Business News›Tech›Newsletters›Tech Top 5›YouTube hack hits Indian crypto firms; Budget wish lists for crypto, fintech

Daily Top 5 Daily Top 5 |

YouTube hack hits Indian crypto firms; Budget wish lists for crypto, fintech

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

Several crypto influencers and Indian crypto exchanges found their YouTube accounts had been compromised by cybercriminals on Monday morning. They realised the accounts had been hijacked when the hackers posted a video of a cryptocurrency scam on their channels. The exchanges are now awaiting a response from YouTube.

Also in this letter:

■ Crypto and fintech firms’ Budget wish lists

■ Zomato back in the black after Monday mayhem

■ SAP picks up minority stake in Icertis

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

The YouTube accounts of various Indian crypto companies including CoinDCX, CoinSwitch Kuber, WazirX and Unocoin were among those compromised in a worldwide hack on Monday morning.

The breach was revealed when an unidentified hacker posted a video promoting a crypto scam called ‘One World Cryptocurrency’ on the compromised channels.

Reponse: Many crypto exchanges told us that they had conducted internal investigations and found there was no suspicious activity – such as a change of password -- on their accounts prior to the hack. WazirX said it has contacted YouTube and is awaiting a response.

Rajagopal Menon, vice president for marketing at WazirX, said, “There was a systematic hack on several crypto YouTube accounts around the world. Fortunately, our team caught the fraudulent video within seven minutes of going live on our channel and deleted it. On conducting a diagnosis, we did not find any security flaw from WazirX's end that could have given hackers access to our channel.”

A CoinDCX spokesperson tweeted, “Our security team was swift in identifying and taking down the fraudulent video posted on CoinDCX’s channel, limiting the video’s reach. For the few of our subscribers who saw the video before it was removed, please disregard all of its content.”

Cybersecurity expert Rajshekhar Rajaharia said the incident may have been due to the integration of compromised accounts with third-party application programming interfaces (API) used for live streaming. An API is a type of software that allows two other pieces of software to talk to each other.

Hack to the future: In December, Prime Minister Narendra Modi’s Twitter account was briefly compromised. A hacker tweeted from it that India has “officially adopted bitcoin as legal tender” and “the government has officially bought 500 BTC and is distributing them to all residents of the country”.

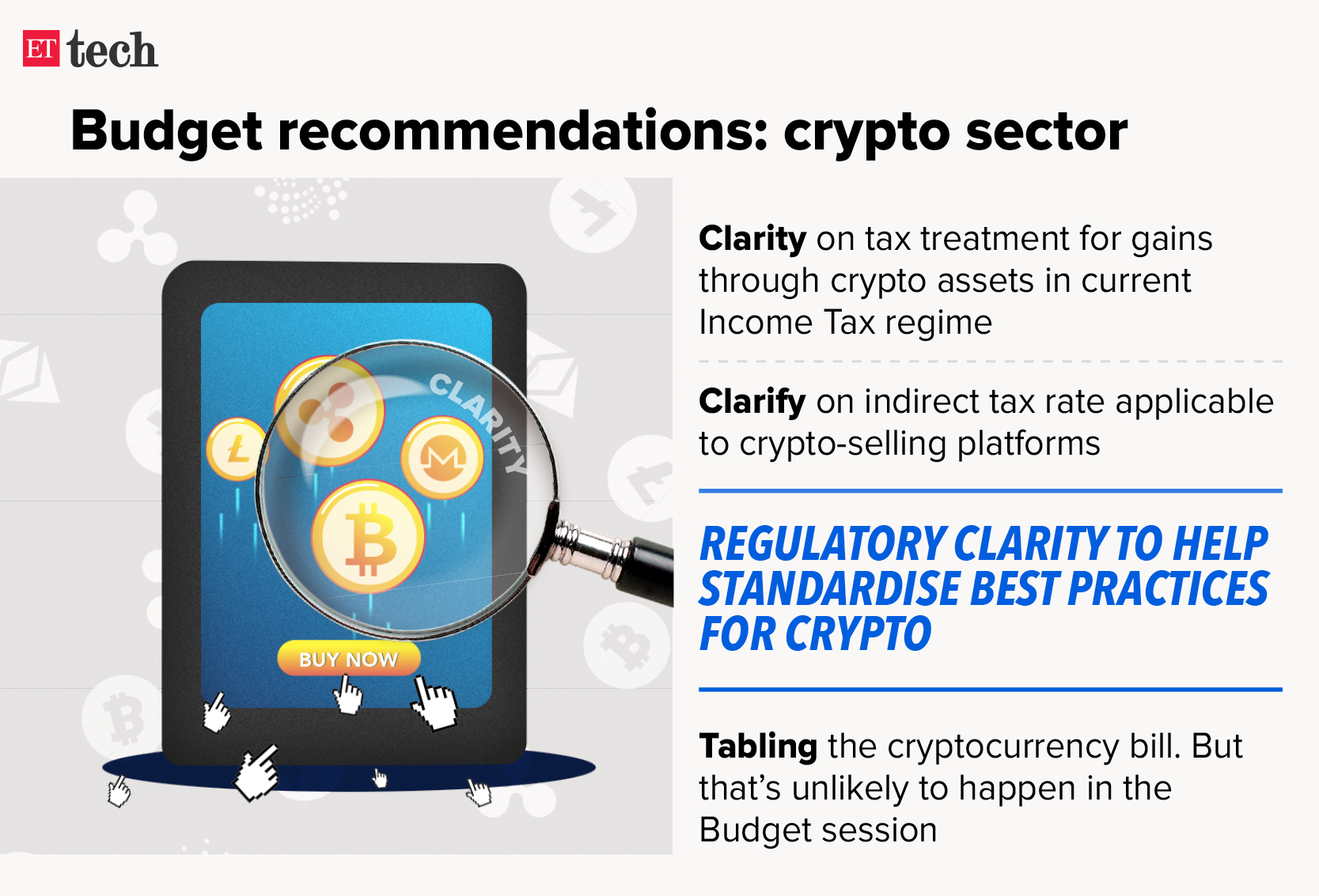

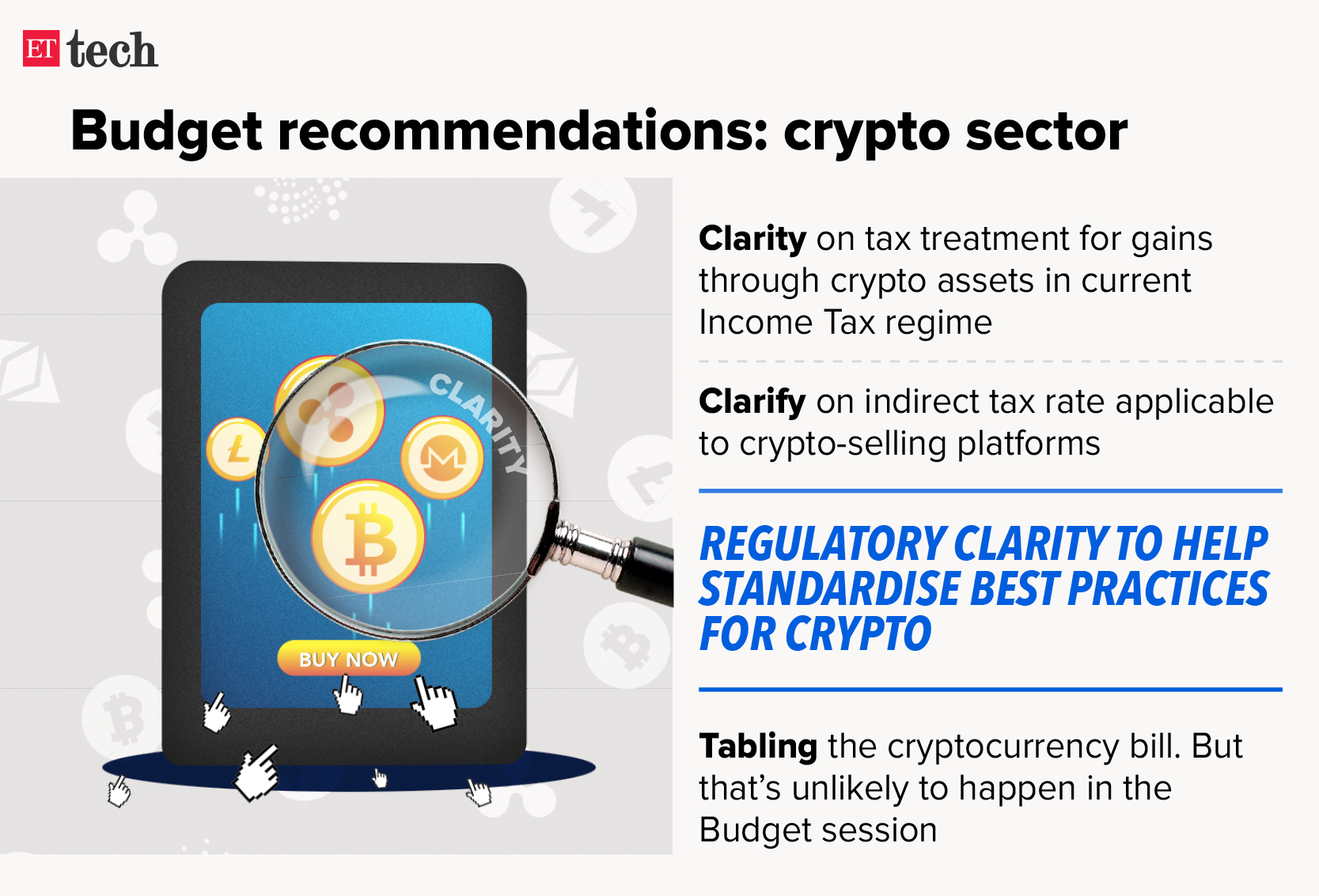

With the Union Budget 2022 just a week away, India’s crypto and fintech sectors are clear about their wish lists for the government.

Crypto firms want clarity on taxes: Cryptocurrency companies say they have been suffering due to a lack of regulations and clarity on taxation. There is widespread confusion among crypto firms on matters of indirect taxes, and the GST implications on the purchase and sale of cryptocurrencies.

Crypto exchange WazirX was recently fined almost Rs 50 crore by the GST Mumbai (East Commissionerate Zone) for alleged tax evasion. Many other crypto platforms including CoinSwitch Kuber, Buyucoin and Unocoin are under investigation by the Directorate General of GST Intelligence for allegedly evading taxes.

We had previously reported that the government has sought the opinion of senior tax advisors on whether income earned from trading cryptocurrencies could be treated as business income, as against capital gains.

Also Read: Union Budget 2022: Startups seek a reset in tax regime

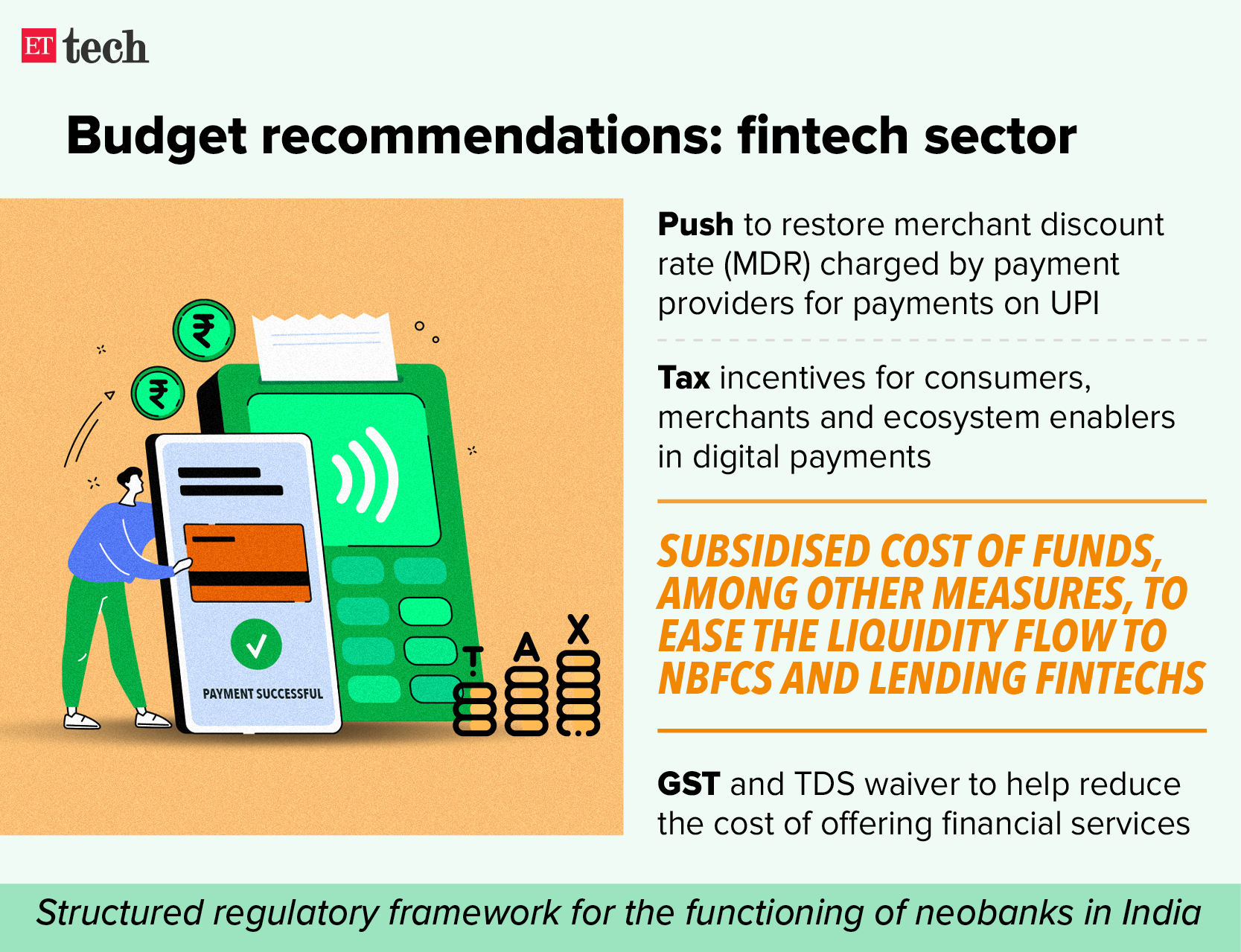

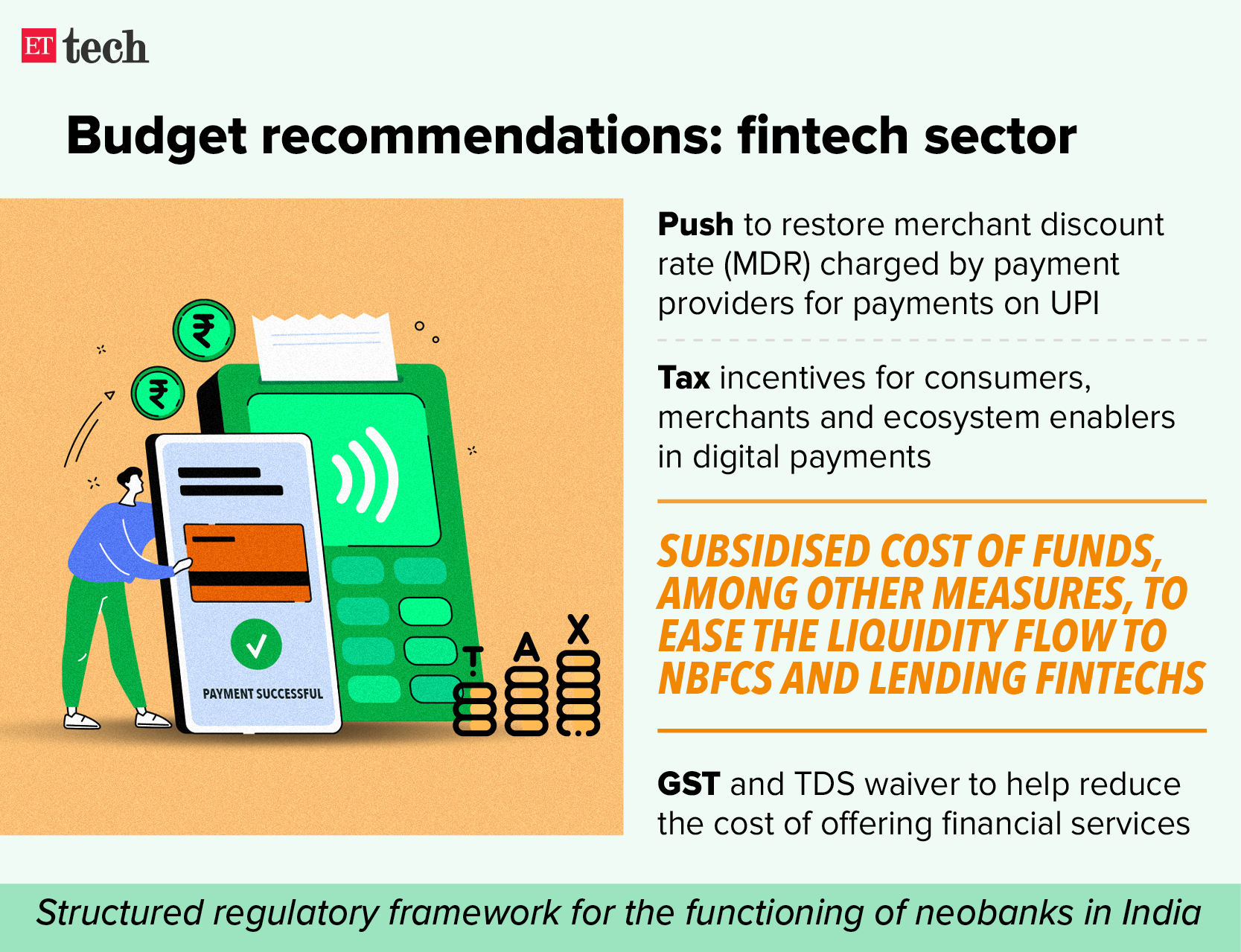

Fintech firms rally for sops: Fintech companies meanwhile are lobbying the government to bring back the merchant discount rate (MDR) – a fee that payment providers charge for each transaction – on the Unified Payments Interface (UPI).

The digital lending industry, which was severely hit at the start of the pandemic, wants the government to announce measures to ease liquidity flow to non-banking finance companies (NBFCs). Loan disbursals of the top three digital lending companies fell 90% from $104 million to $15 million from March to May 2020, according to management consultancy Redseer.

India’s fledgling neobanks, meanwhile, are just looking for recognition. Since they are not eligible for banking licences under RBI rules, they have to tie up with traditional banks to offer their services.

German enterprise software major SAP has picked up a minority stake in software-as-a-service (SaaS) firm Icertis, the two companies said in a statement on Tuesday. Icertis, headquartered in Bellevue (Washington) and Pune, will deepen its existing partnership with SAP after the investment. The financial details of the deal were not disclosed.

Samir Bodas, founder and CEO of Icertis, told us the announcement means that SAP will now co-sell Icertis products. He said Icertis Contract Intelligence will see further integration with SAP, Ariba and SAP Customer Experience solutions going forward.

"We have many common customers like automaker Daimler AG and The Boeing Company, among others. There is tremendous alignment between our products. SAP will integrate with our products and co-sell them," he said.

Last September, SoftBank Vision Fund had bought secondary shares from Icertis's existing investor Eight Roads at a valuation of around $5 billion, catapulting it into the top league of SaaS startups out of India.

■ Tech company Smartron said it has signed an agreement with Global Emerging Markets Group (GEM), in which the alternative investment organisation will provide a share subscription facility of up to $200 million (about Rs 1,495.8 crore).

■ Mobile app builder firm Vajro said it has raised $8.5 million (around Rs 63.52 crore) in a funding round from Kansas City-based growth equity firm Five Elms Capital. Vajro will use the funds to build its next-generation platform and to build integrations with other ecommerce platforms such as WooCommerce, Magento, and others to expand its reach.

■ Crypto investment app Flint has raised $5.1 million in a funding round led by Sequoia Capital India and Global Founders. The Bengaluru-based startup will use the funds to acquire users, enhance its product base, and hire for senior positions across engineering, design and product. Flint also plans to allocate a significant portion of the funding to strengthen legal and risk functions.

■ NowPurchase, a procurement technology company for the metal manufacturing industry, said it has raised $2.4 million in a funding round led by Orios and InfoEdge Ventures.

■ 100X.VC portfolio firm Super Scholar, an edtech platform, has raised $400,000 in a funding round from MAGIC Fund, 2am VC, Astir VC, JITO Angel Network and others. The company said it will use the funds to strengthen its courses and scholarship offerings to ensure more students can leverage these facilities or grants.

Shares of online food aggregator Zomato pared some losses on Tuesday after its stock hit a 52-week low of Rs 84 in early trade. The scrip ended the day 9.96% up to close at Rs 100.5. BSE Sensex and Nifty 50 rebounded on Tuesday afternoon, ending a five-day losing streak.

BSE Sensex jumped 367 points or 0.64% to close at 57,858, while NSE Nifty 50 index gained 128 points or 0.75% to close at 17,278.

What about the others? Shares of Nykaa, Paytm, Policybazaar and Cartrade once again ended the day in red after hitting all-time lows on Monday.

■ Nykaa, which opened the day at Rs 1,744, dropped 4.20% to Rs 1,661.90. The scrip hit a 52-week low of Rs1,609.05 on Tuesday.

■ PB Fintech, the parent company of PolicyBazaar, too hit a 52-week low of Rs 726 during the day. The stock was trading at its new low, having fallen 29% in the past six days. However, the scrip ended the day 0.05% lower at Rs 776.20.

■ Paytm’s parent firm One97 Communications dropped 4.6% to a 52-week low of Rs 875.5 on BSE at one point before closing the day at Rs 915.70, down 0.18%. In the last six sessions, the stock has shed 18% of its value. On Monday, it slid below the Rs 900-mark for the first time.

■ Cartrade Tech's shares declined more than 6% in intraday trade on Tuesday to hit a fresh all-time low after it reported its third-quarter results. The company reported a net loss of Rs 23.3 crore for the quarter ended December 31, 2021, against a net profit of Rs 18.2 crore for the corresponding period a year ago. The scrip ended the day at Rs 721.70, down 6.03%

IPO Index down 10%: Meanwhile, the S&P BSE IPO Index, which tracks firms for two years since their listing, has plunged about 10% since the start of the year and is headed for its worst month since March 2020, when the pandemic took hold.

Of the 42 companies that debuted in India over the past year and raised at least $100 million, 38% are trading below the listing price, data compiled by Bloomberg showed. The picture is even worse for those that raised at least $500 million, with the rate rising to about 46%.

Bear necessities: The slump comes on the back of fading risk appetite for equities as central banks prepare to tighten monetary policy to quell inflation. In the US, more than two-thirds of shares that listed this year are trading at or below their starting prices.

After the Indian Institutes of Technology (IITs), the National Institutes of Technology (NITs) are seeing record placement numbers, not just in terms of the line-up of offers but also an increase in top packages and average salaries.

Show me the money! NIT Hamirpur has received five Rs 1 crore-plus offers for international roles, its director Lalit Kumar Awasthi told us. It had received a single Rs 1 crore offer in 2019.

The top offer at other NITs such as Calicut and Jamshedpur increased by almost 50%. The number of offers so far is nearing—and in some cases has even surpassed—the total at the last placement season at these NITs and those in Durgapur, Manipur, Warangal and Jalandhar.

Quote: “The average salary is up by 35% this year compared to last year. Our top salary is Rs 1.5 crore—the highest ever,” said Awasthi. Most offers are coming from IT firms or for tech roles, driving average salaries up.

There’s an increase of about 30% in the average salary from last year at NIT Jamshedpur.

The rapid digital transformation across all industries amid the pandemic has pushed demand for young engineers from NITs to new highs, resulting in one of the best placement seasons across these colleges, officials said.

Placement highlights: NIT Durgapur has received 530 offers so far this year compared with 429 last year. The average salary has gone up at Durgapur to Rs 11.46 lakh so far this year, up 37% from Rs 8.34 lakh for the 2021 batch.

Campus call: Prominent recruiters at the NITs this year include Microsoft, Amazon, Paytm, Samsung, Atlassian, Intuit, Tata Steel, Texas Instruments, Aditya Birla Group, Flipkart, Tata Motors, Vedanta, Qualcomm, Goldman Sachs, PwC and Deloitte, said placement officials.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanaban in New Delhi and Zaheer Merchant in Mumbai.

Also in this letter:

■ Crypto and fintech firms’ Budget wish lists

■ Zomato back in the black after Monday mayhem

■ SAP picks up minority stake in Icertis

Got a minute? ETtech’s goal is to bring you the latest news, exclusives, and analysis from the thriving technology and startup sector, and we’re always looking to improve. You can help us do so by filling in a short survey here. Thank you!

YouTube accounts of Indian crypto firms compromised

The YouTube accounts of various Indian crypto companies including CoinDCX, CoinSwitch Kuber, WazirX and Unocoin were among those compromised in a worldwide hack on Monday morning.

The breach was revealed when an unidentified hacker posted a video promoting a crypto scam called ‘One World Cryptocurrency’ on the compromised channels.

Reponse: Many crypto exchanges told us that they had conducted internal investigations and found there was no suspicious activity – such as a change of password -- on their accounts prior to the hack. WazirX said it has contacted YouTube and is awaiting a response.

Rajagopal Menon, vice president for marketing at WazirX, said, “There was a systematic hack on several crypto YouTube accounts around the world. Fortunately, our team caught the fraudulent video within seven minutes of going live on our channel and deleted it. On conducting a diagnosis, we did not find any security flaw from WazirX's end that could have given hackers access to our channel.”

A CoinDCX spokesperson tweeted, “Our security team was swift in identifying and taking down the fraudulent video posted on CoinDCX’s channel, limiting the video’s reach. For the few of our subscribers who saw the video before it was removed, please disregard all of its content.”

Cybersecurity expert Rajshekhar Rajaharia said the incident may have been due to the integration of compromised accounts with third-party application programming interfaces (API) used for live streaming. An API is a type of software that allows two other pieces of software to talk to each other.

Hack to the future: In December, Prime Minister Narendra Modi’s Twitter account was briefly compromised. A hacker tweeted from it that India has “officially adopted bitcoin as legal tender” and “the government has officially bought 500 BTC and is distributing them to all residents of the country”.

Budget 2022: Crypto sector seeks tax clarity, fintech wants sops

With the Union Budget 2022 just a week away, India’s crypto and fintech sectors are clear about their wish lists for the government.

Crypto firms want clarity on taxes: Cryptocurrency companies say they have been suffering due to a lack of regulations and clarity on taxation. There is widespread confusion among crypto firms on matters of indirect taxes, and the GST implications on the purchase and sale of cryptocurrencies.

Crypto exchange WazirX was recently fined almost Rs 50 crore by the GST Mumbai (East Commissionerate Zone) for alleged tax evasion. Many other crypto platforms including CoinSwitch Kuber, Buyucoin and Unocoin are under investigation by the Directorate General of GST Intelligence for allegedly evading taxes.

We had previously reported that the government has sought the opinion of senior tax advisors on whether income earned from trading cryptocurrencies could be treated as business income, as against capital gains.

Also Read: Union Budget 2022: Startups seek a reset in tax regime

Fintech firms rally for sops: Fintech companies meanwhile are lobbying the government to bring back the merchant discount rate (MDR) – a fee that payment providers charge for each transaction – on the Unified Payments Interface (UPI).

The digital lending industry, which was severely hit at the start of the pandemic, wants the government to announce measures to ease liquidity flow to non-banking finance companies (NBFCs). Loan disbursals of the top three digital lending companies fell 90% from $104 million to $15 million from March to May 2020, according to management consultancy Redseer.

India’s fledgling neobanks, meanwhile, are just looking for recognition. Since they are not eligible for banking licences under RBI rules, they have to tie up with traditional banks to offer their services.

SAP picks up minority stake in Icertis

German enterprise software major SAP has picked up a minority stake in software-as-a-service (SaaS) firm Icertis, the two companies said in a statement on Tuesday. Icertis, headquartered in Bellevue (Washington) and Pune, will deepen its existing partnership with SAP after the investment. The financial details of the deal were not disclosed.

Samir Bodas, founder and CEO of Icertis, told us the announcement means that SAP will now co-sell Icertis products. He said Icertis Contract Intelligence will see further integration with SAP, Ariba and SAP Customer Experience solutions going forward.

"We have many common customers like automaker Daimler AG and The Boeing Company, among others. There is tremendous alignment between our products. SAP will integrate with our products and co-sell them," he said.

Last September, SoftBank Vision Fund had bought secondary shares from Icertis's existing investor Eight Roads at a valuation of around $5 billion, catapulting it into the top league of SaaS startups out of India.

ETtech Done deals

■ Tech company Smartron said it has signed an agreement with Global Emerging Markets Group (GEM), in which the alternative investment organisation will provide a share subscription facility of up to $200 million (about Rs 1,495.8 crore).

■ Mobile app builder firm Vajro said it has raised $8.5 million (around Rs 63.52 crore) in a funding round from Kansas City-based growth equity firm Five Elms Capital. Vajro will use the funds to build its next-generation platform and to build integrations with other ecommerce platforms such as WooCommerce, Magento, and others to expand its reach.

■ Crypto investment app Flint has raised $5.1 million in a funding round led by Sequoia Capital India and Global Founders. The Bengaluru-based startup will use the funds to acquire users, enhance its product base, and hire for senior positions across engineering, design and product. Flint also plans to allocate a significant portion of the funding to strengthen legal and risk functions.

■ NowPurchase, a procurement technology company for the metal manufacturing industry, said it has raised $2.4 million in a funding round led by Orios and InfoEdge Ventures.

■ 100X.VC portfolio firm Super Scholar, an edtech platform, has raised $400,000 in a funding round from MAGIC Fund, 2am VC, Astir VC, JITO Angel Network and others. The company said it will use the funds to strengthen its courses and scholarship offerings to ensure more students can leverage these facilities or grants.

Tweet of the day

Zomato back in the black after Monday mayhem

Shares of online food aggregator Zomato pared some losses on Tuesday after its stock hit a 52-week low of Rs 84 in early trade. The scrip ended the day 9.96% up to close at Rs 100.5. BSE Sensex and Nifty 50 rebounded on Tuesday afternoon, ending a five-day losing streak.

BSE Sensex jumped 367 points or 0.64% to close at 57,858, while NSE Nifty 50 index gained 128 points or 0.75% to close at 17,278.

What about the others? Shares of Nykaa, Paytm, Policybazaar and Cartrade once again ended the day in red after hitting all-time lows on Monday.

■ Nykaa, which opened the day at Rs 1,744, dropped 4.20% to Rs 1,661.90. The scrip hit a 52-week low of Rs1,609.05 on Tuesday.

■ PB Fintech, the parent company of PolicyBazaar, too hit a 52-week low of Rs 726 during the day. The stock was trading at its new low, having fallen 29% in the past six days. However, the scrip ended the day 0.05% lower at Rs 776.20.

■ Paytm’s parent firm One97 Communications dropped 4.6% to a 52-week low of Rs 875.5 on BSE at one point before closing the day at Rs 915.70, down 0.18%. In the last six sessions, the stock has shed 18% of its value. On Monday, it slid below the Rs 900-mark for the first time.

■ Cartrade Tech's shares declined more than 6% in intraday trade on Tuesday to hit a fresh all-time low after it reported its third-quarter results. The company reported a net loss of Rs 23.3 crore for the quarter ended December 31, 2021, against a net profit of Rs 18.2 crore for the corresponding period a year ago. The scrip ended the day at Rs 721.70, down 6.03%

IPO Index down 10%: Meanwhile, the S&P BSE IPO Index, which tracks firms for two years since their listing, has plunged about 10% since the start of the year and is headed for its worst month since March 2020, when the pandemic took hold.

Of the 42 companies that debuted in India over the past year and raised at least $100 million, 38% are trading below the listing price, data compiled by Bloomberg showed. The picture is even worse for those that raised at least $500 million, with the rate rising to about 46%.

Bear necessities: The slump comes on the back of fading risk appetite for equities as central banks prepare to tighten monetary policy to quell inflation. In the US, more than two-thirds of shares that listed this year are trading at or below their starting prices.

After IITs, NITs clock record placement season amid talent crunch

After the Indian Institutes of Technology (IITs), the National Institutes of Technology (NITs) are seeing record placement numbers, not just in terms of the line-up of offers but also an increase in top packages and average salaries.

Show me the money! NIT Hamirpur has received five Rs 1 crore-plus offers for international roles, its director Lalit Kumar Awasthi told us. It had received a single Rs 1 crore offer in 2019.

The top offer at other NITs such as Calicut and Jamshedpur increased by almost 50%. The number of offers so far is nearing—and in some cases has even surpassed—the total at the last placement season at these NITs and those in Durgapur, Manipur, Warangal and Jalandhar.

Quote: “The average salary is up by 35% this year compared to last year. Our top salary is Rs 1.5 crore—the highest ever,” said Awasthi. Most offers are coming from IT firms or for tech roles, driving average salaries up.

There’s an increase of about 30% in the average salary from last year at NIT Jamshedpur.

- The highest offer received this year at NIT Jamshedpur is Rs 56 lakh a year from Atlassian, up from last year’s peak of Rs 37.5 lakh.

The rapid digital transformation across all industries amid the pandemic has pushed demand for young engineers from NITs to new highs, resulting in one of the best placement seasons across these colleges, officials said.

Placement highlights: NIT Durgapur has received 530 offers so far this year compared with 429 last year. The average salary has gone up at Durgapur to Rs 11.46 lakh so far this year, up 37% from Rs 8.34 lakh for the 2021 batch.

- At NIT Calicut, the top offer is Rs 67.6 lakh, bagged by four students, compared with last year’s top offer of Rs 43 lakh.

- NIT Manipur has received 80 offers already, matching that of the entire placement season last year.

- At NIT Jalandhar, the average salary has gone up to Rs 11.87 lakh per year from Rs 8.5 lakh last year. The top offer is Rs 44 lakh per annum, its highest ever

Campus call: Prominent recruiters at the NITs this year include Microsoft, Amazon, Paytm, Samsung, Atlassian, Intuit, Tata Steel, Texas Instruments, Aditya Birla Group, Flipkart, Tata Motors, Vedanta, Qualcomm, Goldman Sachs, PwC and Deloitte, said placement officials.

Today’s ETtech Top 5 newsletter was curated by Arun Padmanaban in New Delhi and Zaheer Merchant in Mumbai.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.