Morning Dispatch Morning Dispatch |

Fintech firms face IPO challenges

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

Three Indian fintech firms have IPOs coming up soon, but face unique challenges related to their revenue models, foreign ownership, and increased scrutiny from regulators. Will they be able to replicate Zomato’s success?

Also in this letter:

At least three fintech startups are set to launch initial public offerings (IPOs) in the next five months. Paytm, Mobikwik, Policybazaar are likely to raise up to Rs 28,000 crore ($3.7 billion) from the offerings.

Successful listings could trigger more IPOs by homegrown fintech firms, mirroring trends set by their counterparts in the US and China in the past two years, experts said.

Yes, but: These startups are set to face unique challenges, which include building public confidence in their revenue models, diluting foreign ownership, and working around tighter scrutiny by regulators, the experts added.

Why IPO? Being publicly listed not only offers fintech startups greater legitimacy in the eyes of regulators while applying for new licenses, it also presents an acceptable exit window for foreign investors. Chinese investors of both Paytm and Policybazaar are likely to offload stakes during the proposed IPO, our sources said.

Also Read: Paytm eyes IPO by end of October, hopes to break even in 18 months

Growth potential: “As this ecosystem expands both in terms of users and talent, we are likely to see increased participation from global investors. Already, 2020 and 2021 have been record years for Foreign Direct Investments (FDI) in India among the emerging markets economies,” said Pai. “For many investors, the eventual exit strategy tends towards IPOs; the only question then is when to do the IPO?”

Dinesh Arora, a partner at PwC India, 2021 could be the year for Indian fintech startup IPOs just like 2008 was for microfinance institutions going public.

“With better availability of information and low transaction costs, fintech companies have opened a new layer of market which is untapped. This helps them command a higher valuation premium in the public market,” said Arora.

Also Read: Nykaa changes status to public company ahead of IPO filing

One factor driving domestic listings is the lack of clarity on rules for foreign listings, said a founder of a fintech startup that’s eyeing a global listing.

Pine Labs, Groww, Razorpay, PhonePe are all reportedly eyeing global listings.

Unacademy is in talks to buy a significant stake in K12 Techno Services, which runs the Orchids International chain of schools, two sources told us.

What: If the deal materialises, it’ll be the first bet on a chain of physical schools by an edtech startup in India.

Why: Unacademy’s move is a part of its plan to start offering K-12 education, a segment that is currently dominated by Byju’s.

How: Incidentally, both K12 and Unacademy are backed by Sequoia Capital and Belgian investment fund Sofina, though Sequoia is likely to exit Orchid through this transaction. “Talks are on for an investment of around $25-30 million by Unacademy,” a source said.

Sofina will invest in K12 along with Unacademy, and the current management will continue to own a minority stake and run the business, a source told us. “If the offer is compelling, a full sale cannot be ruled out,” the person added.

More acquisitions: Unacademy also announced on Monday that it is acquiring Rheo TV, a live streaming platform for gamers.

Besides Orchids, it is also looking to acquire a chain in north and west India, a source said.

The edtech company has made a series of acquisitions in the past three years to grow its business. It bought out Wifistudy for $10 million in 2018 before acquiring Kreatryx, CodeChef, Prepladder, Mastree, Coursavy, Neostencil and Tapchief, among others.

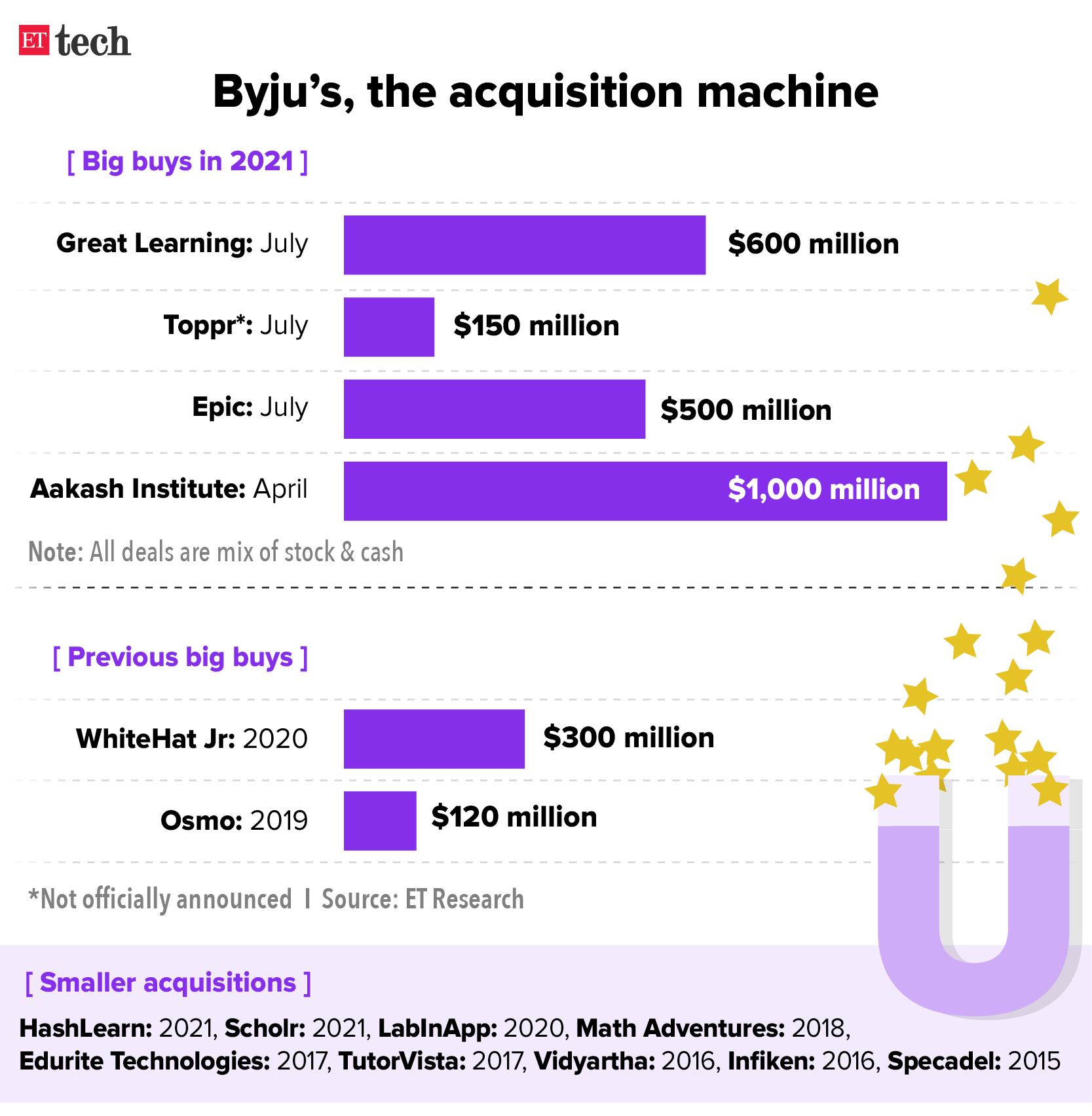

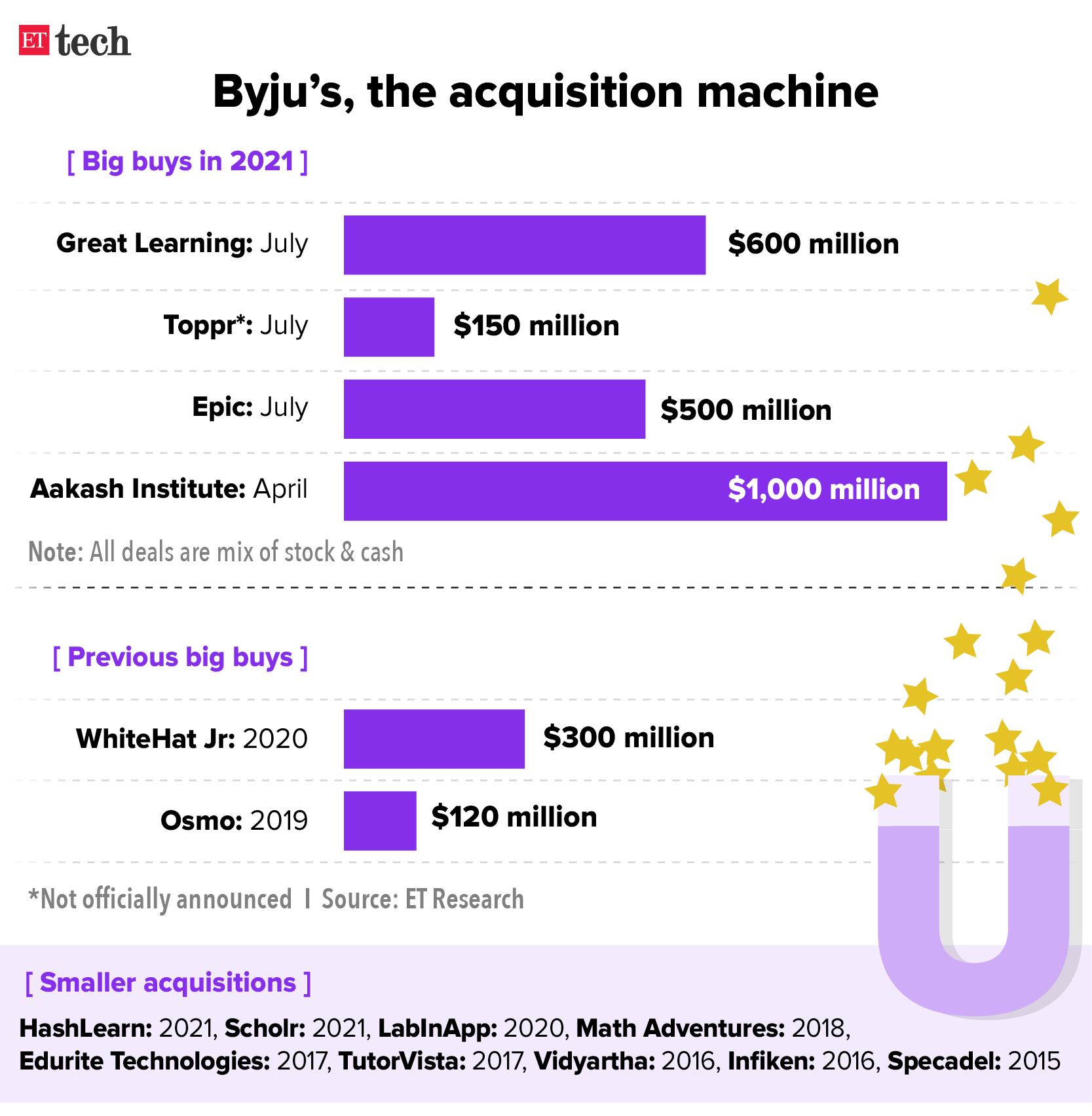

Stiff competition: Unacademy rival Byju’s has been on a buying spree as well. On Monday, it acquired professional and higher education platform Great Learning for $600 million in a cash-and-stock deal. A week ago, it bought US-based Epic for $500 million to boost its overseas business.

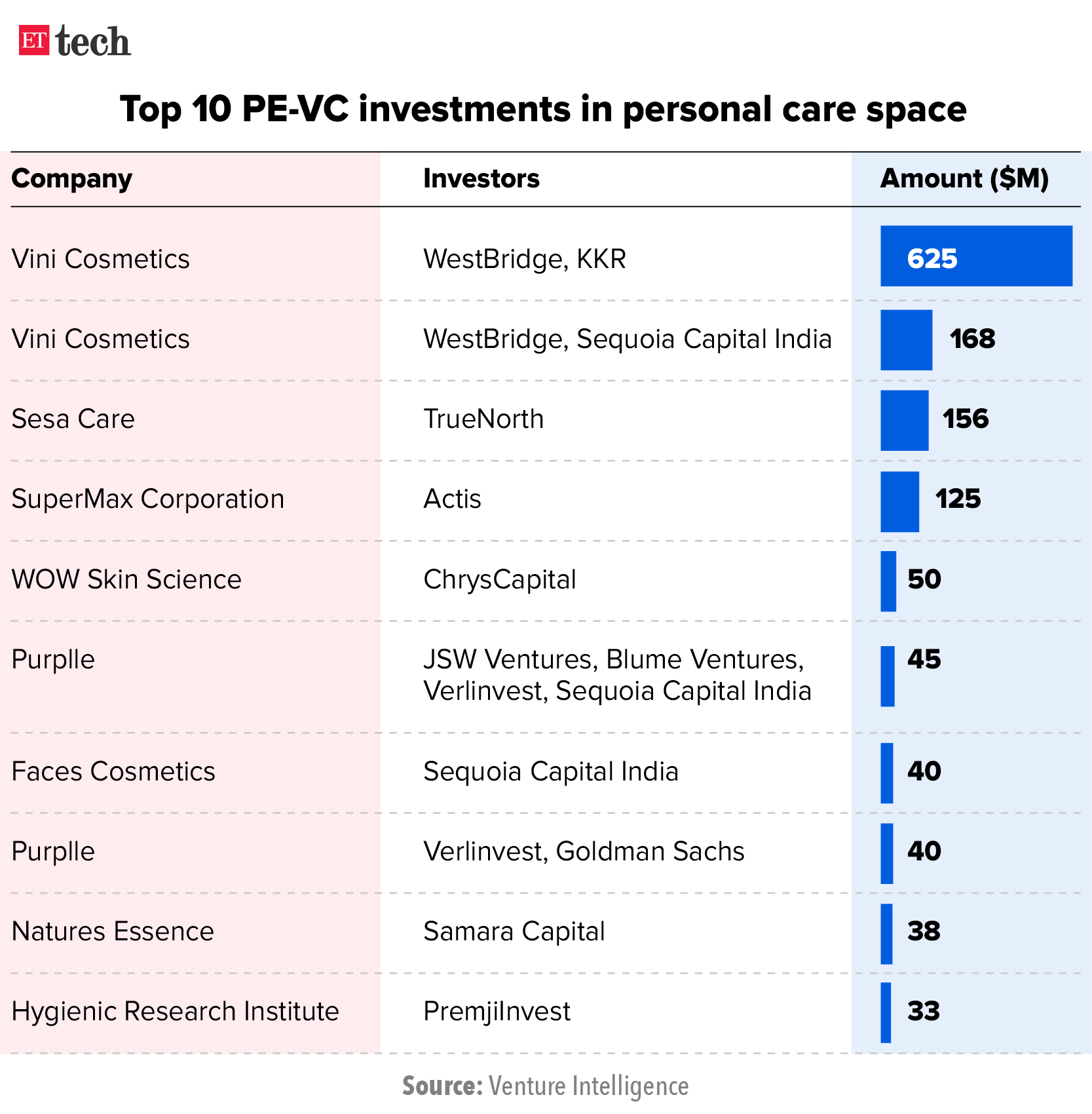

Omnichannel direct-to-consumer beauty brand, MyGlamm has landed an additional Rs 355 crore in Series C funding led by Accel.

This takes the total funds raised in the round to Rs 530 crore -- the highest amount raised by a beauty brand in a Series C round in India.

Valuation soars: The Amazon-backed startup, which had raised Rs 175 crore in March when the round opened, is now valued at Rs 2,000 crore, almost three times more than its previous valuation of Rs 745 crore, sources told us.

What’s the plan? The company will use the funds for product development, supporting data science and technology research, increasing offline expansion, funding working capital requirements and expanding content creation capabilities, Darpan Sanghvi, cofounder of MyGlamm, told us.

Revenue forecast: The company is expected to clock Rs 750 crore in revenue by the end of the calendar year. Its current revenue run rate is Rs 480 crore.

Beauty e-commerce boom: The Indian beauty e-commerce industry could see a slew of acquisitions over the next 3 to 4 years as small, direct-to-consumer (D2C) brands reach scale. This would follow a pattern established in the US, we discussed earlier this year on The Rundown by ETtech, our weekly chat show.

Indian FMCG giants are testing the D2C beauty e-commerce market by picking up stakes in startups. Marico acquired men’s grooming startup Beardo in 2020. Other Indian FMCG majors such as ITC and Emami have backed Fireside Ventures, an early-stage fund focussed on consumer brands that has Mamaearth in its portfolio.

Also Read:

■ Goat Brand Labs has closed a $36-million funding round for its Thrasio-style investment platform. Led by Tiger Global, the round also involved Flipkart Ventures, US-based Mayfield, Nordstar Capital and Better Capital. We had first reported this deal on May 17.

■ Re-commerce marketplace Cashify has acquired UniShop, a platform that helps neighbourhood retailers sell online, for an undisclosed amount in cash and stock as part of its plan to aggressively expand both online and offline.

■ Veera Health, a digital health platform for women, has picked up $3 million in a funding round co-led by Sequoia Capital India’s Surge and Global Founders Capital, with participation from Y Combinator, CloudNine Hospitals’ co-founder Rohit M.A. and Tinder India head Taru Kapoor. The startup plans to use the funds to scale its business and grow teams across engineering, product and operations.

■ Swift, a Bengaluru-based online commerce enabler, has raised $2.2 million funding in a round led by Kalaari Capital, with participation from existing investors FirstCheque, Indian Angel Network and other angel investors. It plans to use the funds to scale its engineering efforts and simplify complex business workflows across checkout, payments and fulfillment.

■ Knorish, a do-it-yourself platform for creators to take their business online, has raised $1.1 million in a pre-Series A funding round led by Inflection Point Ventures along with participation of Rockstud Capital, Pentathlon Ventures and Prophetic Ventures syndicate, among others.

South Korean gaming firm Krafton said it will use part of its IPO proceeds to invest in new markets including India.

Earlier this month, the company’s division head in India, Sean Hyunil Sohn, told us that the company would deploy further capital in India as investors from the mid- to long-term perspective.

Betting big on India: The PUBG creator recently announced an investment in game streaming platform Loco and said it would chip in more if the right opportunity arose. It has also invested in esports company Nodwin Gaming.

Zomato cofounder and chief executive Deepinder Goyal

Zomato cofounder and chief executive Deepinder Goyal

Zomato continues to rise on the bourses. After a big-bang listing last week, the company's market capitalisation has crossed the Rs 1 lakh crore mark.

Startup IPOs in India: That a startup which is yet to make a profit can have rip-roaring public issue in India dispels the myth that startups have to domicile outside India to tap the public market.

Returns for investors: Info Edge, the earliest backer of Zomato, has seen the value of its investment in the food delivery app skyrocket more than 1,000 times as the food-delivery company went public on Friday.

How Uber Eats acquisition helped: Uber, which sold its Uber Eats division to Zomato mostly for shares, made a killing in the IPO. However, for Zomato, even if the acquisition itself resulted in impairment, the benefit of not having to waste time, energy and money on a protracted battle with a well-funded rival has been significant.

Also Read: How Zomato executed its IPO plan

L&T Technology Services sees auto, healthcare driving growth: L&T Technology Services, the engineering services arm of the L&T Group, expects opportunities in sectors such as healthcare and automobiles to drive growth in the coming quarters, said CEO Amit Chadha.

'Open source software is key for digital democracy': The government on Monday launched a contest for firms which create Free and Open Source Software (FOSS) in a bid to boost such development in the country. Union minister for IT, telecom and railways Ashwini Vaishnaw said that open source software is key for “digital democracy” and it will help ordinary citizens get access to technology much more easily.

Today's ETtech Morning Dispatch was curated by Zaheer Merchant and Karan Dhar in Mumbai.

Also in this letter:

- Unacademy in talks to invest in school chain

- MyGlamm bag Rs 355 crore

- Zomato’s IPO success will inspire many

Paytm, Mobikwik, Policybazaar look to raise Rs 28,000 crore

At least three fintech startups are set to launch initial public offerings (IPOs) in the next five months. Paytm, Mobikwik, Policybazaar are likely to raise up to Rs 28,000 crore ($3.7 billion) from the offerings.

Successful listings could trigger more IPOs by homegrown fintech firms, mirroring trends set by their counterparts in the US and China in the past two years, experts said.

Yes, but: These startups are set to face unique challenges, which include building public confidence in their revenue models, diluting foreign ownership, and working around tighter scrutiny by regulators, the experts added.

- Also, a bumper Rs 1 lakh crore Life Insurance Corp of India (LIC) offer in the fourth quarter could test the depth of Indian market, and startups listing around the same time could struggle, an investment banker working with an IPO-bound startup said.

Why IPO? Being publicly listed not only offers fintech startups greater legitimacy in the eyes of regulators while applying for new licenses, it also presents an acceptable exit window for foreign investors. Chinese investors of both Paytm and Policybazaar are likely to offload stakes during the proposed IPO, our sources said.

Also Read: Paytm eyes IPO by end of October, hopes to break even in 18 months

Growth potential: “As this ecosystem expands both in terms of users and talent, we are likely to see increased participation from global investors. Already, 2020 and 2021 have been record years for Foreign Direct Investments (FDI) in India among the emerging markets economies,” said Pai. “For many investors, the eventual exit strategy tends towards IPOs; the only question then is when to do the IPO?”

Dinesh Arora, a partner at PwC India, 2021 could be the year for Indian fintech startup IPOs just like 2008 was for microfinance institutions going public.

“With better availability of information and low transaction costs, fintech companies have opened a new layer of market which is untapped. This helps them command a higher valuation premium in the public market,” said Arora.

Also Read: Nykaa changes status to public company ahead of IPO filing

One factor driving domestic listings is the lack of clarity on rules for foreign listings, said a founder of a fintech startup that’s eyeing a global listing.

- “The government was supposed to issue guidelines on direct global listing in March, but this has been delayed. Most fintech startups which were eyeing a US listing are now looking for a viable domestic alternative,” the founder said.

Pine Labs, Groww, Razorpay, PhonePe are all reportedly eyeing global listings.

Unacademy in talks to invest in school chain

Unacademy is in talks to buy a significant stake in K12 Techno Services, which runs the Orchids International chain of schools, two sources told us.

What: If the deal materialises, it’ll be the first bet on a chain of physical schools by an edtech startup in India.

Why: Unacademy’s move is a part of its plan to start offering K-12 education, a segment that is currently dominated by Byju’s.

How: Incidentally, both K12 and Unacademy are backed by Sequoia Capital and Belgian investment fund Sofina, though Sequoia is likely to exit Orchid through this transaction. “Talks are on for an investment of around $25-30 million by Unacademy,” a source said.

Sofina will invest in K12 along with Unacademy, and the current management will continue to own a minority stake and run the business, a source told us. “If the offer is compelling, a full sale cannot be ruled out,” the person added.

More acquisitions: Unacademy also announced on Monday that it is acquiring Rheo TV, a live streaming platform for gamers.

Besides Orchids, it is also looking to acquire a chain in north and west India, a source said.

The edtech company has made a series of acquisitions in the past three years to grow its business. It bought out Wifistudy for $10 million in 2018 before acquiring Kreatryx, CodeChef, Prepladder, Mastree, Coursavy, Neostencil and Tapchief, among others.

Stiff competition: Unacademy rival Byju’s has been on a buying spree as well. On Monday, it acquired professional and higher education platform Great Learning for $600 million in a cash-and-stock deal. A week ago, it bought US-based Epic for $500 million to boost its overseas business.

Tweet of the day

MyGlamm secures Rs 355 crore in funding

Omnichannel direct-to-consumer beauty brand, MyGlamm has landed an additional Rs 355 crore in Series C funding led by Accel.

This takes the total funds raised in the round to Rs 530 crore -- the highest amount raised by a beauty brand in a Series C round in India.

Valuation soars: The Amazon-backed startup, which had raised Rs 175 crore in March when the round opened, is now valued at Rs 2,000 crore, almost three times more than its previous valuation of Rs 745 crore, sources told us.

What’s the plan? The company will use the funds for product development, supporting data science and technology research, increasing offline expansion, funding working capital requirements and expanding content creation capabilities, Darpan Sanghvi, cofounder of MyGlamm, told us.

Revenue forecast: The company is expected to clock Rs 750 crore in revenue by the end of the calendar year. Its current revenue run rate is Rs 480 crore.

Beauty e-commerce boom: The Indian beauty e-commerce industry could see a slew of acquisitions over the next 3 to 4 years as small, direct-to-consumer (D2C) brands reach scale. This would follow a pattern established in the US, we discussed earlier this year on The Rundown by ETtech, our weekly chat show.

Indian FMCG giants are testing the D2C beauty e-commerce market by picking up stakes in startups. Marico acquired men’s grooming startup Beardo in 2020. Other Indian FMCG majors such as ITC and Emami have backed Fireside Ventures, an early-stage fund focussed on consumer brands that has Mamaearth in its portfolio.

Also Read:

- Mamaearth valued at $730 million as Sofina leads $50 million funding

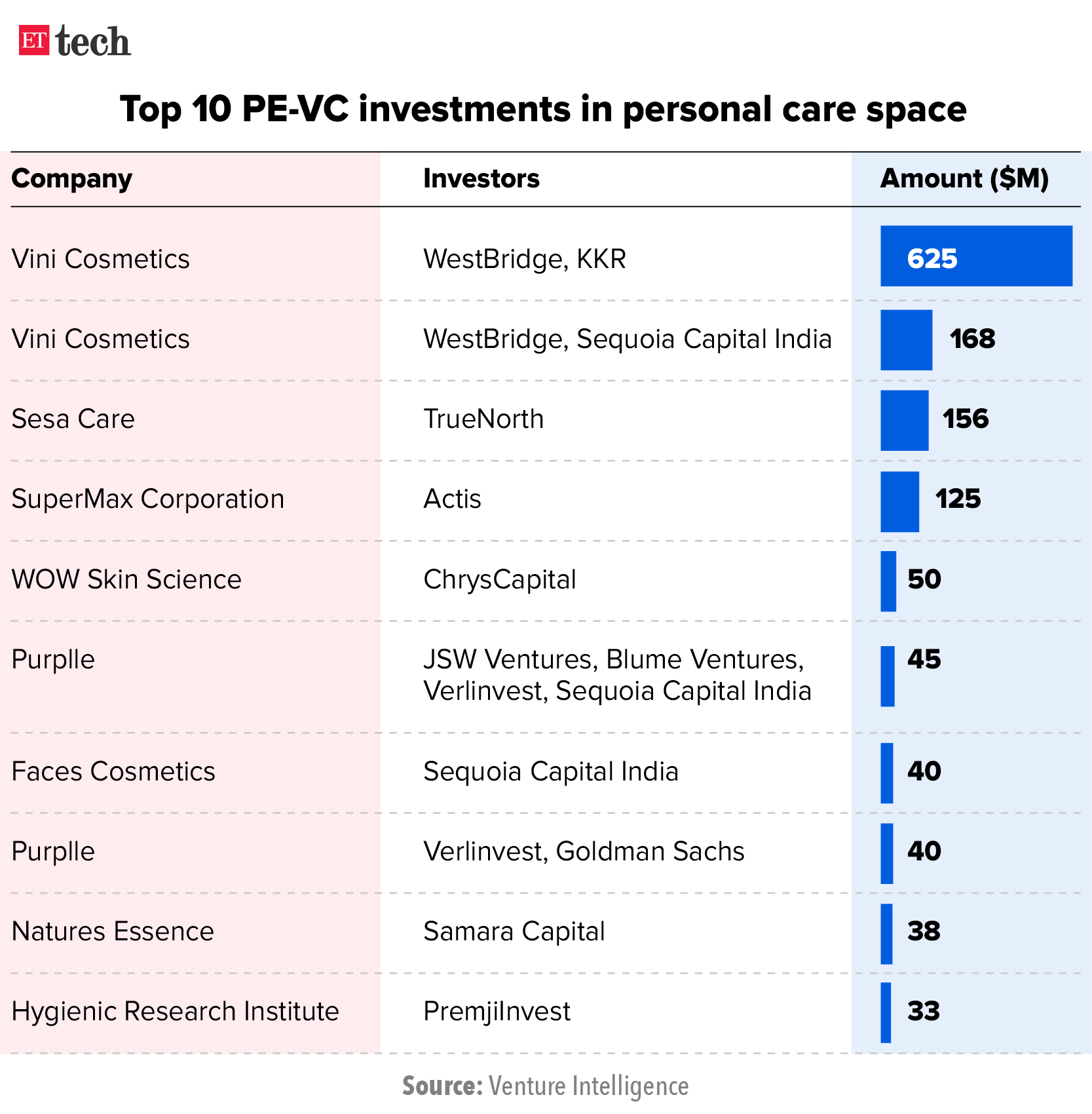

- KKR buys 54% Stake in Vini Cosmetics for Rs 4,600 crore

- D2C beauty startup Pilgrim gets funding from Fireside Ventures, others

ETtech Done Deals

■ Goat Brand Labs has closed a $36-million funding round for its Thrasio-style investment platform. Led by Tiger Global, the round also involved Flipkart Ventures, US-based Mayfield, Nordstar Capital and Better Capital. We had first reported this deal on May 17.

■ Re-commerce marketplace Cashify has acquired UniShop, a platform that helps neighbourhood retailers sell online, for an undisclosed amount in cash and stock as part of its plan to aggressively expand both online and offline.

■ Veera Health, a digital health platform for women, has picked up $3 million in a funding round co-led by Sequoia Capital India’s Surge and Global Founders Capital, with participation from Y Combinator, CloudNine Hospitals’ co-founder Rohit M.A. and Tinder India head Taru Kapoor. The startup plans to use the funds to scale its business and grow teams across engineering, product and operations.

■ Swift, a Bengaluru-based online commerce enabler, has raised $2.2 million funding in a round led by Kalaari Capital, with participation from existing investors FirstCheque, Indian Angel Network and other angel investors. It plans to use the funds to scale its engineering efforts and simplify complex business workflows across checkout, payments and fulfillment.

■ Knorish, a do-it-yourself platform for creators to take their business online, has raised $1.1 million in a pre-Series A funding round led by Inflection Point Ventures along with participation of Rockstud Capital, Pentathlon Ventures and Prophetic Ventures syndicate, among others.

Krafton to use IPO proceeds to invest in India

South Korean gaming firm Krafton said it will use part of its IPO proceeds to invest in new markets including India.

Earlier this month, the company’s division head in India, Sean Hyunil Sohn, told us that the company would deploy further capital in India as investors from the mid- to long-term perspective.

Betting big on India: The PUBG creator recently announced an investment in game streaming platform Loco and said it would chip in more if the right opportunity arose. It has also invested in esports company Nodwin Gaming.

Zomato’s IPO success will inspire many

Zomato continues to rise on the bourses. After a big-bang listing last week, the company's market capitalisation has crossed the Rs 1 lakh crore mark.

Startup IPOs in India: That a startup which is yet to make a profit can have rip-roaring public issue in India dispels the myth that startups have to domicile outside India to tap the public market.

Returns for investors: Info Edge, the earliest backer of Zomato, has seen the value of its investment in the food delivery app skyrocket more than 1,000 times as the food-delivery company went public on Friday.

How Uber Eats acquisition helped: Uber, which sold its Uber Eats division to Zomato mostly for shares, made a killing in the IPO. However, for Zomato, even if the acquisition itself resulted in impairment, the benefit of not having to waste time, energy and money on a protracted battle with a well-funded rival has been significant.

Also Read: How Zomato executed its IPO plan

Other Top Stories We Are Covering

L&T Technology Services sees auto, healthcare driving growth: L&T Technology Services, the engineering services arm of the L&T Group, expects opportunities in sectors such as healthcare and automobiles to drive growth in the coming quarters, said CEO Amit Chadha.

'Open source software is key for digital democracy': The government on Monday launched a contest for firms which create Free and Open Source Software (FOSS) in a bid to boost such development in the country. Union minister for IT, telecom and railways Ashwini Vaishnaw said that open source software is key for “digital democracy” and it will help ordinary citizens get access to technology much more easily.

Global Picks We Are Reading

- Jeff Bezos-backed NotCo gets funding at $1.5-billion valuation (Reuters)

- EU gives Google 2 months to improve hotel, flight search results (Reuters)

- Bitcoin jumps to a six-week high (WSJ)

Today's ETtech Morning Dispatch was curated by Zaheer Merchant and Karan Dhar in Mumbai.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.