Green finance: Hong Kong’s role in the global standard to cut through the alphabet soup of ESG rules

- The world has at least 200 sets of standards for reporting and assessing climate and sustainability risks, mostly created without coordination among different jurisdictions

- The International Sustainability Standards Board (ISSB) will set “baseline” sustainability reporting standards, starting with climate-related issues

As the world’s governments and corporations face up to sustainability risks amid extreme weather patterns under the Earth’s changing climate, regulators are inching towards creating a common standard out of an alphabet soup of regulations.

The world has at least 200 sets of standards for reporting and assessing climate and sustainability risks, most of them created in recent years without coordination between regulators, industry guilds, companies or financial institutions across different jurisdictions.

“This proliferation led to market fragmentation and could potentially increase transaction costs when it comes to cross-border capital flows,” said Ma Jun, chairman of the Hong Kong Green Finance Association, and co-chair of the G20 Sustainable Finance Working Group that is responsible for improving sustainability reporting and aligning the efforts of financial institutions with the Paris climate agreement.

Small transaction costs could add up to large sums given the fast proliferation of sustainable finance tools such as stocks and debt instruments. A global body called the International Sustainability Standards Board (ISSB) is due in June, mandated to come up with a set of internationally accepted baseline standards for measuring and reporting corporate sustainability performance and aspirations.

Major Sustainability Reporting Frameworks and Standards Setters

| Acronym |

Full Name | Year of Establishment |

| GRI | Global Reporting Initiative | 2000 |

| IFRS Foundation | International Financial Reporting Standards Foundation | 2001 |

| PRI | Principles for Responsible Investment | 2006 |

| CDSB | Climate Disclosure Standards Board | 2007 |

| IIRC | International Integrated Reporting Council | 2010 |

| SASB | Sustainability Accounting Standards Board | 2011 |

| TCFD | Task Force on Climate-Related Financial Disclosures | 2015 |

| NGFS | Network for Greening the Financial System | 2017 |

| SFDR | Sustainable Finance Disclosure Regulation | 2019 |

| ISSB | International Sustainability Standards Board | 2021 |

“As there are great differences among the standards from which companies can pick and choose, you end up with a lot of noise in the system,” said Ashley Alder, chairman of the International Organisation of Securities Commissions (Iosco) that comprises 130 securities regulators worldwide.

Greenwashing refers to sustainability benefit claims without clear, agreed definitions on sustainable investment, which could sometimes lead to a false impression of the overall benefits.

“We’ve been emphasising the dangers of greenwashing, and we’ve seen it for real,” Alder said.

Disclosures should be full, accurate, regular, timely, relevant and significant for investors’ decision-making. Names for sustainability-related investment products must accurately reflect their sustainability focus, and relevant investment risks must be disclosed.

ESG ratings and data suppliers must be transparent with their methodology and have procedures in place to manage conflicts of interest, and increase trust in their products.

Chinese banks’ love of coal drag on nation’s 2060 carbon neutrality marathon

Regulators’ concern about the quality of sustainability disclosures has also resonated with industry practitioners.

Lack of unified, easily understandable ESG standards was cited by a third of an undisclosed number of respondents in a live poll at the forum, as the top barrier preventing a company or institution from implementing more ESG-friendly policies.

“We have many ESG data providers, but their scope of coverage and data quality all vary … it’s difficult to select the appropriate data set,” said Ju Weimin, vice-chairman and chief investment officer of the Chinese sovereign wealth fund China Investment Corporation.

Currently fragmented sustainability reporting standards have limited asset managers’ confidence in making big investments to help companies scale up their new projects and drive down the cost of sustainable products, said Andrew Erickson, head of international business at State Street.

A survey of the Hong Kong Federation of Insurers also found that the absence of harmonised standards and definitions was the “single biggest issue” facing implementers of sustainability-related initiatives. The potential business and reputation risks should not be ignored, said Edward Moncreiffe, chairman of the federation and CEO of HSBC Insurance (Asia).

“Globally, we are starting to see an increase in ESG litigation around greenwashing and misleading statements in disclosures and advertisements,” Moncreiffe said. “This shows that even [with] a globally consistent regulatory and legislative framework, if you don’t have a common taxonomy, you face a much higher inherent risk of confusion, misinterpretation and inconsistencies. We have seen this in the travel, fashion and utilities industries.”

Taxonomy refers to the classification and definition of investment projects and products recognised to have sustainability benefits.

Qualifying financial instruments supporting the projects and products to be labelled as green or sustainable, it gives investors clarity and confidence, and facilitates the measurement and tracking of fund flows.

One litigation involved Irish low cost airline Ryanair, which was told to stop airing advertisements by the UK’s Advertising Standards Authority in 2020.

The authority ruled that Ryanair’s claims in advertisements of “Europe’s … Lowest Emissions Airline” and “low CO2 emissions” were misleading, citing the absence of well-known competitors in its calculations.

Meet Billie, Hong Kong’s clean solution to turn textile waste into yarn

Progress is being made internationally on finding common grounds to tackle “alphabet soup” sustainability reporting which has led to “greenwashing and cherry-picking” by companies, said Teresa Ko, a vice chair of the International Financial Reporting Standards Foundation (IFRSF) that sets and interprets accounting standards.

They will be merged by June into the ISSB, which will develop a comprehensive set of “baseline” global standards on sustainability reporting, starting with climate-related issues. Other pressing global sustainable issues such as biodiversity will be added in the future.

“The baseline standards will be far from basic,” Ko said. “We are not looking at the lowest common denominator. We want disclosure to be comparable and compatible with companies’ existing financial disclosures … and requirements in other jurisdictions already have or hope to have. We do not intend to hold any jurisdictions back if they want to go further or faster.”

Prototypes of climate and general disclosure requirements have been published for public consultation. Iosco’s endorsement of the revised versions will be sought.

Adoption by jurisdictional securities regulators, such as Hong Kong’s SFC, will follow. Alder expected them to be incorporated into the city’s companies audit and listing rules as early as late this year or early next year.

The quantitative and qualitative climate and sustainability information on past performance and future targets, when combined with companies’ financial reports, will help users assess the potential impact on their future cash flows over the short, medium and long term.

It will also drive companies to plan and take action to mitigate risks and grasp opportunities from climate change and other sustainability challenges, and guide capital markets to finance such projects.

The ISSB’s evolution mirrors the IFRS Foundation’s establishment two decades ago, Alder said. The latter was tasked to come up with a set of commonly accepted financial reporting standards to enhance transparency, accountability and efficiency across global financial markets.

Resources will be pooled so that a multi-location presence will be established by the ISSB quickly, Ko said. Besides Frankfurt, Montreal, London and San Francisco, the ISSB is considering proposals to set up operations in Beijing and Tokyo.

With Emmanuel Faber, the former CEO of dairy products giant Danone taking chairman position on January 1, the ISSB is seeking to appoint up to 11 inaugural board members.

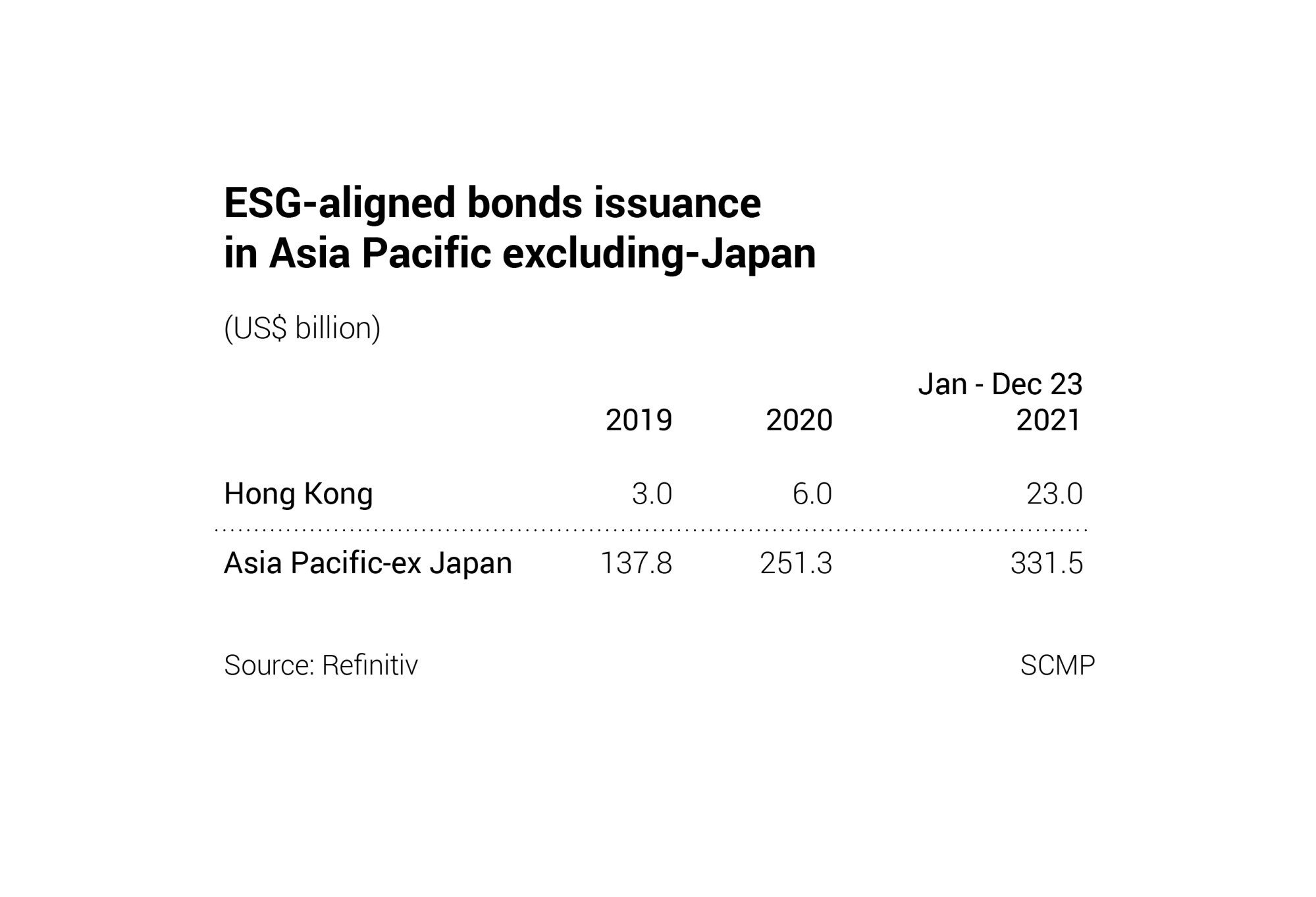

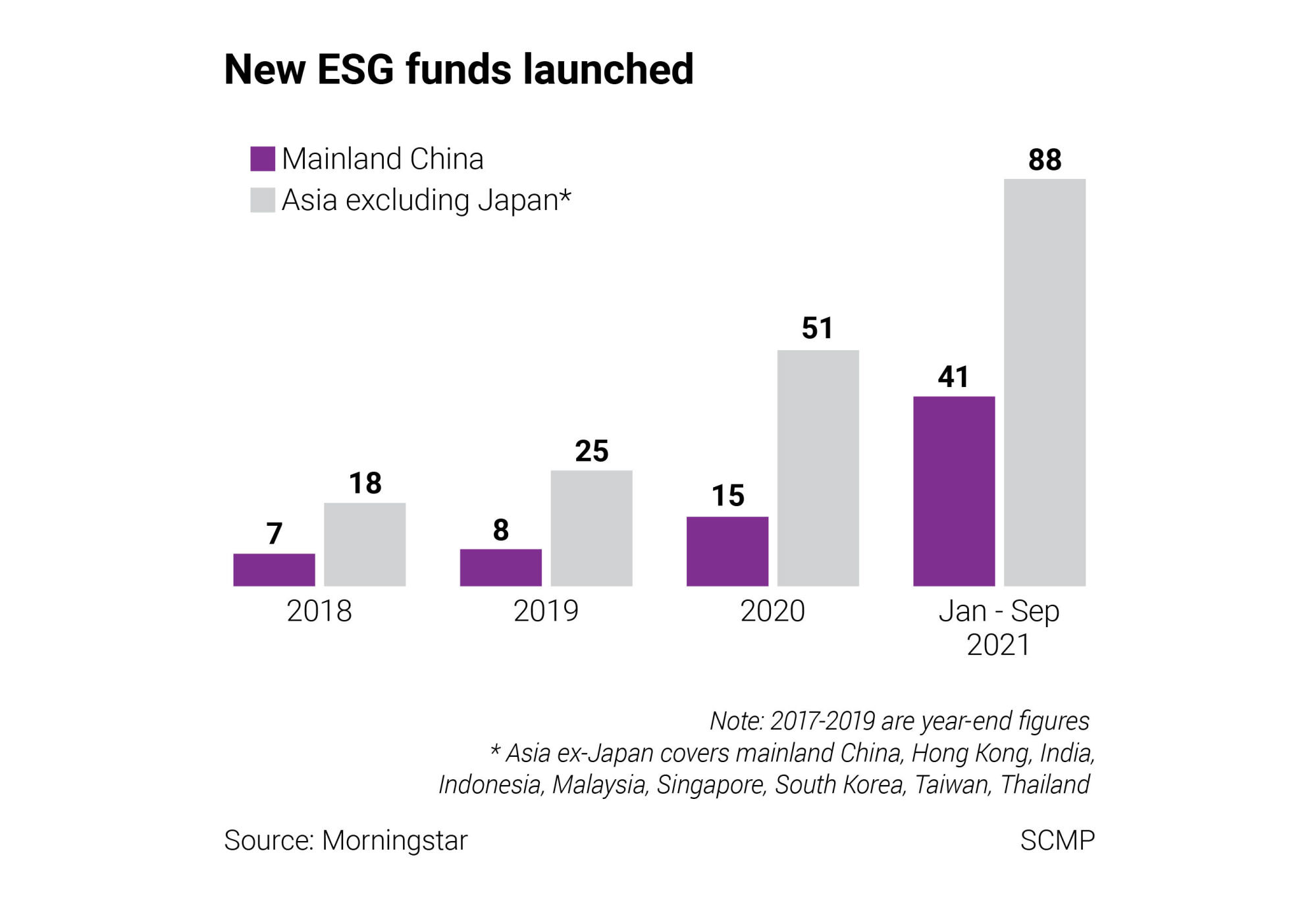

Convergence of international standards will support the next phase of growth of sustainable investing, which should see the broadening and deepening of the sustainable bond market, said Desmond Kuek, head of sustainable finance in the Asia Pacific region at UBS.

“Investors, regulators and other market participants will continue to increase their focus on greater transparency and clearer reporting,” Kuek said. “We are seeing a convergence around definitions, terminology and standards.”

An example of progress made on cross-jurisdiction taxonomy collaboration is the unveiling of the China-EU “common ground taxonomy” in November.

Earth’s biggest plastics polluter embarks on clean-up journey to cut waste

Although far from achieving harmony, the 16-month comparison exercise identified commonalities and differences of the taxonomies of the world’s two most active sustainable finance issuance jurisdictions.

Some 61 activities – out of over 80 analysed – across six sectors were listed in the common ground taxonomy, with descriptions of the degree and nature of overlaps.

Besides facilitating the issuance of green financial products, it would provide a reference for other jurisdictions – including Hong Kong – and act as the building block of future efforts of reaching harmony, Ma said.

China’s carbon neutrality goal

Still, Ko said the risk of persistent global fragmentation should not be underestimated.

The US Securities and Exchange Commission (SEC) is expected to publish a climate reporting framework for listed firms, while the Europe Union will impose mandatory sustainability reporting and external assurance of the information on all large and listed firms by year-end, she noted.

“I hope there will be harmonisation of content on these frameworks,” she said. “The ISSB is not here to compete [with country regulators], we just want the standards to be more comparable.”

Deciphering China’s relationship with coal as it aims for carbon neutrality

It will entail a huge amount of work to make sustainability disclosures auditable, and many skilled professionals will be needed to do the assessments, she added.

Meanwhile, extreme climate events are increasingly affecting business operations and decisions, raising the urgency for more funding to enable quicker decarbonisation of the global economy.

The momentum for change in the right direction has gathered pace, Alder noted.

“The pace of change, the level of commitment among all players in this space has accelerated remarkably over the past 18 months,” he said.

“That’s important, because we don’t have the luxury of time [to fight climate change]. The pandemic has highlighted that risks which are serious may sometimes seem remote, until they actually hit.”

Additional reporting by Enoch Yiu, Georgina Lee and Martin Choi