- News

- City News

- Hyderabad News

- Rs 50 crore global credit card scam busted; 7 held from Hyderabad, Delhi

Trending

This story is from January 14, 2022

Rs 50 crore global credit card scam busted; 7 held from Hyderabad, Delhi

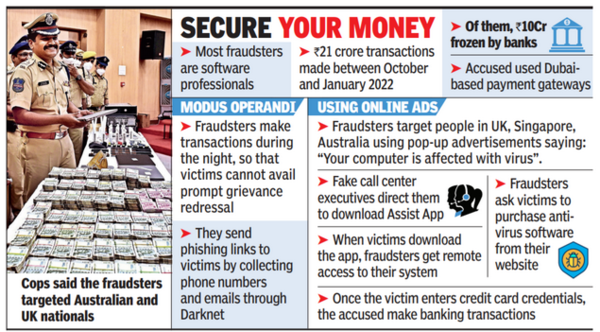

An inter-state gang involved in international credit card fraud by cheating payment gateways, including one belonging to a prominent private bank, to the tune of nearly 50 crore was busted on Thursday and seven persons were arrested from Delhi and Hyderabad.

Cops said the fraudsters targeted Australian and UK nationals

HYDERABAD: An inter-state gang involved in international credit card fraud by cheating payment gateways, including one belonging to a prominent private bank, to the tune of nearly 50 crore was busted on Thursday and seven persons were arrested from Delhi and Hyderabad.

They reportedly targeted residents of the United Kingdom, Singapore and Australia.

Addressing a press conference on Thursday, Cyberabad police commissioner Stephen Raveendra said that New Delhi-based Naveen Bhutani, Mohit, Monu and city-based B Nagaraju, D Sravan Kumar, V Pavan and SM Srinivas Rao — were arrested from their respective locations.

In the execution of the credit card fraud, these seven accused in coordination with a few others missing accused set up an organised system by developing fake websites, took international toll-free number connections besides setting up fake call centres in Janakpur in New Delhi, Kaushambi in Ghaziabad and Mohali in Punjab. For the websites, which the accused created offering different fake e-commerce services, they took the services of payment gateways.

The accused contacted people in the United Kingdom, Singapore and Australia by sending online ads or bulk fake SMSes about payment alert or make direct phone calls to some claiming to be technical service providers of prominent e-commerce and cloned their credit cards.

For customers who had raised red flag after realising the fraud transaction, their respective banks froze the money. However, in a payment transaction, the payment gateway would generally pay money to the final service provider/ vendor in advance with an understanding that the bank would return the money. But, since these were fraud transactions, the banks did not release the money to payment gateways.

On the instructions of Sravan, Nagaraju had developed websites and integrated them with payment gateways. Nagaraju links the bank accounts of Srinivas Rao, Pavan and others to these payment gateways. It was Nagaraju, by operating these bank accounts, would forward the ill-gotten money to Mohit after deducting the agreed commission, police said.

They reportedly targeted residents of the United Kingdom, Singapore and Australia.

Addressing a press conference on Thursday, Cyberabad police commissioner Stephen Raveendra said that New Delhi-based Naveen Bhutani, Mohit, Monu and city-based B Nagaraju, D Sravan Kumar, V Pavan and SM Srinivas Rao — were arrested from their respective locations.

However, police said that the investigation was still in initial stages and they did not have full information about how the accused used the money and the money trail.

In the execution of the credit card fraud, these seven accused in coordination with a few others missing accused set up an organised system by developing fake websites, took international toll-free number connections besides setting up fake call centres in Janakpur in New Delhi, Kaushambi in Ghaziabad and Mohali in Punjab. For the websites, which the accused created offering different fake e-commerce services, they took the services of payment gateways.

The accused contacted people in the United Kingdom, Singapore and Australia by sending online ads or bulk fake SMSes about payment alert or make direct phone calls to some claiming to be technical service providers of prominent e-commerce and cloned their credit cards.

For customers who had raised red flag after realising the fraud transaction, their respective banks froze the money. However, in a payment transaction, the payment gateway would generally pay money to the final service provider/ vendor in advance with an understanding that the bank would return the money. But, since these were fraud transactions, the banks did not release the money to payment gateways.

On the instructions of Sravan, Nagaraju had developed websites and integrated them with payment gateways. Nagaraju links the bank accounts of Srinivas Rao, Pavan and others to these payment gateways. It was Nagaraju, by operating these bank accounts, would forward the ill-gotten money to Mohit after deducting the agreed commission, police said.

End of Article

FOLLOW US ON SOCIAL MEDIA