Daily Top 5 Daily Top 5 |

Nykaa IPO gets Sebi nod; Urban Company cuts commissions

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

In early August we reported that Nykaa had filed for an IPO, seeking to raise Rs 525 crore by issuing new shares. Sources told us today that the listing now has Sebi’s approval, and that Nykaa will file an updated draft prospectus to increase the size of the primary issue to Rs 630 crore.

Also in this letter:

Nykaa received clearance from the Securities and Exchange Board of India (Sebi) earlier today for its initial public offering, sources told us.

There’s more: The omnichannel beauty and consumer-care products retailer is likely to file an updated draft red herring prospectus (DRHP) with Sebi today to increase the primary issue size from Rs 525 crore to Rs 630 crore, banking sources said. It had first filed its DRHP in early August.

Nykaa’s IPO will also include an offer for sale (OFS) in which existing shareholders will sell up to 431.1 lakh shares.

The Sanjay Nayar Family Trust, a promoter, will sell 48 lakh shares and other investors that will dilute their stakes include TPG, Light House India Fund, JM Financials, Yogesh Agencies, Sunil Kant Munjal, Harindarpal Singh Banga, Narotam Sekhsaria and Mala Gaonkar, according to the company’s draft IPO prospectus, which it had filed in August.

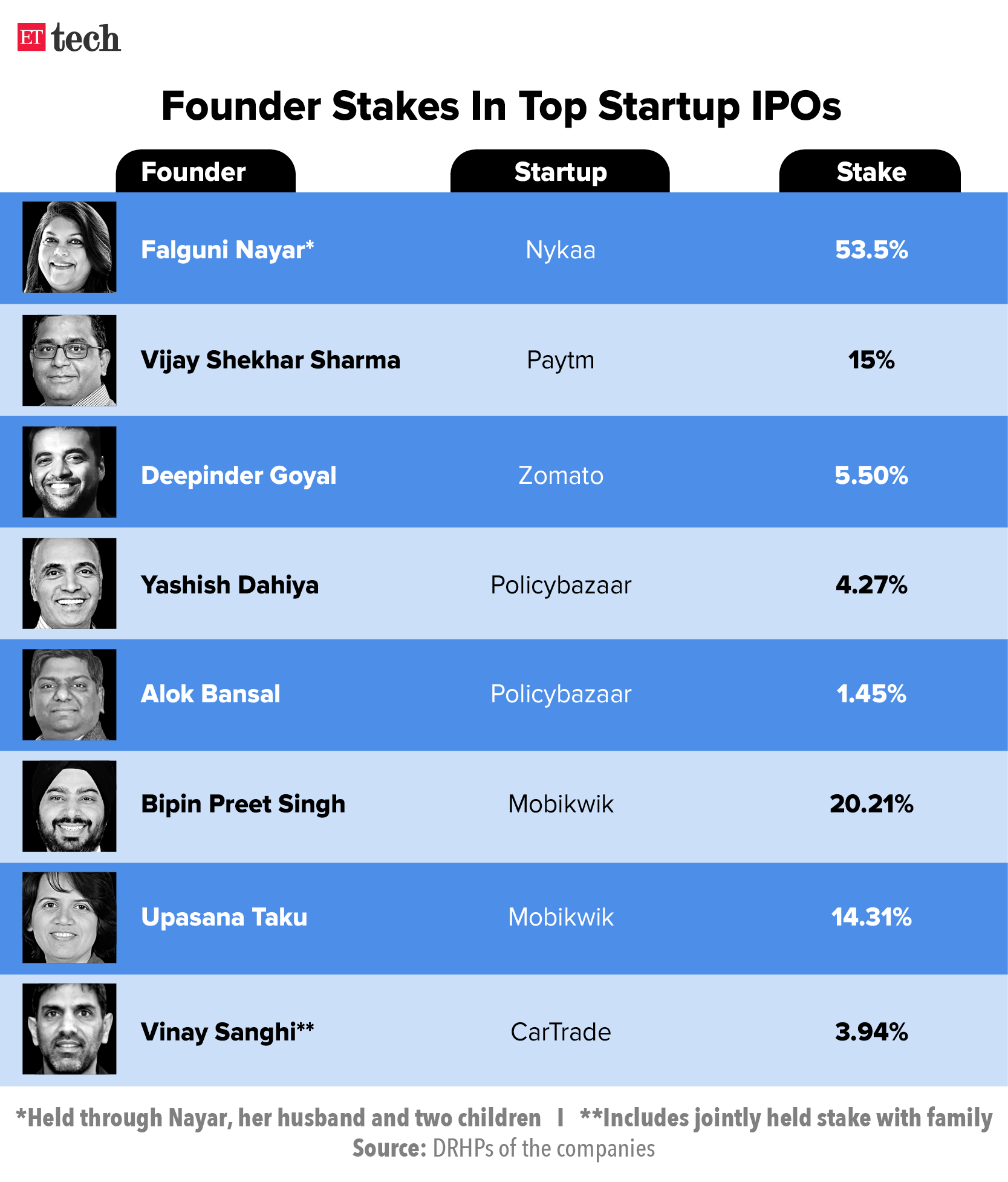

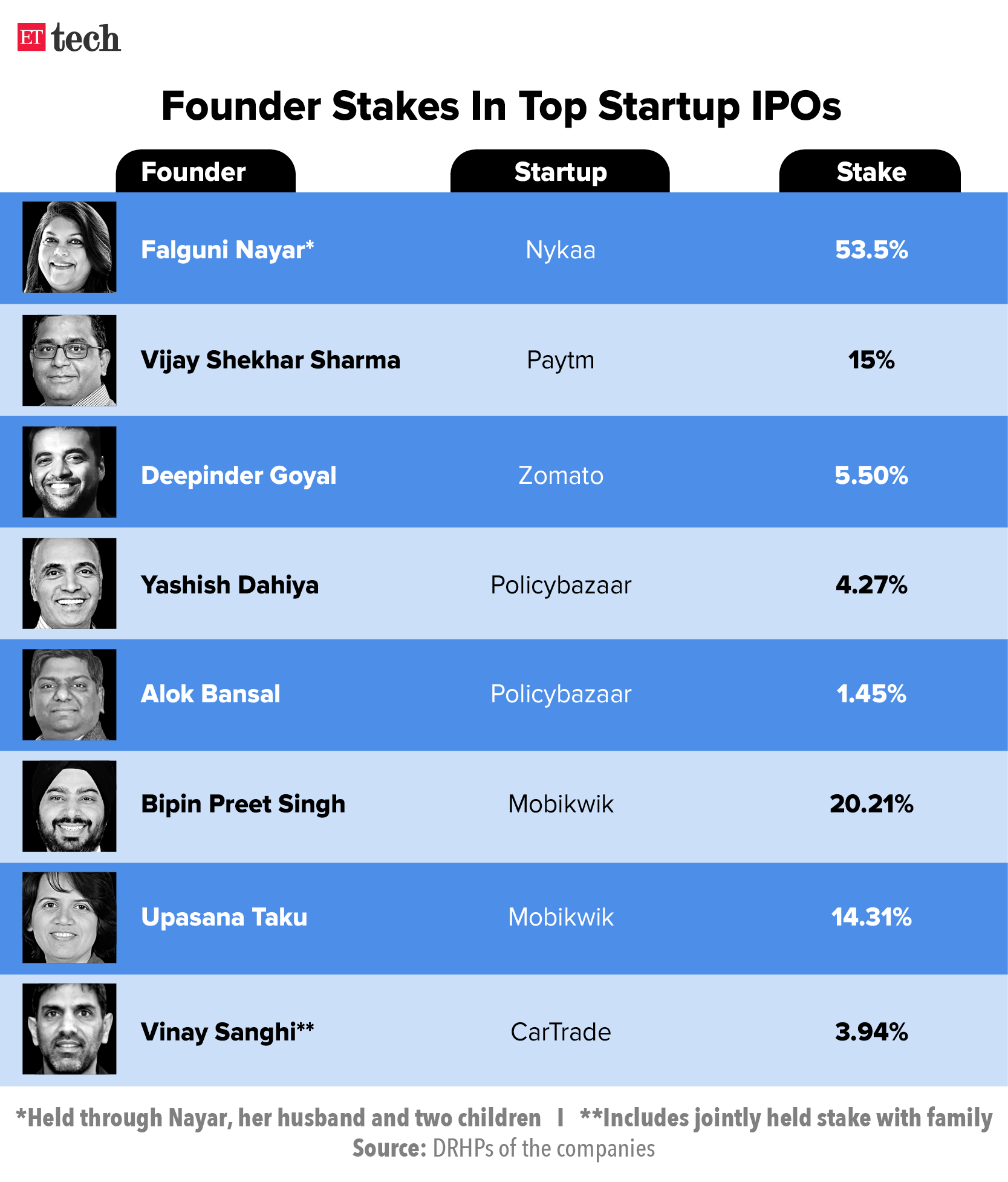

Founder will retain control: We had previously reported that founder Falguni Nayar and her family would continue to own a majority stake in Nykaa even after the IPO. She, her husband Sanjay Nayar and their two children currently hold more than 53% in FSN E-Commerce Ventures, the parent firm of Nykaa, mainly through two trusts in their names.

What that means: Nayar, as a promoter, will have the right to nominate up to half the board members and pick at least one such nominee director as a member of each committee constituted by the board. This will be valid as long as Nykaa’s promoters hold more than 25% of the company.

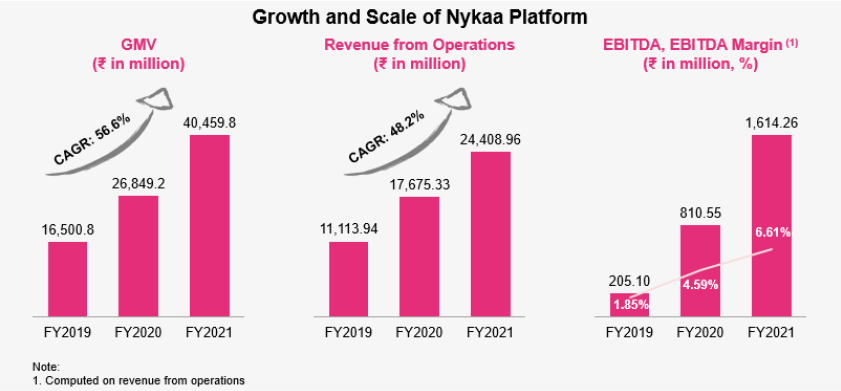

Source: Nykaa DRHP

Source: Nykaa DRHP

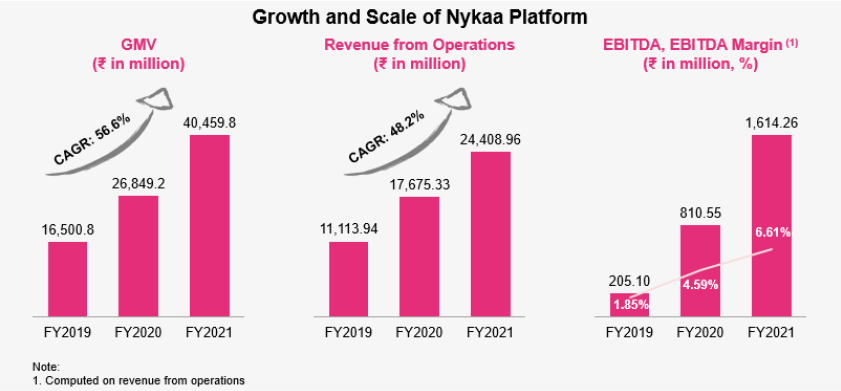

It clocked a gross merchandise value of Rs 4,045.98 crore in FY21, a 50.7% increase year-on-year. It currently offers around two million items from 3,826 national and international brands to consumers.

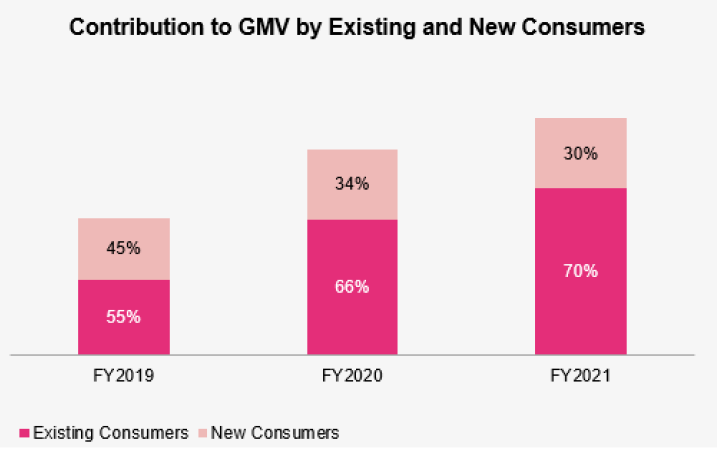

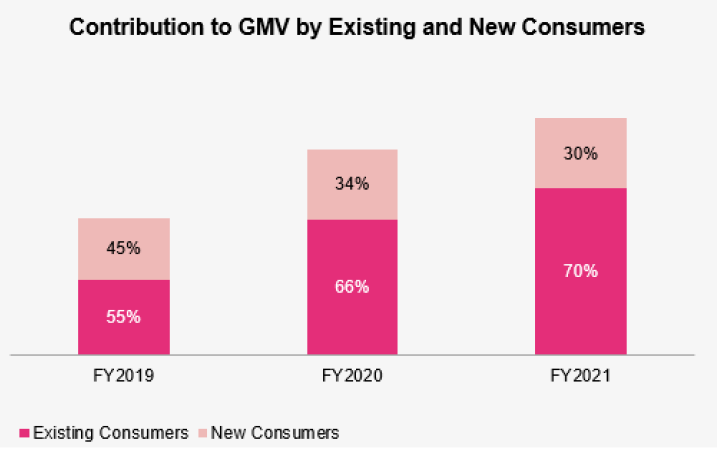

Nykaa Prive, the firm's consumer loyalty programme for its beauty and personal care vertical, had about 2.1 million members as of March 31. The programme includes customers who have spent Rs 7,500 on the platform in a year.

Urban Company founders Varun Khaitan, Rahav Chandra and Abhiraj Bhal

Urban Company founders Varun Khaitan, Rahav Chandra and Abhiraj Bhal

Days after facing protests—online and offline—by ‘partners’ who provide services on its platform, Urban Company has announced a slew of changes for them. It said it would, among other things, slash the highest commission it charges beauty service professionals from 30% to 25%.

12-point plan: In a blog post, the company laid out a 12-point plan to improve the earnings and livelihoods of service professionals on its platform. These include:

The protests: Last Friday, more than 100 Urban Company ‘partners’—mainly women—protested outside the company’s Gurugram office, demanding better pay, safer working conditions and social security benefits.

US Senator Elizabeth Warren called for breaking up Amazon and Indian retailers demanded a government probe of the company after a Reuters investigation showed the ecommerce giant had copied products and rigged search results in India.

What is the issue? The report, reviewing thousands of internal Amazon documents, found that the US company ran a systematic campaign to create knockoffs and manipulate search results to boost its own private brands in India, one of the company’s largest growth markets.

The report showed for the first time that, at least in India, manipulating search results to favour Amazon’s own products, as well as copying other sellers’ goods, were part of a formal strategy at Amazon—and that at least two senior executives had reviewed it.

Amazon's response: “We believe these claims are factually incorrect and unsubstantiated,” the company said, but did not elaborate. It added that Amazon displays search results based on relevance to the customer’s search query, irrespective of whether such products have private brands offered by sellers or not”.

Rising opposition: But a group representing millions of India's brick-and-mortar retailers said the government must launch an investigation into Amazon.

ADIF, too: The Alliance of Digital India Foundation (ADIF), a non-profit representing some of India’s biggest startups, said the practices detailed in the Reuters report were "highly deplorable" and called into question "the credibility of Amazon as a good faith operator in the Indian startup ecosystem".

In a blog post, the group urged the Indian government to take action against “Amazon’s predatory playbook of copying, rigging and killing Indian brands”.

Antitrust threat: Warren, a prominent Democrat, advocated the breakup of Amazon and other tech giants in 2019 when she was running for president. Since then, as a senator from Massachusetts, she has continued to apply pressure on companies like Amazon.

"These documents show what we feared about Amazon’s monopoly power — that the company is willing and able to rig its platform to benefit its bottom line while stiffing small businesses and entrepreneurs," Warren said in a tweet. "This is one of the many reasons we need to break it up.”

Logistics startup Delhivery has appointed three new independent directors to its board and elevated an existing one to the post of chairman ahead of its initial public offering (IPO).

The three new independent directors are:

The appointments come a week after Delhivery changed its registration to that of a public company as it prepares to file its draft IPO papers with the Sebi.

IPO plans: The Gurugram-based firm is looking to raise close to $1 billion from the IPO at a valuation of $5.5-6 billion and aims to list before the end of the current fiscal. It has issued bonus shares to its shareholders, realigned its capitalisation table and announced stock options for employees, we reported earlier.

Also Read: ETtech IPO Watch: A decade of Delhivery

Clubhouse, the audio-only app designed to be a virtual conference hall, generated huge buzz during the peak of the pandemic and received a $4 billion valuation earlier this year. In the months since then, that excitement seems to have cooled.

The red-hot start may have been a drawback, Clubhouse chief executive officer Paul Davison said in an interview with Emily Chang on Bloomberg Television.

Davison said Clubhouse’s rapid growth early on “really stressed our systems,” prompting the company of eight people to scramble to hire quickly.

Now Clubhouse has about 80 employees, he said. Davison also said that “paying creators is something we should absolutely be thinking about”.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

- Protest-hit Urban Company’s 12-point plan

- Amazon under fire over India ‘malpractices’ report

- IPO-bound Delhivery appoints three new directors

Nykaa gets Sebi’s go-ahead for IPO, to seek bigger primary issue

Nykaa received clearance from the Securities and Exchange Board of India (Sebi) earlier today for its initial public offering, sources told us.

There’s more: The omnichannel beauty and consumer-care products retailer is likely to file an updated draft red herring prospectus (DRHP) with Sebi today to increase the primary issue size from Rs 525 crore to Rs 630 crore, banking sources said. It had first filed its DRHP in early August.

Nykaa’s IPO will also include an offer for sale (OFS) in which existing shareholders will sell up to 431.1 lakh shares.

The Sanjay Nayar Family Trust, a promoter, will sell 48 lakh shares and other investors that will dilute their stakes include TPG, Light House India Fund, JM Financials, Yogesh Agencies, Sunil Kant Munjal, Harindarpal Singh Banga, Narotam Sekhsaria and Mala Gaonkar, according to the company’s draft IPO prospectus, which it had filed in August.

Founder will retain control: We had previously reported that founder Falguni Nayar and her family would continue to own a majority stake in Nykaa even after the IPO. She, her husband Sanjay Nayar and their two children currently hold more than 53% in FSN E-Commerce Ventures, the parent firm of Nykaa, mainly through two trusts in their names.

What that means: Nayar, as a promoter, will have the right to nominate up to half the board members and pick at least one such nominee director as a member of each committee constituted by the board. This will be valid as long as Nykaa’s promoters hold more than 25% of the company.

- As long as Falguni, Sanjay and the two trusts remain promoters of the company, they can nominate up to one-third of the board and nominate at least one such nominee director as a member of a committee constituted by the board.

- Nykaa’s promoters will also have the right of first refusal when a shareholder with less than 3% wants to sell shares.

- Rs 200 crore will be used for marketing, and will be deployed by March 2024. Nykaa currently has 13 of its own brands, including Nykaa Cosmetics, Nykaa Naturals, Kay Beauty, Twenty Dresses, Pipa Bella and Nykd.

- Rs 130 crore will be spent on repayment of outstanding borrowings over the next two fiscals.

- Rs 35 crore will go towards setting up new warehouses with a total built-up area of around 350,000 square feet over the next three fiscals. Nykaa currently has 18 warehouses, of which two are outsourced.

- Rs 35 crore will be used to set up new physical stores with a total built-up area of around 75,000 square feet over the next three fiscals.

It clocked a gross merchandise value of Rs 4,045.98 crore in FY21, a 50.7% increase year-on-year. It currently offers around two million items from 3,826 national and international brands to consumers.

Nykaa Prive, the firm's consumer loyalty programme for its beauty and personal care vertical, had about 2.1 million members as of March 31. The programme includes customers who have spent Rs 7,500 on the platform in a year.

After protests, Urban Company cuts commissions, raises prices

Days after facing protests—online and offline—by ‘partners’ who provide services on its platform, Urban Company has announced a slew of changes for them. It said it would, among other things, slash the highest commission it charges beauty service professionals from 30% to 25%.

12-point plan: In a blog post, the company laid out a 12-point plan to improve the earnings and livelihoods of service professionals on its platform. These include:

- Giving its ‘partners’ the ability to cancel one task per month without facing a penalty.

- "Slightly" increasing prices of several high-demand services to increase its partners’ earnings.

- Further reducing the maximum cap on monthly penalties per partner per month from Rs 3,000 to Rs 1,500.

- Passing on to its partners the cancellation fees it charges customers for last-minute changes.

- Removing all temporary blocks on service professionals who had been algorithmically blocked for a range of reasons.

- Setting up a dedicated SOS helpline for its women partners.

- Sensitising customers on treating service professionals with dignity and respect.

- Simplifying the claims process for life and accidental insurance available to all partners, and the health insurance available to UC Plus partners.

The protests: Last Friday, more than 100 Urban Company ‘partners’—mainly women—protested outside the company’s Gurugram office, demanding better pay, safer working conditions and social security benefits.

- Over the weekend, they logged out of the app en masse as a mark of protest.

- On Monday, they logged back in but only after sharing their list of demands with the company.

Pressure mounts on Amazon after report on its India ‘malpractices’

US Senator Elizabeth Warren called for breaking up Amazon and Indian retailers demanded a government probe of the company after a Reuters investigation showed the ecommerce giant had copied products and rigged search results in India.

What is the issue? The report, reviewing thousands of internal Amazon documents, found that the US company ran a systematic campaign to create knockoffs and manipulate search results to boost its own private brands in India, one of the company’s largest growth markets.

The report showed for the first time that, at least in India, manipulating search results to favour Amazon’s own products, as well as copying other sellers’ goods, were part of a formal strategy at Amazon—and that at least two senior executives had reviewed it.

Amazon's response: “We believe these claims are factually incorrect and unsubstantiated,” the company said, but did not elaborate. It added that Amazon displays search results based on relevance to the customer’s search query, irrespective of whether such products have private brands offered by sellers or not”.

Rising opposition: But a group representing millions of India's brick-and-mortar retailers said the government must launch an investigation into Amazon.

- "Amazon is causing a great disadvantage to the small manufacturers. They are eating the cake that is not meant for them," Praveen Khandelwal of the Confederation of All India Traders (CAIT) said.

ADIF, too: The Alliance of Digital India Foundation (ADIF), a non-profit representing some of India’s biggest startups, said the practices detailed in the Reuters report were "highly deplorable" and called into question "the credibility of Amazon as a good faith operator in the Indian startup ecosystem".

In a blog post, the group urged the Indian government to take action against “Amazon’s predatory playbook of copying, rigging and killing Indian brands”.

Antitrust threat: Warren, a prominent Democrat, advocated the breakup of Amazon and other tech giants in 2019 when she was running for president. Since then, as a senator from Massachusetts, she has continued to apply pressure on companies like Amazon.

"These documents show what we feared about Amazon’s monopoly power — that the company is willing and able to rig its platform to benefit its bottom line while stiffing small businesses and entrepreneurs," Warren said in a tweet. "This is one of the many reasons we need to break it up.”

IPO-bound Delhivery appoints three new independent directors

Logistics startup Delhivery has appointed three new independent directors to its board and elevated an existing one to the post of chairman ahead of its initial public offering (IPO).

The three new independent directors are:

- Kalpana Morparia: Former chairperson of JPMorgan South and Southeast Asia, and the former CEO of JP Morgan India.

- Romesh Sobti: A career banker who last served as the managing director and CEO of Indusind Bank NSE 2.15 % from 2008 to 2020.

- Saugata Gupta: Current managing director and chief executive officer of Marico Ltd.

The appointments come a week after Delhivery changed its registration to that of a public company as it prepares to file its draft IPO papers with the Sebi.

IPO plans: The Gurugram-based firm is looking to raise close to $1 billion from the IPO at a valuation of $5.5-6 billion and aims to list before the end of the current fiscal. It has issued bonus shares to its shareholders, realigned its capitalisation table and announced stock options for employees, we reported earlier.

Also Read: ETtech IPO Watch: A decade of Delhivery

Tweet of the day

What happened to Clubhouse? It grew way too fast, says CEO

Clubhouse, the audio-only app designed to be a virtual conference hall, generated huge buzz during the peak of the pandemic and received a $4 billion valuation earlier this year. In the months since then, that excitement seems to have cooled.

The red-hot start may have been a drawback, Clubhouse chief executive officer Paul Davison said in an interview with Emily Chang on Bloomberg Television.

- “Boy, I think we grew way, way too fast earlier this year,” Davison said. “What we really want to do is be on that path of steady, gradual growth.”

Davison said Clubhouse’s rapid growth early on “really stressed our systems,” prompting the company of eight people to scramble to hire quickly.

Now Clubhouse has about 80 employees, he said. Davison also said that “paying creators is something we should absolutely be thinking about”.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.