Morning Dispatch Morning Dispatch |

E-commerce draft policy & recommended changes

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

Earlier this month, online retailers had raised concerns about the draft e-commerce rules with government officials and sought more time to suggest changes. As the deadline to submit feedback comes to an end, we bring you all the suggestions given by industry groups.

Also in this letter:

Hi, Digbijay here. We here at ETtech have been closely tracking all the important developments around the much-talked and debated draft proposals for e-commerce in India.

Today, we are reporting on all the recommendations from top industry groupings like US-India Strategic Partnership Forum (USISPF), Internet and Mobile Association of India (IAMAI), IndiaTech and Rashtriya Swayamsevak Sangh (RSS) affiliate Swadeshi Jagran Manch (SJM) which were submitted on Wednesday.

What’s worrying the industry? They say the recommendations in the draft policy are not under the purview of the Department of Consumer Affairs. Changes suggested like inclusion of “related parties” and logistics service providers within the definition of an e-commerce entity, ban of flash sales and mandatory listing of local alternatives while selling imported goods or services will hurt the sector, they say.

Also Read: New India e-commerce rules and their impact, explained

Please delete: While many recommendations are asking for the draft rules to be diluted, USISPF has asked for some of the most-talked-about clauses to be completely deleted.

Who said what?

USISPF’s submissions: “The proposed amendments deal with issues which have no nexus with aspects of consumer protection, and most of the suggested changes do not seem to further consumer interest being the core objective of the Consumer Protection Acts (CPA) and its related proposed amendments.”

Susan Ritchie of USISPF told ET: "The proposed rules create an artificial distinction between physical and digital sales channels that are only designed to inhibit the growth of digital sales rather than to protect consumers. As proposed, the draft guidelines exceed the provisions of the underlying legislation, the Consumer Protection Act, 2019 and should be aligned to implement the law as written," she said.

RSS affiliate SJM’s submissions: SJM has also sought a better definition of what would be construed as ‘price manipulation’ in the context of flash sales. SJM, which has been critical of etailers and counts offline traders among its members, is seeking tighter monitoring of e-commerce platforms and its practices like alleged biased treatment of select sellers by a marketplace.

IndiaTech to ET: IndiaTech, has been closely working with many online platforms offering services, instead of just selling goods. The group’s CEO Rameesh Kailasam told us this: "The rules transgress from consumer welfare into various domains such as FDI, trade, competition, personal data protection, data sharing, related party, aggregator guidelines, insurance, all of which technically do not fall under the ambit of consumer protection and have been adequately addressed by other laws, regulators and ministries.”

What’s next? The Department of Consumer Affairs has held the view that its proposals are in line with some of the international markets like the US, Europe among others. In fact, at a meeting with e-commerce firms earlier this month, officials from the department told these platforms that the proposals weren’t as stringent as the ones globally. Clearly, e-commerce companies don’t think as much. Now that all the feedback is with the government, we’ll have to wait for the final contours to be drawn up in what’s arguably the most significant event for the nascent industry.

Also Read: Why e-tailers are upset over India's new draft e-commerce rules

The government is likely to offer guidelines on the procedure to be followed by law enforcement agencies seeking information or content takedowns from social media platforms.

Why is it significant? This will also address a key industry demand for clarity about the official agencies that are authorised to send such requests and the procedure required to be followed, sources told us.

Single touch point: The technology and social media industry has requested the government to institute a central portal or establish a common email address through which official requests for content takedowns or further information.

Social media platforms have been vocal in their concern over stringent takedown timelines as well as what they term as the opacity in the revised IT rules, which came into effect on May 26. More so, as non-compliance can invite criminal penalties on key company executives.

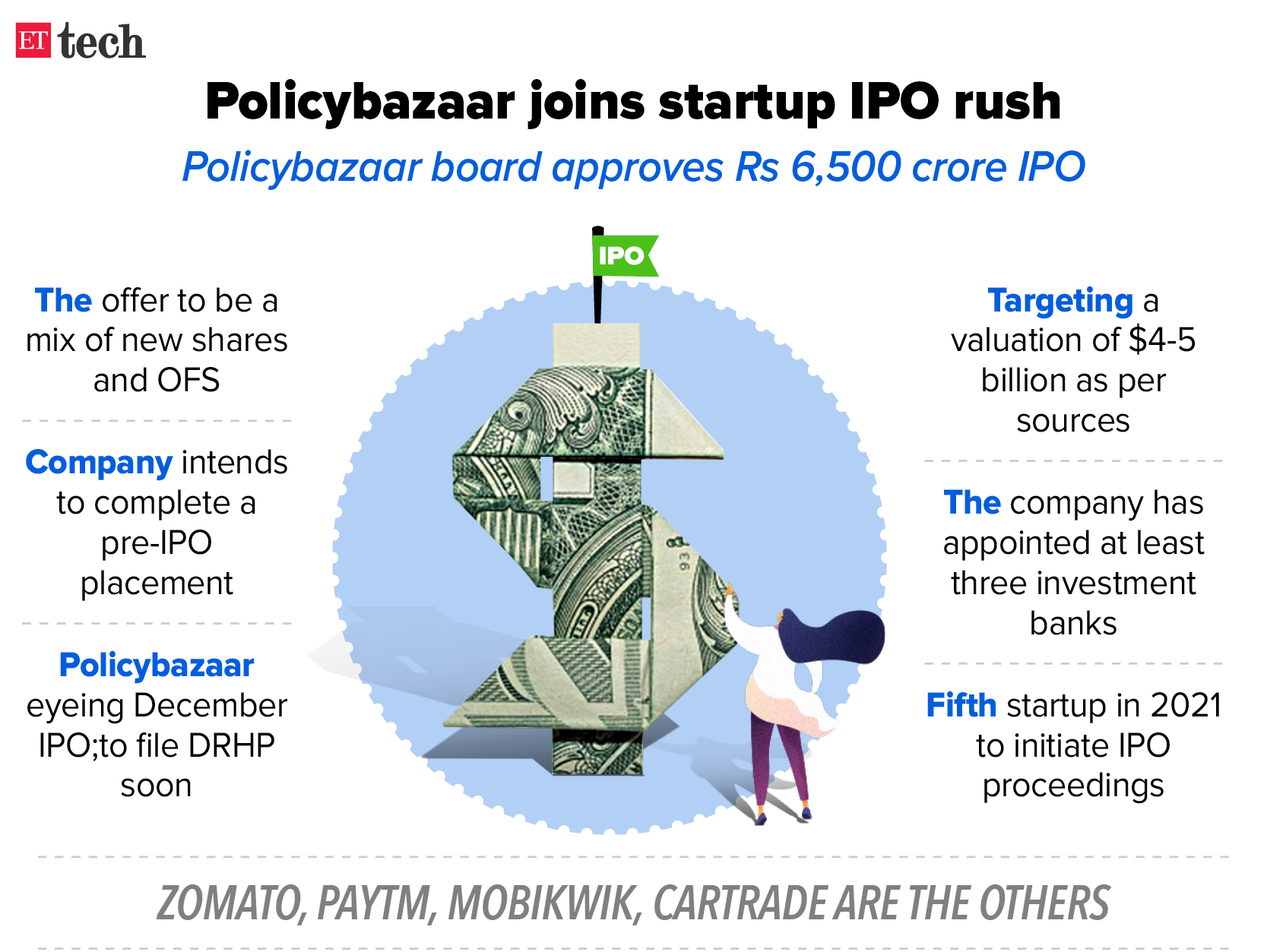

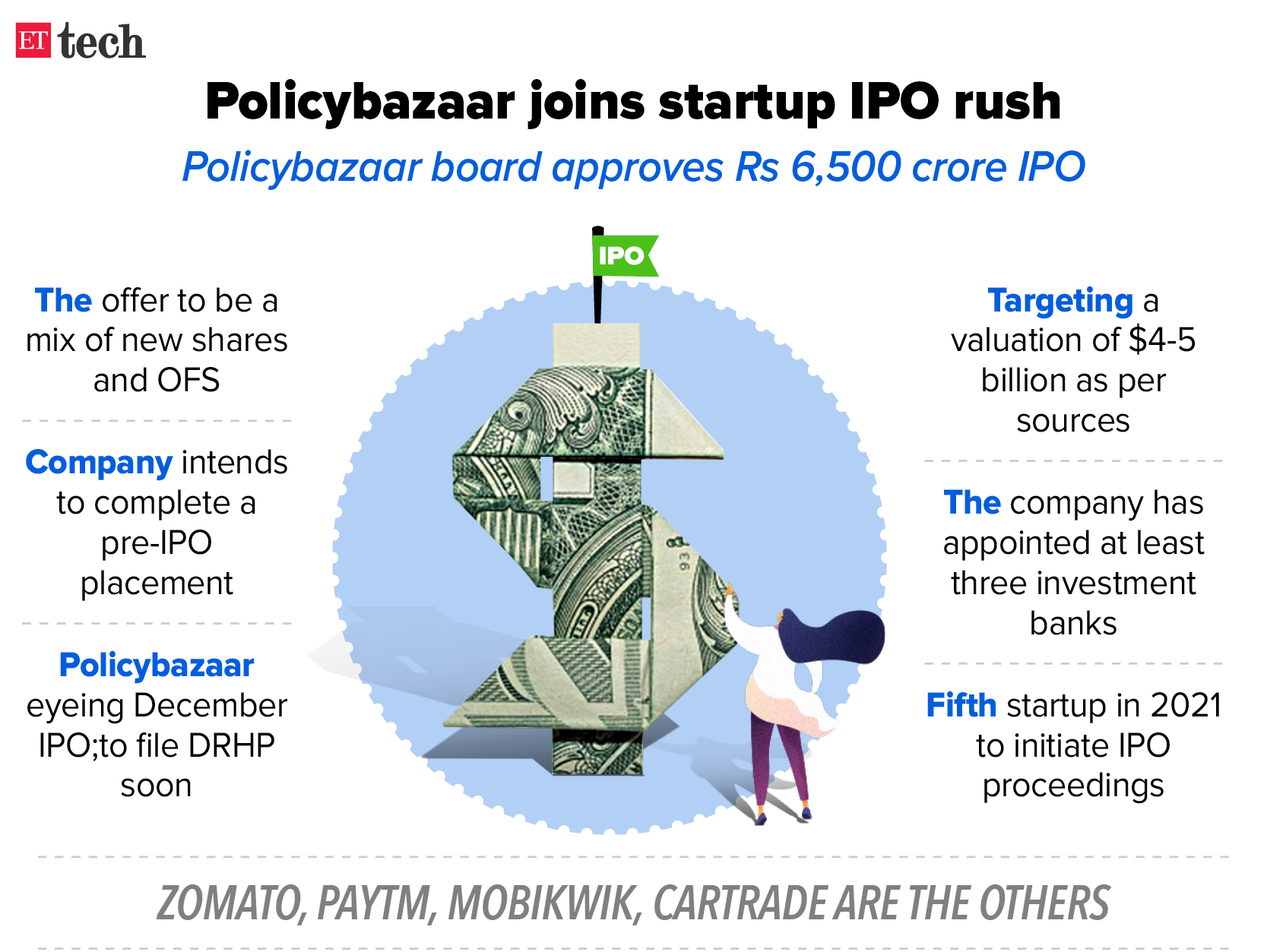

Online insurance aggregator Policybazaar is all set to become the fifth Indian startup this year to go public after Zomato, Paytm, Mobikwik and CarTrade.

PB Fintech, the parent entity of SoftBank-backed online insurance aggregator Policybazaar, has approved a resolution to raise up to Rs 6,500 crore, or $870 million, via an IPO.

What’s the plan? The IPO is expected to be a mix of a fresh issue of shares and an offer for sale (OFS), wherein existing investors can sell their stakes directly through exchanges, as per regulatory filings.

PB Fintech also operates an online lending marketplace PaisaBazaar that allows users to compare and apply for loans and credit cards.

Details: Policybazaar is eyeing to go public by December this year and plans to submit its IPO documents soon, sources tell us. The firm is also expected to raise a pre-IPO round, which could include a secondary transaction for existing investors to dilute their stakes.

The Gurugram-based startup counts SoftBank Vision Fund, Naukri owner Info Edge, private equity firm True North, Premji Invest, Tiger Global and Temasek, among others as investors. It was valued at $2.4 billion when it rejigged its cap table as part of a secondary share sale in March this year.

Financials: Policybazaar posted a loss of Rs 218 crore in FY20 against Rs 213 crore in the previous fiscal. The financial results for FY21 are not out yet.

In March 2021, the company claimed it conducts one million transactions a month, accounting for nearly 25% of India’s life cover, and more than 7% of India’s retail health business.

Status upgrade: Last month, Policybazaar had surrendered its web aggregator licence and acquired an insurance broking licence from the insurance regulator, the Insurance Regulatory and Development Authority of India (IRDAI). This will allow the company to set up its physical network while also significantly expanding its product and service offerings.

Earlier this month, we spoke to several influential founders and investors on our chat show, The Rundown by ETtech, on the significance of these upcoming IPOs, the state of the startup ecosystem, and how investors deal with rapidly rising valuations. You can read the key takeaways here and listen to the entire episode here.

Food delivery platform Zomato is expected to advance its listing date from July 27 to July 26 or as early as July 23, sources told us.

Last week, Zomato launched the first domestic initial public offering by an Indian startup unicorn. The IPO was subscribed 40.38 times, generating demand of Rs 2.13 lakh crore, the most in 11 years and the third highest in Indian capital market history. It set a record for anchor investors and drew the second highest ever applications.

Byju's cofounder Byju Raveendran

Byju's cofounder Byju Raveendran

Edtech major Byju's has made its second-largest acquisition as it looks to make a big foray into the overseas market.

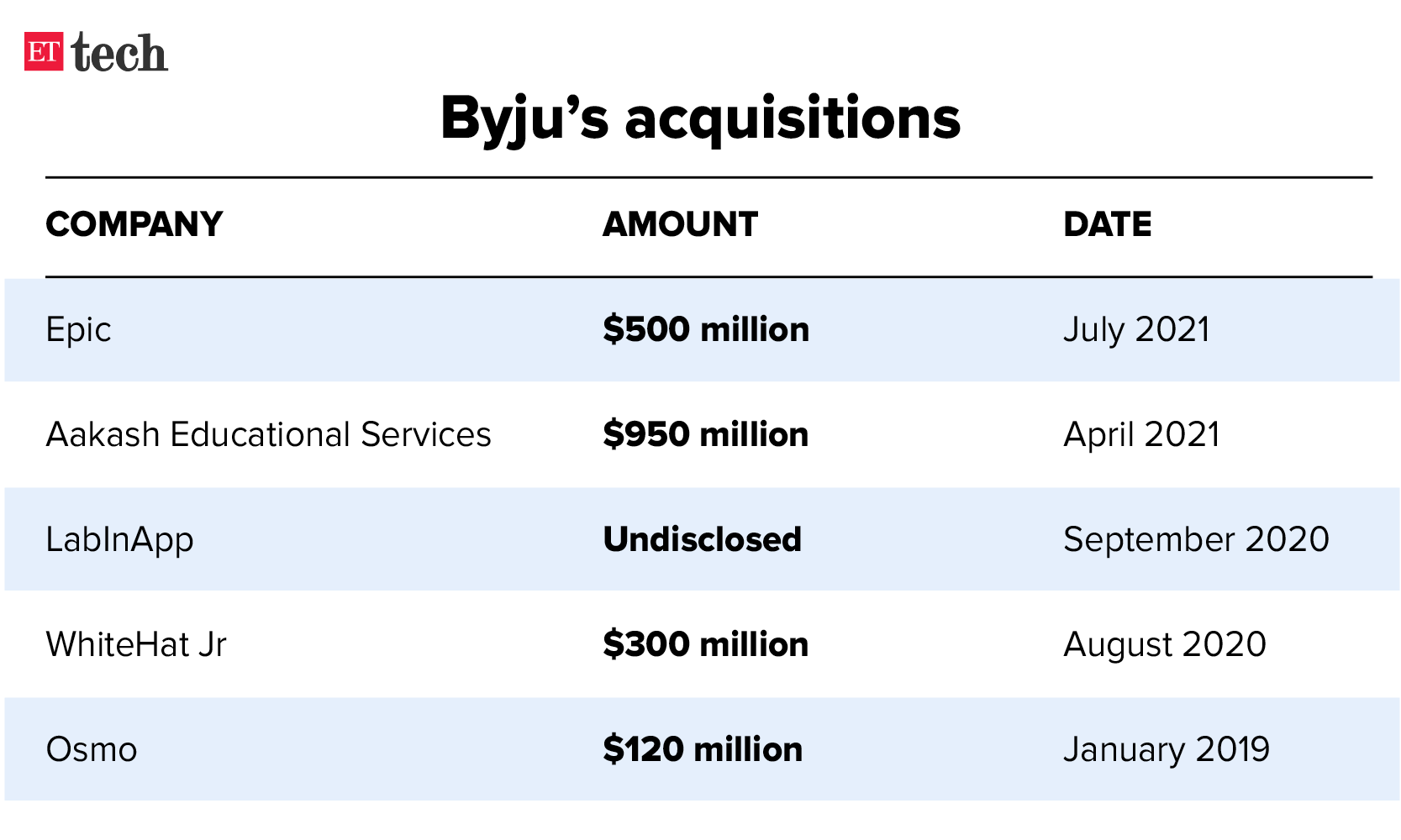

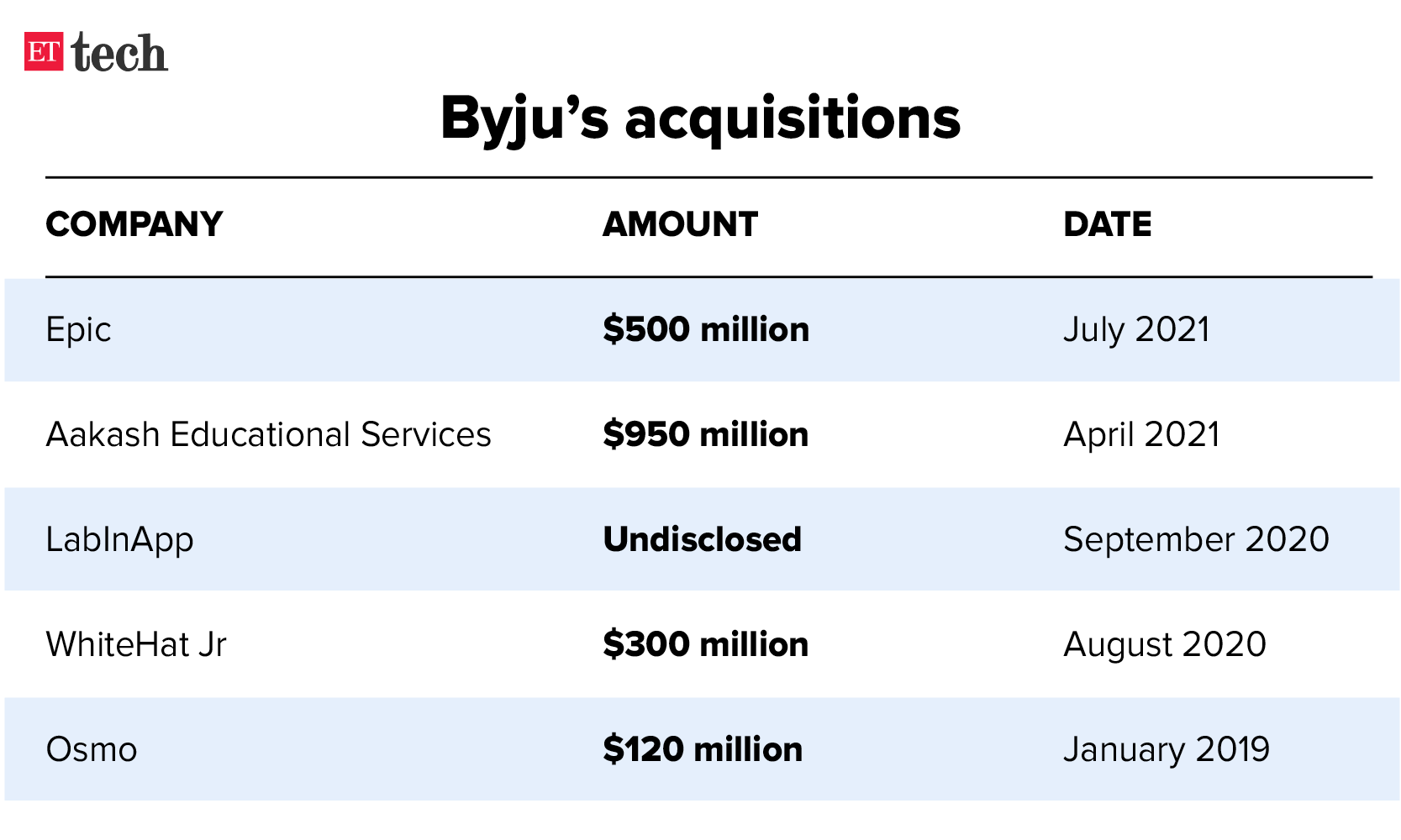

What's the news? Byju's has acquired US-based kids learning platform Epic in a $500 million cash-and-stock deal. The startup has a user base of 50 million kids in the United States who access digital books for free as well as through paid subscriptions. Founders Suren Markosian and Kevin Donahue will continue to run the business.

This acquisition is expected to help strengthen Byju's international footprint, where it expects to generate annual revenue of $300 million this financial year, cofounder Byju Raveendran told us. The edtech firm aims to invest around $1 billion in North America over the next couple of years.

Future School: In April this year, Byju's unveiled a new product called Byju’s Future School that is available in the US, the UK, Brazil, Indonesia and Mexico. The product is being headed by WhiteHat Jr founder Karan Bajaj and initially offered maths and coding tutorials. It was expected to offer science, music, English and fine arts classes in the forthcoming future.

Acquisitions: In April, Byju's had acquired brick-and-mortar coaching network Aakash Institute in a $950 million deal. It had also snagged coding tutor WhiteHat Jr in a $300-million deal amid the pandemic last year and purchased educational game maker Osmo for $120 million in 2019.

Funding spree: To fund these acquisitions and finance its rapid expansion, the Bengaluru-based firm has been on a fundraising spree since last year. After having raised $1 billion in 2020 from global and domestic investors, the decacorn has mopped up almost $1.5 billion from investors such as UBS Group, Blackstone, Abu Dhabi sovereign fund ADQ and others in the last few months.

Other key deals

Direct-to-consumer personal care startup Bella Vita Organic has raised $10 million in Series A from Ananta Capital, a private equity platform backed by the Mumbai-based Taparia family of Famy Care Group.

Outplay has landed $7.3 million from Sequoia Capital India in its Series A round, as the sales engagement platform looks to ride the tailwind of digitisation of outbound sales due to the Covid-19 pandemic.

Dozee, a health tech startup offering contactless remote patient monitoring (RPM) solutions, said it has picked up Rs 44 crore in a Series A funding round led by existing investor Prime Venture Partners, with participation from YourNest Venture Capital and 3one4 Capital.

Vegan lifestyle brand Zouk has raised $1.5 million in a pre-Series A funding round led by Stellaris Venture Partners. The founders of Wow Skin Science and existing investor Titan Capital also participated in the fundraising.

The Reserve Bank of India barred Mastercard from issuing new cards in India after it found the US-based payments major was storing customers’ data on servers located outside India, three sources told us.

Indian regulations require all foreign payment operators to store card and customer-related data in servers physically located in the country.

In March, the Reserve Bank of India (RBI) had tightened its supervision norms over payment companies storing customer data, amid a slew of cyber-security breaches at Indian tech startups.

Crypto exchange ads under ASCI scanner: Cryptocurrency exchanges could get their first set of advertising guidelines soon with Advertising Standards Council of India (ASCI) looking into the issue after identifying it as an “emerging area of concern”.

Indian SaaS cos could log $75 billion in revenues: India’s Software-as-a-Service (SaaS) sector has the potential to grow revenues to as much as $75 billion by 2025 and create market capitalisation of over $1.3 trillion, capturing around 19% of global demand for software products by then, according to a new report.

Instagram starts testing new feature ‘Collab’: Instagram has started testing a new feature called 'Collab' in India and the United Kingdom that lets users invite another account as a collaborator on a post or a Reel. If they accept, both accounts will appear in the header of the post or the Reel, and it will be shared to the followers of both accounts.

Also in this letter:

- Policybazaar’s Rs 6,500 crore IPO

- Govt plans SOPs on content takedown

- Zomato likely to advance its listing

USISPF, IAMAI and IndiaTech submit their feedback to govt

Hi, Digbijay here. We here at ETtech have been closely tracking all the important developments around the much-talked and debated draft proposals for e-commerce in India.

Today, we are reporting on all the recommendations from top industry groupings like US-India Strategic Partnership Forum (USISPF), Internet and Mobile Association of India (IAMAI), IndiaTech and Rashtriya Swayamsevak Sangh (RSS) affiliate Swadeshi Jagran Manch (SJM) which were submitted on Wednesday.

What’s worrying the industry? They say the recommendations in the draft policy are not under the purview of the Department of Consumer Affairs. Changes suggested like inclusion of “related parties” and logistics service providers within the definition of an e-commerce entity, ban of flash sales and mandatory listing of local alternatives while selling imported goods or services will hurt the sector, they say.

Also Read: New India e-commerce rules and their impact, explained

Please delete: While many recommendations are asking for the draft rules to be diluted, USISPF has asked for some of the most-talked-about clauses to be completely deleted.

- Flash sales

- Local alternatives while selling imported goods or services

- Inclusion of related parties and service providers for order fulfilment as e-commerce entity

Who said what?

USISPF’s submissions: “The proposed amendments deal with issues which have no nexus with aspects of consumer protection, and most of the suggested changes do not seem to further consumer interest being the core objective of the Consumer Protection Acts (CPA) and its related proposed amendments.”

Susan Ritchie of USISPF told ET: "The proposed rules create an artificial distinction between physical and digital sales channels that are only designed to inhibit the growth of digital sales rather than to protect consumers. As proposed, the draft guidelines exceed the provisions of the underlying legislation, the Consumer Protection Act, 2019 and should be aligned to implement the law as written," she said.

RSS affiliate SJM’s submissions: SJM has also sought a better definition of what would be construed as ‘price manipulation’ in the context of flash sales. SJM, which has been critical of etailers and counts offline traders among its members, is seeking tighter monitoring of e-commerce platforms and its practices like alleged biased treatment of select sellers by a marketplace.

IndiaTech to ET: IndiaTech, has been closely working with many online platforms offering services, instead of just selling goods. The group’s CEO Rameesh Kailasam told us this: "The rules transgress from consumer welfare into various domains such as FDI, trade, competition, personal data protection, data sharing, related party, aggregator guidelines, insurance, all of which technically do not fall under the ambit of consumer protection and have been adequately addressed by other laws, regulators and ministries.”

What’s next? The Department of Consumer Affairs has held the view that its proposals are in line with some of the international markets like the US, Europe among others. In fact, at a meeting with e-commerce firms earlier this month, officials from the department told these platforms that the proposals weren’t as stringent as the ones globally. Clearly, e-commerce companies don’t think as much. Now that all the feedback is with the government, we’ll have to wait for the final contours to be drawn up in what’s arguably the most significant event for the nascent industry.

Also Read: Why e-tailers are upset over India's new draft e-commerce rules

Govt may issue guidelines on new IT rules

The government is likely to offer guidelines on the procedure to be followed by law enforcement agencies seeking information or content takedowns from social media platforms.

- Top officials told us these will form part of the clarifications to the Intermediary Guidelines that are being worked out by the ministry of electronics and IT.

Why is it significant? This will also address a key industry demand for clarity about the official agencies that are authorised to send such requests and the procedure required to be followed, sources told us.

Single touch point: The technology and social media industry has requested the government to institute a central portal or establish a common email address through which official requests for content takedowns or further information.

Social media platforms have been vocal in their concern over stringent takedown timelines as well as what they term as the opacity in the revised IT rules, which came into effect on May 26. More so, as non-compliance can invite criminal penalties on key company executives.

Tweet of the day

Policybazaar’s Rs 6,500 crore IPO

Online insurance aggregator Policybazaar is all set to become the fifth Indian startup this year to go public after Zomato, Paytm, Mobikwik and CarTrade.

PB Fintech, the parent entity of SoftBank-backed online insurance aggregator Policybazaar, has approved a resolution to raise up to Rs 6,500 crore, or $870 million, via an IPO.

What’s the plan? The IPO is expected to be a mix of a fresh issue of shares and an offer for sale (OFS), wherein existing investors can sell their stakes directly through exchanges, as per regulatory filings.

PB Fintech also operates an online lending marketplace PaisaBazaar that allows users to compare and apply for loans and credit cards.

Details: Policybazaar is eyeing to go public by December this year and plans to submit its IPO documents soon, sources tell us. The firm is also expected to raise a pre-IPO round, which could include a secondary transaction for existing investors to dilute their stakes.

The Gurugram-based startup counts SoftBank Vision Fund, Naukri owner Info Edge, private equity firm True North, Premji Invest, Tiger Global and Temasek, among others as investors. It was valued at $2.4 billion when it rejigged its cap table as part of a secondary share sale in March this year.

Financials: Policybazaar posted a loss of Rs 218 crore in FY20 against Rs 213 crore in the previous fiscal. The financial results for FY21 are not out yet.

In March 2021, the company claimed it conducts one million transactions a month, accounting for nearly 25% of India’s life cover, and more than 7% of India’s retail health business.

Status upgrade: Last month, Policybazaar had surrendered its web aggregator licence and acquired an insurance broking licence from the insurance regulator, the Insurance Regulatory and Development Authority of India (IRDAI). This will allow the company to set up its physical network while also significantly expanding its product and service offerings.

Earlier this month, we spoke to several influential founders and investors on our chat show, The Rundown by ETtech, on the significance of these upcoming IPOs, the state of the startup ecosystem, and how investors deal with rapidly rising valuations. You can read the key takeaways here and listen to the entire episode here.

Zomato likely to advance listing to Friday or Monday

Food delivery platform Zomato is expected to advance its listing date from July 27 to July 26 or as early as July 23, sources told us.

- "The listing may be as early as Friday...however, there are multiple processes which are yet to be closed," said a person in the know. Zomato's earlier date for listing was July 27.

Last week, Zomato launched the first domestic initial public offering by an Indian startup unicorn. The IPO was subscribed 40.38 times, generating demand of Rs 2.13 lakh crore, the most in 11 years and the third highest in Indian capital market history. It set a record for anchor investors and drew the second highest ever applications.

Byju's latest acquisition

Edtech major Byju's has made its second-largest acquisition as it looks to make a big foray into the overseas market.

What's the news? Byju's has acquired US-based kids learning platform Epic in a $500 million cash-and-stock deal. The startup has a user base of 50 million kids in the United States who access digital books for free as well as through paid subscriptions. Founders Suren Markosian and Kevin Donahue will continue to run the business.

This acquisition is expected to help strengthen Byju's international footprint, where it expects to generate annual revenue of $300 million this financial year, cofounder Byju Raveendran told us. The edtech firm aims to invest around $1 billion in North America over the next couple of years.

Future School: In April this year, Byju's unveiled a new product called Byju’s Future School that is available in the US, the UK, Brazil, Indonesia and Mexico. The product is being headed by WhiteHat Jr founder Karan Bajaj and initially offered maths and coding tutorials. It was expected to offer science, music, English and fine arts classes in the forthcoming future.

Acquisitions: In April, Byju's had acquired brick-and-mortar coaching network Aakash Institute in a $950 million deal. It had also snagged coding tutor WhiteHat Jr in a $300-million deal amid the pandemic last year and purchased educational game maker Osmo for $120 million in 2019.

Funding spree: To fund these acquisitions and finance its rapid expansion, the Bengaluru-based firm has been on a fundraising spree since last year. After having raised $1 billion in 2020 from global and domestic investors, the decacorn has mopped up almost $1.5 billion from investors such as UBS Group, Blackstone, Abu Dhabi sovereign fund ADQ and others in the last few months.

Other key deals

Direct-to-consumer personal care startup Bella Vita Organic has raised $10 million in Series A from Ananta Capital, a private equity platform backed by the Mumbai-based Taparia family of Famy Care Group.

Outplay has landed $7.3 million from Sequoia Capital India in its Series A round, as the sales engagement platform looks to ride the tailwind of digitisation of outbound sales due to the Covid-19 pandemic.

Dozee, a health tech startup offering contactless remote patient monitoring (RPM) solutions, said it has picked up Rs 44 crore in a Series A funding round led by existing investor Prime Venture Partners, with participation from YourNest Venture Capital and 3one4 Capital.

Vegan lifestyle brand Zouk has raised $1.5 million in a pre-Series A funding round led by Stellaris Venture Partners. The founders of Wow Skin Science and existing investor Titan Capital also participated in the fundraising.

Why Mastercard was barred from signing on new customers

The Reserve Bank of India barred Mastercard from issuing new cards in India after it found the US-based payments major was storing customers’ data on servers located outside India, three sources told us.

- The company also failed to erase from overseas servers the Indian leg of the transactions data within 24 hours as mandated, they said.

Indian regulations require all foreign payment operators to store card and customer-related data in servers physically located in the country.

In March, the Reserve Bank of India (RBI) had tightened its supervision norms over payment companies storing customer data, amid a slew of cyber-security breaches at Indian tech startups.

Other Top Stories We Are Covering

Crypto exchange ads under ASCI scanner: Cryptocurrency exchanges could get their first set of advertising guidelines soon with Advertising Standards Council of India (ASCI) looking into the issue after identifying it as an “emerging area of concern”.

Indian SaaS cos could log $75 billion in revenues: India’s Software-as-a-Service (SaaS) sector has the potential to grow revenues to as much as $75 billion by 2025 and create market capitalisation of over $1.3 trillion, capturing around 19% of global demand for software products by then, according to a new report.

Instagram starts testing new feature ‘Collab’: Instagram has started testing a new feature called 'Collab' in India and the United Kingdom that lets users invite another account as a collaborator on a post or a Reel. If they accept, both accounts will appear in the header of the post or the Reel, and it will be shared to the followers of both accounts.

Global Picks We Are Reading

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.