Business News›Tech›Newsletters›Morning Dispatch›Ecomm sales boom in festive season; PharmEasy raises $350 million

Morning Dispatch Morning Dispatch |

Ecomm sales boom in festive season; PharmEasy raises $350 million

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

Last year, online platforms accounted for 55% of smartphones sold in the first two weeks of October. This year, that number is estimated to be 60%. And it isn't just smartphones. From refrigerators to clothes, ecommerce firms accounted for a higher share of total sales than they did this time last year. Read on to find out why.

Also in this letter:

Ecommerce's share in the total sales of various products hit new highs in the first half of October, market trackers and companies told us. In several categories, including smartphones, consumer electronics, apparel and daily necessities, online sales accounted for a higher share of the total than last year, they added.

Examples: 60% of smartphones sold during this period were bought online, up from around 55% in the same period last year, according to early estimates by Counterpoint Research. RedSeer estimated that smartphones worth around Rs 68 crore were sold online every hour during the festive sales period.

Why? The Covid-19 pandemic, a supply shortage, and longer pre-Diwali sales with bigger discounts are some of the reasons, according to Tarun Pathak, research director at Counterpoint Technology Market Research.

Quote: “Reach, coupled with behavioural changes accelerated by Covid-19, is driving adoption. For instance, online AC sales this month have doubled over last year, led by premium models,” Sharma said.

Diversifying: According to RedSeer, smartphones, TVs and appliances accounted for 73% of the total gross merchandise value (GMV) across platforms during the first week of online sales. But FMCG and clothes companies also reported a bigger surge in online shopping than last year’s festive season, led by higher discounts.

That’s because this year, most ecommerce platforms are paying attention to all categories, including groceries, instead of just focussing on electronics and clothes, said Krishnarao Buddha, senior category head at Parle Products.

“We have seen record growth from online channels, with its contribution increasing 300 basis points compared to a year ago, mainly driven by offers and deals. In fact, we are seeing a massive surge in orders for their sale events in December, indicating that online growth is sustainable,” Buddha said.

PharmEasy has closed a pre-IPO funding round worth nearly $350 million, valuing it at $5.6 billion, according to regulatory documents sourced by ET and people briefed on the matter. The company was last valued at $4 billion in June, after it acquired diagnostics chain Thyrocare for more than $600 million.

Details: The documents showed the online pharmacy has raised around $204 million (more than Rs 1,505 crore) in primary funding from Singapore’s Amansa Capital, Blackstone-backed hedge fund ApaH Capital, US hedge fund Janus Henderson, OrbiMed, Steadview Capital, Abu Dhabi’s sovereign wealth fund ADQ, hedge fund Neuberger Berman and London’s Sanne Group.

Stock options for founders: PharmEasy’s founders -- Siddharth Shah, Dhaval Shah, Dhramil Sheth, Harsh Parekh and Hardik Dedhia -- have also been given new stock options ahead of the IPO, giving them a significant wealth creation opportunity before its public market debut. Each founder has been given 9,987 stock options under its employee stock ownership plan (Esop), the documents showed.

On a roll: This is the third major funding round that the company has closed this year. In all, it has raised $1 billion (including secondary funding) in 2021 alone. Excluding the latest fundraise, PharmEasy has mopped up about $650 million since April, when it entered the unicorn club at a valuation of $1.5 billion.

You heard it here first: We reported exclusively on October 4 and September 14 that many of the above-mentioned investors were in the final stages of backing the company and that it planned to close a secondary share sale before going public. We also reported that PharmEasy was planning to file its draft IPO papers this month.

Investors are betting on crypto and blockchain startups founded by Indians at a time when the country has emerged as one of the fastest growing cryptocurrency markets globally.

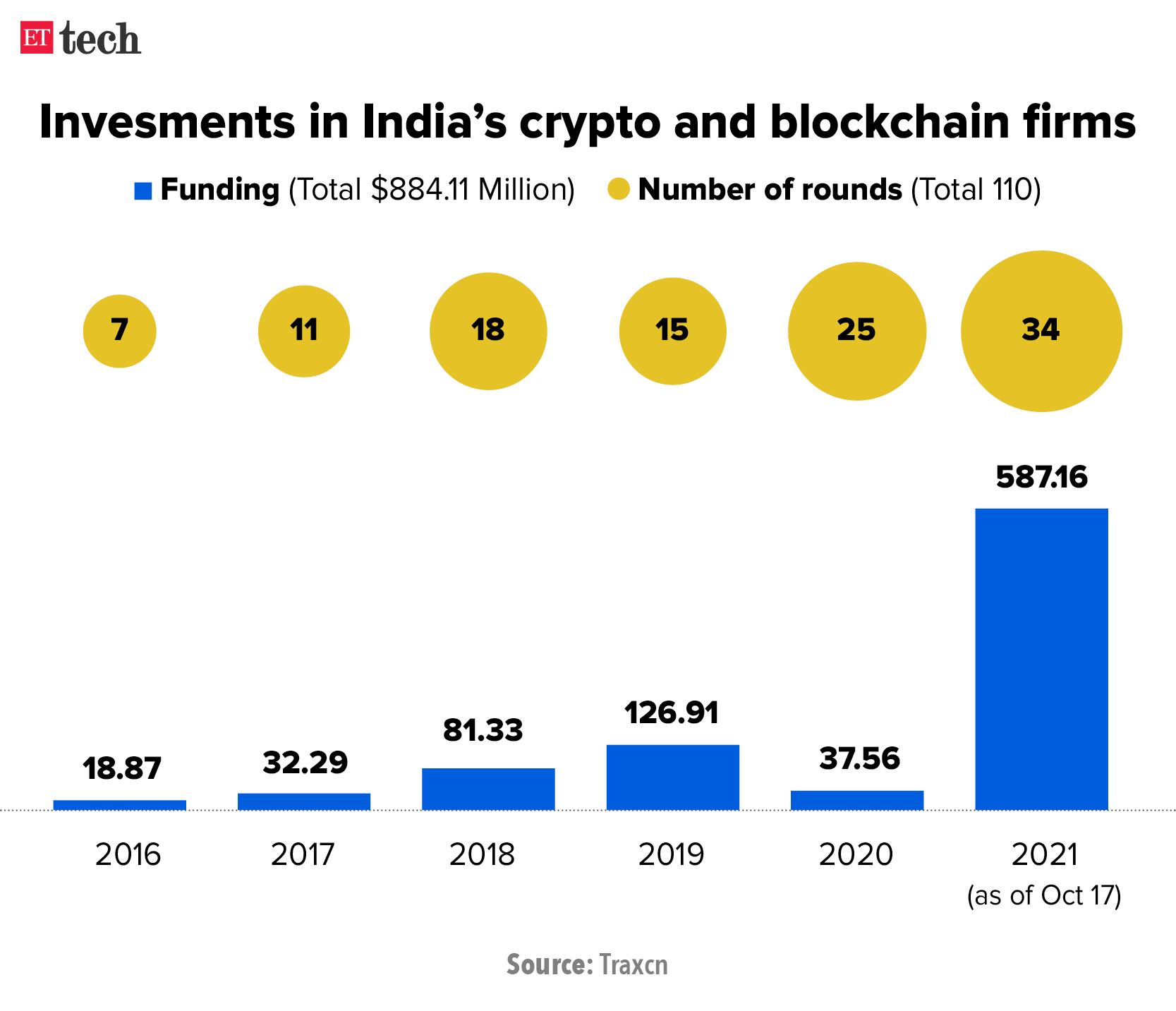

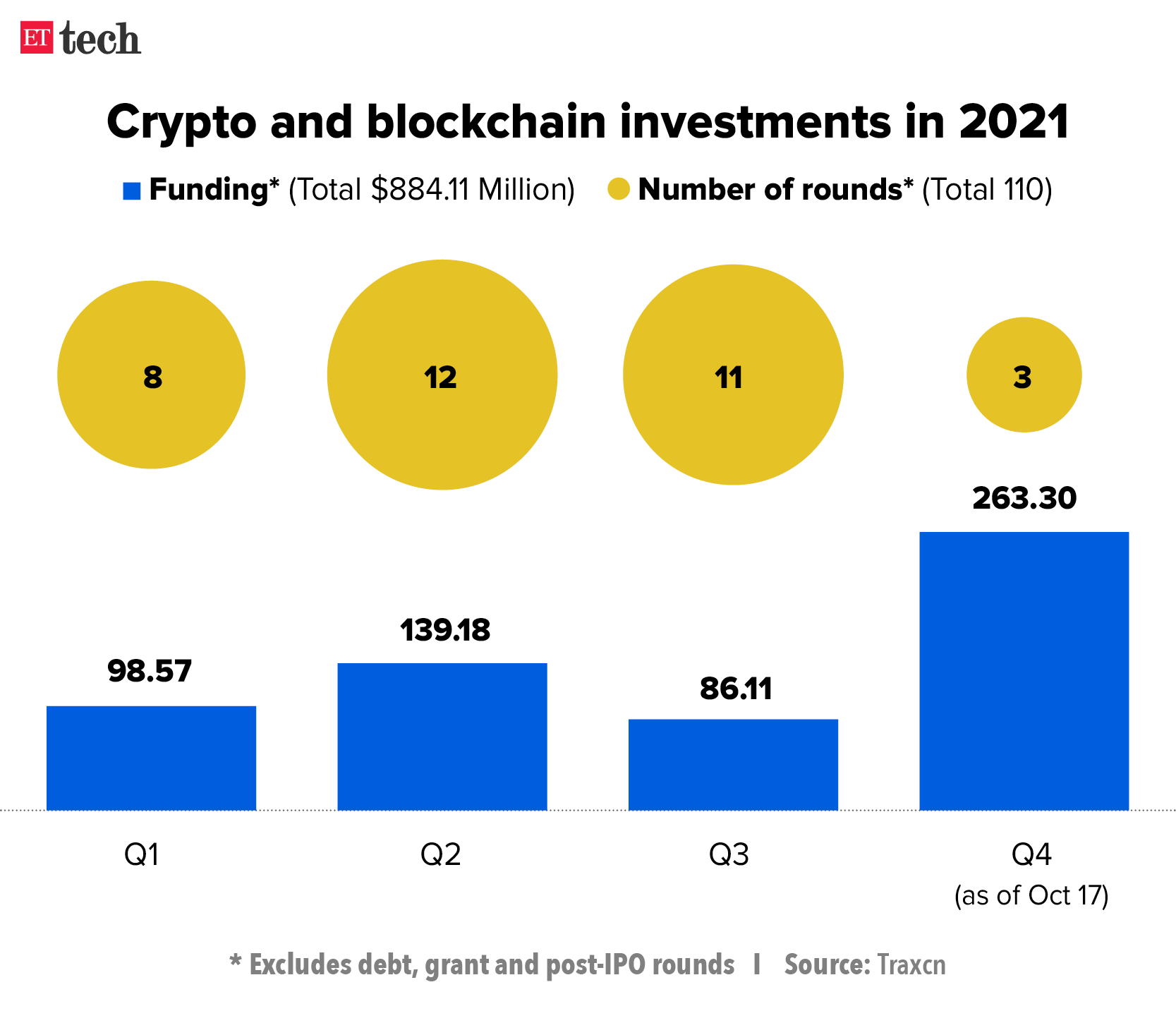

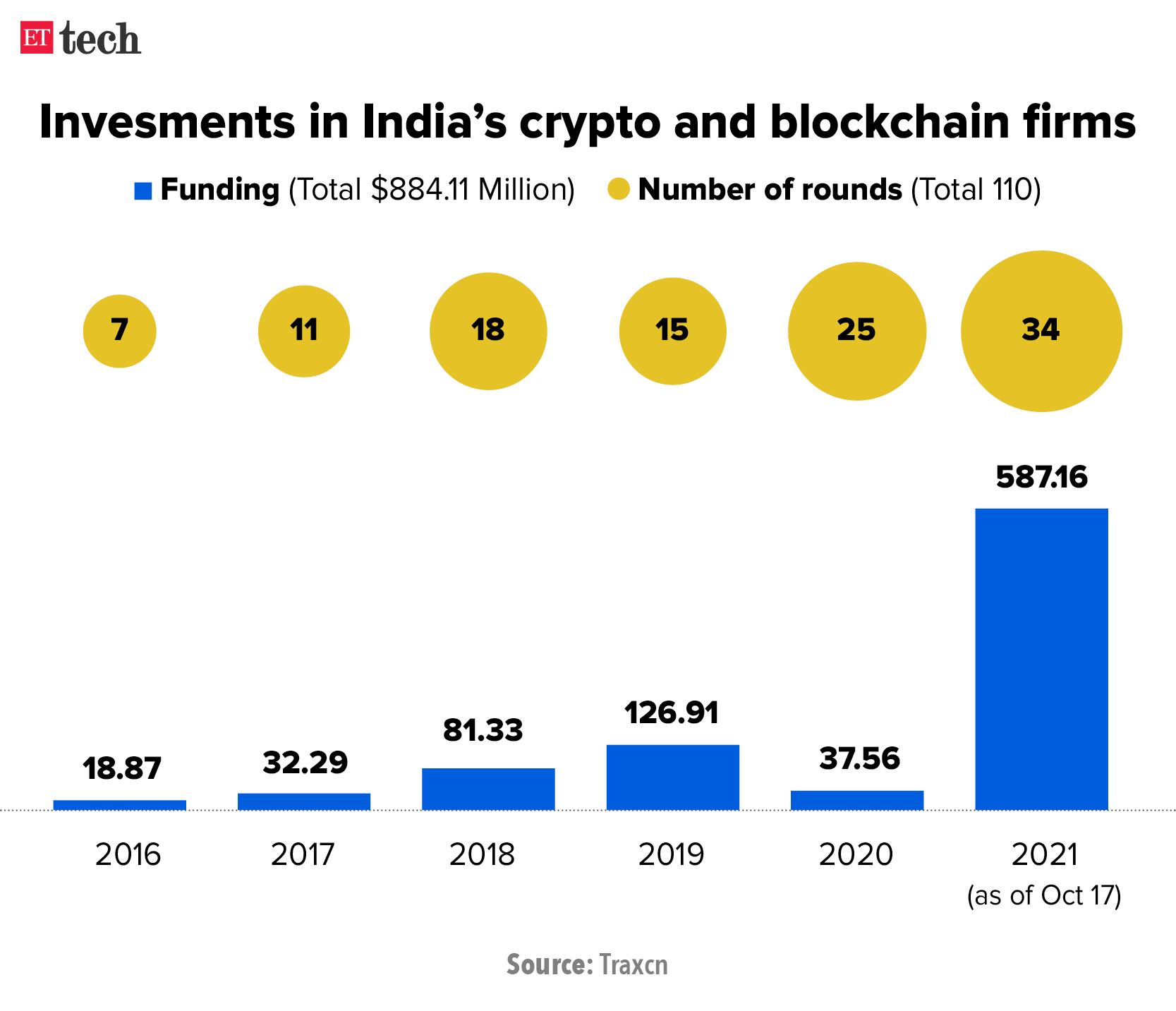

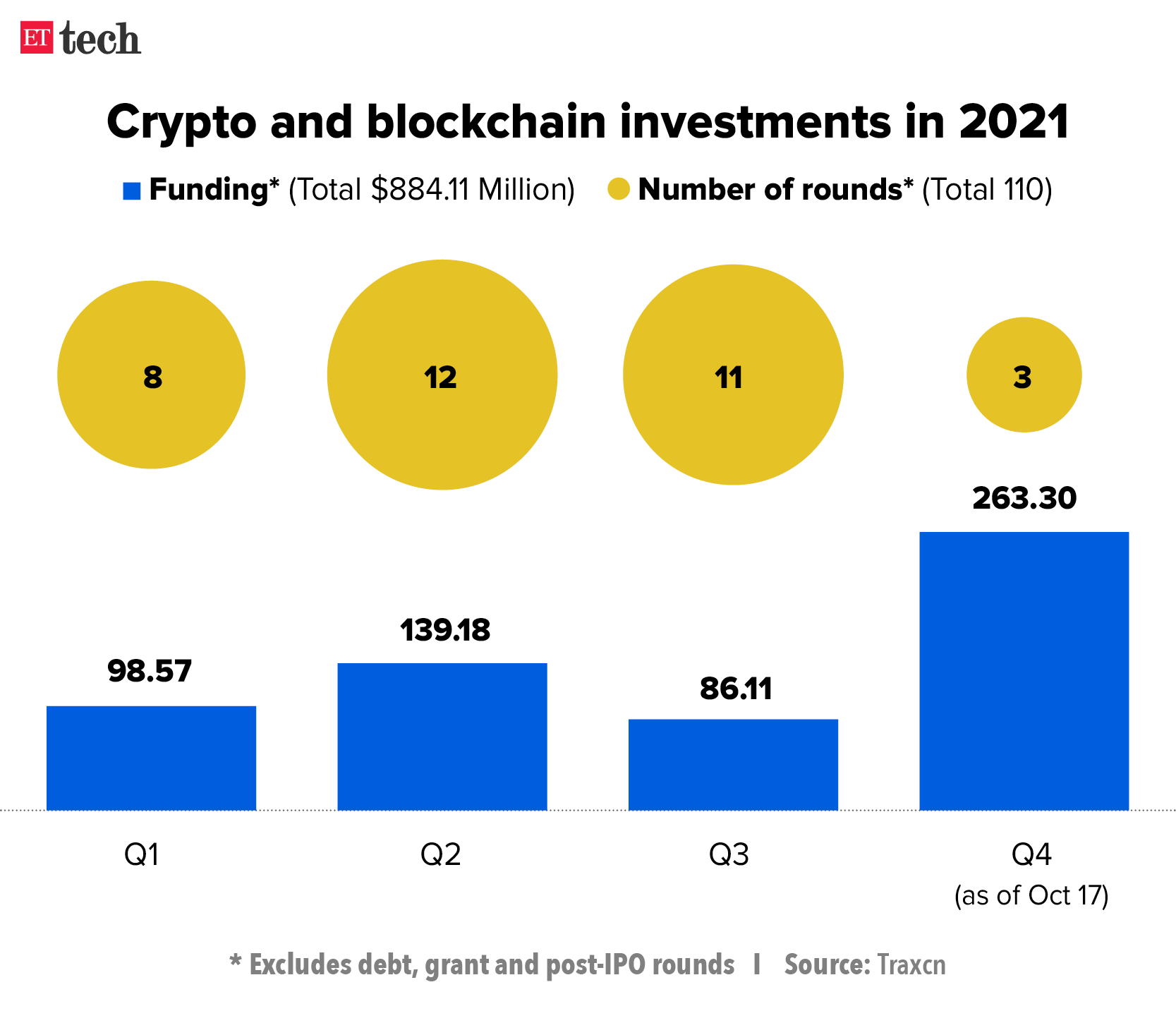

The numbers: The total risk funding in domestic crypto and blockchain startups shot up to $587.16 million as of October 17 this year, compared to $37 million in all of 2020, according to data shared with ET by industry tracker Tracxn. Foreign investors poured in the bulk of this capital.

The lion's share: Crypto exchange platforms CoinDCX and Coinswitch Kuber received almost 60% of the capital raised this year. While CoinDCX entered the unicorn club in August, CoinSwitch Kuber achieved the coveted status earlier this month, when it raised $260 million, the largest funding round by any crypto company in India.

Indian investors join crypto bandwagon: Local investors are also eyeing dedicated crypto funds. Industry sources told us a few VCs are in the process of setting up India-focussed blockchain and crypto funds that will have a corpus of $15-$50 million. Elevation Capital has completed multiple deals across crypto investing, non-fungible tokens (NFTs) and gaming, and decentralised finance.

The Indian crypto-tech industry will touch $241 million by 2030, the National Association of Software and Services Companies (Nasscom) said in a report in association with cryptocurrency platform WazirX.

Also Read: RSS urges govt to regulate streaming platforms, cryptocurrency

Wipro chief executive Thierry Delaporte

Wipro chief executive Thierry Delaporte

Wipro chief executive Thierry Delaporte said that the software services firm is eyeing more acquisitions, including "one big one". In an interview with ET, Delaporte said that the company’s year-on-year growth will “approach 30% by end of the third quarter”.

Here are some excerpts from the interview:

You took charge amid the pandemic and would have begun with expectations. Have those been met?

The decision to take this role was made in April 2020. At that time, I had no clue that Covid would last for so long; it’s been 15 months. So that has been probably the biggest gap to my own expectations.

Wipro is outpacing Infosys and TCS in growth. How much longer can you sustain this?

We will probably approach 30% year-on-year growth in the third quarter. We've said we will get to 27-30%. I'm not going to give you a number for next year, but I think we'll continue to grow well. We are firing on all cylinders. And then we'll continue to do (more) acquisitions, and possibly one big one. The only driver will be strategic intent.

Will India become less attractive for IT services?

India has the best concentration of talent in the world by far. Should we only rely on India to address our growth? The answer is no. But will there be a country that will outpace India? Not at all.

I think India is producing more engineers than America, Germany, the UK and France combined, and the quality of talent in India is really strong. You have places like Mexico, Poland, Romania, the Philippines and Vietnam, where you get good talent, but you never get the quality of talent at this scale.

You said attrition isn’t going away, but at 20.5%, has it topped out or is it going to get a lot worse?

It's going to get worse, (but) there's always a seasonality, typically in the last quarter of the year. People tend to stick around. The more you invest in new technologies, the more attractive your talent becomes.

Read the full interview here.

Akshay Singhal (left) and Kartik Hajela, cofounders, Log 9 Materials

Akshay Singhal (left) and Kartik Hajela, cofounders, Log 9 Materials

Log 9 Materials, which won in the Top Innovator category at the Economic Times Startup Awards 2021, is looking to expand its production of advanced lithium-ion cells to giga-factory scale as early as next year. Its cofounder and chief executive Akshay Singhal said the market for two- and three-wheeler electric vehicles is expected to grow exponentially in the next 12-18 months, with demand for battery packs rising 10-fold by then.

Here are some excerpts from the interview:

What is the manufacturing capacity that Log 9 will be able to build in the next 12-24 months?

The next 18 months is where you’re going to see things go crazy in terms of electric vehicle sales. Already, we’re seeing in the two-wheeler and three-wheeler space demand of around one Gw-h of battery packs, so a giga-factory-level of demand is something we’re already receiving today. In the next 12-18 months, I would not be surprised if this demand goes up to 10 Gw-h.

Also Read: Genrobotic Innovations looking to deploy cleantech solutions in UK, Malaysia, South Korea

Log 9 has run a bunch of pilots with customers. Are you ready to commercially launch the solution later this month?

We have one of the largest battery pack assembly lines set up in Bengaluru from which we are targeting a capacity of over 100 Mw-h. This will be by far the largest in the two- and three-wheeler space (in India), and we plan to ramp this up to a gigawatt hour (Gw-h) kind of capacity in the next one year itself. That’s the kind of scale we want, and the production has already started. We have a plan to put 200 three-wheelers on the road this month, and our target is to have around 4,500 vehicles by March next year.

Read the full interview here.

Also Read: Startups going public will turn profitable in three years, says Sanjeev Bikhchandani

Facebook is looking to bolster its presence in the fast-growing and fiercely competitive online gaming and streaming segment in India. It recorded 234 million gameplay sessions here during July-August, making India the country with the third-highest number of gameplay sessions on the platform. In the past year, viewership for live gaming in India has grown by over six times.

FB’s pitch to gaming publishers and streamers is simple: one app for users to play and stream games, and build a community of followers.

Quote: “For the last two years, we’ve been pretty serious in growing and our numbers are very clearly evident… what we haven’t been doing is going out and talking so much about it,” said Manish making Chopra, director and head of partnerships, Facebook India. “In recent months, we’ve seen dramatic growth…much larger than any of those platforms that are specifically gaming-only”

Taking on Google: YouTube, which is owned by Google, has long dominated the game streaming space in India, and startups such as Loco and Rheo TV have also carved a niche for themselves.

SaaS Labs gets $17 million: SaaS Labs, a cloud-based platform that builds productivity and business process automation software for enterprises, has raised $17 million in Series A funding, from Base 10 Partners and Eight Roads Ventures. This is the first institutional capital raising by the bootstrapped startup, which operates out of India and the Philippines.

Why firms are racing to hire the best of talent: Demand for tech talent has spiked across sectors as companies realise that technology has become critical to survive in a post-pandemic world. This trend is likely to persist as more firms take to digital transformation.

Also in this letter:

- PharmEasy raises $350 million in pre-IPO round

- India's crypto startups on record fundraising spree

- Interviews with Wipro CEO, Log 9 Materials founders

Ecommerce's share in total sales hits new highs in Oct

Ecommerce's share in the total sales of various products hit new highs in the first half of October, market trackers and companies told us. In several categories, including smartphones, consumer electronics, apparel and daily necessities, online sales accounted for a higher share of the total than last year, they added.

Examples: 60% of smartphones sold during this period were bought online, up from around 55% in the same period last year, according to early estimates by Counterpoint Research. RedSeer estimated that smartphones worth around Rs 68 crore were sold online every hour during the festive sales period.

- The percentage of TVs sold online grew to 40% from 31%.

- For refrigerators, ACs, washing machines and kitchen appliances, this number rose from 6-8% to 9-10%, industry executives said.

Why? The Covid-19 pandemic, a supply shortage, and longer pre-Diwali sales with bigger discounts are some of the reasons, according to Tarun Pathak, research director at Counterpoint Technology Market Research.

- Amazon and Flipkart began their festive sales from October 3 (October 2 for subscribers) and are running it for longer this time round than in previous years. They also offered higher discounts in the first 2-3 days.

- Market research firm RedSeer Consulting said there are around 20% more online shoppers in India this festive season from last year, with tier II markets contributing almost 61% of all shoppers.

- Smaller platforms such as Tata Cliq, Reliance Digital and Croma also ran promotional offers on their online stores and apps.

Quote: “Reach, coupled with behavioural changes accelerated by Covid-19, is driving adoption. For instance, online AC sales this month have doubled over last year, led by premium models,” Sharma said.

Diversifying: According to RedSeer, smartphones, TVs and appliances accounted for 73% of the total gross merchandise value (GMV) across platforms during the first week of online sales. But FMCG and clothes companies also reported a bigger surge in online shopping than last year’s festive season, led by higher discounts.

That’s because this year, most ecommerce platforms are paying attention to all categories, including groceries, instead of just focussing on electronics and clothes, said Krishnarao Buddha, senior category head at Parle Products.

“We have seen record growth from online channels, with its contribution increasing 300 basis points compared to a year ago, mainly driven by offers and deals. In fact, we are seeing a massive surge in orders for their sale events in December, indicating that online growth is sustainable,” Buddha said.

PharmEasy valuation jumps to $5.6 billion after pre-IPO funding

PharmEasy has closed a pre-IPO funding round worth nearly $350 million, valuing it at $5.6 billion, according to regulatory documents sourced by ET and people briefed on the matter. The company was last valued at $4 billion in June, after it acquired diagnostics chain Thyrocare for more than $600 million.

Details: The documents showed the online pharmacy has raised around $204 million (more than Rs 1,505 crore) in primary funding from Singapore’s Amansa Capital, Blackstone-backed hedge fund ApaH Capital, US hedge fund Janus Henderson, OrbiMed, Steadview Capital, Abu Dhabi’s sovereign wealth fund ADQ, hedge fund Neuberger Berman and London’s Sanne Group.

- Sources told us that PharmEasy parent API Holdings has also closed a $130-$140 million secondary share sale, in which PharmEasy’s founders bought shares worth around $40 million and around 20 senior employees bought shares worth $5 million.

- Early investors and angel investors have sold their stakes in the firm, while IIFL’s tech fund has picked up shares, the sources added. In a secondary share sale, existing investors sell their shares to new investors and the money does not flow into the company coffers.

Stock options for founders: PharmEasy’s founders -- Siddharth Shah, Dhaval Shah, Dhramil Sheth, Harsh Parekh and Hardik Dedhia -- have also been given new stock options ahead of the IPO, giving them a significant wealth creation opportunity before its public market debut. Each founder has been given 9,987 stock options under its employee stock ownership plan (Esop), the documents showed.

On a roll: This is the third major funding round that the company has closed this year. In all, it has raised $1 billion (including secondary funding) in 2021 alone. Excluding the latest fundraise, PharmEasy has mopped up about $650 million since April, when it entered the unicorn club at a valuation of $1.5 billion.

You heard it here first: We reported exclusively on October 4 and September 14 that many of the above-mentioned investors were in the final stages of backing the company and that it planned to close a secondary share sale before going public. We also reported that PharmEasy was planning to file its draft IPO papers this month.

Tweet of the day

India's crypto startups on a record fundraising spree

Investors are betting on crypto and blockchain startups founded by Indians at a time when the country has emerged as one of the fastest growing cryptocurrency markets globally.

The numbers: The total risk funding in domestic crypto and blockchain startups shot up to $587.16 million as of October 17 this year, compared to $37 million in all of 2020, according to data shared with ET by industry tracker Tracxn. Foreign investors poured in the bulk of this capital.

The lion's share: Crypto exchange platforms CoinDCX and Coinswitch Kuber received almost 60% of the capital raised this year. While CoinDCX entered the unicorn club in August, CoinSwitch Kuber achieved the coveted status earlier this month, when it raised $260 million, the largest funding round by any crypto company in India.

Indian investors join crypto bandwagon: Local investors are also eyeing dedicated crypto funds. Industry sources told us a few VCs are in the process of setting up India-focussed blockchain and crypto funds that will have a corpus of $15-$50 million. Elevation Capital has completed multiple deals across crypto investing, non-fungible tokens (NFTs) and gaming, and decentralised finance.

The Indian crypto-tech industry will touch $241 million by 2030, the National Association of Software and Services Companies (Nasscom) said in a report in association with cryptocurrency platform WazirX.

Also Read: RSS urges govt to regulate streaming platforms, cryptocurrency

Wipro's year-on-year growth will approach 30% by Q4, says CEO

Wipro chief executive Thierry Delaporte said that the software services firm is eyeing more acquisitions, including "one big one". In an interview with ET, Delaporte said that the company’s year-on-year growth will “approach 30% by end of the third quarter”.

Here are some excerpts from the interview:

You took charge amid the pandemic and would have begun with expectations. Have those been met?

The decision to take this role was made in April 2020. At that time, I had no clue that Covid would last for so long; it’s been 15 months. So that has been probably the biggest gap to my own expectations.

Wipro is outpacing Infosys and TCS in growth. How much longer can you sustain this?

We will probably approach 30% year-on-year growth in the third quarter. We've said we will get to 27-30%. I'm not going to give you a number for next year, but I think we'll continue to grow well. We are firing on all cylinders. And then we'll continue to do (more) acquisitions, and possibly one big one. The only driver will be strategic intent.

Will India become less attractive for IT services?

India has the best concentration of talent in the world by far. Should we only rely on India to address our growth? The answer is no. But will there be a country that will outpace India? Not at all.

I think India is producing more engineers than America, Germany, the UK and France combined, and the quality of talent in India is really strong. You have places like Mexico, Poland, Romania, the Philippines and Vietnam, where you get good talent, but you never get the quality of talent at this scale.

You said attrition isn’t going away, but at 20.5%, has it topped out or is it going to get a lot worse?

It's going to get worse, (but) there's always a seasonality, typically in the last quarter of the year. People tend to stick around. The more you invest in new technologies, the more attractive your talent becomes.

Read the full interview here.

Log 9 Materials eyes giga-factory scale as early as next year

Log 9 Materials, which won in the Top Innovator category at the Economic Times Startup Awards 2021, is looking to expand its production of advanced lithium-ion cells to giga-factory scale as early as next year. Its cofounder and chief executive Akshay Singhal said the market for two- and three-wheeler electric vehicles is expected to grow exponentially in the next 12-18 months, with demand for battery packs rising 10-fold by then.

Here are some excerpts from the interview:

What is the manufacturing capacity that Log 9 will be able to build in the next 12-24 months?

The next 18 months is where you’re going to see things go crazy in terms of electric vehicle sales. Already, we’re seeing in the two-wheeler and three-wheeler space demand of around one Gw-h of battery packs, so a giga-factory-level of demand is something we’re already receiving today. In the next 12-18 months, I would not be surprised if this demand goes up to 10 Gw-h.

Also Read: Genrobotic Innovations looking to deploy cleantech solutions in UK, Malaysia, South Korea

Log 9 has run a bunch of pilots with customers. Are you ready to commercially launch the solution later this month?

We have one of the largest battery pack assembly lines set up in Bengaluru from which we are targeting a capacity of over 100 Mw-h. This will be by far the largest in the two- and three-wheeler space (in India), and we plan to ramp this up to a gigawatt hour (Gw-h) kind of capacity in the next one year itself. That’s the kind of scale we want, and the production has already started. We have a plan to put 200 three-wheelers on the road this month, and our target is to have around 4,500 vehicles by March next year.

Read the full interview here.

Also Read: Startups going public will turn profitable in three years, says Sanjeev Bikhchandani

Facebook eyes Indian game streaming space

Facebook is looking to bolster its presence in the fast-growing and fiercely competitive online gaming and streaming segment in India. It recorded 234 million gameplay sessions here during July-August, making India the country with the third-highest number of gameplay sessions on the platform. In the past year, viewership for live gaming in India has grown by over six times.

FB’s pitch to gaming publishers and streamers is simple: one app for users to play and stream games, and build a community of followers.

Quote: “For the last two years, we’ve been pretty serious in growing and our numbers are very clearly evident… what we haven’t been doing is going out and talking so much about it,” said Manish making Chopra, director and head of partnerships, Facebook India. “In recent months, we’ve seen dramatic growth…much larger than any of those platforms that are specifically gaming-only”

Taking on Google: YouTube, which is owned by Google, has long dominated the game streaming space in India, and startups such as Loco and Rheo TV have also carved a niche for themselves.

Other Top Stories By Our Reporters

SaaS Labs gets $17 million: SaaS Labs, a cloud-based platform that builds productivity and business process automation software for enterprises, has raised $17 million in Series A funding, from Base 10 Partners and Eight Roads Ventures. This is the first institutional capital raising by the bootstrapped startup, which operates out of India and the Philippines.

Why firms are racing to hire the best of talent: Demand for tech talent has spiked across sectors as companies realise that technology has become critical to survive in a post-pandemic world. This trend is likely to persist as more firms take to digital transformation.

Global Picks We Are Reading

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.