Business News›Tech›Newsletters›Morning Dispatch›Exclusive interview with Snap CEO; Paytm IPO opens Nov 8

Morning Dispatch Morning Dispatch |

Exclusive interview with Snap CEO; Paytm IPO opens Nov 8

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

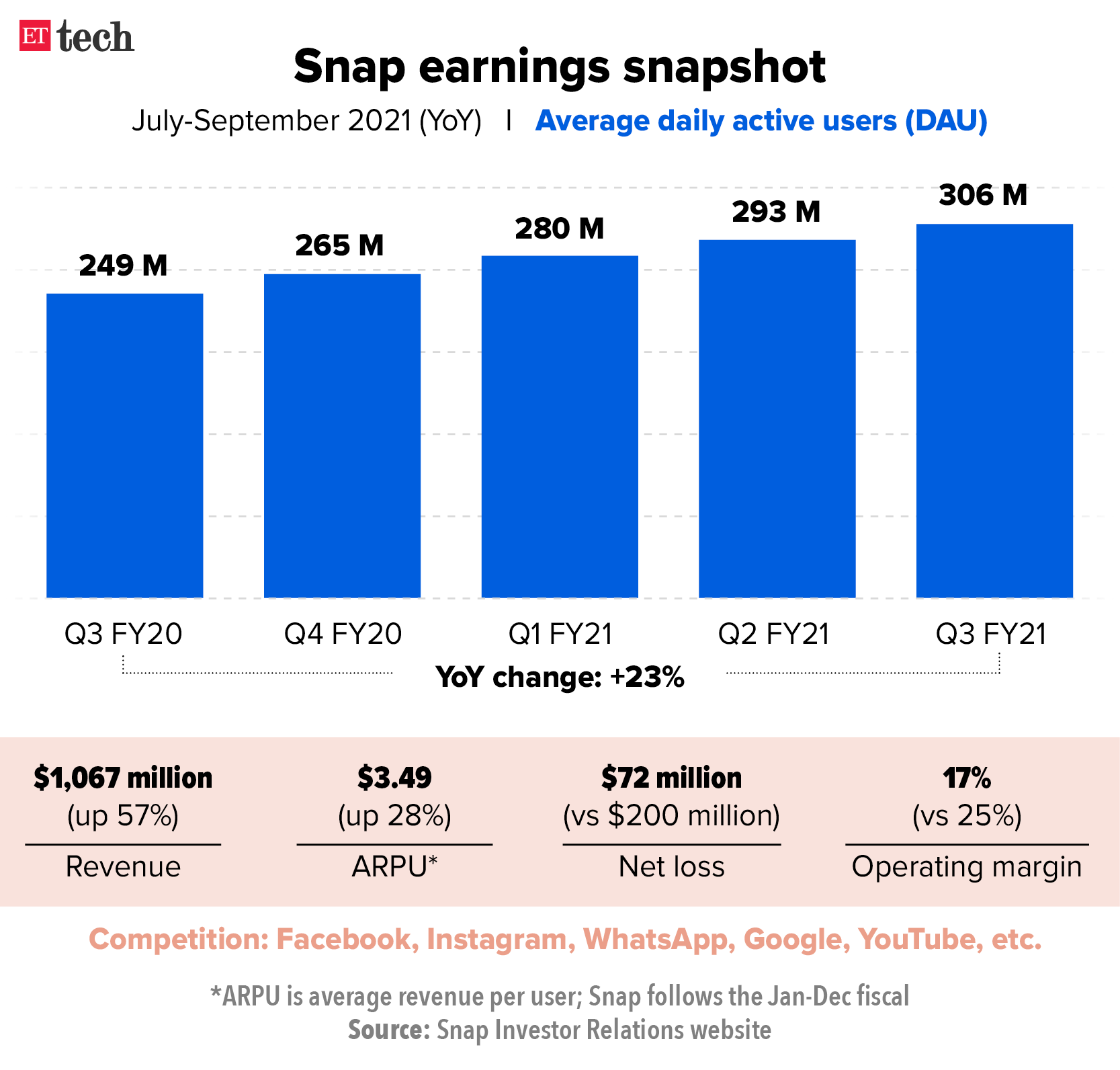

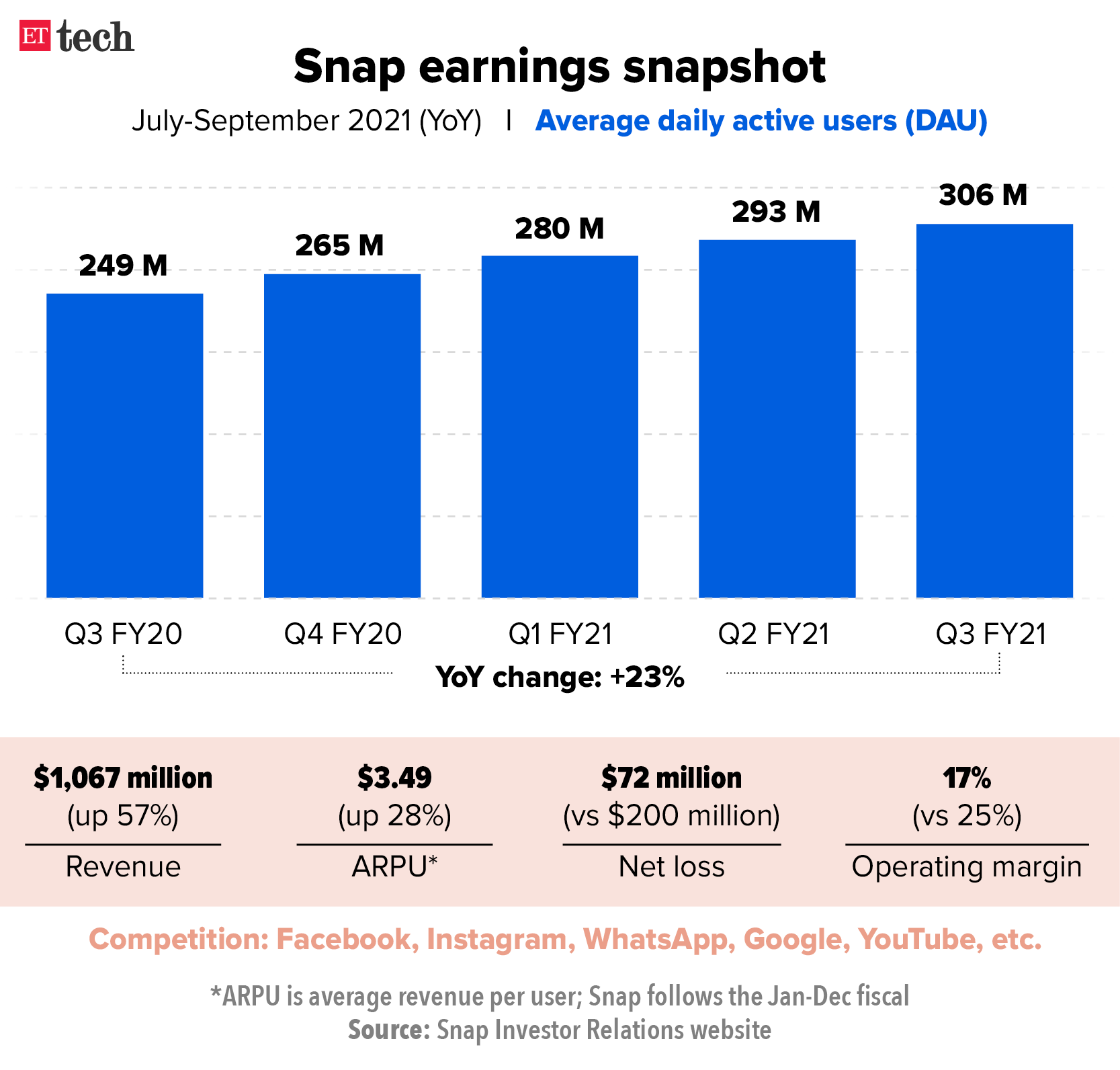

In 2013, Snap Inc CEO Evan Spiegel rebuffed a $3-billion takeover bid from Facebook. Mark Zuckerberg went on to turn Instagram into a Snapchat killer and by 2017, Snap was in the doldrums. But the company has regained its mojo in the four years since, and now has 100 million users in India alone. In an exclusive interview, Spiegel told us the reasons for Snap's resurrection, the secrets of its success in India, and what he really thinks of Facebook.

Also in this letter:

Evan Spiegel, cofounder and CEO, Snap

Evan Spiegel, cofounder and CEO, Snap

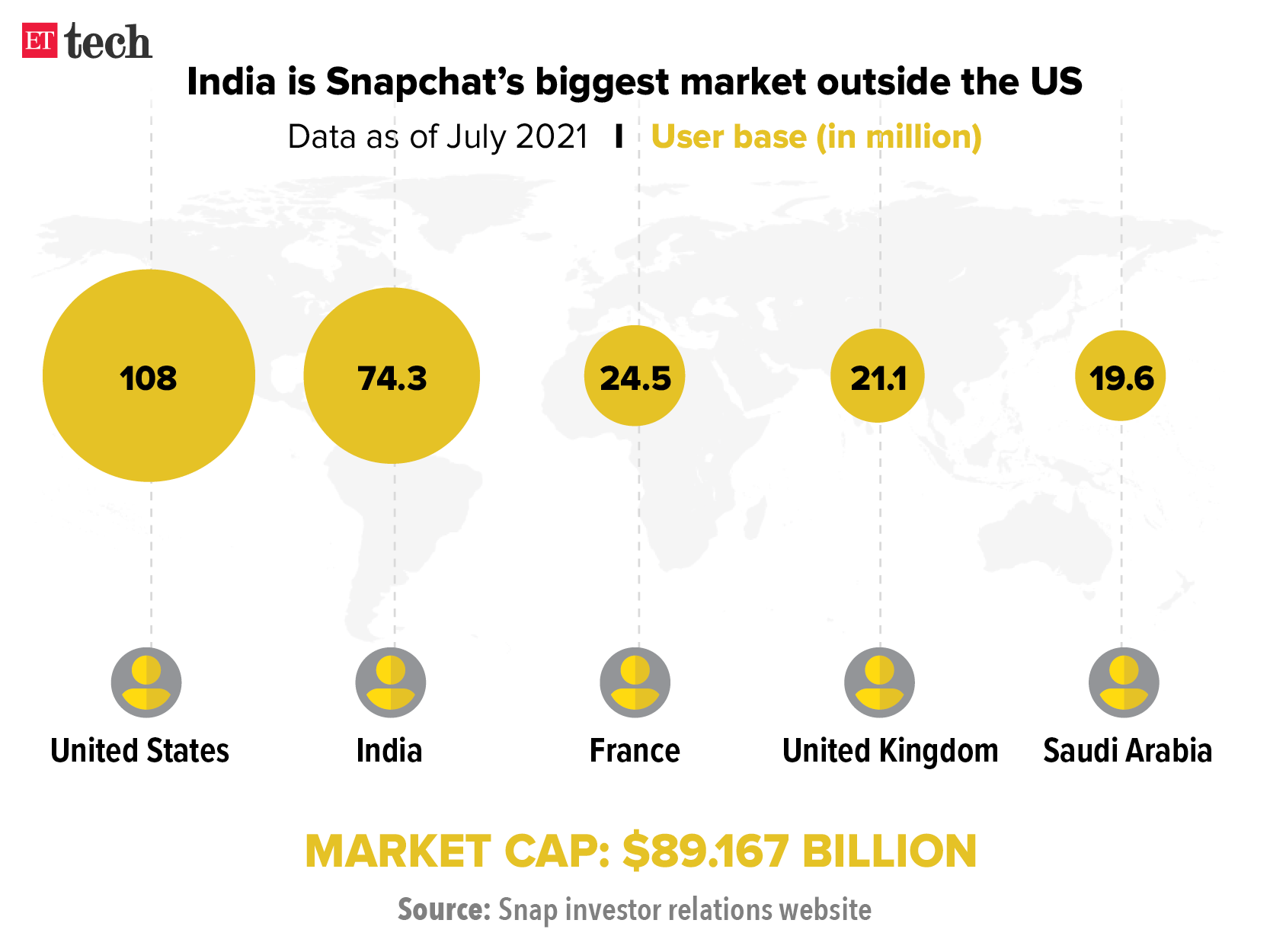

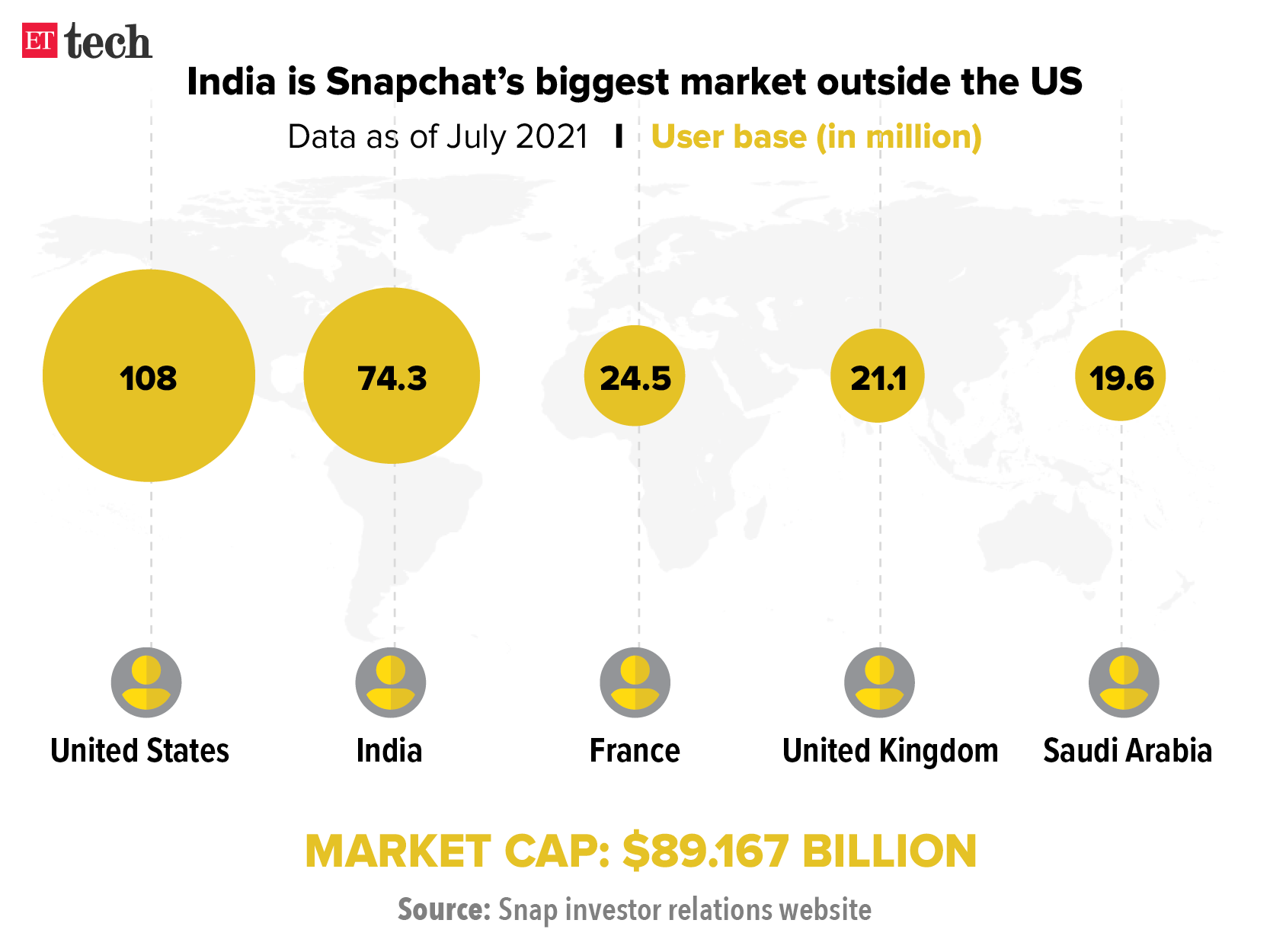

Evan Speigel, chief executive of Snap, told us in an interview that the company has seen strong growth in India over the past few years and now reaches 100 million people in the country, its second largest market after the US.

He also spoke about the company’s dramatic turnaround since 2017, the ubiquitous Stories format that Snapchat pioneered, the ongoing controversy around Facebook, and Apple’s recent privacy changes, which caused Snap’s shares to plummet 25% last Thursday.

Here are some edited excerpts.

Snap has been doing really well in India over the past six to eight months. But not too long ago, India wasn’t a priority market for the company. What changed?

We have been building a team on the ground for the past two or three years. One of the things we found out very early on was that our community in India really loves to use augmented reality and also build augmented reality. I think we've now taught over 5,000 youngsters how to build augmented reality experiences and share them through Snapchat. All of that helps create a much more locally relevant Snapchat experience.

India is now the second largest user base for Snap outside of the US, right? How did things change?

I think the thing that made a big difference for us was rebuilding our Android application. So if you go back to 2017, we hadn't done enough work to make sure that the client application really worked well, no matter what smartphone you had. We had to rebuild our Android application, which was a huge project for the business. After we did that, then we started to see a lot more traction in India.

What do you think is wrong with Big Tech, especially in the social space right now? What do you make of the Facebook whistleblower’s account that the company puts profits over the good of its users?

I think the challenges that we're seeing today are not necessarily problems faced by all of Big Tech. It is in particular, one large platform that has found out time and again that it has a negative impact on society that well-intentioned people inside their business have tried to make changes. That’s the problem that we're really dealing with today. That business has really large influence and operates multiple very large platforms that reach billions of people.

Read the full interview here.

The big one is here -- almost. One97 Communications, Paytm’s parent company, is looking to launch its initial public offering (IPO) on Monday, November 8, with a price band of Rs 2,080 to Rs 2,150 a share, sources told us. The IPO is expected to close on November 10.

Biggest Indian IPO: The company is targeting a valuation of $20 billion, slightly lower than the $22 billion it wanted, the sources added. Still, it will be the biggest IPO ever in India, surpassing the Rs 15,000 crore that Coal India raised almost a decade ago.

Having earlier targeted Rs 16,600 crore, Paytm is now expected to mop up around Rs 18,300 crore from the issue after it sought to increase the secondary share sale component to Rs 10,000 crore earlier this week. The primary capital raise component would remain unchanged at Rs 8,300 crore.

We reported yesterday that China's Ant Group, Paytm’s largest shareholder, would execute nearly 50% of secondary share sale in the IPO.

This was borne out in Paytm’s red herring prospectus, which said Ant Group will sell shares worth Rs 4,704.40 crore, while Alibaba will sell shares worth Rs 785 crore.

Japan’s SoftBank is slated to sell shares worth Rs 1,689 crore and Elevation Capital will sell shares with an aggregate value of more than Rs 2,030 crore.

Sharma, who owns close to 15% in the company, will sell shares worth over Rs 402 crore.

Also Read: Swiss Re to invest Rs 920 crore in Paytm’s insurance unit

According to the prospectus, Paytm’s operational revenue in April-June 2021 was Rs 890 crore, up more than 61% from Rs 551 crore in the same period last year.

But first, Policybazaar IPO: PB Fintech, the parent company of online marketplaces Policybazaar and Paisabazaar, will continue to chase growth in the long term over short-term profits as it looks to list on the Indian bourses. The company’s IPO will open on November 1, a week before Paytm’s, and close on November 3.

Yashish Dahiya, cofounder and chairman of PB Fintech, said yesterday that being listed won’t change the company’s operating style, and that growth, efficiency and experiments will go hand-in-hand.

Quote: “Even in our conversations with prospective anchor investors, we have communicated that we will continue to grow the business as is and we have received tremendous support from them,” said Dahiya. “Our DNA will not change even after listing. We will continue to invest small amounts in experiments and scale up only those where we find success,” he added.

IPO details: The IPO comprises a fresh issue of equity shares worth Rs 3,750 crore and an offer for sale (OFS) of over Rs 1,900 crore—largely by SoftBank. The company has set a price band of Rs 940-980 per share for the offering.

We had reported earlier, citing sources, that the 13-year-old startup could seek a valuation of between $5 billion and $6 billion in the public offering.

Shareholders: The startup is backed by investors such as Japan’s SoftBank (15.76%), InfoEdge (14.56%), China’s Tencent (9.16%), Claymore Investment (6.26%) and others including Tiger Global, Falcon Capital and Alpha Wave Incubation.

Offloading stakes: Policybazaar’s founders — Dahiya and other key management — are expected to sell shares worth a combined Rs 585 crore. China’s Tencent, which owns over 9% of PB Fintech, has not been listed as an investor seeking to offload stake during the OFS.

Also Read: Nykaa IPO heavily oversubscribed by anchor investors

Varun Dua, cofounder and chief executive, Acko

Varun Dua, cofounder and chief executive, Acko

General insurance startup Acko has picked up $255 million in funding led by General Atlantic and Multiples Private Equity. We first reported on June 29 that the Bengaluru-based company was in talks with General Atlantic and others for an investment.

Another unicorn minted: The fundraising values the four-year-old startup at $1.1 billion, catapulting it into the unicorn club. Acko's total funding, including the latest round, stands at $450 million.

Details: The funding is also expected to have a secondary component, which is likely to take the round size to more than $300 million, a source told us. The fresh capital will go towards investment in the health insurance market.

Quote: “As many as 80% of the people who can buy health insurance still don’t have it in India, so the market is very large and untapped. It’s not a winner take all market and easily 10-20 large insurance manufacturers and brands can exist here like how it is globally,” Varun Dua, the cofounder and chief executive of Acko, told us.

Other done deals

■ LoveLocal, an aggregator of hyper-local retailers, has raised $18 million in a funding round led by Vulcan Capital, which was founded by Microsoft cofounder Paul Allen. Alumni Ventures Group, Commerce Ventures as well as angel investors including Nami Zarringhalam, cofounder of Truecaller; Sriram Krishnan, general partner of Andreessen Horowitz, also participated in the funding round.

■ Instoried, which offers artificial intelligence-enabled pre-publication sentiment analysis tools, has raised $8 million in a funding round led by Pritt Investment Partners and 9 Unicorns. The company has now raised a total of $10 million. The latest fundraising also saw the participation of Mumbai Angels, Venture Catalysts Angel Fund, SOSV and a few high-net-worth individuals.

■ OSlash, an enterprise software startup, has raised $2.5 million in a seed funding round led by Accel Partners. The fundraising also saw the participation of angel investors, including Dylan Field (CEO and founder of Figma); Akshay Kothari (COO of Notion), Girish Mathrubootham (CEO of Freshworks Inc). Top executives from Quora, Stripe, and Airtable also pitched in.

■ Direct to consumer baby products brand R for Rabbit has raised Rs 40 crore from private equity firm Xponentia Capital Partners. The funds will be used to strengthen the brand, scale distribution and operations in the domestic market, for enhancing the existing product portfolio and for introducing new categories of products.

■ Koovers, a business-to-business auto spares startup, has raised $1.5 million in a round led by Inflection Point Ventures. Other investors in the round include JPIN-VCats and Venture Catalysts. The company said it will use the funds to enter more markets across India, expand its product portfolio and upgrade its technology platform.

■ Non-fungible token (NFT) marketplace Colexion has raised an undisclosed sum from Polygon, an Ethereum scaling and digital infrastructure development platform founded by Indians and backed by billionaire Mark Cuban. Colexion raised the capital at a valuation of about $50 million, cofounder Bibin Babu told ET. The investment is a mix of token and equity, he added.

Months after it acquired e-grocer BigBasket, the Tata Group is now using the company to build a supply chain and logistics network for its ambitious super app TataNeu.

What’s happening? BigBasket director KB Nagaraju is currently putting together a team to set up a unified logistics and supply chain for all Tata consumer goods companies that are part of the upcoming TataNeu super app, sources told us.

Innovative Retail Concept, the retail arm of BigBasket, has made changes to its memorandum of association (MoA), inserting new clauses on the object of the firm that now includes “business of being service provider for various businesses, including providing third-party logistic services, warehousing, supply chain management, and last-mile delivery services to customers, etc”.

Tata Digital, which is spearheading the super app, seeks to bring almost all of Tata Group’s consumer and financial products into one application.

Rollout by Feb: Tata Digital is currently testing TataNeu among more than half a million group employees. The conglomerate plans to roll it out to the public in January or February.

Also Read: Inside Tata Digital's plan to integrate online businesses and launch a super app

India's top five IT firms nearly matched last year’s hiring numbers in the first six months of the ongoing fiscal. Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies and Tech Mahindra added 122,546 employees in April-September 2021. For comparison, an estimated 138,000 people were onboarded in the whole of the previous financial year, according to Nasscom.

Second quarter aids hiring numbers: These five companies added a net 68,894 employees in the recently-concluded September quarter, compared with just 17,918 in the same period last year.

Talent crunch: This comes at a time when India’s software services sector is witnessing a talent crunch as the current pool of digitally skilled professionals in the country isn’t enough to meet the pandemic-induced demand for digitalisation. IT firms are in hire-or-poach mode, resulting in sky-high salaries, with several tapping even non-engineering grads to bridge the skills gap.

Since the nationwide lockdown last year, the top five companies have added a total of 202,223 employees, according to the latest quarterly results filings.

Quote: “We had the foresight to continue hiring in large numbers throughout the second half of last year and the first half of this year. In this fiscal, we have already onboarded 43,000 freshers, all trained on the latest technologies,” TCS chief financial officer Samir Seksaria said during an earnings call.

Alphabet Inc CEO Sundar Pichai

Alphabet Inc CEO Sundar Pichai

There is a wave of demand in India from people looking to shift from feature phones to smartphones, Alphabet Inc CEO Sundar Pichai said.

This comes as the search giant gears up to unveil its JioPhone Next around Diwali. The entry-level handset was made in partnership with Reliance Industries.

Quote: “What excites me about the upcoming partnership with Jio in building a phone is really investing beyond just English and getting languages and the local needs right in a way that many more people can take advantage of a smartphone,” Pichai said at a post-earnings call.

Massive market: India is estimated to have 850 million unique mobile phone users covering 61% of the country’s 1.39 billion people, with an untapped user base of 540 million according to Counterpoint Research. It estimates that nearly 320 million of the country’s mobile phone users have feature phones.

Indian startups' hiring spree continues: It is a mad rush for talent across unicorns in India. There are nearly 70 unicorns — startups valued at $1 billion or more — in India and these are likely to create 125,000-160,000 white-collar jobs over the next two-three quarters, according to two separate studies conducted by EMA Partners and CIEL HR Services for ET.

Online gaming law amended to counter a pressing social evil, Karnataka tells HC: The Karnataka government on Wednesday submitted to the Karnataka High Court that the recent amendments to ban betting and wagering in online games were aimed at saving the youth from becoming addicts and their families from falling into deep debts.

Spotify Q3 results: Swedish music streaming service Spotify reported a 19% year on year growth in monthly active user base (MAUs) during its third quarter ended September, led by resumption marketing initiatives in India and growth in markets like the Philippines and Indonesia.

Google partners MeitY Startup Hub: Google has partnered with the Ministry of Electronics and IT’s Startup Hub to launch Appscale Academy, a growth and development programme to train early to mid-stage startups across India on building high-quality apps for the world.

Also in this letter:

- Paytm to launch Rs 18,300-crore IPO on Nov 8

- Acko becomes 32nd startup unicorn of 2021

- BigBasket building supply chain for Tata super app

Exclusive: One large platform is the problem, not all of Big Tech, says Snap CEO

Evan Speigel, chief executive of Snap, told us in an interview that the company has seen strong growth in India over the past few years and now reaches 100 million people in the country, its second largest market after the US.

He also spoke about the company’s dramatic turnaround since 2017, the ubiquitous Stories format that Snapchat pioneered, the ongoing controversy around Facebook, and Apple’s recent privacy changes, which caused Snap’s shares to plummet 25% last Thursday.

Here are some edited excerpts.

Snap has been doing really well in India over the past six to eight months. But not too long ago, India wasn’t a priority market for the company. What changed?

We have been building a team on the ground for the past two or three years. One of the things we found out very early on was that our community in India really loves to use augmented reality and also build augmented reality. I think we've now taught over 5,000 youngsters how to build augmented reality experiences and share them through Snapchat. All of that helps create a much more locally relevant Snapchat experience.

India is now the second largest user base for Snap outside of the US, right? How did things change?

I think the thing that made a big difference for us was rebuilding our Android application. So if you go back to 2017, we hadn't done enough work to make sure that the client application really worked well, no matter what smartphone you had. We had to rebuild our Android application, which was a huge project for the business. After we did that, then we started to see a lot more traction in India.

What do you think is wrong with Big Tech, especially in the social space right now? What do you make of the Facebook whistleblower’s account that the company puts profits over the good of its users?

I think the challenges that we're seeing today are not necessarily problems faced by all of Big Tech. It is in particular, one large platform that has found out time and again that it has a negative impact on society that well-intentioned people inside their business have tried to make changes. That’s the problem that we're really dealing with today. That business has really large influence and operates multiple very large platforms that reach billions of people.

Read the full interview here.

Paytm to launch Rs 18,300-crore IPO on November 8

The big one is here -- almost. One97 Communications, Paytm’s parent company, is looking to launch its initial public offering (IPO) on Monday, November 8, with a price band of Rs 2,080 to Rs 2,150 a share, sources told us. The IPO is expected to close on November 10.

Biggest Indian IPO: The company is targeting a valuation of $20 billion, slightly lower than the $22 billion it wanted, the sources added. Still, it will be the biggest IPO ever in India, surpassing the Rs 15,000 crore that Coal India raised almost a decade ago.

Having earlier targeted Rs 16,600 crore, Paytm is now expected to mop up around Rs 18,300 crore from the issue after it sought to increase the secondary share sale component to Rs 10,000 crore earlier this week. The primary capital raise component would remain unchanged at Rs 8,300 crore.

We reported yesterday that China's Ant Group, Paytm’s largest shareholder, would execute nearly 50% of secondary share sale in the IPO.

This was borne out in Paytm’s red herring prospectus, which said Ant Group will sell shares worth Rs 4,704.40 crore, while Alibaba will sell shares worth Rs 785 crore.

Japan’s SoftBank is slated to sell shares worth Rs 1,689 crore and Elevation Capital will sell shares with an aggregate value of more than Rs 2,030 crore.

Sharma, who owns close to 15% in the company, will sell shares worth over Rs 402 crore.

Also Read: Swiss Re to invest Rs 920 crore in Paytm’s insurance unit

According to the prospectus, Paytm’s operational revenue in April-June 2021 was Rs 890 crore, up more than 61% from Rs 551 crore in the same period last year.

But first, Policybazaar IPO: PB Fintech, the parent company of online marketplaces Policybazaar and Paisabazaar, will continue to chase growth in the long term over short-term profits as it looks to list on the Indian bourses. The company’s IPO will open on November 1, a week before Paytm’s, and close on November 3.

Yashish Dahiya, cofounder and chairman of PB Fintech, said yesterday that being listed won’t change the company’s operating style, and that growth, efficiency and experiments will go hand-in-hand.

Quote: “Even in our conversations with prospective anchor investors, we have communicated that we will continue to grow the business as is and we have received tremendous support from them,” said Dahiya. “Our DNA will not change even after listing. We will continue to invest small amounts in experiments and scale up only those where we find success,” he added.

IPO details: The IPO comprises a fresh issue of equity shares worth Rs 3,750 crore and an offer for sale (OFS) of over Rs 1,900 crore—largely by SoftBank. The company has set a price band of Rs 940-980 per share for the offering.

We had reported earlier, citing sources, that the 13-year-old startup could seek a valuation of between $5 billion and $6 billion in the public offering.

Shareholders: The startup is backed by investors such as Japan’s SoftBank (15.76%), InfoEdge (14.56%), China’s Tencent (9.16%), Claymore Investment (6.26%) and others including Tiger Global, Falcon Capital and Alpha Wave Incubation.

Offloading stakes: Policybazaar’s founders — Dahiya and other key management — are expected to sell shares worth a combined Rs 585 crore. China’s Tencent, which owns over 9% of PB Fintech, has not been listed as an investor seeking to offload stake during the OFS.

Also Read: Nykaa IPO heavily oversubscribed by anchor investors

Tweet of the day

Acko enters unicorn club after $255 million funding

General insurance startup Acko has picked up $255 million in funding led by General Atlantic and Multiples Private Equity. We first reported on June 29 that the Bengaluru-based company was in talks with General Atlantic and others for an investment.

Another unicorn minted: The fundraising values the four-year-old startup at $1.1 billion, catapulting it into the unicorn club. Acko's total funding, including the latest round, stands at $450 million.

Details: The funding is also expected to have a secondary component, which is likely to take the round size to more than $300 million, a source told us. The fresh capital will go towards investment in the health insurance market.

Quote: “As many as 80% of the people who can buy health insurance still don’t have it in India, so the market is very large and untapped. It’s not a winner take all market and easily 10-20 large insurance manufacturers and brands can exist here like how it is globally,” Varun Dua, the cofounder and chief executive of Acko, told us.

Other done deals

■ LoveLocal, an aggregator of hyper-local retailers, has raised $18 million in a funding round led by Vulcan Capital, which was founded by Microsoft cofounder Paul Allen. Alumni Ventures Group, Commerce Ventures as well as angel investors including Nami Zarringhalam, cofounder of Truecaller; Sriram Krishnan, general partner of Andreessen Horowitz, also participated in the funding round.

■ Instoried, which offers artificial intelligence-enabled pre-publication sentiment analysis tools, has raised $8 million in a funding round led by Pritt Investment Partners and 9 Unicorns. The company has now raised a total of $10 million. The latest fundraising also saw the participation of Mumbai Angels, Venture Catalysts Angel Fund, SOSV and a few high-net-worth individuals.

■ OSlash, an enterprise software startup, has raised $2.5 million in a seed funding round led by Accel Partners. The fundraising also saw the participation of angel investors, including Dylan Field (CEO and founder of Figma); Akshay Kothari (COO of Notion), Girish Mathrubootham (CEO of Freshworks Inc). Top executives from Quora, Stripe, and Airtable also pitched in.

■ Direct to consumer baby products brand R for Rabbit has raised Rs 40 crore from private equity firm Xponentia Capital Partners. The funds will be used to strengthen the brand, scale distribution and operations in the domestic market, for enhancing the existing product portfolio and for introducing new categories of products.

■ Koovers, a business-to-business auto spares startup, has raised $1.5 million in a round led by Inflection Point Ventures. Other investors in the round include JPIN-VCats and Venture Catalysts. The company said it will use the funds to enter more markets across India, expand its product portfolio and upgrade its technology platform.

■ Non-fungible token (NFT) marketplace Colexion has raised an undisclosed sum from Polygon, an Ethereum scaling and digital infrastructure development platform founded by Indians and backed by billionaire Mark Cuban. Colexion raised the capital at a valuation of about $50 million, cofounder Bibin Babu told ET. The investment is a mix of token and equity, he added.

Tata using BigBasket to build supply chain for super app

Months after it acquired e-grocer BigBasket, the Tata Group is now using the company to build a supply chain and logistics network for its ambitious super app TataNeu.

What’s happening? BigBasket director KB Nagaraju is currently putting together a team to set up a unified logistics and supply chain for all Tata consumer goods companies that are part of the upcoming TataNeu super app, sources told us.

Innovative Retail Concept, the retail arm of BigBasket, has made changes to its memorandum of association (MoA), inserting new clauses on the object of the firm that now includes “business of being service provider for various businesses, including providing third-party logistic services, warehousing, supply chain management, and last-mile delivery services to customers, etc”.

Tata Digital, which is spearheading the super app, seeks to bring almost all of Tata Group’s consumer and financial products into one application.

Rollout by Feb: Tata Digital is currently testing TataNeu among more than half a million group employees. The conglomerate plans to roll it out to the public in January or February.

Also Read: Inside Tata Digital's plan to integrate online businesses and launch a super app

Top five IT firms add over 1.22 lakh hands in H1

India's top five IT firms nearly matched last year’s hiring numbers in the first six months of the ongoing fiscal. Tata Consultancy Services (TCS), Infosys, Wipro, HCL Technologies and Tech Mahindra added 122,546 employees in April-September 2021. For comparison, an estimated 138,000 people were onboarded in the whole of the previous financial year, according to Nasscom.

Second quarter aids hiring numbers: These five companies added a net 68,894 employees in the recently-concluded September quarter, compared with just 17,918 in the same period last year.

Talent crunch: This comes at a time when India’s software services sector is witnessing a talent crunch as the current pool of digitally skilled professionals in the country isn’t enough to meet the pandemic-induced demand for digitalisation. IT firms are in hire-or-poach mode, resulting in sky-high salaries, with several tapping even non-engineering grads to bridge the skills gap.

Since the nationwide lockdown last year, the top five companies have added a total of 202,223 employees, according to the latest quarterly results filings.

Quote: “We had the foresight to continue hiring in large numbers throughout the second half of last year and the first half of this year. In this fiscal, we have already onboarded 43,000 freshers, all trained on the latest technologies,” TCS chief financial officer Samir Seksaria said during an earnings call.

Google CEO sees a smartphone wave in India

There is a wave of demand in India from people looking to shift from feature phones to smartphones, Alphabet Inc CEO Sundar Pichai said.

This comes as the search giant gears up to unveil its JioPhone Next around Diwali. The entry-level handset was made in partnership with Reliance Industries.

Quote: “What excites me about the upcoming partnership with Jio in building a phone is really investing beyond just English and getting languages and the local needs right in a way that many more people can take advantage of a smartphone,” Pichai said at a post-earnings call.

Massive market: India is estimated to have 850 million unique mobile phone users covering 61% of the country’s 1.39 billion people, with an untapped user base of 540 million according to Counterpoint Research. It estimates that nearly 320 million of the country’s mobile phone users have feature phones.

Other Top Stories By Our Reporters

Indian startups' hiring spree continues: It is a mad rush for talent across unicorns in India. There are nearly 70 unicorns — startups valued at $1 billion or more — in India and these are likely to create 125,000-160,000 white-collar jobs over the next two-three quarters, according to two separate studies conducted by EMA Partners and CIEL HR Services for ET.

Online gaming law amended to counter a pressing social evil, Karnataka tells HC: The Karnataka government on Wednesday submitted to the Karnataka High Court that the recent amendments to ban betting and wagering in online games were aimed at saving the youth from becoming addicts and their families from falling into deep debts.

Spotify Q3 results: Swedish music streaming service Spotify reported a 19% year on year growth in monthly active user base (MAUs) during its third quarter ended September, led by resumption marketing initiatives in India and growth in markets like the Philippines and Indonesia.

Google partners MeitY Startup Hub: Google has partnered with the Ministry of Electronics and IT’s Startup Hub to launch Appscale Academy, a growth and development programme to train early to mid-stage startups across India on building high-quality apps for the world.

Global Picks We Are Reading

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.