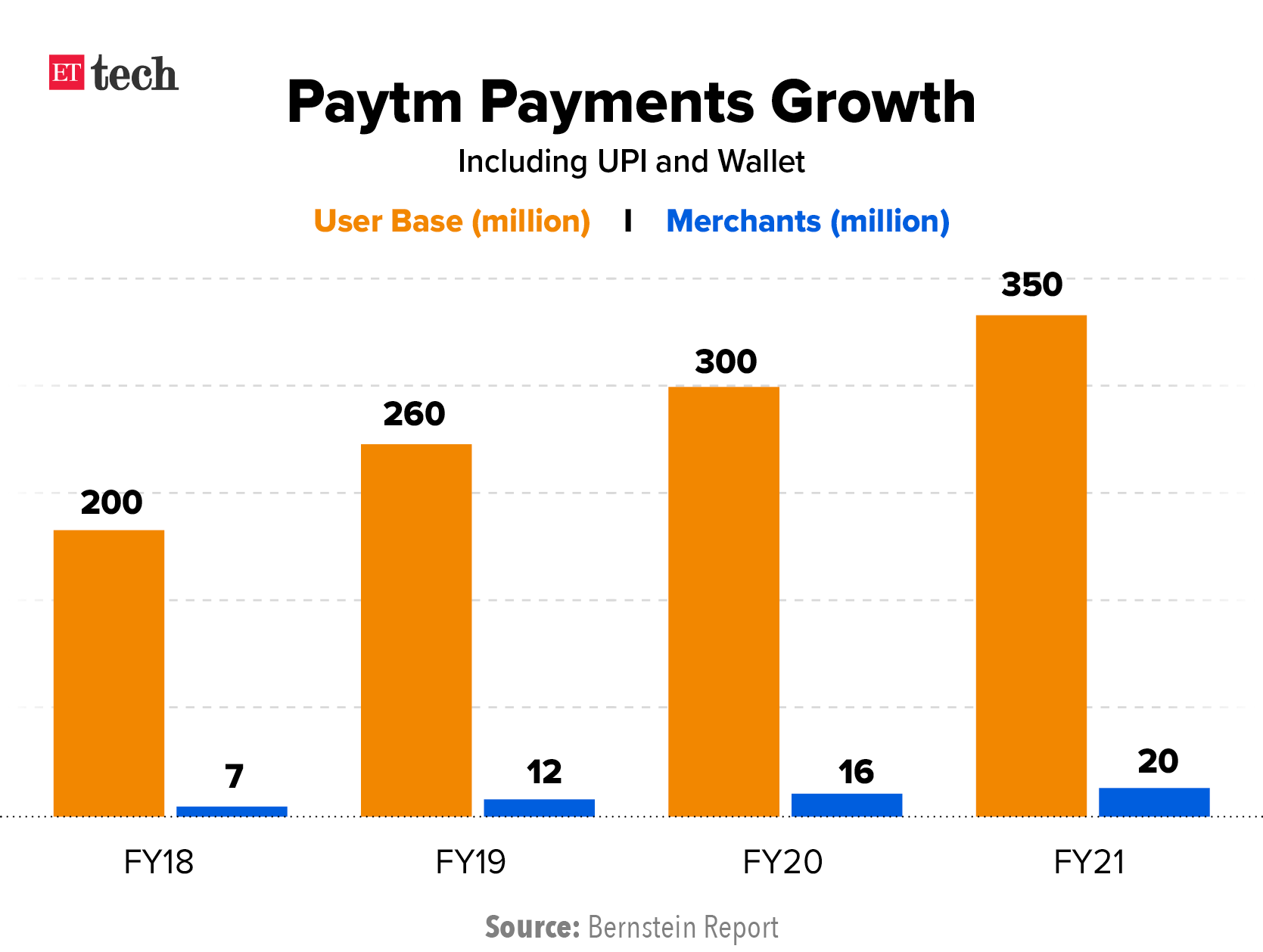

According to a recent Bernstein report published on the same day Paytm’s IPO news hit the internet, the company’s future profitability hinges on the success of two upcoming verticals -- credit and insurance.

For a profitable financial conglomerate, a balance sheet with margin accretive income sources – premiums from policyholders and interest from borrowers -- is a must. Paytm has learnt this the hard way. Despite building one of the best payments platforms for UPI and digital wallets in India, its payments business doesn’t make any money.

Well, then what’s happening with Paytm’s credit and insurance businesses?

The company has applied for both an insurance and a non-banking financial company (NBFC) licence. Its ambition to convert its Payments Bank into a Small Finance Bank is also well documented. However, it seems the RBI and insurance regulator Irda are not sold, at least not yet.

It’s been nearly a year since the applications were submitted. Why the regulators haven't cleared the proposals yet is anyone’s guess.

So, it is a question as good as any to ask: What could a successful public listing do for the firm and its pending regulatory clearances?

A source close to the company tells us that a successful IPO is a well-established practice to curtail the ownership and influence of private investors in any firm. In the case of Paytm, there are a few – China’s Ant Group, Japan’s SoftBank and venture capital firm Elevation Capital, and US’s T Rowe Price, among others.

SoftBank Vision Fund’s CEO told us this week it doesn't want to exit Paytm in the near term. However, Ant Group, part of Chinese e-commerce group Alibaba, could dilute its stake. That would be more than 'just an exit.' Chinese money in Paytm has always been scrutinised and this scrutiny has only increased since last year, when border tensions erupted between India and China.

Read our full interview with SoftBank Vision Fund CEO Rajeev Misra

It’s worth noting that Ant Group, in its IPO prospectus in August 2020, listed Paytm as one of the companies on which it had 'significant influence'. The Chinese government later stopped the IPO, citing regulatory issues.

Now, would Paytm Public Ltd, under the watchful purview of Sebi, have a better shot at building a profit-making financial conglomerate than it has in its current avatar, having to fight for legitimacy every step of the way?

These are the questions we believe are important to ask. As for how Paytm’s IPO saga will play out this time, your guess is as good as ours.

Let's move on to other big developments of the week

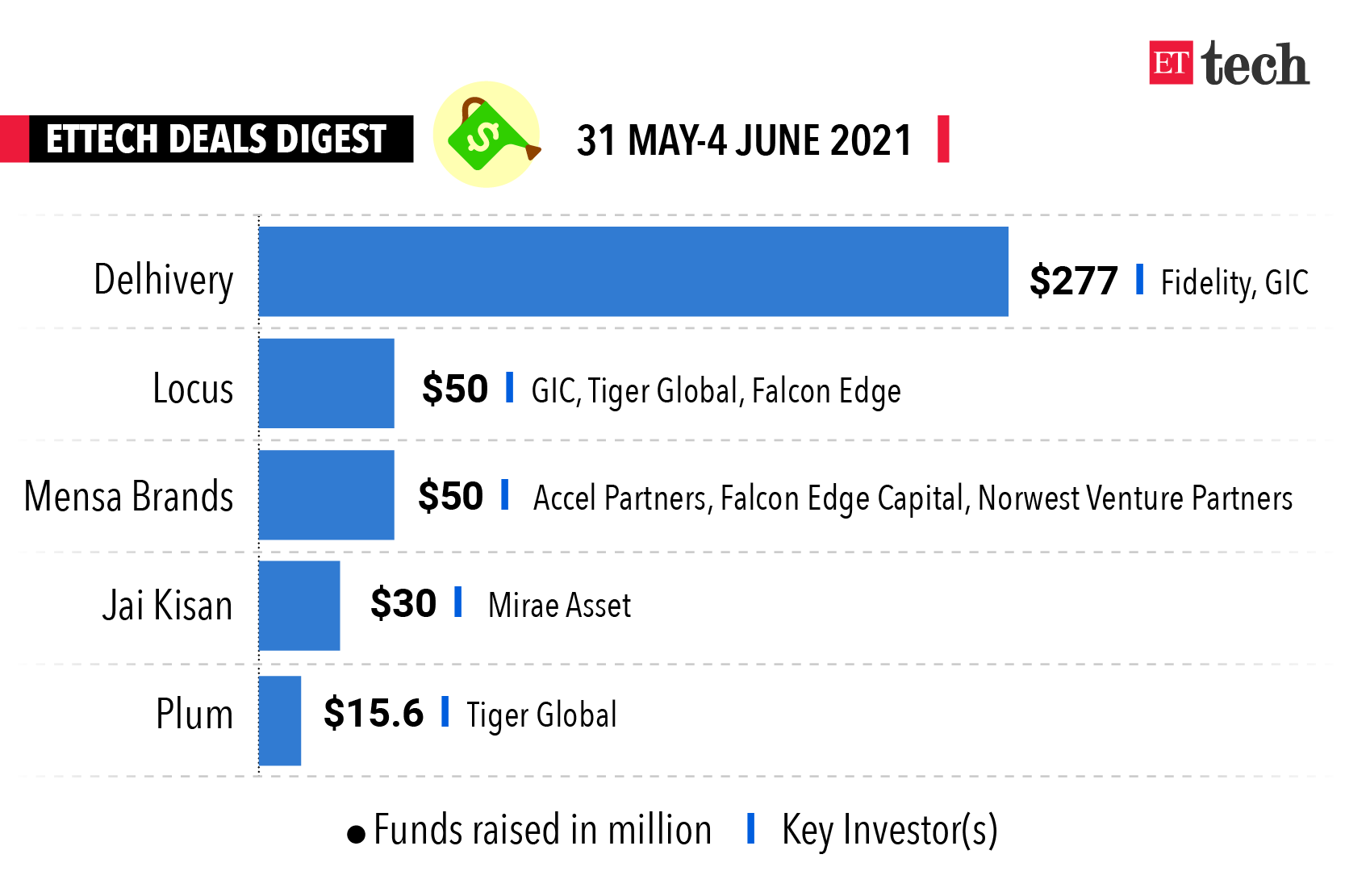

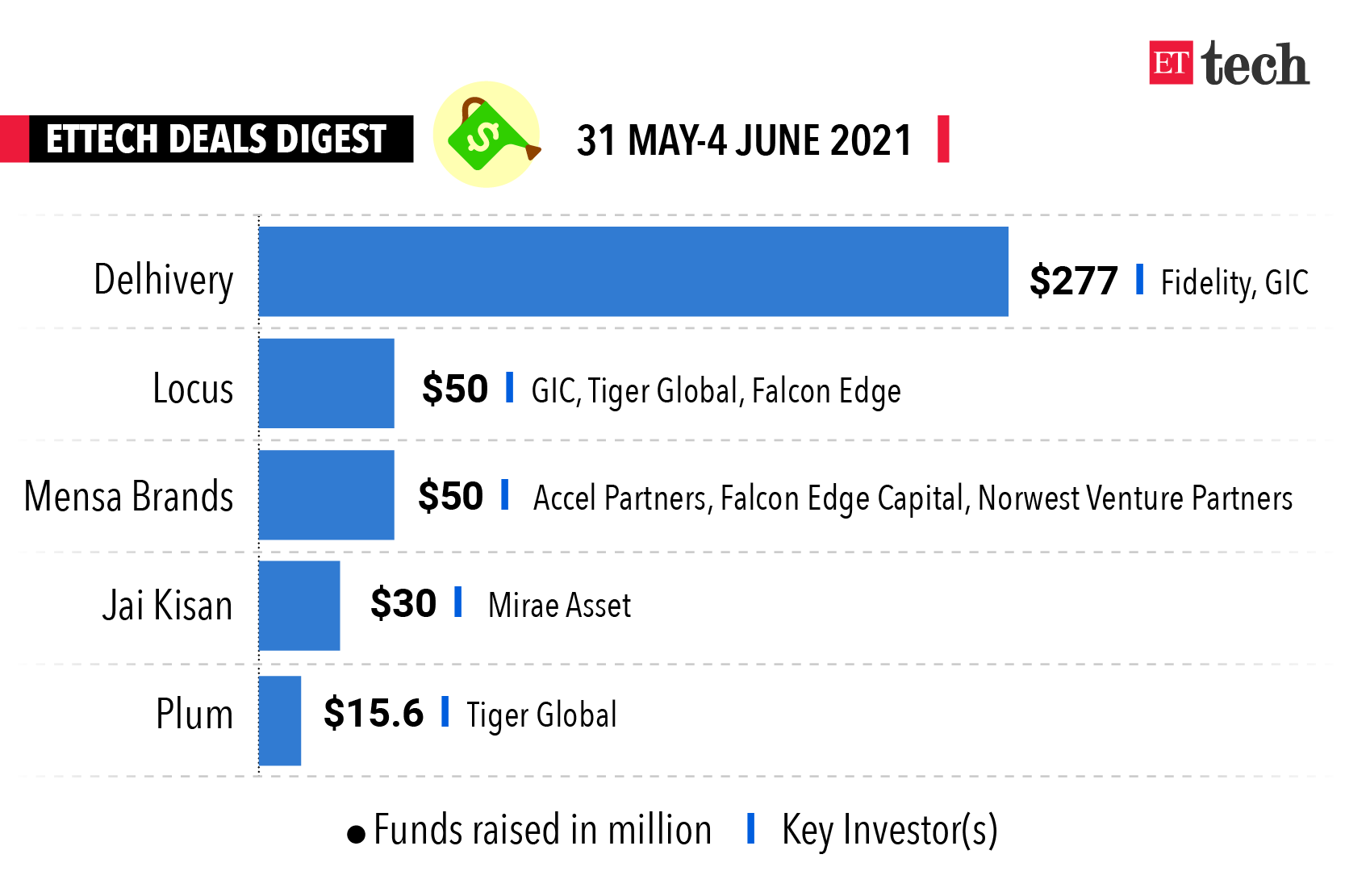

ETtech DEALS DIGEST

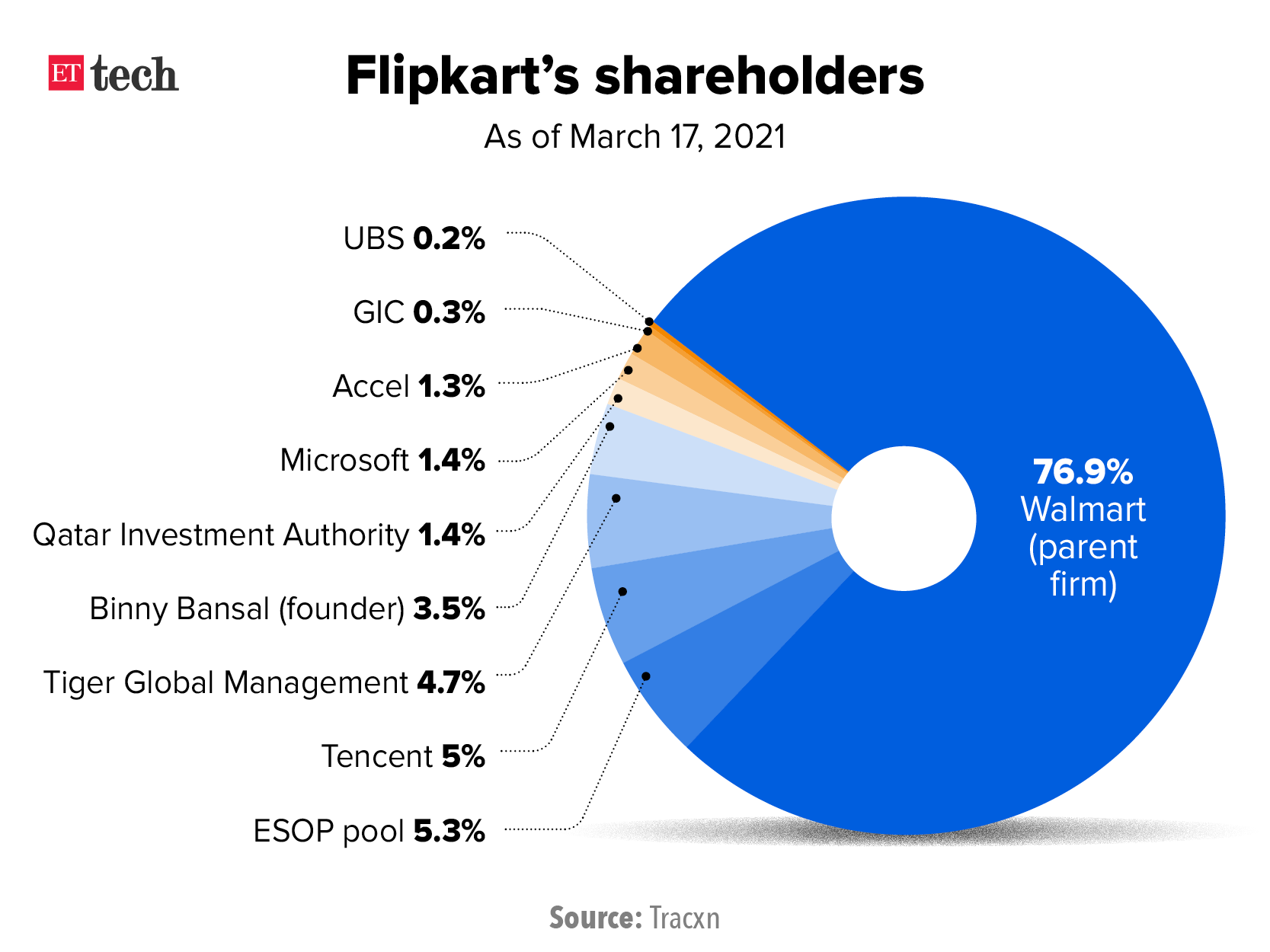

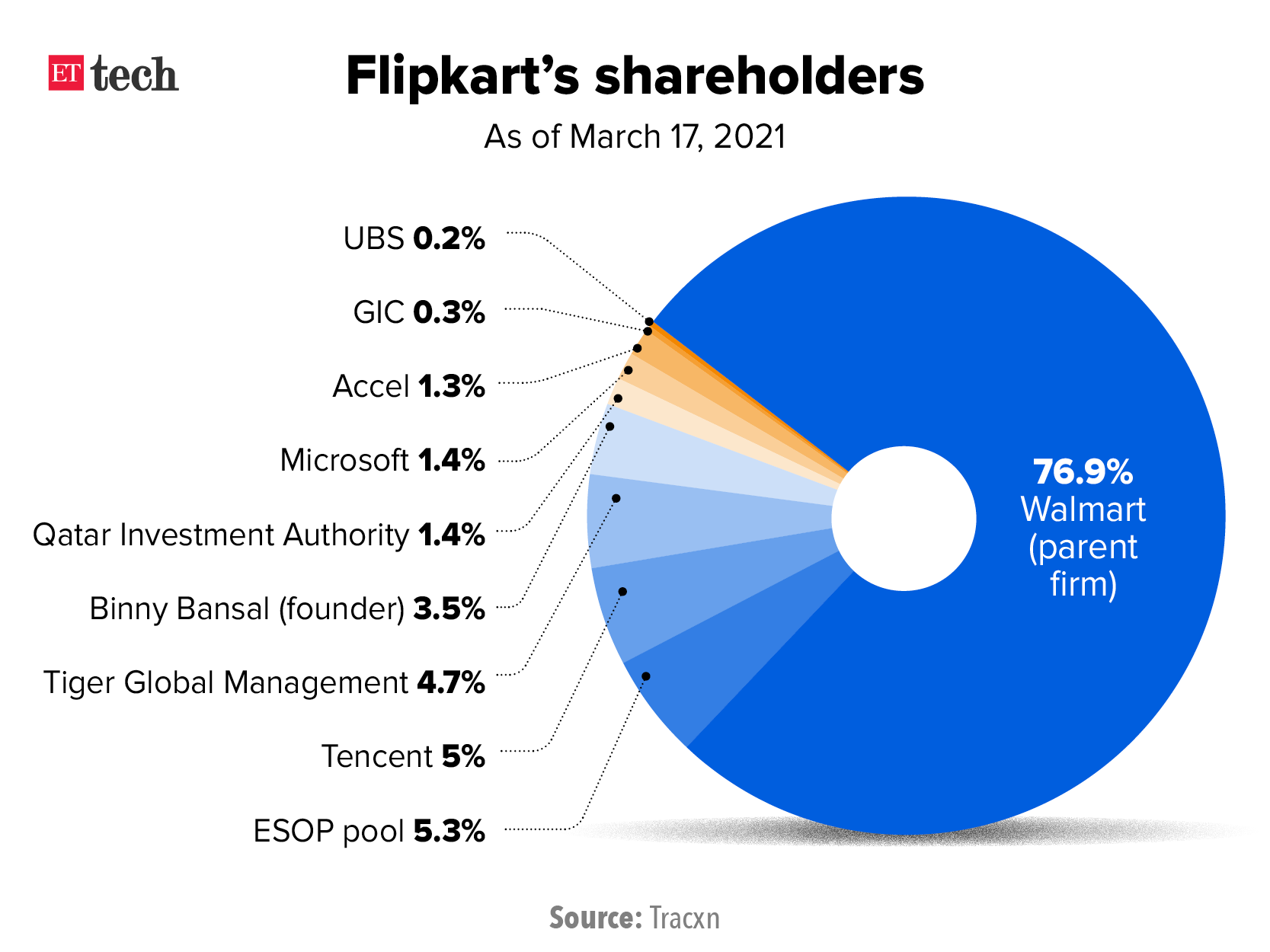

■ SoftBank Vision Fund has held discussions with Flipkart to invest around $600-700 million, three years after the Japanese group exited the Walmart-owned online retailer. The funding is part of a larger $2 billion round which could see the participation of a group of sovereign wealth funds like Abu Dhabi’s ADQ, Canada’s CPPIB, as well as the company’s existing investors such as GIC and Qatar Investment Authority. The round will likely to value the Bengaluru-based firm at $25-30 billion, sources told ET.

■ Business-to-business (B2B) e-commerce platform OfBusiness is in talks with Japan’s SoftBank Group to raise $100-150 million at a valuation of $1.2 billion, two people in the know of developments told ET. The startup was last valued at around $800 million in April when it closed a $97 million round led by Falcon Edge. Some angel investors and employees sold shares in the funding round, taking the total size to $113 million.

■ Sleep and home solutions firm Wakefit is in talks with L Catterton Fund and other US and Indian investors to raise primary capital of $40-50 million (Rs 300-350 crore), three people aware of the development told ET. The deal will likely value the company at $350-400 million.

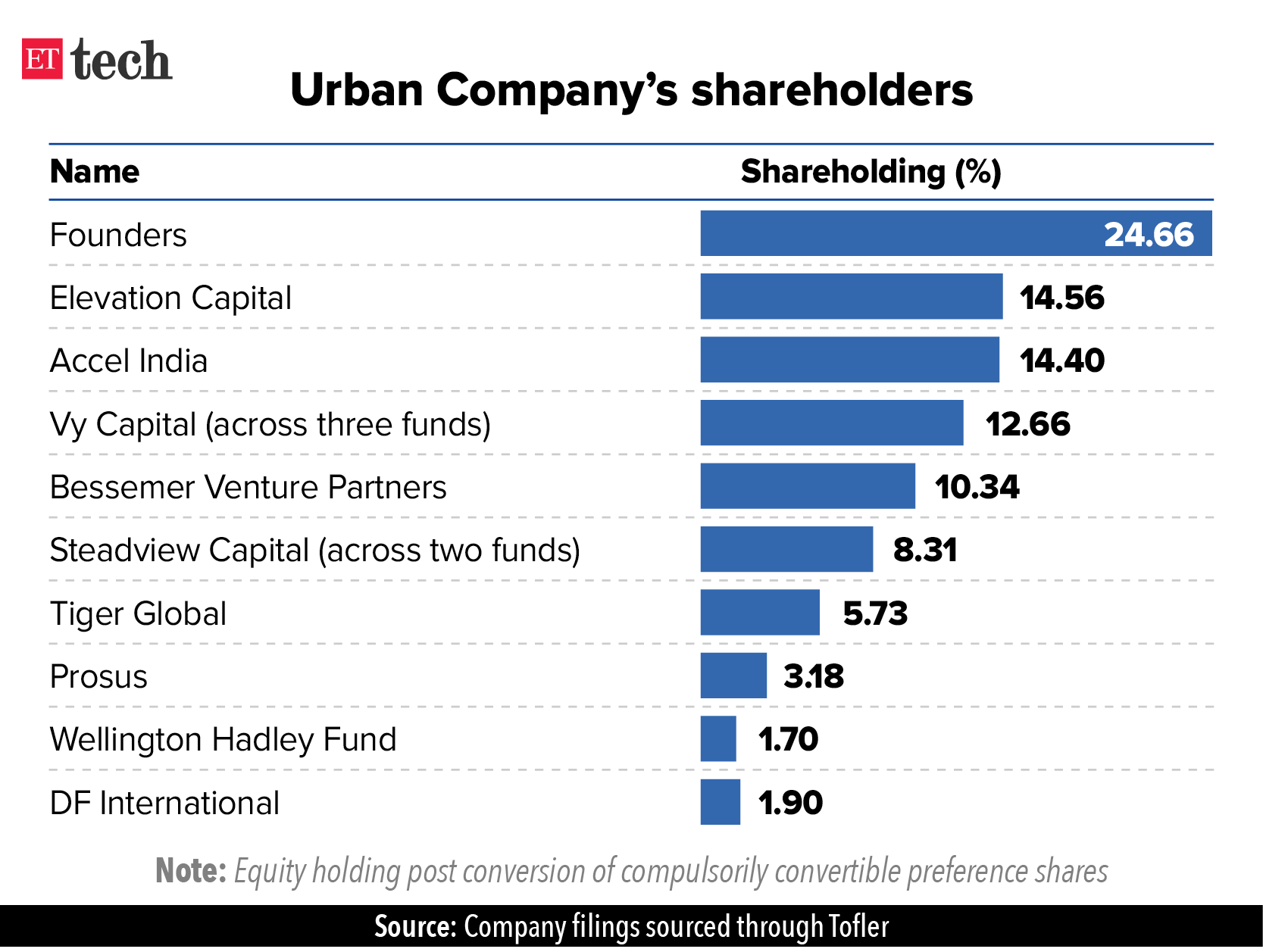

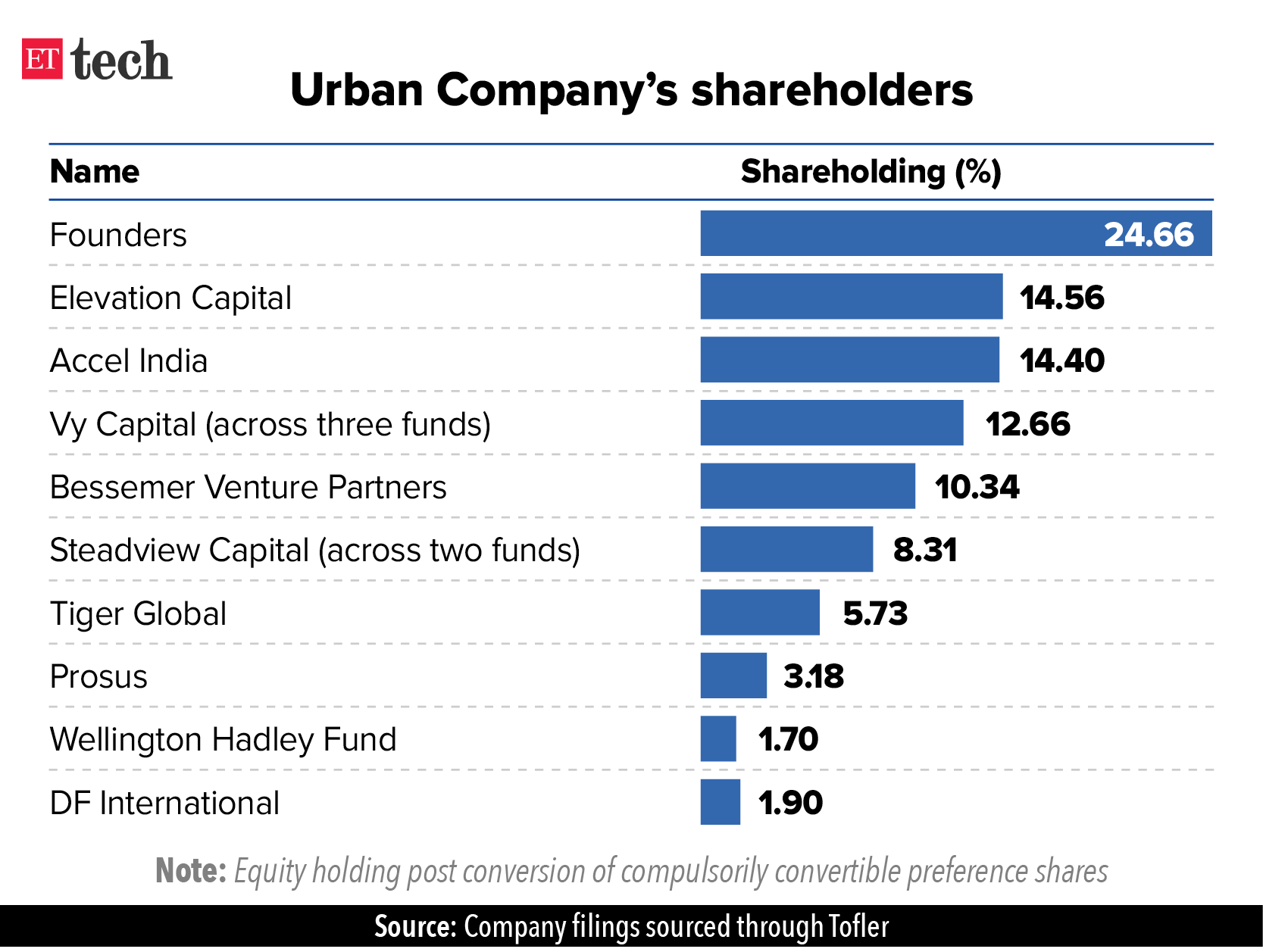

■ Home services marketplace Urban Company is hopping on to the IPO bandwagon after raising $255 million financing last month that valued the company at $2.1 billion. Previously known as UrbanClap, the company plans to go public in the next 18-24 months.

Here is a quick look at the top funding deals of the week

OTHER BIG STORIES BY OUR REPORTERS

Social media platforms must comply with India’s IT rules, as they have a “responsibility” towards users and that the guidelines provide a robust grievance redressal mechanism, Union Minister of Electronics and IT Ravi Shankar Prasad says in an interview.

Retired Supreme Court judge Srikrishna described the face-off between the central government and global social media platforms over the new IT rules as well as other attempts to gag voices speaking against the government as an 'undeclared emergency'.

India’s leading cryptocurrency exchanges, including WazirX, CoinDCX and CoinSwitch Kuber, have partnered with IAMAI to set up an advisory board to implement a code of conduct for the crypto industry in India.

As doctors embrace social media to share stories and to give advice, they see surge in number of followers.

Affle, a minority investor in Indus OS, has filed a petition against PhonePe in a Singapore court. Indus OS, keen to close the acquisition deal with the Walmart-backed company, has hit back by filing a case against Affle Global.

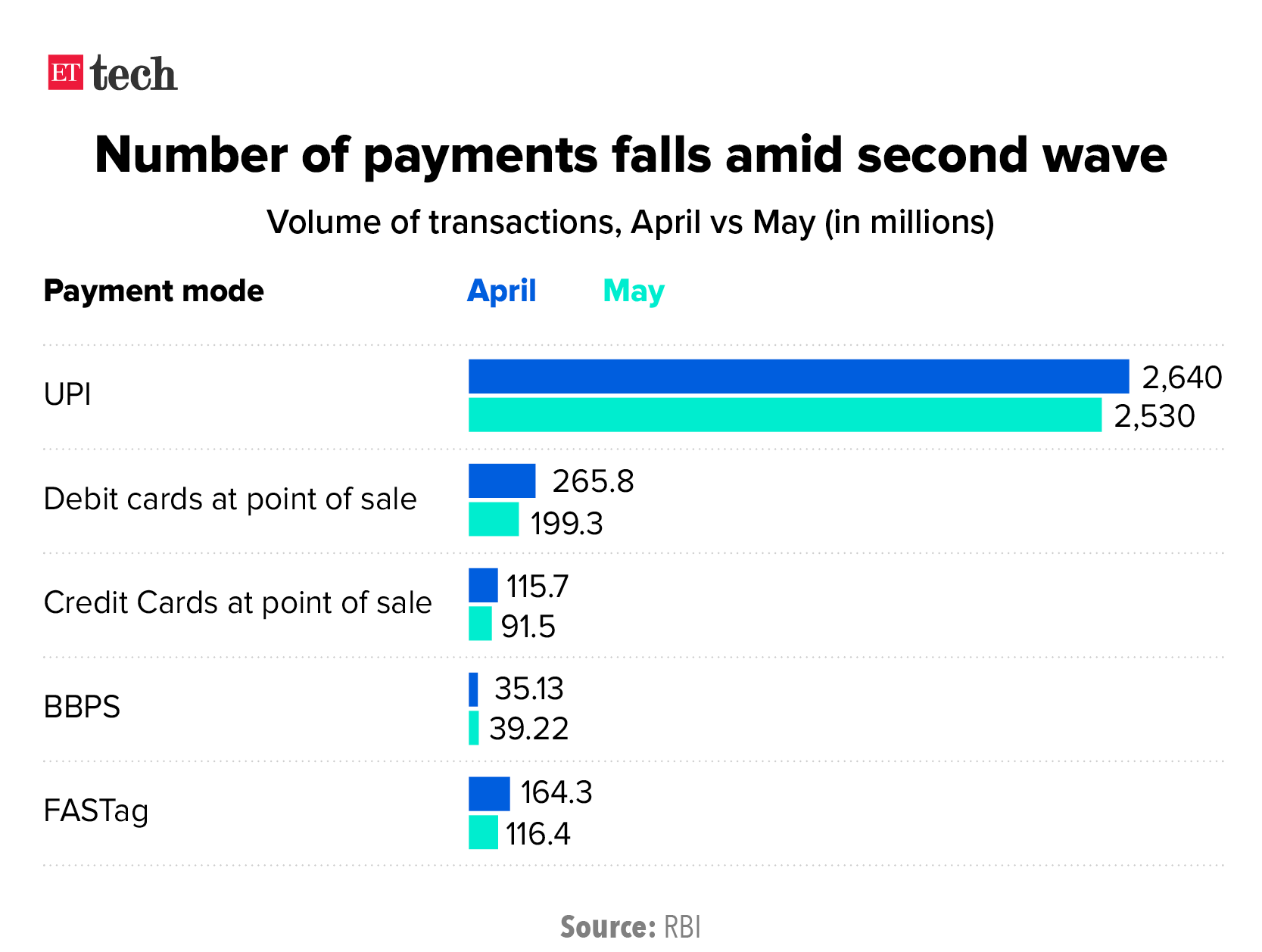

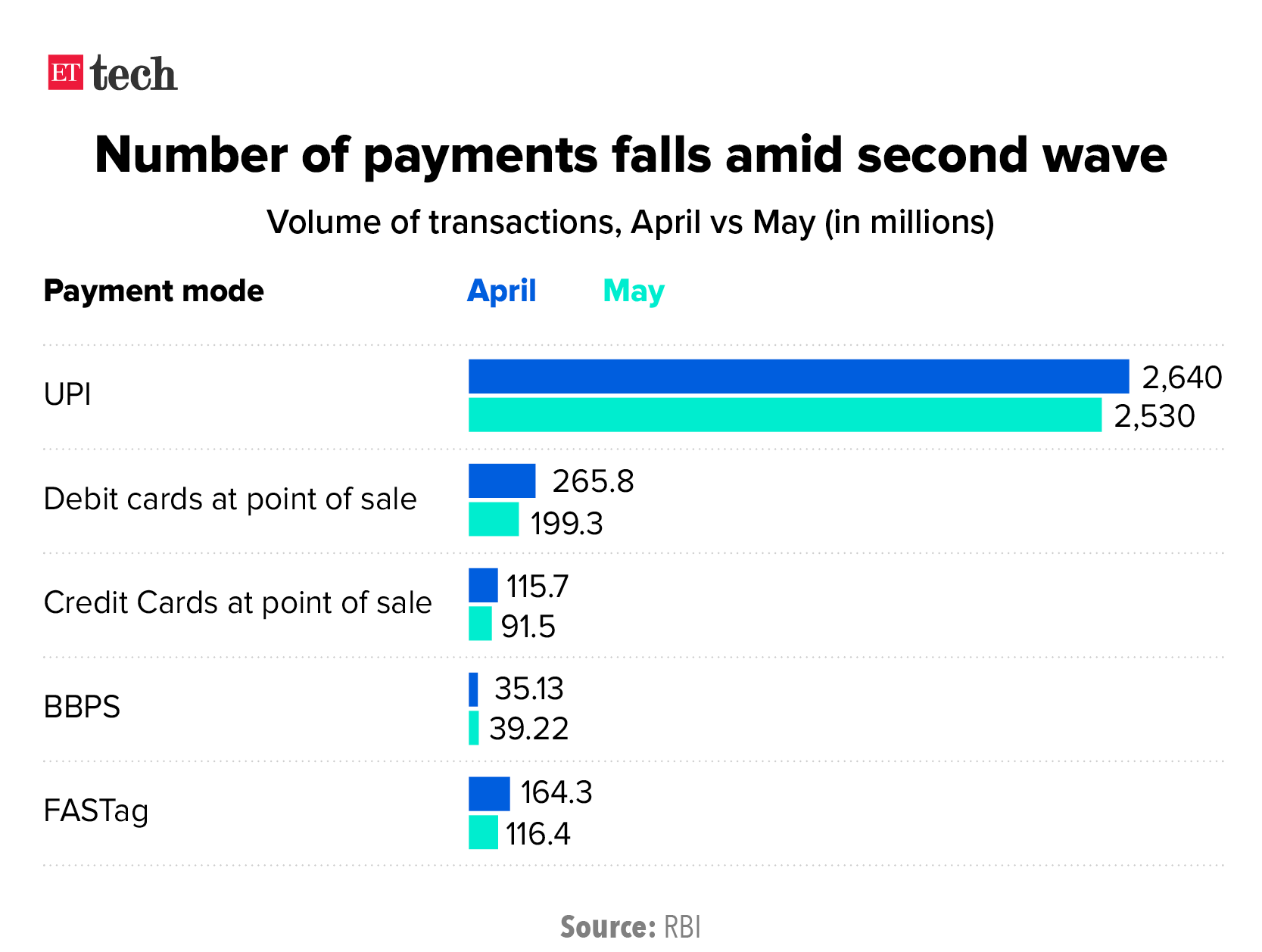

The monthly decline in digital payments, despite their increased adoption during the pandemic, reveals the extent of Covid’s impact on consumer sentiment, according to experts.

That's about it from us this week. Stay safe and get vaccinated when you get the opportunity.

Hi, Ashwin and Digbijay here. Earlier this week, we reported that Paytm’s board has given a go-ahead for an IPO by November. The news got almost everyone questioning the timeline drawn up by the company, along with the reported valuation it could fetch when it lists.

Drop the notion that IPOs are just about raising money and you might understand why a loss-making company with flattish revenues, and competition from Google, Amazon, Walmart-backed PhonePe and Facebook’s WhatsApp, just gave itself six months to go public.

An IPO is more than just a money-raising exercise. It’s an invitation to public scrutiny every quarter, a commitment to age-old regulatory codes, and more significantly, a vote of public confidence in a company.

A successful IPO, therefore, automatically elevates a company’s reputation and brings in a certain degree of legitimacy to its operations in the public eye -- and also in the eyes of the regulator. A publicly listed company has stringent disclosure norms, a corporate governance code and a perpetual obligation to deliver returns to its retail and institutional owners.

Some facts about IPOs in India:

1) There are only four companies in India to date that have raised a public issue of over Rs 10,000 crore.

2) The country’s largest IPO was that of Coal India, which raised Rs 15,200 crore in 2010.

3) The next four mega IPOs were those of Reliance Power, GIC, ONGC and New India Assurance.

4) Four out of India’s five largest IPOs were those of state-owned companies.

So, when headlines emerged that Paytm, owned partly by Jack Ma’s Ant Financial (now renamed Ant Group) – will attempt to raise $3 billion (about Rs 24,000 crore) from the public market at a $25-30 billion valuation, more than a few eyebrows were raised.

Remember, this is not the first time Vijay Shekhar Sharma-led One97 Communications is planning an IPO. In 2010, when it was a telecom VAS firm (and nowhere close to Paytm's current avatar) it had filed a draft red herring prospectus with Sebi with plans to raise Rs 120 crore but postponed it to later in the year citing volatile markets.

The company, as we have reported, wants to go public in October-November, during the festive season. This would mean that it is already operating in highly constrained timelines. It will have to:

1) File the draft red herring prospectus by July.

2) Conduct roadshows and rallies by August.

3) Finish the compliance processes, down to last detail, by September.

It’s a Herculean task. Why would Paytm want to rush this, especially when company insiders confidently claim that it still has a big chunk of the $1 billion from its 2019 funding round in the bank.

This begs the question: What could be the deeper, more significant purpose of this IPO? Let’s look at where Paytm currently stands.

The company is in the midst of an ambitious pivot from the digital payments poster child of yesteryear to a financial services conglomerate that doesn’t just aggregate and distribute financial products of other licensed companies but also manufactures its own products, from loans to insurance policies. In short, think Ant Group and its model.

According to a recent Bernstein report published on the same day Paytm’s IPO news hit the internet, the company’s future profitability hinges on the success of two upcoming verticals -- credit and insurance.

For a profitable financial conglomerate, a balance sheet with margin accretive income sources – premiums from policyholders and interest from borrowers -- is a must. Paytm has learnt this the hard way. Despite building one of the best payments platforms for UPI and digital wallets in India, its payments business doesn’t make any money.

Well, then what’s happening with Paytm’s credit and insurance businesses?

The company has applied for both an insurance and a non-banking financial company (NBFC) licence. Its ambition to convert its Payments Bank into a Small Finance Bank is also well documented. However, it seems the RBI and insurance regulator Irda are not sold, at least not yet.

It’s been nearly a year since the applications were submitted. Why the regulators haven't cleared the proposals yet is anyone’s guess.

So, it is a question as good as any to ask: What could a successful public listing do for the firm and its pending regulatory clearances?

A source close to the company tells us that a successful IPO is a well-established practice to curtail the ownership and influence of private investors in any firm. In the case of Paytm, there are a few – China’s Ant Group, Japan’s SoftBank and venture capital firm Elevation Capital, and US’s T Rowe Price, among others.

SoftBank Vision Fund’s CEO told us this week it doesn't want to exit Paytm in the near term. However, Ant Group, part of Chinese e-commerce group Alibaba, could dilute its stake. That would be more than 'just an exit.' Chinese money in Paytm has always been scrutinised and this scrutiny has only increased since last year, when border tensions erupted between India and China.

Read our full interview with SoftBank Vision Fund CEO Rajeev Misra

It’s worth noting that Ant Group, in its IPO prospectus in August 2020, listed Paytm as one of the companies on which it had 'significant influence'. The Chinese government later stopped the IPO, citing regulatory issues.

Now, would Paytm Public Ltd, under the watchful purview of Sebi, have a better shot at building a profit-making financial conglomerate than it has in its current avatar, having to fight for legitimacy every step of the way?

These are the questions we believe are important to ask. As for how Paytm’s IPO saga will play out this time, your guess is as good as ours.

Let's move on to other big developments of the week

ETtech DEALS DIGEST

■ SoftBank Vision Fund has held discussions with Flipkart to invest around $600-700 million, three years after the Japanese group exited the Walmart-owned online retailer. The funding is part of a larger $2 billion round which could see the participation of a group of sovereign wealth funds like Abu Dhabi’s ADQ, Canada’s CPPIB, as well as the company’s existing investors such as GIC and Qatar Investment Authority. The round will likely to value the Bengaluru-based firm at $25-30 billion, sources told ET.

■ Business-to-business (B2B) e-commerce platform OfBusiness is in talks with Japan’s SoftBank Group to raise $100-150 million at a valuation of $1.2 billion, two people in the know of developments told ET. The startup was last valued at around $800 million in April when it closed a $97 million round led by Falcon Edge. Some angel investors and employees sold shares in the funding round, taking the total size to $113 million.

■ Sleep and home solutions firm Wakefit is in talks with L Catterton Fund and other US and Indian investors to raise primary capital of $40-50 million (Rs 300-350 crore), three people aware of the development told ET. The deal will likely value the company at $350-400 million.

■ Home services marketplace Urban Company is hopping on to the IPO bandwagon after raising $255 million financing last month that valued the company at $2.1 billion. Previously known as UrbanClap, the company plans to go public in the next 18-24 months.

Here is a quick look at the top funding deals of the week

OTHER BIG STORIES BY OUR REPORTERS

Social media platforms must comply with India’s IT rules, as they have a “responsibility” towards users and that the guidelines provide a robust grievance redressal mechanism, Union Minister of Electronics and IT Ravi Shankar Prasad says in an interview.

Retired Supreme Court judge Srikrishna described the face-off between the central government and global social media platforms over the new IT rules as well as other attempts to gag voices speaking against the government as an 'undeclared emergency'.

India’s leading cryptocurrency exchanges, including WazirX, CoinDCX and CoinSwitch Kuber, have partnered with IAMAI to set up an advisory board to implement a code of conduct for the crypto industry in India.

As doctors embrace social media to share stories and to give advice, they see surge in number of followers.

Affle, a minority investor in Indus OS, has filed a petition against PhonePe in a Singapore court. Indus OS, keen to close the acquisition deal with the Walmart-backed company, has hit back by filing a case against Affle Global.

The monthly decline in digital payments, despite their increased adoption during the pandemic, reveals the extent of Covid’s impact on consumer sentiment, according to experts.

That's about it from us this week. Stay safe and get vaccinated when you get the opportunity.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.