US consumers to spend $209 billion online during holiday season, $910 billion to be spent globally

Adobe released its online shopping forecast for the holiday season, which estimates that US consumers will spend about $209 billion online this year. Globally, online shoppers will spend nearly $1 billion.

The Adobe Digital Economy Index is based on insights gleaned from more than one trillion visits to US retail sites and over 100 million SKUs in 18 product categories. The global figures are based on transactions in more than 100 countries. Adobe also conducted a survey of 1,012 US consumers last month as an addendum to the index.

Adobe expects US consumers to set a new holiday record this year in online spending between November 1 and December 31. The estimated $209 billion that could be spent would mean a 10% increase compared to the spending seen in 2020. The $910 billion expected globally would be an 11% growth year-over-year.

For all of 2021, Adobe estimates that more than $4 trillion will be spent worldwide online.

Surprisingly, US consumers are actually showing less interest in buying online on specific days, most notably Black Friday, Cyber Monday, and other typical shopping hot spots. Adobe expects shoppers to spend $36 billion through e-commerce during Cyber Week — from Thanksgiving to Cyber Monday — which represents just 17% of the total shopping done during the holiday season.

That represents just a 5% growth compared to last year, and the growth expected for shopping on Cyber Monday specifically is even lower at 4%. Adobe predicts that $11.3 billion will be spent on Cyber Monday and $9.5 billion spent on Black Friday, just a 5% year-over-year increase. Thanksgiving will see about $5.4 billion spent online, according to Adobe's estimates.

The index does note that retailers will face significant problems this holiday season as supply chains continue to struggle due to the COVID-19 pandemic.

Adobe explained that retailers are facing crowded ports, cargo delays, and disruptions in overseas manufacturing.

"We are entering a second holiday season where the pandemic will dictate the terms," said Patrick Brown, vice president of growth marketing and insights at Adobe. "Limited product availability, higher prices, and concerns about shipping delays will drive another surge towards e-commerce, as it provides more flexibility in how and when consumers choose to shop."

Adobe found that the number of out-of-stock messages grew by 172% going into the holiday season compared to the last pre-pandemic period.

Adobe's index said apparel currently has the highest out-of-stock levels followed by sporting goods, baby products, and electronics.

Supply chain woes are also causing retailers to raise prices, with Adobe predicting that US consumers will end up paying 9% more on average during Cyber Week this year compared to last year.

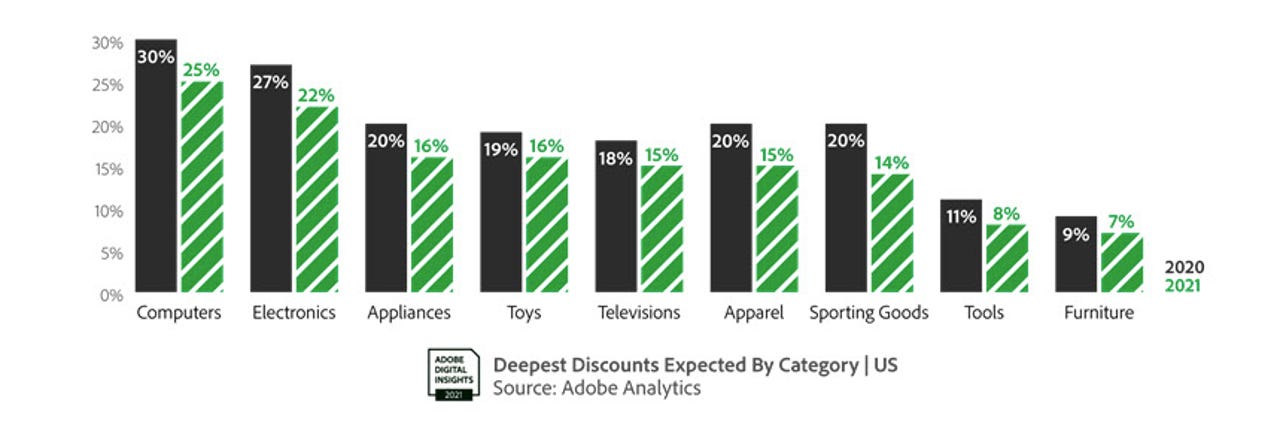

"This is the result of smaller discounts, on top of e-commerce inflation that has persisted through the year. Adobe forecasts discounts will be in the 5% to 25% range across categories this season, compared to a historical average of 10% to 30%. This is happening as pricing levels have been elevated: Inflation in e-commerce has been observed since June 2020 (16 consecutive months) with online prices up 3% going into the holiday season. In past years, online prices were down 5% YoY on average prior to the shopping season," Adobe explained.

"Adobe expects smaller discounts in all major gifting categories tracked by the Digital Economy Index. Discount levels in electronics for instance, will peak at 22% for the season, down from 27% in 2020. Other categories include computers at 25% (vs 30% in 2020), televisions at 15% (vs 18%), appliances at 16% (vs 20%), toys at 16% (vs 19%), sporting goods at 14% (vs 20%), apparel at 15% (vs 20%), furniture at 7% (vs 9%), and tools at 8% (vs 11%)."

According to a survey done by Adobe, consumers expect seasonal discounts to start in October but the biggest discounts — ranging from 5% to 25% — are expected to occur around Thanksgiving and Cyber Monday. Electronics will see the biggest discounts on Cyber Monday, according to the survey.

Consumers will find the best deals for toys on Thanksgiving and the biggest sales for furniture, bedding, and tools on Black Friday. The day after Black Friday is ideal for buying electronics and appliances and Sunday is ideal for apparel and sporting goods shopping. Cyber Monday, according to Adobe, is best for buying televisions and December 1 is the best day to shop for computers.

Adobe also noticed that consumers are increasingly turning to Buy Now Pay Later (BNPL) platforms like Affirm and Klarna during the holiday season, noting that online revenue for BNPL is 10% higher than last year and a whopping 45% higher than 2019.

Consumers are also turning to BNPL for less expensive orders, with Adobe Analytics data showing that the minimum order value has fallen by 12% year-over-year to $225.

Adobe's survey found that 25% of respondents used a BNPL service over the last three months, particularly when buying apparel, electronics, and groceries. More than 30% of respondents said they used a BNPL for each category.

Curbside pickup is also something that is expected to increase, according to Adobe's findings. For December 22 and December 23, Adobe is expecting a record 40% of online orders to be curbside pickups while remaining at 25% throughout November.

Adobe also tracked the most popular items consumers plan to purchase online. Their study found that Tamagotchi Pix, Pop Fidget, Got2Glow Fairy Finder, Baby Yoda, and Gabby's Dollhouse are the top toys that will be purchased this season.

Nintendo Switch OLED, PlayStation 5, Xbox Series S/X, and Stream Deck are the top gaming platforms garnering interest, and games like Metroid Dread, Battlefield 2042, Pokemon Brilliant Diamond & Shining Pearl, Halo Infinite, and FIFA 22 will be purchased the most, according to Adobe.

Online consumers are also showing interest in Airpods Max, smart mugs, Instant Pot, air fryers, smart water bottles, drones, and record players.

Another trend highlighted in Adobe's study is the prevalence of shopping through smartphones. Adobe found that 42% of all revenue this season will come from shopping done on smartphones, a 5% increase compared to 2020. More than $86 billion will be spent through devices alone as more people spend time at home due to the ongoing pandemic.

Consumers are expected to spend about 12 hours shopping this holiday season, according to Adobe's findings.

"During the 'golden hours' of e-commerce (7:00–11:00 pm PT on Cyber Monday), shoppers will spend nearly $3 billion online ($2.9B) in just 4 hours, 50% more than a typical full day in August 2021 ($1.9B). In the peak hour of Cyber Monday (8:00– 9:00 pm PT), consumers will spend over $12 million every minute," Adobe said.

Adobe's survey of consumers also found that some shoppers may move beyond physical products after many had a rough two years due to the pandemic. About 17% of respondents said they plan to give an experience as a gift this holiday season, offering friends and family members spa treatments, concert tickets, sporting event seats, plane tickets, or cooking classes.