Inflation concerns have hit new heights in the U.S. and Europe amid supply chain issues and pandemic recovery conditions. The U.S. Commerce Department issued a report that prices rose 4.3% between August 2020 and August 2021, the largest annual increase since 1990.

Europe, meanwhile, has seen energy costs balloon almost 25%, driving up prices in just about every sector. In the countries that utilize the euro, inflation has increased 3.4% in September, up from August’s 3%.

“Supply-chain problems have led to higher prices for many goods and some services, but some of those high prices are now starting to fall and others are increasing at a slower pace,” said chief economist Gus Faucher of PNC Financial Services.

Oil prices have been surging, and there is concern that an especially cold winter could push barrel prices over $100, which in turn could fuel a global inflation crisis.

Analysts led by Francisco Blanch noted that “…Oil prices could spike and lead to a second round of inflationary pressures around the world. Put differently, we may just be one storm away from the next macro hurricane.”

The Fed, along with some analysts, have downplayed the situation and are claiming that though inflation numbers seem high right now, they will fade. “I am a strong believer that we are going to be looking at closer to 2.5% inflation for an extended period of time,” said Joel Naroff of Naroff Economic Advisors. “By the Fed saying they are going to inflation average, I think they think the same thing.”

Hedge Against Inflation With SmartETFs

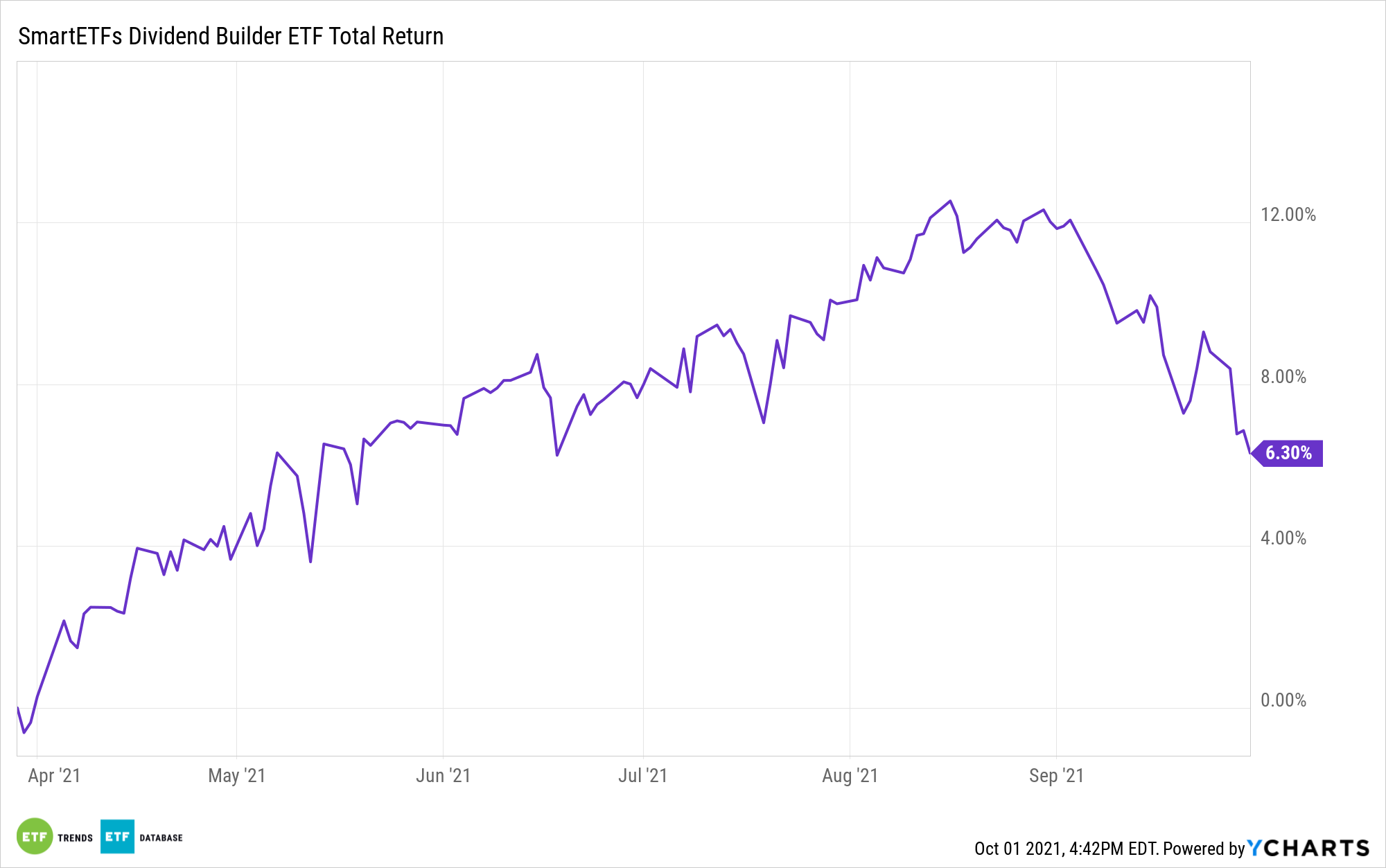

Dividend growth ETFs like the SmartETFs Dividend Builder (DIVS) can be effective inflation hedges because dividend rates tend to outpace inflation. As the costs of goods and services rise, companies can adjust their dividends accordingly. Because DIVS has focus on quality companies with healthy balance sheets and a record of dividend growth, the funds roster should be able to deliver income ahead of the pace of inflation — whether that pace retreats to 2.5% or continues to heat up.

For more news, information, and strategy, visit the Dividend Channel.