Unwrapped Unwrapped |

Lights, camera, Activision!

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.

Hi, it's Zaheer. This week, Microsoft Corp. agreed to pay a stunning $68.7 billion—all cash—to acquire Activision Blizzard, the company behind blockbuster games such as 'Call of Duty', 'Overwatch', 'Diablo', 'Warcraft', 'Candy Crush' and more.

Here’s a look at the numbers behind the gigantic deal.

1

According to data from Refinitiv, the Microsoft-Activision deal would be the biggest tech acquisition of all time, trumping the $67 billion Dell and equity firm Silver Lake paid for EMC in 2015 and dwarfing the $26 billion Microsoft paid for LinkedIn in 2016.

It would also be the largest all-cash acquisition on record, beating Bayer's $63.9 billion offer for Monsanto in 2016 and the $60.4 billion that InBev bid for Anheuser-Busch in 2008.

3

Once the deal goes through, Microsoft said it will be the world’s “third-largest gaming company by revenue, behind Tencent and Sony”.

18 months

How long the deal will take to close, according to Microsoft.

$95

What Microsoft agreed to pay for each Activision share, a 45% premium on the target’s closing price on January 14.

13%

How much Sony’s shares fell in Tokyo on Wednesday, a day after the deal was announced. It was the biggest single-day fall in Sony’s stock since October 2008, Bloomberg reported.

10.7%

Microsoft’s share of the global gaming market after acquiring Activision Blizzard, according to Newzoo. It said Microsoft's gaming market share was 6.5% in 2020.

34

The number of game development studios Microsoft will own should the deal go through. It currently owns 23.

400 million

Activision's monthly active users

$3 billion

What Microsoft will have to pay Activision Blizzard as a “break fee” if the deal falls through.

$180.3 billion

Revenue generated by the global gaming market in 2021, according to data analytics firm Newzoo, which expects it to grow to $218.8 billion by 2024.

$18 million

What Activision agreed to pay in September 2021 to settle a complaint filed by the US Equal Employment Opportunity Commission over sexual harassment and discrimination issues.

Since July, it has faced a lawsuit from California regulators alleging the company "fostered a sexist culture” that was a "breeding ground for harassment and discrimination against women."

In November, more than 100 Activision Blizzard employees staged a walkout, calling for Kotick to step down as CEO, after the Wall Street Journal published an investigation suggesting Kotick was aware of these issues for several years.

$390 million

How much Kotick could receive once Microsoft completes the acquisition. Most of his payout would come from the 3.95 million company shares he holds. Kotick had taken a 99.9% pay cut in October, which reduced his annual salary to $62,500 from $155 million the previous year.

TOP STORIES BY OUR REPORTERS

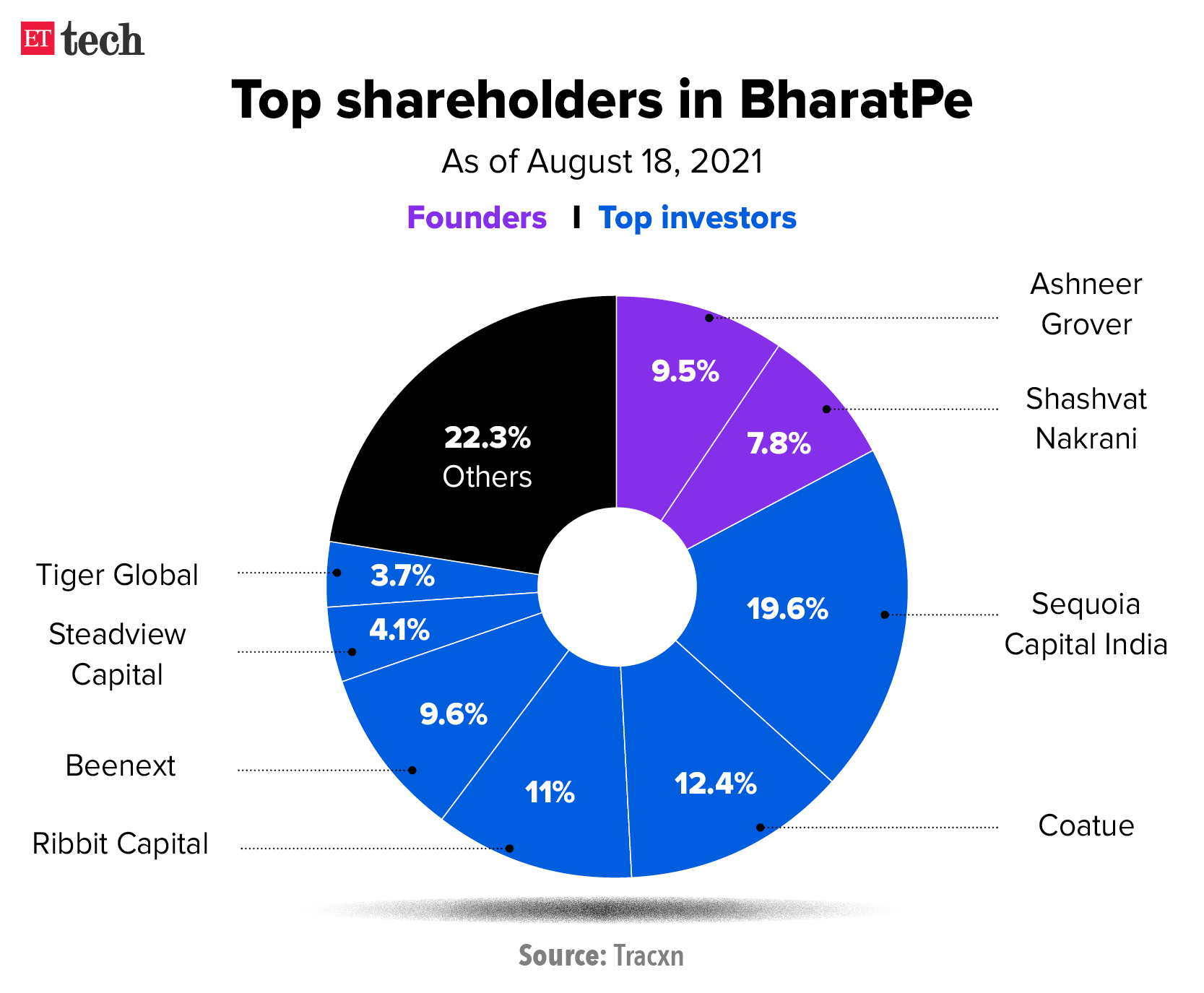

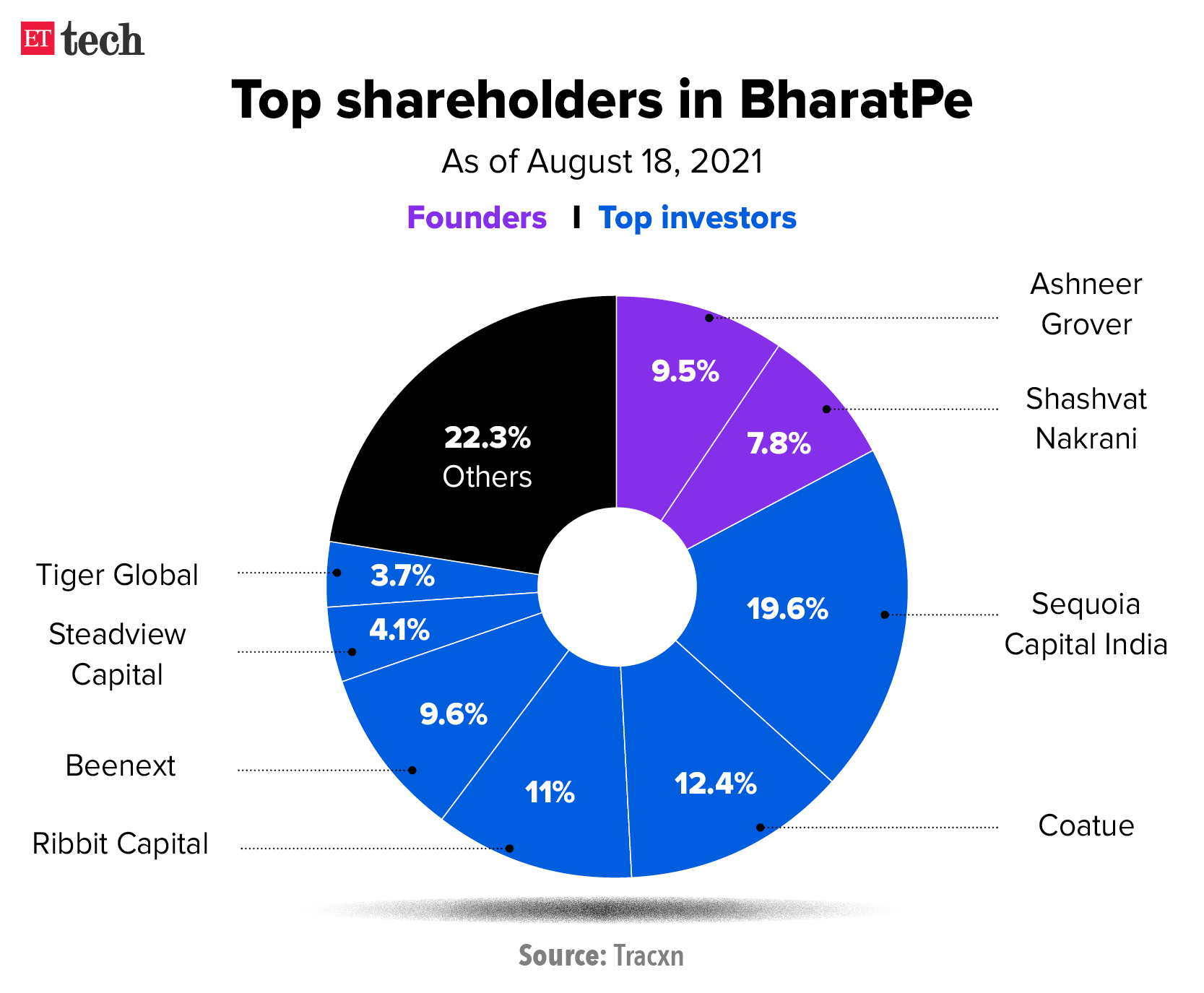

Inside the Ashneer Grover saga

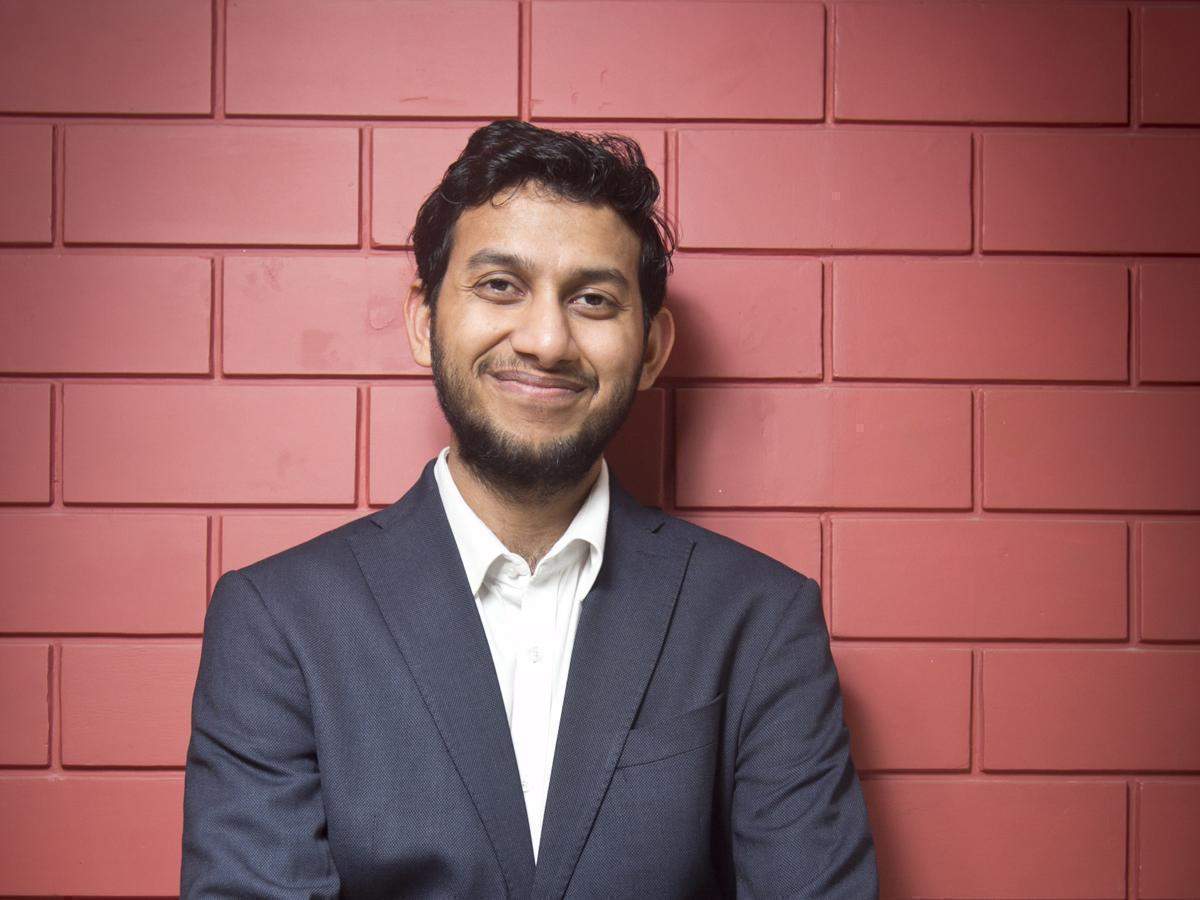

BharatPe's cofounder and MD Ashneer Grover

BharatPe's cofounder and MD Ashneer Grover

Ashneer Grover, the cofounder and managing director of BharatPe, has taken a voluntary leave of absence until the end of March, weeks after an audio clip of him admonishing a bank employee surfaced.

“I’ve been relentlessly at work building up BharatPe for almost four years. After much deliberation and introspection, I plan to take a temporary leave of absence from BharatPe till March-end," he said in a statement on Wednesday. "I will return on or before April 1, 2022.”

The company’s board has accepted Grover’s decision, which it agreed was “in the best interests of the company, its employees, investors and merchants. It said the company would continue to be led by CEO Suhail Sameer, who was appointed to the post in August.

Investors in BharatPe had met Grover last week to discuss the matter and the next steps to be taken, people aware of the discussions told ET. One of them said, “The option was to either ask him to step down or get him to go on temporary leave and then phase him out.”

It’s not clear if the board has started a formal investigation into the allegations against Grover. “It was a difficult conversation with Grover… It has been advised that he stay away from the company for a few weeks until the dust settles,” said another person aware of the discussions.

Controversies: Grover has been in the spotlight since the turn of the year for all the wrong reasons.

In the first week of January, an anonymous handle on Twitter—‘bongo babu’—had posted a SoundCloud link to an audio clip of a man, allegedly Grover, abusing and threatening the bank employee over the phone in October after missing out on Nykaa’s initial public offering.

Grover initially tweeted that the audio clip was fake and that “some scamster” was trying to extort $240,000 in bitcoin from him. The same week, the audio clip was taken off Twitter and SoundCloud and Grover deleted the tweet claiming it was fake.

On Monday, we reported on a leaked email exchange from August 2020 between Grover and Harshjit Sethi of Sequoia Capital India, in which the BharatPe founder allegedly used several expletives. Sethi, who has been with Sequoia Capital India since 2015, was promoted to managing director in the venture team in July 2021.

In a report detailing BharatPe’s partnership with 44-year-old NBFC Centrum Finance to acquire a banking licence in July 2021, ET, citing sources, said the company’s investors were not comfortable with Grover’s “mercurial" style of leadership. Grover and BharatPe have also been embroiled in a public spat and legal battle around the ‘Pe’ suffix with rival PhonePe, which is owned by Flipkart.

Related Coverage

Top tech investors expect a correction in private markets

Two of the world’s most influential tech investors have signalled an impending softness in private valuations amid a major correction in the US public markets.

SoftBank Vision Fund CEO Rajeev Misra, at a virtual event organised by Axios on Thursday, said private markets were overvalued compared to the public markets and that a rebalance was on the cards.

The comments from Misra and Singh are significant as their funds power a large number of deals in India and abroad. This also means companies will have to readjust their valuation demands.

Amazon offers help to Future Retail, with a rider

Amazon.com Inc. has offered financial assistance to cash-strapped Future Retail Ltd., with which it is embroiled in a legal battle over the planned Rs 25,000-crore Reliance-Future deal.

Latest on tech stocks, IPOs

■ Stocks of India’s new-age tech firms slide: Zomato’s shares have fallen below their listing price for the first time since its market debut last July.

On Friday, the stock fell another 10% to hit a new low of Rs 113.15, less than the listing price of Rs 115, on the National Stock Exchange. The company has lost nearly 17% in four trading sessions, resulting in a market capitalisation of less than Rs 1 lakh crore.

Its tech-driven peers Paytm, PolicyBazaar, Nykaa and CarTrade are also down 4-14% in the last five trading sessions, compared to a 3.5% fall in the Nifty.

■ HomeLane plans Rs 1,500 crore IPO by mid-2022: The home interior solutions startup backed by former Indian cricket captain Mahendra Singh Dhoni plans to raise up to Rs 1,500 crore in an initial public offering that’s likely to hit the market by mid-2022.

Oyo founder Ritesh Agarwal

Oyo founder Ritesh Agarwal

■ Oyo is said to seek $9-billion valuation in IPO: Oyo Hotels & Homes, the once hard-charging Indian startup that struggled during the pandemic, is eyeing a valuation of about $9 billion in its initial public offering after preliminary conversations with potential investors.

■ Xpressbees in advanced talks for ‘unicorn round’: Xpressbees, the new-age logistics services provider from the Firstcry stable, is in advanced talks with private equity funds led by Blackstone to raise $300 million.

From the IT Space

■ TCS says India growth will be platform driven: India’s largest IT services company is positioning itself to provide apps and platforms that can integrate with the India Stack and provide solutions to customers across government, industry and even B2C, Chief Operating Officer N. Ganapathy Subramaniam says. TCS is also bullish on “low-code, no-code” solutions, having won 24 such deals in the three months ended Dec. 31.

■ ‘Infosys has seen rapid growth from Big Tech firms’: India’s second largest IT services firm invested heavily in the last few years in anticipation of an increase in digital spending by clients, CEO Salil Parekh told us in an interview. The company would have registered a similar pace of growth even without the Covid-19 pandemic, he said.

■ HCL Tech seeks to arrest attrition with ‘hire to retire’ platform: India’s third largest IT firm by revenue is revamping its internal technology interface to gauge employee sentiment better, in an attempt to stem its soaring attrition rates. The “hire to retire” platform aims to improve the entire employee lifecycle—from recruitment, training and retirement.

Also Read: IT firms passing on rising talent cost to clients

In The Crypto World

■ Indian investors wary of buying the dip as crypto crashes again: The news of a crackdown on crypto exchanges for alleged tax evasion, and the possibility of tax clarity in the upcoming budget session has added to the uncertainty. For some, the initial excitement to get rich quickly has worn off, and they are now more wary of “buying the dip” than they were before. (read more)

■ Centre may skip crypto bill in budget session: The government wants to hold more discussions and build consensus on the regulatory framework for cryptocurrency in India. It also wants to wait for the pilot launch of Reserve Bank of India's digital currency, expected in a few months. (read more)

■ India's crypto sector likely to update code of conduct: India’s crypto-selling platforms may add warnings and appropriate banners that highlight the volatile nature of the industry while onboarding new customers on their platform. Guidelines are being framed on customer protection measures. Discussions are also on to appoint a tax expert from one of the Big Four audit firms to conduct an audit and tax compliance strategies to members. (read more)

Inside Ola’s Tesla-esque Twitter empire

Ola Electric is among the first auto manufacturers in India to have bypassed traditional dealerships and delivered vehicles directly to customers. But it has seen its fair share of teething issues with this distribution model and has already been forced to delay deliveries several times.

Ola upped its social media game, especially on Twitter, in January 2021. A media event at the Ola Electric factory in February 2021 was a grand success, and founder Bhavish Aggarwal is said to have doubled down on Twitter ever since.

Click here to read the full story.

Startups seek new definition in note to govt

In a note to the government, industry body Indian Private Equity and Venture Capital Association has proposed a new definition for startups.

Tata Digital sets up 100% arm for payments play

Tata Digital Ltd. has floated a wholly owned subsidiary, Tata Payments Ltd., that will take over all payment-related assets of the Tata Group firm.

Tata Digital, which will be rolling out the group’s ecommerce platform through a super app, will integrate Tata Pay as a payments gateway for consumers. Tata Pay may also be offered to other companies as a digital payments gateway.

Institutes told to cut ties with edtech firms or face action

The University Grants Commission and the All India Council for Technical Education have warned that educational institutes that partner with edtech firms to offer online or conventional programmes face being derecognised.

That’s all from us this week, please stay safe and have a relaxing weekend.

Here’s a look at the numbers behind the gigantic deal.

1

According to data from Refinitiv, the Microsoft-Activision deal would be the biggest tech acquisition of all time, trumping the $67 billion Dell and equity firm Silver Lake paid for EMC in 2015 and dwarfing the $26 billion Microsoft paid for LinkedIn in 2016.

It would also be the largest all-cash acquisition on record, beating Bayer's $63.9 billion offer for Monsanto in 2016 and the $60.4 billion that InBev bid for Anheuser-Busch in 2008.

3

Once the deal goes through, Microsoft said it will be the world’s “third-largest gaming company by revenue, behind Tencent and Sony”.

18 months

How long the deal will take to close, according to Microsoft.

$95

What Microsoft agreed to pay for each Activision share, a 45% premium on the target’s closing price on January 14.

13%

How much Sony’s shares fell in Tokyo on Wednesday, a day after the deal was announced. It was the biggest single-day fall in Sony’s stock since October 2008, Bloomberg reported.

10.7%

Microsoft’s share of the global gaming market after acquiring Activision Blizzard, according to Newzoo. It said Microsoft's gaming market share was 6.5% in 2020.

34

The number of game development studios Microsoft will own should the deal go through. It currently owns 23.

400 million

Activision's monthly active users

$3 billion

What Microsoft will have to pay Activision Blizzard as a “break fee” if the deal falls through.

$180.3 billion

Revenue generated by the global gaming market in 2021, according to data analytics firm Newzoo, which expects it to grow to $218.8 billion by 2024.

$18 million

What Activision agreed to pay in September 2021 to settle a complaint filed by the US Equal Employment Opportunity Commission over sexual harassment and discrimination issues.

Since July, it has faced a lawsuit from California regulators alleging the company "fostered a sexist culture” that was a "breeding ground for harassment and discrimination against women."

In November, more than 100 Activision Blizzard employees staged a walkout, calling for Kotick to step down as CEO, after the Wall Street Journal published an investigation suggesting Kotick was aware of these issues for several years.

$390 million

How much Kotick could receive once Microsoft completes the acquisition. Most of his payout would come from the 3.95 million company shares he holds. Kotick had taken a 99.9% pay cut in October, which reduced his annual salary to $62,500 from $155 million the previous year.

TOP STORIES BY OUR REPORTERS

Inside the Ashneer Grover saga

Ashneer Grover, the cofounder and managing director of BharatPe, has taken a voluntary leave of absence until the end of March, weeks after an audio clip of him admonishing a bank employee surfaced.

“I’ve been relentlessly at work building up BharatPe for almost four years. After much deliberation and introspection, I plan to take a temporary leave of absence from BharatPe till March-end," he said in a statement on Wednesday. "I will return on or before April 1, 2022.”

The company’s board has accepted Grover’s decision, which it agreed was “in the best interests of the company, its employees, investors and merchants. It said the company would continue to be led by CEO Suhail Sameer, who was appointed to the post in August.

Investors in BharatPe had met Grover last week to discuss the matter and the next steps to be taken, people aware of the discussions told ET. One of them said, “The option was to either ask him to step down or get him to go on temporary leave and then phase him out.”

It’s not clear if the board has started a formal investigation into the allegations against Grover. “It was a difficult conversation with Grover… It has been advised that he stay away from the company for a few weeks until the dust settles,” said another person aware of the discussions.

Controversies: Grover has been in the spotlight since the turn of the year for all the wrong reasons.

In the first week of January, an anonymous handle on Twitter—‘bongo babu’—had posted a SoundCloud link to an audio clip of a man, allegedly Grover, abusing and threatening the bank employee over the phone in October after missing out on Nykaa’s initial public offering.

Grover initially tweeted that the audio clip was fake and that “some scamster” was trying to extort $240,000 in bitcoin from him. The same week, the audio clip was taken off Twitter and SoundCloud and Grover deleted the tweet claiming it was fake.

On Monday, we reported on a leaked email exchange from August 2020 between Grover and Harshjit Sethi of Sequoia Capital India, in which the BharatPe founder allegedly used several expletives. Sethi, who has been with Sequoia Capital India since 2015, was promoted to managing director in the venture team in July 2021.

In a report detailing BharatPe’s partnership with 44-year-old NBFC Centrum Finance to acquire a banking licence in July 2021, ET, citing sources, said the company’s investors were not comfortable with Grover’s “mercurial" style of leadership. Grover and BharatPe have also been embroiled in a public spat and legal battle around the ‘Pe’ suffix with rival PhonePe, which is owned by Flipkart.

Related Coverage

Top tech investors expect a correction in private markets

Two of the world’s most influential tech investors have signalled an impending softness in private valuations amid a major correction in the US public markets.

SoftBank Vision Fund CEO Rajeev Misra, at a virtual event organised by Axios on Thursday, said private markets were overvalued compared to the public markets and that a rebalance was on the cards.

- "If the public markets stay where they are, then the private markets, which are overvalued, have to rebalance. And we're seeing that already," he said.

The comments from Misra and Singh are significant as their funds power a large number of deals in India and abroad. This also means companies will have to readjust their valuation demands.

Amazon offers help to Future Retail, with a rider

Amazon.com Inc. has offered financial assistance to cash-strapped Future Retail Ltd., with which it is embroiled in a legal battle over the planned Rs 25,000-crore Reliance-Future deal.

- The offer for help has a rider, though. The US-based etailer firm has warned the Big Bazaar operator against selling any retail stores without its consent.

Latest on tech stocks, IPOs

■ Stocks of India’s new-age tech firms slide: Zomato’s shares have fallen below their listing price for the first time since its market debut last July.

On Friday, the stock fell another 10% to hit a new low of Rs 113.15, less than the listing price of Rs 115, on the National Stock Exchange. The company has lost nearly 17% in four trading sessions, resulting in a market capitalisation of less than Rs 1 lakh crore.

Its tech-driven peers Paytm, PolicyBazaar, Nykaa and CarTrade are also down 4-14% in the last five trading sessions, compared to a 3.5% fall in the Nifty.

■ HomeLane plans Rs 1,500 crore IPO by mid-2022: The home interior solutions startup backed by former Indian cricket captain Mahendra Singh Dhoni plans to raise up to Rs 1,500 crore in an initial public offering that’s likely to hit the market by mid-2022.

- The offering will be a combination of primary and secondary shares where some existing investors, including Sequoia Capital and Accel Partners, will make part exits.

■ Oyo is said to seek $9-billion valuation in IPO: Oyo Hotels & Homes, the once hard-charging Indian startup that struggled during the pandemic, is eyeing a valuation of about $9 billion in its initial public offering after preliminary conversations with potential investors.

- The SoftBank Group Corp.-backed firm is expected to get the green light to proceed with the IPO this week or next after filing preliminary documents last year. A formal roadshow will begin after regulatory approval and determine final pricing.

■ Xpressbees in advanced talks for ‘unicorn round’: Xpressbees, the new-age logistics services provider from the Firstcry stable, is in advanced talks with private equity funds led by Blackstone to raise $300 million.

- The round will value the startup at $1.1 billion, making it India’s latest unicorn.

From the IT Space

■ TCS says India growth will be platform driven: India’s largest IT services company is positioning itself to provide apps and platforms that can integrate with the India Stack and provide solutions to customers across government, industry and even B2C, Chief Operating Officer N. Ganapathy Subramaniam says. TCS is also bullish on “low-code, no-code” solutions, having won 24 such deals in the three months ended Dec. 31.

■ ‘Infosys has seen rapid growth from Big Tech firms’: India’s second largest IT services firm invested heavily in the last few years in anticipation of an increase in digital spending by clients, CEO Salil Parekh told us in an interview. The company would have registered a similar pace of growth even without the Covid-19 pandemic, he said.

■ HCL Tech seeks to arrest attrition with ‘hire to retire’ platform: India’s third largest IT firm by revenue is revamping its internal technology interface to gauge employee sentiment better, in an attempt to stem its soaring attrition rates. The “hire to retire” platform aims to improve the entire employee lifecycle—from recruitment, training and retirement.

Also Read: IT firms passing on rising talent cost to clients

In The Crypto World

■ Indian investors wary of buying the dip as crypto crashes again: The news of a crackdown on crypto exchanges for alleged tax evasion, and the possibility of tax clarity in the upcoming budget session has added to the uncertainty. For some, the initial excitement to get rich quickly has worn off, and they are now more wary of “buying the dip” than they were before. (read more)

■ Centre may skip crypto bill in budget session: The government wants to hold more discussions and build consensus on the regulatory framework for cryptocurrency in India. It also wants to wait for the pilot launch of Reserve Bank of India's digital currency, expected in a few months. (read more)

■ India's crypto sector likely to update code of conduct: India’s crypto-selling platforms may add warnings and appropriate banners that highlight the volatile nature of the industry while onboarding new customers on their platform. Guidelines are being framed on customer protection measures. Discussions are also on to appoint a tax expert from one of the Big Four audit firms to conduct an audit and tax compliance strategies to members. (read more)

Inside Ola’s Tesla-esque Twitter empire

Ola Electric is among the first auto manufacturers in India to have bypassed traditional dealerships and delivered vehicles directly to customers. But it has seen its fair share of teething issues with this distribution model and has already been forced to delay deliveries several times.

- Amid the melee, Twitter has turned from a place for updates and complaints into a forum for meeting fellow Ola scooter customers and endlessly discussing the minutiae of their shiny new purchases.

Ola upped its social media game, especially on Twitter, in January 2021. A media event at the Ola Electric factory in February 2021 was a grand success, and founder Bhavish Aggarwal is said to have doubled down on Twitter ever since.

Click here to read the full story.

Startups seek new definition in note to govt

In a note to the government, industry body Indian Private Equity and Venture Capital Association has proposed a new definition for startups.

- IVCA’s note, sent to various stakeholders in the government including officials in the finance ministry, also reiterated older demands such as allowing local firms to directly list overseas.

Tata Digital sets up 100% arm for payments play

Tata Digital Ltd. has floated a wholly owned subsidiary, Tata Payments Ltd., that will take over all payment-related assets of the Tata Group firm.

- The move is seen as a precursor to the salt-to-software conglomerate entering the payments business in a big way under the Tata Pay banner. Just days ago, Tata Digital set up Tata Fintech, a financial services marketplace.

Tata Digital, which will be rolling out the group’s ecommerce platform through a super app, will integrate Tata Pay as a payments gateway for consumers. Tata Pay may also be offered to other companies as a digital payments gateway.

Institutes told to cut ties with edtech firms or face action

The University Grants Commission and the All India Council for Technical Education have warned that educational institutes that partner with edtech firms to offer online or conventional programmes face being derecognised.

- In a red-letter notice, both UGC and AICTE asked institutes of higher education to annul their agreements with edtech companies. Officials said the move came after the higher education secretary flagged ads offering educational degrees through edtech firms.

That’s all from us this week, please stay safe and have a relaxing weekend.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.