Daily Top 5 Daily Top 5 |

Zomato in the firing line; Cred’s valuation hits $4B

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

This morning, Zomato said it had fired a customer service employee who told a customer from Tamil Nadu that he ought to know Hindi. Two hours later, the company reinstated the employee after CEO Deepinder Goyal tweeted that she should not have been sacked for her "ignorant mistake".

Also in this letter:

■ Cred valued at $4 billion

■ Top executives leave as Ola prepares to go public

■ CoinSwitch in talks with govt for crypto rules: CEO

Zomato CEO Deepinder Goyal

Zomato CEO Deepinder Goyal

Zomato CEO Deepinder Goyal reinstated a customer service employee of the firm just hours after she was sacked on Tuesday for telling a customer he ought to know Hindi.

Goyal termed the employee’s actions “an ignorant mistake” but said the company was reinstating her as “this is easily something she can learn and do better about going forward”.

What happened? Earlier, the company came under fire on Twitter after the customer, from Tamil Nadu, posted screenshots of his chat with the Zomato employee.

"Customer care says amount can't be refunded as I didn't know Hindi. Also takes lesson that being an Indian I should know Hindi. Tagged me a liar as he didn't know Tamil. @zomato not the way you talk to a customer," he wrote.

The tweet triggered a storm on Twitter and soon #Reject_Zomato was trending.

Sacked: Following the backlash, Zomato apologised to the customer and said the incident was unacceptable. It also issued a statement in Tamil and English, stressing that the company stood for diversity.

Backed: But a little over two hours later, Goyal tweeted that Zomato was reinstating the sacked employee.

Other controversies: In late August, Zomato was criticised on social media after it released ads showing its delivery workers refusing selfies with celebrities for the sake of their next delivery. The ads, widely panned as tone-deaf to workers’ concerns, were “well-intentioned”, the company said in its response.

Earlier that month, the company and its rival Swiggy were forced on the defensive after delivery partners began posting on social media about their ‘poor treatment’ at the hands of these companies.

Posts by Twitter users SwiggyDE and Delivery Bhoy, who said they worked for Swiggy and Zomato, respectively, said they got insufficient compensation for skyrocketing petrol prices, no first-mile pay, no long-distance return bonus, and face daily earning caps. Their posts have received thousands of likes and retweets.

Cred founder Kunal Shah.

Cred founder Kunal Shah.

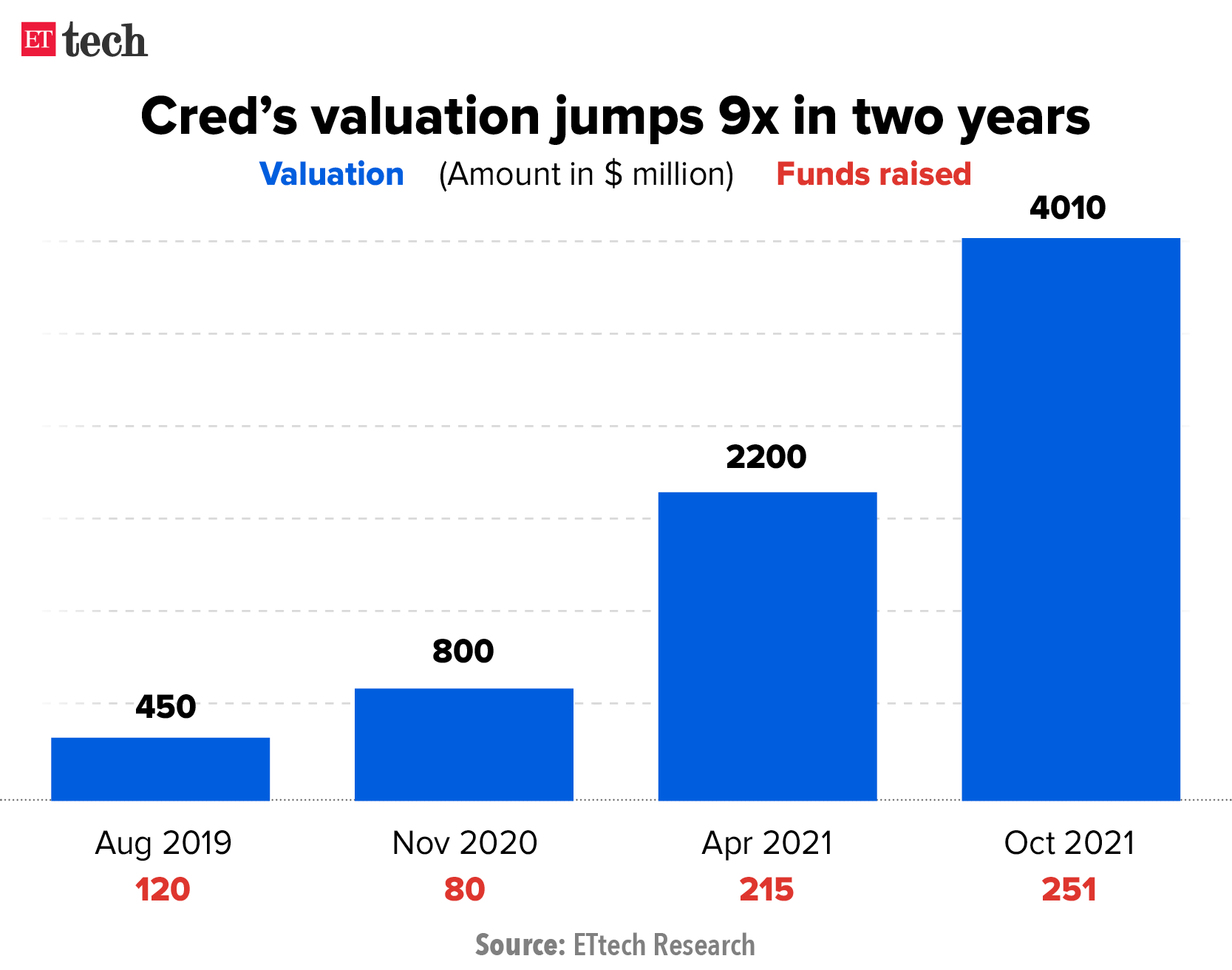

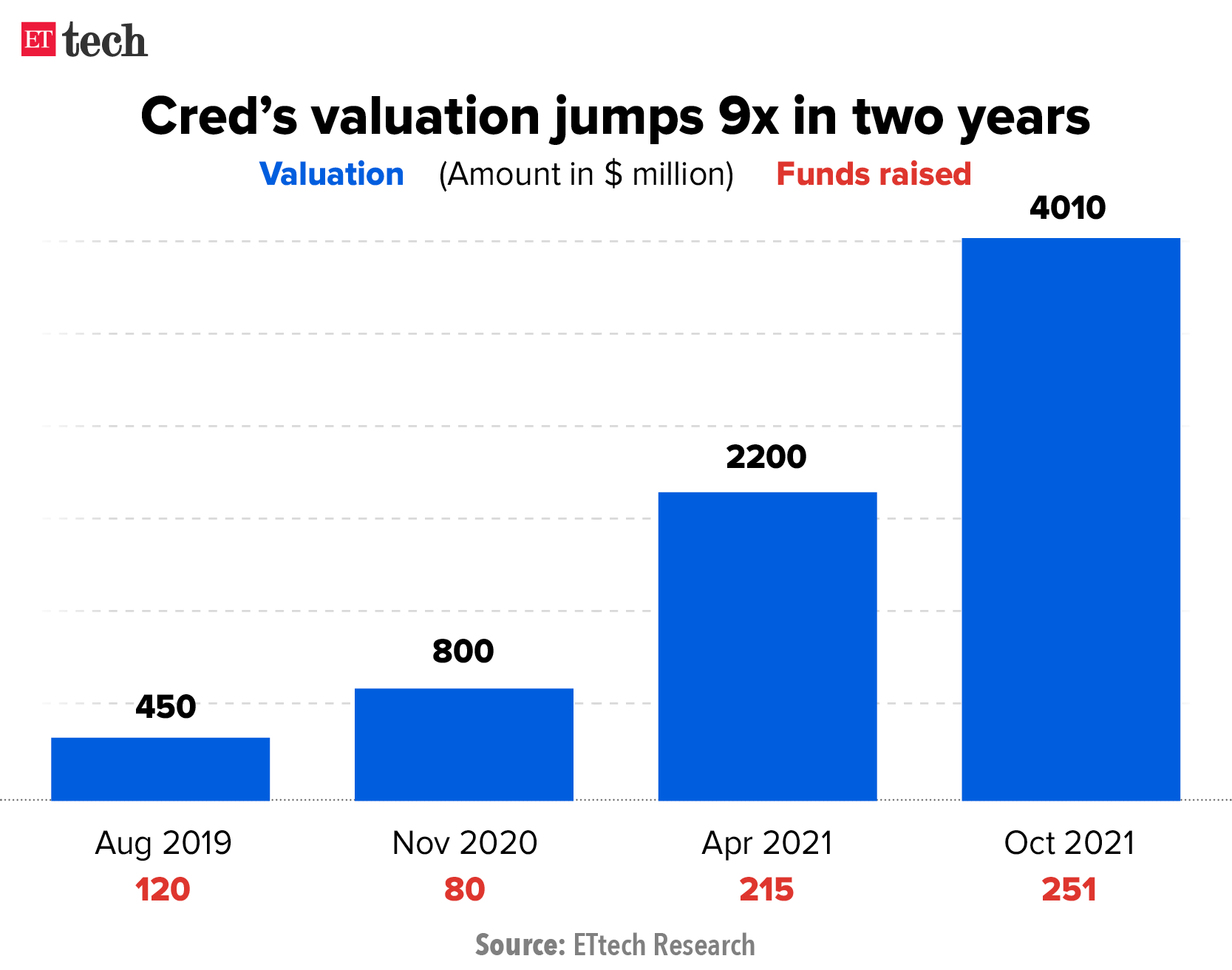

Fintech unicorn Cred has raised $251 million in a Series E funding round that was jointly led by Tiger Global and Falcon Edge. The new funding gives the company a valuation of $4.01 billion and underscores the huge interest from investors in India’s fintech startups.

Cred was valued at $2.2 billion just six months ago, when it raised $215 million in April, and $800 million less than a year ago, when it raised $80 million in November 2020.

The latest round saw two new investors—Marshall Wace and Steadfast Venture Capital—join the cap table of the fintech startup. Existing investors DST Global, Insight Partners, Coatue and Sofina also participated.

According to reports, the company plans to use the funds to grow its range of products and offer more financial services to customers.

Beyond credit cards: Cred, which began in 2018 as a platform to help people manage their credit card payments, is now a diversified fintech company with verticals such as ecommerce, digital payments, wealth management, bank lending and peer-to-peer lending.

Two top Ola executives have left the ride-hailing company as it prepares to go public. Ola's chief operating officer Gaurav Porwal and chief financial officer Swayam Saurabh have left the Bengaluru-bases firm over the past week.

On Tuesday, in an internal email to all employees, Bhavish Agarwal, cofounder and CEO of Ola, acknowledged the exits and called them a " part of management restructuring”.

Saurabh, a veteran finance hand with more than two decades of experience, took charge as CFO in April. He was previously the CFO for Hindustan Zinc, Philips and has had stints at Asian Paints and L&T. He will be moving on to pursue other opportunities in mid-December, the mail said.

Rejig: Arun Kumar G, the group CFO, will continue to run the finance function across the company and all the key finance leaders will now report directly to him.

IPO plans: As we reported earlier, Ola is exploring a public offering early next year, aiming to raise at least $1.5-2 billion at a valuation of $12-14 billion. It plans to raise half this sum by issuing fresh shares and half through an offer for sale (OFS), in which a few early backers will sell some or all their shares.

The cryptocurrency industry is in talks with the government and regulators to assuage their concerns about the sector, according to Ashish Singhal, cofounder and chief executive of crypto exchange CoinSwitch Kuber.

The exchange is in a question-and-answer phase with regulators and has made "amazing progress," he said.

Quote: "Regulators are engaging with industry leaders like us and industry bodies and trying to understand cryptocurrencies—and we do understand the stance of the government," Singhal said. "There are some fundamental flaws in the crypto ecosystem which do not abide by the laws of the land in India.”.

CoinSwitch Kuber, which is backed by Tiger Global, Sequoia and Coinbase Ventures, has about 10 million users — and about half of them are in their mid-20s, Singhal said.

Indian crypto story so far: India has had a hot-and-cold relationship with the asset class in the past few years. In 2018, the Reserve Bank of India effectively halted crypto transactions by banning banks from dealing with crypto-related firms. But the Supreme Court struck down the ban in March 2020, and India’s nascent crypto industry has thrived since.

India's crypto market grew 640% in the 12 months to June, according to blockchain data platform Chainalysis.

■ Onato, a B2B (business to business) platform for fresh produce, has raised $2.2 million in a seed round led by Vertex Ventures Southeast Asia & India with participation from Omnivore. The company plans to use funds for talent acquisition and to scale its operations.

■ Aviom India Housing Finance, which deals in micro mortgages, has raised $8 million in a Series C funding round led by Sabre Partners. The company has received debt financing from more than 40 lenders, including public and private sector banks, and global and local development financial institutions.

■ Delivery Hero today said it had invested $235 million in Berlin-based grocery delivery company Gorillas. This means Delivery Hero owns 8% of the fast-growing startup, which operates more than 180 warehouses in nine countries.

■ Finland-based cloud software firm Aiven has raised $60 million from existing investors World Innovation Lab, IVP and Atomico, giving it a valuation of $2 billion. The funding round, an extension of the firm's $100 million Series C announced seven months earlier, was initiated by one of its investors. The firm was last valued at $800 million.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ Cred valued at $4 billion

■ Top executives leave as Ola prepares to go public

■ CoinSwitch in talks with govt for crypto rules: CEO

Zomato CEO reinstates employee fired over 'national language' remark

Zomato CEO Deepinder Goyal reinstated a customer service employee of the firm just hours after she was sacked on Tuesday for telling a customer he ought to know Hindi.

Goyal termed the employee’s actions “an ignorant mistake” but said the company was reinstating her as “this is easily something she can learn and do better about going forward”.

What happened? Earlier, the company came under fire on Twitter after the customer, from Tamil Nadu, posted screenshots of his chat with the Zomato employee.

"Customer care says amount can't be refunded as I didn't know Hindi. Also takes lesson that being an Indian I should know Hindi. Tagged me a liar as he didn't know Tamil. @zomato not the way you talk to a customer," he wrote.

The tweet triggered a storm on Twitter and soon #Reject_Zomato was trending.

Sacked: Following the backlash, Zomato apologised to the customer and said the incident was unacceptable. It also issued a statement in Tamil and English, stressing that the company stood for diversity.

Backed: But a little over two hours later, Goyal tweeted that Zomato was reinstating the sacked employee.

Other controversies: In late August, Zomato was criticised on social media after it released ads showing its delivery workers refusing selfies with celebrities for the sake of their next delivery. The ads, widely panned as tone-deaf to workers’ concerns, were “well-intentioned”, the company said in its response.

Earlier that month, the company and its rival Swiggy were forced on the defensive after delivery partners began posting on social media about their ‘poor treatment’ at the hands of these companies.

Posts by Twitter users SwiggyDE and Delivery Bhoy, who said they worked for Swiggy and Zomato, respectively, said they got insufficient compensation for skyrocketing petrol prices, no first-mile pay, no long-distance return bonus, and face daily earning caps. Their posts have received thousands of likes and retweets.

Cred’s valuation nearly doubles to $4.01 billion in six months

Fintech unicorn Cred has raised $251 million in a Series E funding round that was jointly led by Tiger Global and Falcon Edge. The new funding gives the company a valuation of $4.01 billion and underscores the huge interest from investors in India’s fintech startups.

Cred was valued at $2.2 billion just six months ago, when it raised $215 million in April, and $800 million less than a year ago, when it raised $80 million in November 2020.

The latest round saw two new investors—Marshall Wace and Steadfast Venture Capital—join the cap table of the fintech startup. Existing investors DST Global, Insight Partners, Coatue and Sofina also participated.

According to reports, the company plans to use the funds to grow its range of products and offer more financial services to customers.

Beyond credit cards: Cred, which began in 2018 as a platform to help people manage their credit card payments, is now a diversified fintech company with verticals such as ecommerce, digital payments, wealth management, bank lending and peer-to-peer lending.

- The ecommerce platform, called Cred Store, charges partner businesses a fee for directing its users to their products. It also charges its bank partners a cut of the fee for improving the fiscal discipline of customers.

- Its lending business, launched in 2020, had a loan book of Rs 2,000 crore as of August. Non-performing assets were less than 1% of this.

- Earlier this year, the company launched a peer-to-peer lending platform called Cred Mint in partnership Liquiloans.

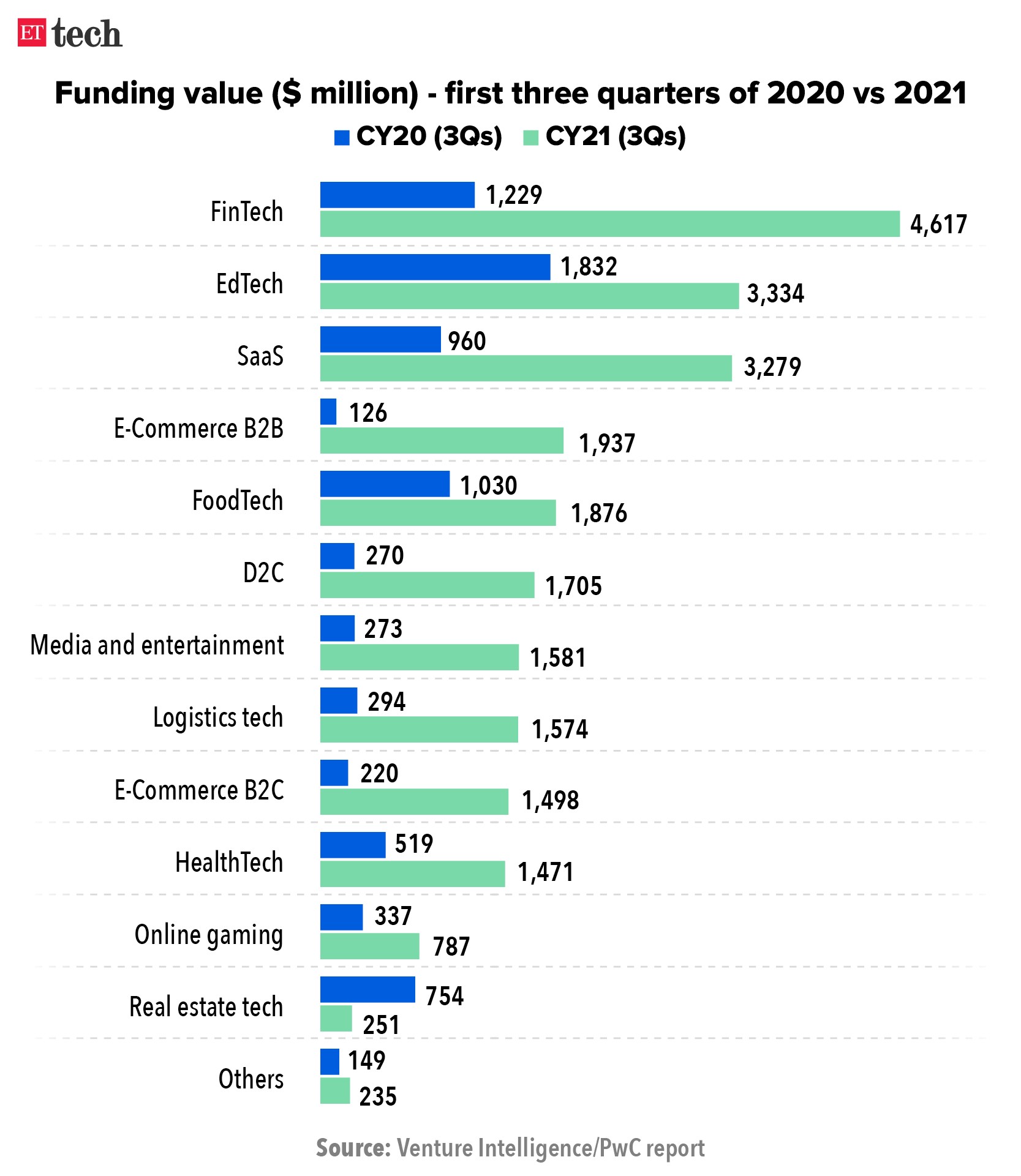

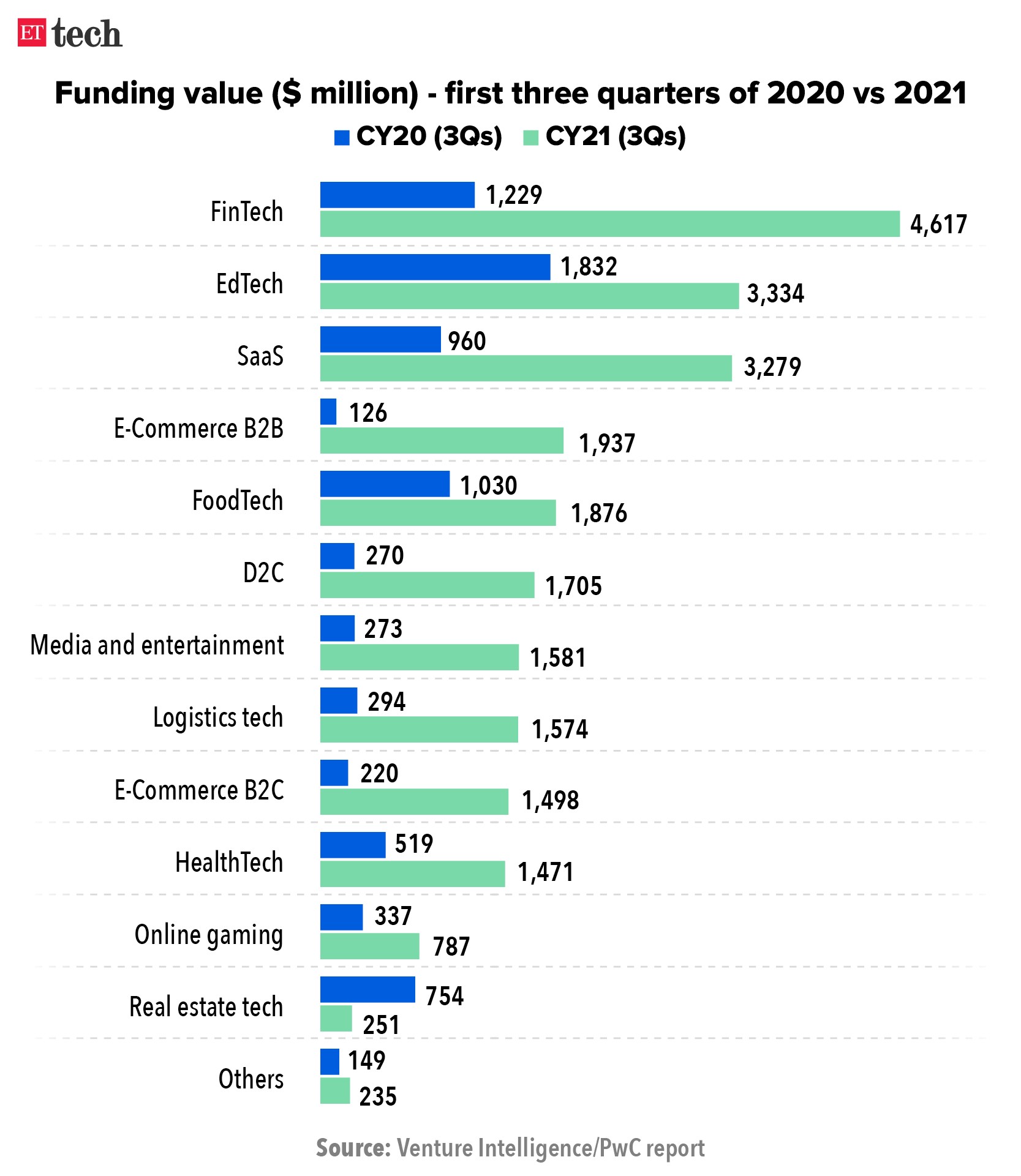

- Fifty-three deals were recorded in the third quarter alone. Companies operating in fintech offshoots—insurtech, wealthtech, neobanking, etc.—also garnered investor interest, the report showed.

- Amid unprecedented funding for Indian startups, six fintech unicorns have been minted so far this year — Digit Insurance, Five Star Finance, Cred, Groww, Zeta and BharatPe.

- At least four others — Paytm, MobiKwik, Policybazaar and Pine Labs — are looking to go public soon.

Two top executives leave as Ola prepares to go public

Two top Ola executives have left the ride-hailing company as it prepares to go public. Ola's chief operating officer Gaurav Porwal and chief financial officer Swayam Saurabh have left the Bengaluru-bases firm over the past week.

On Tuesday, in an internal email to all employees, Bhavish Agarwal, cofounder and CEO of Ola, acknowledged the exits and called them a " part of management restructuring”.

- “As we look forward to Ola’s next phase of growth, we are making some key updates to our organisation that will enable us to capture the opportunities that lie ahead," Agarwal wrote in the email, a copy of which we have seen.

Saurabh, a veteran finance hand with more than two decades of experience, took charge as CFO in April. He was previously the CFO for Hindustan Zinc, Philips and has had stints at Asian Paints and L&T. He will be moving on to pursue other opportunities in mid-December, the mail said.

Rejig: Arun Kumar G, the group CFO, will continue to run the finance function across the company and all the key finance leaders will now report directly to him.

IPO plans: As we reported earlier, Ola is exploring a public offering early next year, aiming to raise at least $1.5-2 billion at a valuation of $12-14 billion. It plans to raise half this sum by issuing fresh shares and half through an offer for sale (OFS), in which a few early backers will sell some or all their shares.

Tweet of the day

Talks on with govt over crypto regulations, says CoinSwitch Kuber CEO

The cryptocurrency industry is in talks with the government and regulators to assuage their concerns about the sector, according to Ashish Singhal, cofounder and chief executive of crypto exchange CoinSwitch Kuber.

The exchange is in a question-and-answer phase with regulators and has made "amazing progress," he said.

Quote: "Regulators are engaging with industry leaders like us and industry bodies and trying to understand cryptocurrencies—and we do understand the stance of the government," Singhal said. "There are some fundamental flaws in the crypto ecosystem which do not abide by the laws of the land in India.”.

CoinSwitch Kuber, which is backed by Tiger Global, Sequoia and Coinbase Ventures, has about 10 million users — and about half of them are in their mid-20s, Singhal said.

Indian crypto story so far: India has had a hot-and-cold relationship with the asset class in the past few years. In 2018, the Reserve Bank of India effectively halted crypto transactions by banning banks from dealing with crypto-related firms. But the Supreme Court struck down the ban in March 2020, and India’s nascent crypto industry has thrived since.

India's crypto market grew 640% in the 12 months to June, according to blockchain data platform Chainalysis.

ETtech Done Deals

■ Onato, a B2B (business to business) platform for fresh produce, has raised $2.2 million in a seed round led by Vertex Ventures Southeast Asia & India with participation from Omnivore. The company plans to use funds for talent acquisition and to scale its operations.

■ Aviom India Housing Finance, which deals in micro mortgages, has raised $8 million in a Series C funding round led by Sabre Partners. The company has received debt financing from more than 40 lenders, including public and private sector banks, and global and local development financial institutions.

■ Delivery Hero today said it had invested $235 million in Berlin-based grocery delivery company Gorillas. This means Delivery Hero owns 8% of the fast-growing startup, which operates more than 180 warehouses in nine countries.

■ Finland-based cloud software firm Aiven has raised $60 million from existing investors World Innovation Lab, IVP and Atomico, giving it a valuation of $2 billion. The funding round, an extension of the firm's $100 million Series C announced seven months earlier, was initiated by one of its investors. The firm was last valued at $800 million.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanabhan in New Delhi and Zaheer Merchant in Mumbai. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.