Daily Top 5 Daily Top 5 |

Freshworks IPO lives the American dream

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

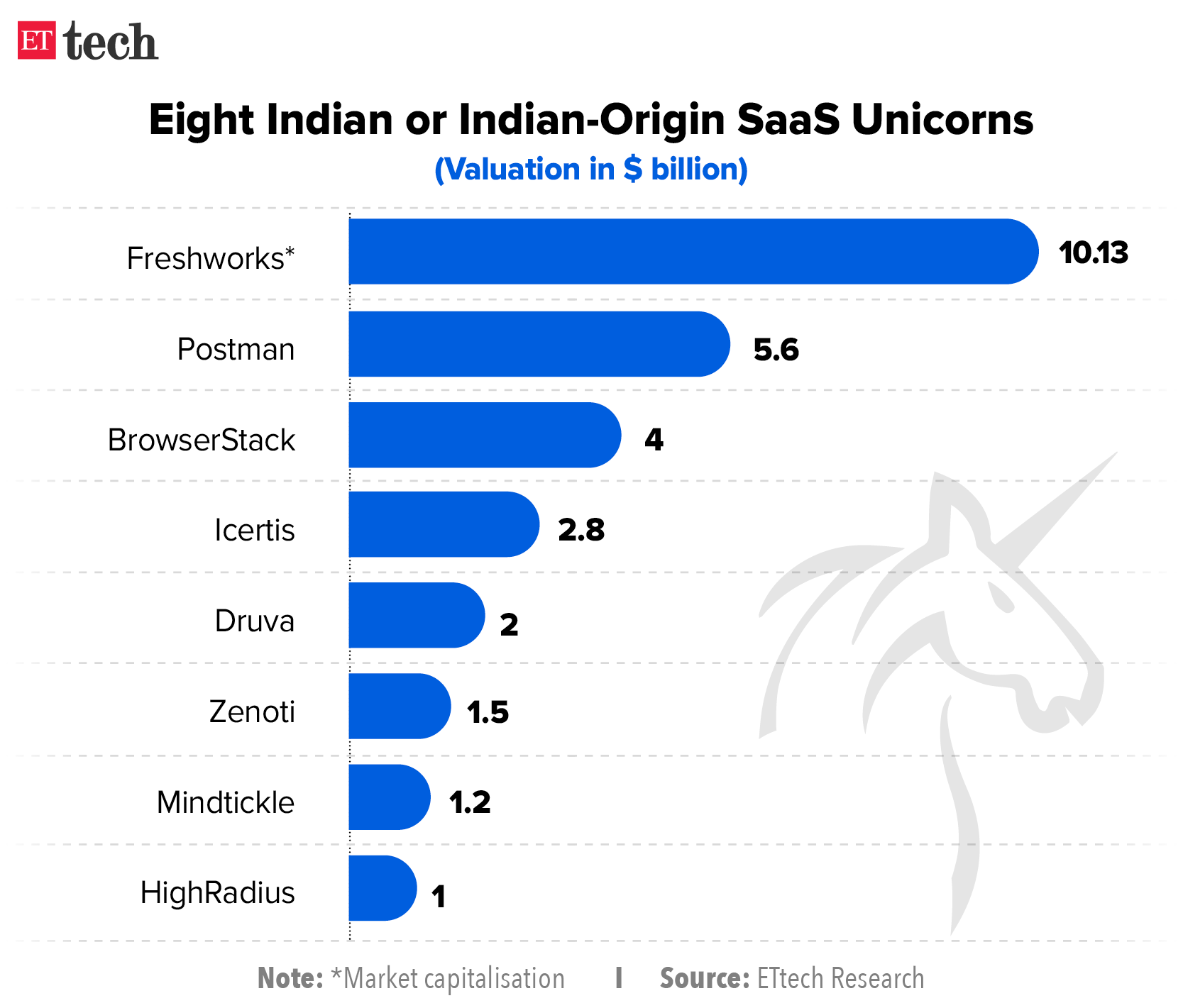

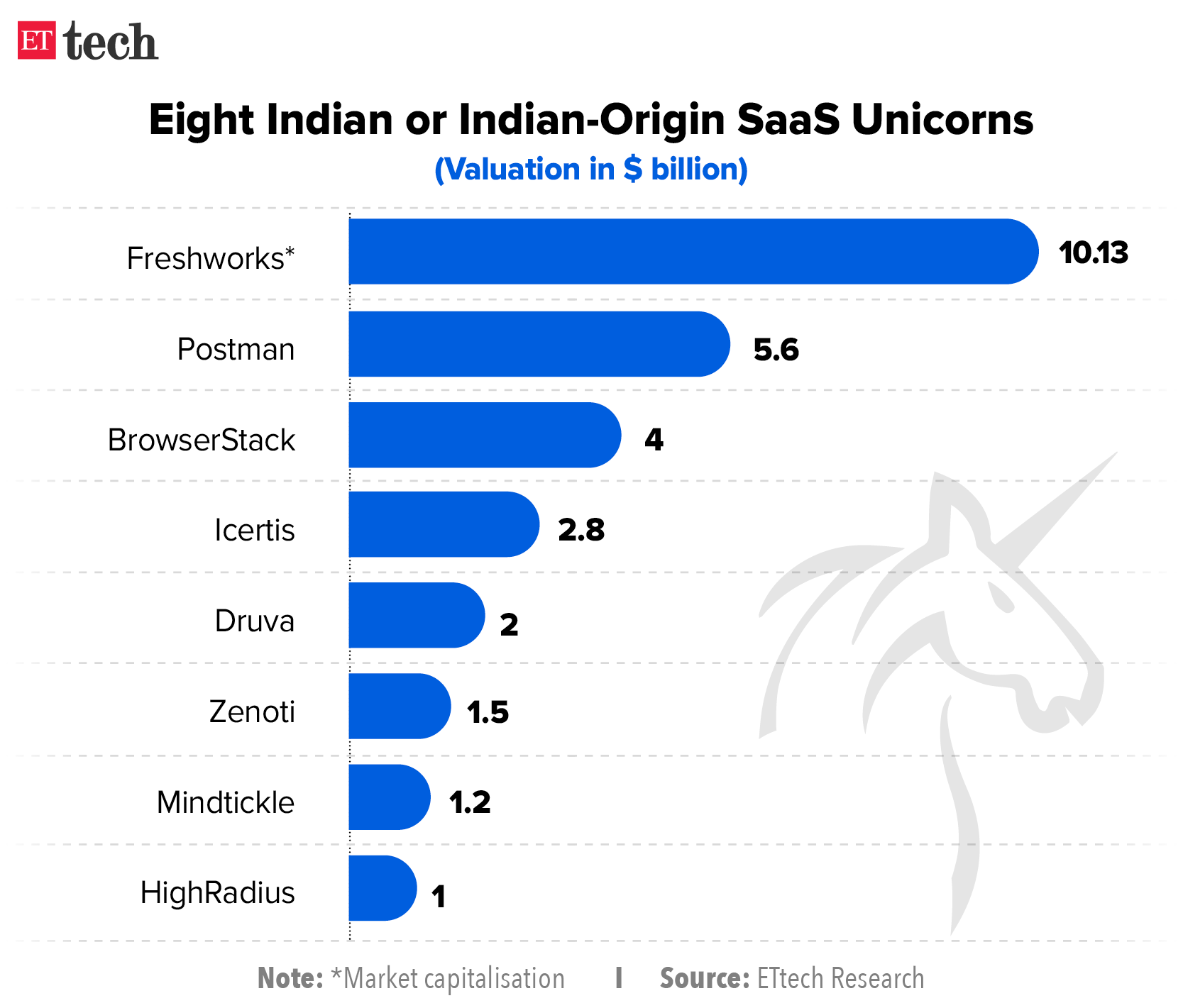

Freshworks has become the first Indian software products company to list on the Nasdaq, raising over $1.03 billion from investors through its initial public offering at a market cap of $10.13 billion. This is a big moment for Indian SaaS startups, one that's been in the making for years. We will dive into the significance of the IPO and what it could mean for the overall cross-border SaaS market which has been hotting up in the last year or so.

Also in this letter:

2021 continues to be a banner year for Indian startups. While Zomato's stellar IPO broke many records on the Indian stock markets in July, setting the stage for consumer-tech startups to go public, Freshworks, which was founded in Chennai, is likely to set a similar trend for Indian SaaS (software-as-a-service) startups eyeing the US public markets.

The company sold 28.5 million shares at $36 each, up from the $32-$34 range the company announced earlier this week, pointing to strong investor interest. The listing, which triggered elation amongst India’s startup mavens, will also benefit two-thirds of its over 4,300 employees, who own stock options.

Its founder Girish Mathrubootham said, "This was a dream come true moment for him to be able to take Freshworks to Nasdaq from its humble beginnings in Trichy." The IPO is expected to give a further boost to Indian startups to build for global markets from India.

Opening doors: Investors who backed Freshworks—winner of ET’s Startup of the Year in 2016—say the company’s Nasdaq listing will make it easier for the next set of Indian companies to aim big.

Financials: Freshworks reported a 53% increase in revenue to $169 million in the six months that ended June 30, 2021, from $110 million in the same period last year. Losses declined sharply by 83% to $ 8.9 million.

It was valued at $3.5 billion in November 2019 when it raised $150 million from Sequoia Capital, CapitalG and Accel.

IPO fever here and there: Freshworks is one of many Indian tech startups looking to tap the public markets in the next few months, following Zomato’s landmark listing in July. Others include Paytm, PolicyBazaar, PharmEasy and MobiKwik.

In the US, too, a wave of recent IPOs by technology firms such as Zoom, Snowflake, Asana and Palantir have been extremely well received in the wake of increased digitisation due to the pandemic. Gupshup, a Silicon Valley messaging startup with a focus on India, also plans to list in the US next year.

Related coverage

Unacademy CEO Gaurav Munjal

Unacademy CEO Gaurav Munjal

A city civil court in Mumbai has temporarily restrained Unacademy from using its PrepLadder application following allegations of plagiarism from a Sri Lankan startup. PrepLadder helps students prepare for a variety of entrance exams, including NEET-PG, FMGE, CAT, UPSC, GATE and IIT-JEE.

Why? The court’s order came in response to a petition filed by Sri Lankan edtech startup Medical Joyworks, which offers digital products and solutions to the medical sector. It said it had provided comprehensive evidence to the court, detailing how PrepLadder has been systematically copying and altering its proprietary information, expertise and technology, and presenting them as their own.

The order named Sorting Hat Technologies, the parent company of Unacademy, and its investors including Blume Venture Advisors, Sequoia Capital India, SoftBank Vision Fund and Temasek Holdings.

The court also said Medical Joyworks could claim compensation after assessing the loss, if any.

Acquired last year: Unacademy had acquired PrepLadder for $50 million last July in a cash-and-stock deal. PrepLadder founders Deepanshu Goyal, Vitul Goyal and Sahil Goyal, and their 250 employees, joined Unacademy.

We reported on August 2 that Bengaluru-based Unacademy had raised $440 million in a new round of funding valuing the company at $3.4 billion.

Reactions: “We are grateful to the court for granting an injunction… and for acting swiftly and decisively. We will continue our lawsuit in the hopes that a satisfactory resolution that honours our work, our customers, and the broader medical community will be achieved,” Dr Nayana Somaratna, CEO and cofounder of Medical Joyworks, wrote a post on the company’s website.

An Unacademy spokesperson said, “We are in the process of reviewing the documents and will decide on our next course of action, including protecting our rights and interests, in consultation with our legal advisors.”

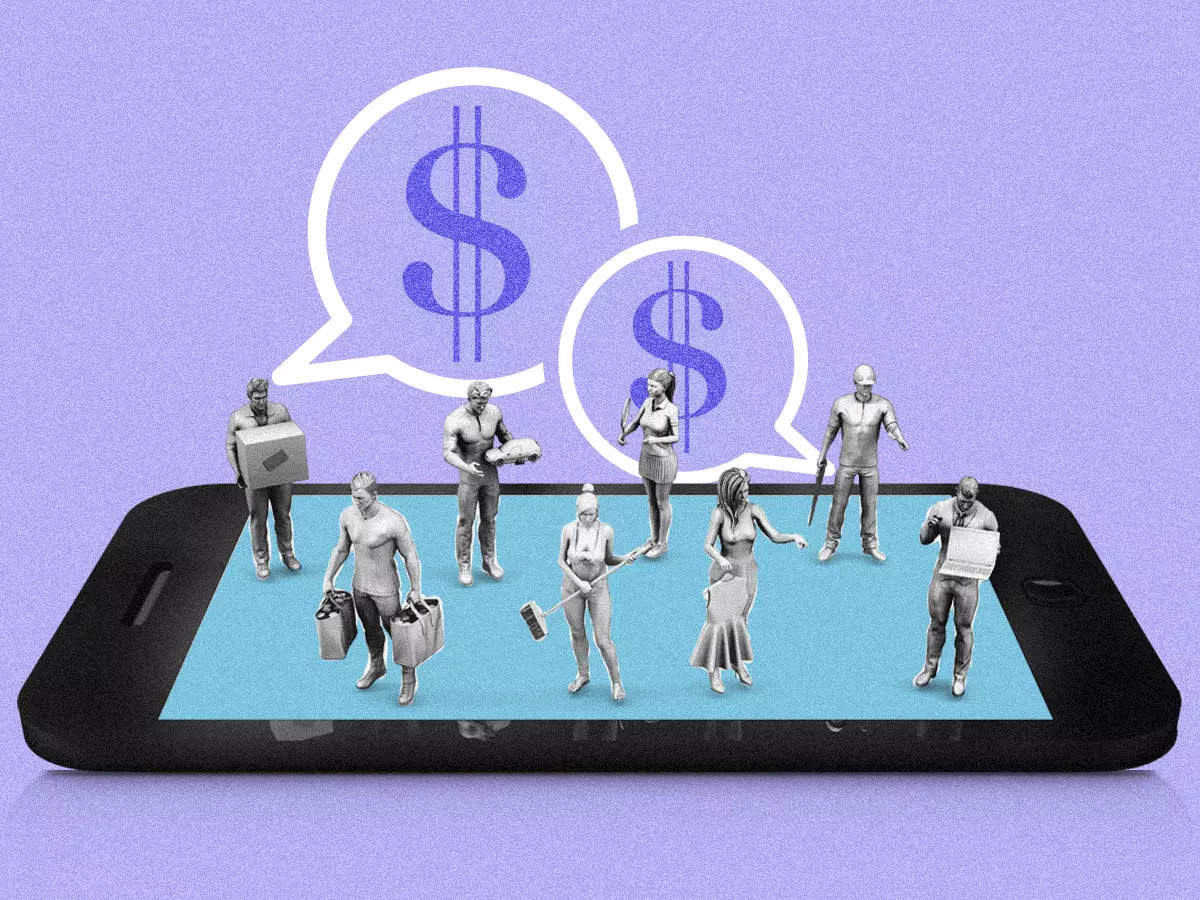

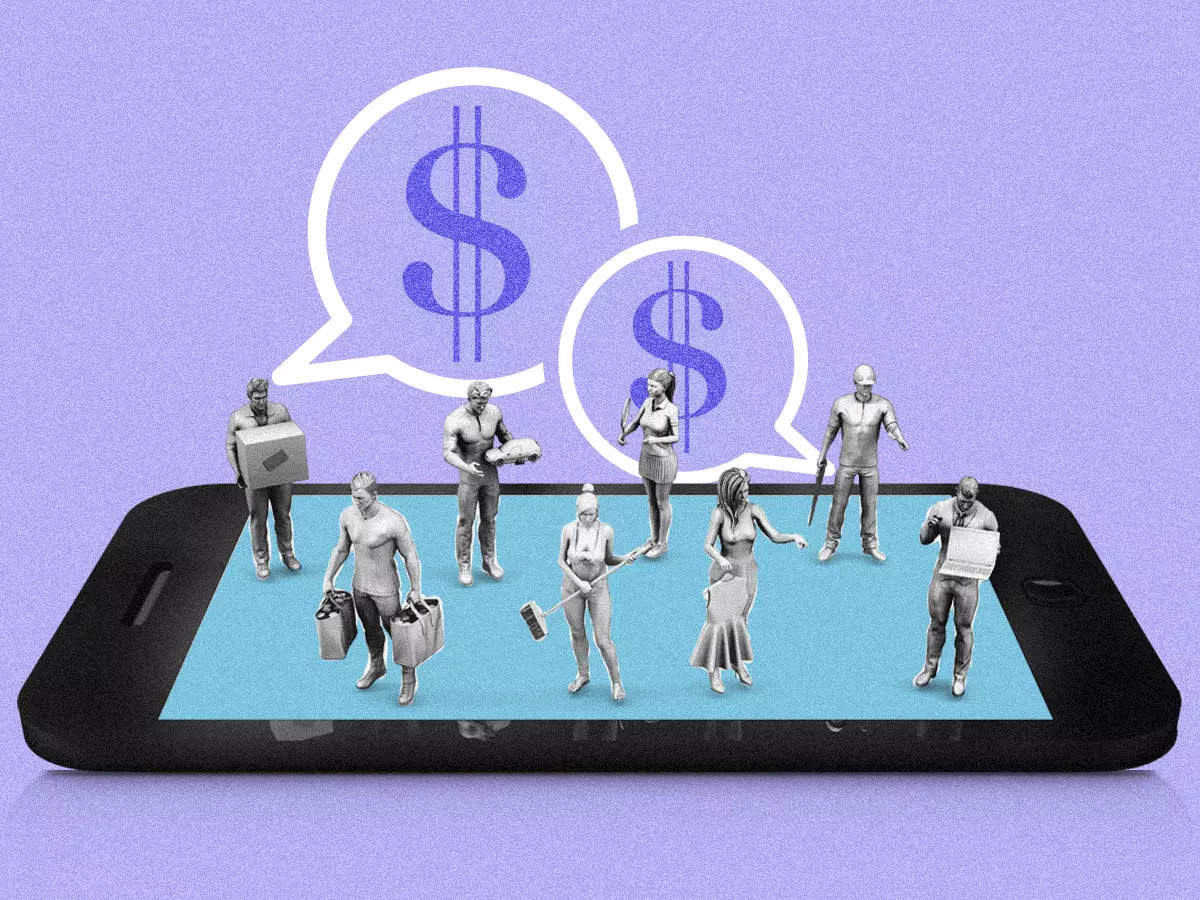

A petition has been filed before the Supreme Court, seeking social security benefits for gig workers engaged by delivery apps such as Zomato Swiggy, and taxi aggregator apps such as Ola and Uber.

By whom? It was filed by a registered union and a federation of trade unions representing app-based transport and delivery workers, and two drivers who have worked with Ola and Uber.

What it said: The petition said the denial of social security benefits such as pension and health insurance to gig workers was a violation of their right to life and right against forced labour. “The present petition is being filed raising questions of great public and constitutional importance, namely whether the ‘Right to Social Security’ is a guaranteed fundamental right for all working people, whether employed in the formal or informal sectors,” it said.

Asking the Supreme Court to issue directions to the union government, it said the fact that their employers call themselves “aggregators” and enter into “partnership agreements” does not take away from the fact that their relationship is one of employer and employee.

It argues that these workers fall under the definition of "unorganised workers" in the Unorganised Workers' Social Welfare Security Act, 2008, making them eligible for social security benefits.

Devas Multimedia Ltd.’s investors have urged a US federal court to deny the Indian government’s motion to pause a suit to enforce a $111 million award in their favour.

The argument: The investors argued that India has abused its sovereign powers and the motion to dismiss the suit is “India’s latest effort to avoid its obligations”.

Investors of Devas include Devas (Mauritius) Ltd, Devas Employees Mauritius Pvt. Ltd and Telecom Devas Ltd.

Tell me more: The submission came in response to a motion filed by India in The United States District Court for The District of Columbia to dismiss an ongoing suit, arguing that the court did not have jurisdiction under the US Foreign Sovereign Immunities Act.

We reported on August 18 that the US District Court for the Western District of Washington had ordered Antrix to furnish information, including documents showing any transfer of assets, money and business contracts from Antrix to NewSpace India Ltd—the commercial arm of the Department of Space—to Devas’ shareholders and the court, by September 17.

Judge Thomas S Zilly had upheld that the shareholders of Devas had a legal right to enforce the award, which the Indian government and Antrix have been disputing ever since it placed Devas in liquidation to avoid paying cumulative arbitral awards worth $1.3 billion (including interest and other costs).

■ ZestMoney, an Indian ‘buy now, pay later’ platform, has raised $50 million from Australian peer Zip Co. Ltd as part of its Series C funding round. It will use the capital to expand its product suite, deepen its merchant network, strengthen its balance sheet and launch new business lines in insurance and savings. As part of the transaction, Zip will acquire a minority shareholding in the fintech startup and a board seat.

■ IT startup Lio has raised around Rs 37 crore in a seed funding round led by Sequoia Capital India and Lightspeed India. The company plans to use the investment primarily to expand its engineering team and increase the number of users of its mobile application.

■ IT solutions provider Mphasis has acquired Blink UX, a user experience research, strategy, and design firm, for about $94 million in an all-cash deal. The Blink leadership will join Mphasis following the acquisition.

Today's ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

- Unacademy can’t use its PrepLadder app for now

- Gig workers move Supreme Court for social security

- Devas Multimedia vs Govt of India

Freshworks listed on Nasdaq after billion-dollar IPO

2021 continues to be a banner year for Indian startups. While Zomato's stellar IPO broke many records on the Indian stock markets in July, setting the stage for consumer-tech startups to go public, Freshworks, which was founded in Chennai, is likely to set a similar trend for Indian SaaS (software-as-a-service) startups eyeing the US public markets.

The company sold 28.5 million shares at $36 each, up from the $32-$34 range the company announced earlier this week, pointing to strong investor interest. The listing, which triggered elation amongst India’s startup mavens, will also benefit two-thirds of its over 4,300 employees, who own stock options.

Its founder Girish Mathrubootham said, "This was a dream come true moment for him to be able to take Freshworks to Nasdaq from its humble beginnings in Trichy." The IPO is expected to give a further boost to Indian startups to build for global markets from India.

Opening doors: Investors who backed Freshworks—winner of ET’s Startup of the Year in 2016—say the company’s Nasdaq listing will make it easier for the next set of Indian companies to aim big.

Financials: Freshworks reported a 53% increase in revenue to $169 million in the six months that ended June 30, 2021, from $110 million in the same period last year. Losses declined sharply by 83% to $ 8.9 million.

It was valued at $3.5 billion in November 2019 when it raised $150 million from Sequoia Capital, CapitalG and Accel.

IPO fever here and there: Freshworks is one of many Indian tech startups looking to tap the public markets in the next few months, following Zomato’s landmark listing in July. Others include Paytm, PolicyBazaar, PharmEasy and MobiKwik.

In the US, too, a wave of recent IPOs by technology firms such as Zoom, Snowflake, Asana and Palantir have been extremely well received in the wake of increased digitisation due to the pandemic. Gupshup, a Silicon Valley messaging startup with a focus on India, also plans to list in the US next year.

Related coverage

- Postman becomes most valued Indian SaaS startup after $225M funding

- BrowserStack becomes India's highest-valued SaaS firm after fresh funding

- Mindtickle becomes a unicorn after SoftBank-led funding

Mumbai court restrains Unacademy from using its PrepLadder app

A city civil court in Mumbai has temporarily restrained Unacademy from using its PrepLadder application following allegations of plagiarism from a Sri Lankan startup. PrepLadder helps students prepare for a variety of entrance exams, including NEET-PG, FMGE, CAT, UPSC, GATE and IIT-JEE.

Why? The court’s order came in response to a petition filed by Sri Lankan edtech startup Medical Joyworks, which offers digital products and solutions to the medical sector. It said it had provided comprehensive evidence to the court, detailing how PrepLadder has been systematically copying and altering its proprietary information, expertise and technology, and presenting them as their own.

The order named Sorting Hat Technologies, the parent company of Unacademy, and its investors including Blume Venture Advisors, Sequoia Capital India, SoftBank Vision Fund and Temasek Holdings.

The court also said Medical Joyworks could claim compensation after assessing the loss, if any.

Acquired last year: Unacademy had acquired PrepLadder for $50 million last July in a cash-and-stock deal. PrepLadder founders Deepanshu Goyal, Vitul Goyal and Sahil Goyal, and their 250 employees, joined Unacademy.

We reported on August 2 that Bengaluru-based Unacademy had raised $440 million in a new round of funding valuing the company at $3.4 billion.

Reactions: “We are grateful to the court for granting an injunction… and for acting swiftly and decisively. We will continue our lawsuit in the hopes that a satisfactory resolution that honours our work, our customers, and the broader medical community will be achieved,” Dr Nayana Somaratna, CEO and cofounder of Medical Joyworks, wrote a post on the company’s website.

An Unacademy spokesperson said, “We are in the process of reviewing the documents and will decide on our next course of action, including protecting our rights and interests, in consultation with our legal advisors.”

Tweet of the Day

Seeking social security, gig workers move Supreme Court

A petition has been filed before the Supreme Court, seeking social security benefits for gig workers engaged by delivery apps such as Zomato Swiggy, and taxi aggregator apps such as Ola and Uber.

By whom? It was filed by a registered union and a federation of trade unions representing app-based transport and delivery workers, and two drivers who have worked with Ola and Uber.

What it said: The petition said the denial of social security benefits such as pension and health insurance to gig workers was a violation of their right to life and right against forced labour. “The present petition is being filed raising questions of great public and constitutional importance, namely whether the ‘Right to Social Security’ is a guaranteed fundamental right for all working people, whether employed in the formal or informal sectors,” it said.

Asking the Supreme Court to issue directions to the union government, it said the fact that their employers call themselves “aggregators” and enter into “partnership agreements” does not take away from the fact that their relationship is one of employer and employee.

It argues that these workers fall under the definition of "unorganised workers" in the Unorganised Workers' Social Welfare Security Act, 2008, making them eligible for social security benefits.

Devas investors urge US court to deny India’s bid to stall arbitration award

Devas Multimedia Ltd.’s investors have urged a US federal court to deny the Indian government’s motion to pause a suit to enforce a $111 million award in their favour.

The argument: The investors argued that India has abused its sovereign powers and the motion to dismiss the suit is “India’s latest effort to avoid its obligations”.

Investors of Devas include Devas (Mauritius) Ltd, Devas Employees Mauritius Pvt. Ltd and Telecom Devas Ltd.

Tell me more: The submission came in response to a motion filed by India in The United States District Court for The District of Columbia to dismiss an ongoing suit, arguing that the court did not have jurisdiction under the US Foreign Sovereign Immunities Act.

- “The Indian government’s latest legal gambit is to argue for delay… attack investors in Devas and evade payment of three lawful international arbitration awards,” said Jay Newman, senior advisor to Devas’s shareholders. “Courts and tribunals everywhere outside India have ruled in Devas’ favour. No one will be fooled, nor deceived, by the Indian government’s actions.”

We reported on August 18 that the US District Court for the Western District of Washington had ordered Antrix to furnish information, including documents showing any transfer of assets, money and business contracts from Antrix to NewSpace India Ltd—the commercial arm of the Department of Space—to Devas’ shareholders and the court, by September 17.

Judge Thomas S Zilly had upheld that the shareholders of Devas had a legal right to enforce the award, which the Indian government and Antrix have been disputing ever since it placed Devas in liquidation to avoid paying cumulative arbitral awards worth $1.3 billion (including interest and other costs).

ETtech Done Deals

■ ZestMoney, an Indian ‘buy now, pay later’ platform, has raised $50 million from Australian peer Zip Co. Ltd as part of its Series C funding round. It will use the capital to expand its product suite, deepen its merchant network, strengthen its balance sheet and launch new business lines in insurance and savings. As part of the transaction, Zip will acquire a minority shareholding in the fintech startup and a board seat.

■ IT startup Lio has raised around Rs 37 crore in a seed funding round led by Sequoia Capital India and Lightspeed India. The company plans to use the investment primarily to expand its engineering team and increase the number of users of its mobile application.

■ IT solutions provider Mphasis has acquired Blink UX, a user experience research, strategy, and design firm, for about $94 million in an all-cash deal. The Blink leadership will join Mphasis following the acquisition.

Today's ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.