Quick Notes

Imported Coal: Source of Energy Security for India?

Background

India is the world’s second-largest

producer, consumer, and importer of coal after China. In 2020, India had the fifth-largest coal reserves of over

111 billion tonnes (BT), just below China which had the fourth-largest reserves of

143 BT. Though coal reserves are comparable in quantity, China produced 3.9 BT of coal in 2020, five times more than India’s production of 759 million tonnes (MT). In November 2021 and again in April-May 2022, a crisis of power supply attributed to low coal stocks at thermal power generation plants led the Indian government to push generators to import coal. This advice came at a time when seaborne thermal coal prices were at their highest levels. An increase in the use of imported coal not only contradicts India’s strategy of self-reliance for energy security but also compromises the quest for affordability, an idea that underpins most of India’s energy policy choices.

Production and Imports

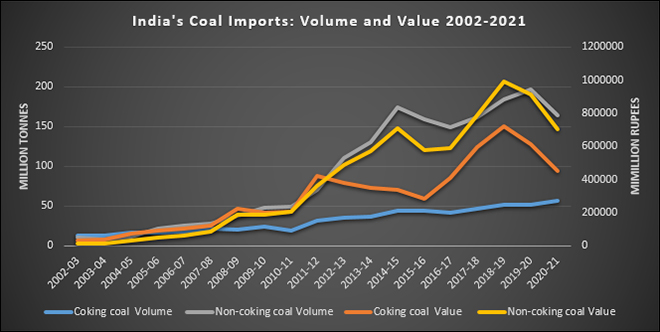

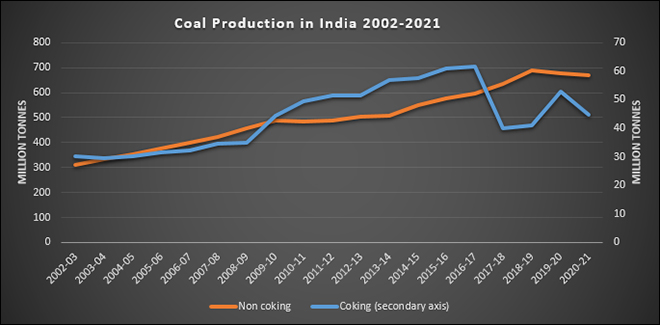

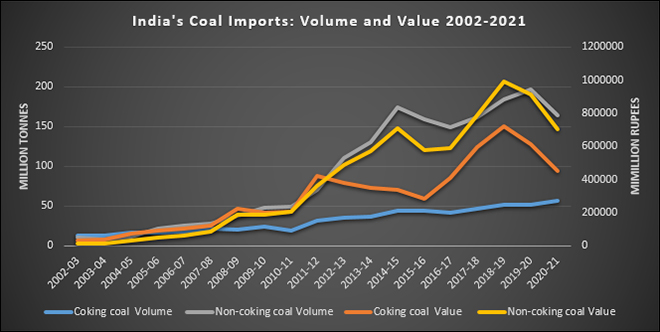

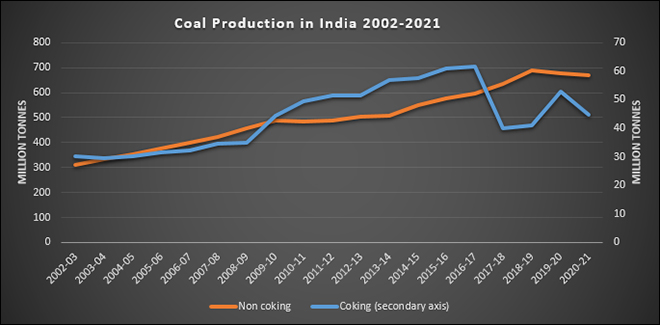

Raw coal (coking and non-coking) production in India increased from

341.272 MT in 2002-03 to

777.31 MT in 2021-22 implying an annual growth rate of just over 8 percent. Most of the growth came from an increase the in production of thermal coal. Historically this has meant the

import of only coking coal as reserves were not adequate. However, as demand for power accelerated, coal was put under

open general licence (OGL) in 1993 that initiated thermal coal imports. Until the mid-2000s, volume of coking coal imports exceeded the volume of thermal coal imports. This changed in

2005-06 when India imported

21.695 MT of thermal coal compared to

16.891 MT of coking coal. It was attributed to consumer (thermal power generators) preference for coal quality. Thermal coal imports accelerated with construction of imported coal-based coastal power plants. Between 2002-03 and 2019-20 (pre-pandemic year), coking coal imports increased from about

12.947 MT to 51.833 MT , whilst thermal coal imports grew from just

10.313 MT to over 196.704 MT in the same period.

Traded Coal Prices

Indonesia, Australia, and South Africa account for over

80 percent of India’s coal imports. In 2020-21, Indonesia accounted for

42.98 percent (92.535 MT) of India’s coal imports followed by Australia 25.53 percent, (54.953 MT), and South Africa (

14.45 percent, 31.093 MT). Indonesia was the largest source of thermal coal imports accounting for

55.56 percent, or 91.137 MT followed by South Africa (18.95 percent, 31.093 MT), and Australia (

10.98 percent, 18.008 MT). Australia alone accounted for

70.21 percent or 35.945 MT of India’s coking coal imports in 2020-21. When the price of coal increased in these markets,

imports fell by 13.7 percent (year-on-year, y-o-y) in August 2021, 9.1 percent in September and 3.4 per cent in October. Coal production grew by

8.6 percent from 716.08 MT to 777.31 MT but imports fell by 13.31 percent from

215.25 MT in 2020-21 to 186.58 MT in 2021-22.

Source: Coal Controllers Organisation, Ministry of Coal, Government of India

Source: Coal Controllers Organisation, Ministry of Coal, Government of India

Most of the reduction in imports was for non-coking (thermal coal) which fell from

164.05 MT in 2020-21 to

134.34 MT in 2021-22. This is typical of what happens in a ‘market’ when demand responds to price signals. One of the negative consequences of this market response was that electricity generation from power plants that rely more on

imported coal was adversely impacted. Some of these plants reverted to using domestic coal. This aggravated the domestic coal stock crisis. The federal government is attempting to counter the market response by

pushing thermal generators to import coal for power generation at a time when international coal prices are at their highest levels. This will impose costs on the Indian power system that is perennially teetering on the brink of financial distress. As of now it is not clear how this

additional cost burden will be shared (federal government, state government, thermal generators, distributers, consumers and other stakeholders).

China’s Coal Import Behaviour

In 2009, China, until then a net exporter of coal, imported

129 MT or 15 percent of globally traded coal. According to detailed analysis of the change in China’s coal trade behaviour, this did not imply a structural shift in global coal markets. There was no need for importing coal as China was producing

2.9 BT of coal a year that was adequate to cover demand. However, coal buyers in Southern China had entered the international market to minimise cost taking advantage of the price arbitrage spreads between domestic and internationally traded coal. China could easily

decide to buy 15-20 percent of globally traded coal when the price is right or just as easily stay out of the international market. The relationship between China’s domestic coal price and the international coal price is now one of the key factors in determining global coal trade flows. India on the other hand is forced into the international market for coal irrespective of prices because domestic production is unable to keep up with growth in demand. Weighted average international coal price (Indonesia, Australia, and South Africa) in rupees (quarterly exchange rate) has increased from around

INR4,000/tonne in 2020-21 to over INR

11,000/tonne in the first quarter of 2021-22. This is almost an order of magnitude higher than the average domestic coal price of

INR1,500/tonne through the same period. In contrast to China’s coal import behaviour that is described as one of ‘cost minimisation’, India’s import behaviour can only be described as one of ‘cost maximisation’, though not by design.

Issues

Under the narrative of self-reliance (Aatmanirbhar) imported coal compromises India’s energy security. To address this challenge the government announced in 2020 that India will

become self-sufficient in thermal coal in 2023-24 with production from CIL (Coal India Limited) alone ramped up to 1 BT and logistical bottlenecks removed through coordination with the Ministry of Railways and the Ministry of Shipping. Ironically, imported coal is the fall-back fuel for power generation contributing to India’s energy security in 2021-22. Imported coal is also challenging the ‘affordability’ rationale that is used to justify the use of domestic coal over alternatives such as natural gas. In reality the frantic embrace of imported coal illustrates that what is unaffordable politically and economically is ‘no power’ rather than expensive power.

2011 was a year of energy supply disruptions and high prices due to

political upheavals in hydrocarbon producing regions that reduced hydrocarbon supply. Natural disasters

(tsunami) and its reverberations reduced world nuclear power and floods in Australia reduced

global coal availability. Annual average price of oil was highest ever above

US$100/barrel. Responses to these multiple supply disruptions were found immediately because countries such as Japan that were hit the hardest were well integrated with global energy markets. Coal and gas flowed into Japan making up for the loss of nuclear power that accounted for 30 percent of generation. The underlying message is that integration with international markets for fuels through prices and logistical networks is a better option for energy security, rather than nationalistic notions of self-reliance.

Source: Coal Controllers Organisation, Ministry of Coal, Government of India

Source: Coal Controllers Organisation, Ministry of Coal, Government of India

Monthly News Commentary: NON-FOSSIL FUELS

State Policy adds Momentum to Renewables Growth

India

RE Policy and Market Trends

Rajasthan Renewable Energy Corporation Ltd (RRECL) and Tehri Hydro Development Corporation (THDC) inked

an agreement to set up 10,000 megawatt (MW) solar power park in Rajasthan. Rajasthan has added record 3,000 MW capacity of solar energy in the last financial year, whilst in the past three years, the capacity increased by 6552 MW in the state. The agreement will add further impetus to achieving the national targets for solar power.

According to Tata Power Company, BlackRock Real Assets and Abu Dhabi's Mubadala Investment Company would invest INR40 billion (US$525.76 million) in the company’s renewable energy unit for a 10.53 percent stake. The investment is expected to fund Tata Power Renewable Energy’s aggressive growth plans in the rooftop and electric vehicle charging space in India.

Tata Power Renewables is targeting a portfolio of over 20 gigawatts (GW) of renewables assets over the next five years, from 4.9 GW currently, Tata Power said.

The Odisha Government and Bharat Petroleum Corporation Limited (BPCL) signed a Memorandum of Understanding (MoU) to take vital steps towards the proliferation of green energy in the state.

BPCL plans to spend INR250 bn to build a renewable energy capacity of 10 GW comprising a mix of solar, wind, small hydro, and biomass by 2040.

The Meghalaya government has successfully installed solar-powered devices in 100 health centres in remote villages. The state government said it plans to cover all rural health centres under the solar power scheme to improve the functioning of these centres and ensure that last mile delivery in the health sector is achieved using solar technologies. In a pilot programme, the National Health Mission has successfully powered 100 sub-centres in the 11 districts with solar devices.

The State Cabinet cleared the Karnataka Renewable Energy Policy (2022-27) that provides for developing the State as a hub of renewable energy generation as well as manufacturing of equipment related to renewable energy. The policy also envisages upgrading the renewable energy generation capacity of the State to 10 GW in the next five years. This includes 1 GW of rooftop solar energy. Presently, the state has renewable energy generation capacity of 15,392 MW. The policy envisages economic development of Karnataka by attracting investments in the field of renewable energy generation in a massive way. As part of the ambitious plans, the policy wants to develop exclusive green power corridors for evacuation of power from generation site with private participation. Interestingly, the new policy is focusing on creation of market for development of suitable storage capacity for the proposed increase in generation of the renewable energy. As part of measures to increase generation of renewable energy, the policy wants to promote floating solar and hybrid generation units in the hydel stations. Amongst other things, the policy enlists setting up of renewable energy parks at various places in the state including the hybrid parks. Technically, the policy wants to improve the reliability of power availability from renewable energy sources and also ensure that it is available round the clock with the help of storage methods whose costs are now seeing a reduction due to innovation in technology. The policy further wants to focus on improving the efficiency (plant load factor) of the renewable energy plants.

Roof Top /Distributed Solar Projects

Soon, house owners in Chandigarh can get rooftop solar plants installed without shelling out a single penny. The UT administration is set to roll out the Renewable Energy Service Company (RESCO) model, under which a private firm will be responsible for developing, installing, financing, and operating the rooftop solar power plant. Whilst consumers (house owners) won’t be charged for installation, RESCO will own the rooftop solar plants for 15 years, after which the ownership will be transferred to the consumer. During the 15-year period, the consumer will be entitled to electricity at INR1.5 less than the normal rate per unit.

Utility Scale Solar Projects

According to Ministry of New and Renewable Energy, the Centre has approved three solar parks with a cumulative capacity of

340 MW for Odisha under the solar park schemex. For the Landeihill village park, NHPC Ltd has already acquired 176 acres and finalised the EPC contractor to implement the project. Odisha Renewable Energy Development Agency is the nodal body of the state government to implement the power plants. At present, the state produces over 430 MW solar power from different sources. As per the Ministry a 10 MW solar power project has been sanctioned as part of the project for solarisation of Konark temple and town in Kalahandi district’s Tentulipada village. The move to solarise the sun temple and Konark town is part of the state’s efforts to make it India’s first zero-emission city by the year-end. To promote production and use of renewable energy in the state, the government in 2016 had unveiled the Odisha Renewable Energy Policy that offered a wide range of incentives to those who are planning to set up renewable energy production units.

Tata Power Solar has commissioned

a 160 MW AC solar project at Jetstar in Rajasthan. Around 6,75,000 monocrystalline PV modules were used in this installation and it will produce 387 million units of energy per year. The Jetstar project was completed within a period of 15 months. It is one of the largest solar projects in Rajasthan.

NTPC Limited announced the commercial operation of 22 MW of floating solar capacity in Kayamkulam, Kerala. The capacity, which began commercial operation on Thursday, is part of its 92 MW Kayamkulam floating solar PV project. With this, the standalone installed and commercial capacity of NTPC has become 54,516.68 MW.

NTPC announced that successful commissioning of third part capacity of

42.5 MW of 100 MW Ramagundam Floating Solar PV Project at Ramagundam, Telangana with effect from 24 March 2022. Further, group installed and commercial capacity of NTPC has become 68609.68 and 67949.68 MW respectively.

Nuclear Power

With the first pour of concrete for a 700 MW atomic power plant in Karnataka’s Kaiga scheduled in 2023, India is set to put in motion construction activities for

10 'fleet mode' nuclear reactors over the next three years. The first pour of concrete (FPC) signals the beginning of construction of nuclear power reactors from the pre-project stage which includes excavation activities at the project site. The Centre had approved construction of 10 indigenously developed pressurised heavy water reactors (PHWR) of 700 MW each in June 2017. The ten PHWRs will be built at a cost of INR1.05k bn. It was for the first time that the government had approved building 10 nuclear power reactors in one go with an aim to reduce costs and speed up construction time. Under the fleet mode, a nuclear power plant is expected to be built over a period of five years from the first pour of concrete. Currently, India operates 22 reactors with a total capacity of 6780 MW in operation. One 700 MW reactor at Kakrapar in Gujarat was connected to the grid on January 10 last year, but it is yet to start commercial operations.

Rest of the World

Global

Prices for wind and solar power in major global markets have climbed nearly 30 percent in a year as developers have struggled with chaotic supply chains and surging costs for everything from shipping to parts to labor. Contract prices for renewables jumped 28.5 percent in North America and 27.5 percent in Europe in the last year, according to a quarterly index by LevelTen Energy that tracks the deals, known in the industry as power purchase agreements (PPAs). In the first quarter alone, prices rose 9.7 percent in North America and 8.6 percent in Europe, LevelTen said. Economic, logistical, and labor market disruptions during the coronavirus pandemic have worsened since the Russian invasion of Ukraine, reversing a decade of cost declines for the renewable energy sector.

Pandemic-related supply chain problems slowed the rollout of new wind power in 2021, as the sector lags far behind the capacity needed to curb greenhouse gas emissions and meet net zero emission targets, an industry report said. The Global Wind Energy Council (GWEC) report comes ahead of a UN (United Nations) report to be published that is expected to tell policymakers a huge ramp up in low carbon technology, such as renewable power, is needed if goals set under the 2015 Paris climate agreement are to be met.

By the end of 2021, total global wind power capacity was 837 GW the report said, compared with the roughly 3,200 GW needed by 2030, the report said. Some 93.6 GW of wind power capacity was installed globally in 2021, down from a record 95.3 GW the previous year, with many projects slowed by COVID 19-related supply chain issues, the report said.

China

China’s largest oil and gas producer, PetroChina, aimed to have

renewable energies make up one third of its energy portfolio by 2035 and 50 percent by 2050. Emissions of greenhouse gases were 159.54 million tonnes (MT) of carbon dioxide equivalent in 2021, down 4.7 percent from a year ago. PetroChina has aimed to bring its carbon emissions to a peak by around 2025 and reach near zero emissions by 2050, ahead of China’s national target of peaking carbon by 2030 and achieving carbon neutrality by 2060. It also plans to raise the output of natural gas, a bridge fuel in the energy transition, to account for 55 percent of its total oil and gas production by 2025, up from current 51.6 percent.

Other Asia Pacific

Japanese trading house

Mitsui has agreed to invest €575 mn (US$631 mn) for a 27.5 percent stake in Mainstream Renewable Power, a company controlled by Norway’s Aker Horizons, the companies said. Mitsui's investment and global business network will help Mainstream to speed expansion of its portfolio of wind and solar energy in the Americas, Africa, Asia-Pacific, and Europe.

USA & North America

New York State approved a multi-billion-dollar, long-term

project by Montreal-based public utility Hydro-Quebec to deliver hydropower to parts of New York City. As per the Hydro-Quebec its US (United States) partner, Transmission Developers Inc, will begin construction of the Champlain Hudson Power Express line in summer 2022 to supply hydropower. Commissioning of the line is scheduled for 2025.

The US Environmental Protection Agency

(EPA) will announce decisions on 36 refineries that are seeking exemptions to biofuel blending mandates, according to a government notice. The EPA has accumulated a backlog of more than 60 requests for the so-called Small Refinery Exemptions, sought by refineries that argue that the cost of blending biofuels like ethanol into their fuel could put them out of business.

The Biden administration may soon consider calls for exemptions to

a ban on financing of new carbon-intensive fossil fuel projects overseas, as energy markets tighten on Russia’s invasion of Ukraine. President Joe Biden in December ordered the US agencies to immediately stop financing coal, gas, and other projects and prioritize global collaborations to deploy clean energy technology. The order provided exemptions if a country faced severe consequences if it was unable to build a plant burning fossil fuels, such as natural gas or coal.

South America

Enel is planning to ramp up its growth in renewable power in Brazil in the coming years with new investments in onshore solar and wind generation plants. Brazil already accounts for 40 percent of Enel’s growth in Latin America’s renewable market, a figure expected to increase as the group starts to depart from polluting thermal generation and adds more renewable power capacity to its portfolio. Enel Green Power, the Italian company’s renewable generation arm, operates more than 4,700 MW of renewable power in Brazil. Almost half of this power is concentrated in wind power, and the rest is divided between solar and hydro plants.

EU & the UK

The European Union (

EU) may set more ambitious targets for its transition to renewable energy as it seeks alternatives to imports of oil and gas from Russia, EU climate policy chief Frans Timmermans said. The EU’s 27 member-states have agreed to collectively reduce their net greenhouse gas emissions by 55 percent from 1990 levels by 2030, a step towards "net zero" emissions by 2050. The Commission is due to propose a "Repower EU" plan in May for how the bloc can quit Russian fossil fuels. Under existing plans, the EU would raise the share of renewable energy to 40 percent of final consumption by 2030.

Portugal’s EDP Renovaveis (EDPR), the world’s fourth largest renewable energy producer

plans to install 1.3 GW of new hybrid solar-wind projects at existing parks and dams in Iberia by 2025. EDPR won the right to build and operate 70 MW in Portugal’s first auction of floating solar plants on dam reservoirs, combining the capacity with a wind farm. As per the EDPR Chief Financial Officer despite having agreed to pay the Portuguese electricity system €4.13 (US$4.50) per megawatt-hour for that solar generation, the company bet on the combination, which "allows the project to be economically viable." EDPR planned to install 900 MW of hybrid capacity in Spain by 2025, and 400 MW in Portugal. EDPR is studying equipping other Iberian dams with floating solar parks and combining them with wind turbines, as well as installing solar panels on wind farm land and vice versa.

Britain set out plans to expand nuclear and offshore wind power to bolster its energy independence, but a failure to target improved energy efficiency even as heating costs surge was attacked for lacking ambition. With energy prices hitting record highs this year, driven in part by Russia’s invasion of Ukraine, Britain set targets to increase wind, nuclear and solar generation, while supporting domestic production of oil and gas. But options that could have delivered a more immediate impact, such as targets to expand onshore wind and improve home insulation, were lacking. As per the Prime Minister Boris Johnson, the plan would scale up domestic sources of affordable, clean and secure energy.

Ingka Group, the owner of most IKEA stores worldwide, has

bought nine solar photovoltaic (PV) park projects in Germany and Spain for a total of €340 mn (US$373 mn) in its push to generate more renewable energy than it consumes. The world’s biggest furniture retailer said it was buying the projects, which would have a combined capacity of 440 MW, from German developer Enerparc. IKEA operates through a franchise system with Ingka Group the main franchisee to brand owner Inter IKEA. IKEA as a whole aims to be climate positive, or reduce greenhouse gas emissions by more than its entire value chain emits, by 2030. The group owns 547 wind turbines in 14 countries, 10 solar parks, and 935,000 solar panels on the roofs of IKEA stores and warehouses, which together produce more than 4 Terawatt hours of electricity.

Italy’s biggest utility

Enel has signed a grant deal with the European Commission to scale up a solar panel Gigafactory it owns in Sicily and make it Europe's largest maker of bifacial photovoltaic modules, which produce power from both sides of the panel. The development of the 3Sun panel factory, dubbed TANGO, is expected to raise production at the site fifteen-fold to 3 GW from the current 200 MW. It will be fully commissioned by July 2024. Enel is looking to scale up its manufacturing capacity to meet growing demand for solar panels and cut Europe's dependence on Asian suppliers. The EU is looking to source 40 percent of its energy consumption from renewable sources by 2030.

The EU has launched its first ever challenge against Britain at the World Trade Organization (WTO) over its former member's green subsidy scheme. The European Commission, which oversees trade policy for the EU's 27 members, said that

criteria used by the British government in awarding subsidies for offshore wind power projects favoured British content. It also said the practice would increase the cost of production and risk slowing down the deployment of green energy.

Africa & Middle East

A flurry of summits across Dubai addressed the threat of climate change, or at least acknowledged that

a pivot away from fossil fuels toward cleaner sources of power is needed to keep temperatures from rising. The glaring fault lines, however, lie on when and how to achieve this. For fossil fuel producers, like the United Arab Emirates (UAE), which hosted the gatherings, more investments, not less, are needed in oil and gas. It was a drumbeat echoed throughout the week in Dubai, reflecting the prominent voice fossil fuel producers are seeking to have in the global climate change conversation. It rang out at the Atlantic Council Global Energy Forum, the World Government Summit and a UAE-sponsored climate week in partnership with the United Nations.

News Highlights: 20 – 26 April 2022

National: Oil

India’s oil import bill doubles to US$119 bn in FY22 as energy prices soar

24 April: India’s crude oil import bill nearly doubled to US$119 billion in the fiscal year that ended on 31 March, as energy prices soared globally following the return of demand and war in Ukraine. India, the world’s third biggest oil consuming and importing nation, spent US$119.2 billion in 2021-22 (April 2021 to March 2022), up from US$62.2 billion in the previous fiscal year, according to data from the Oil Ministry’s Petroleum Planning & Analysis Cell (PPAC). Oil prices started to surge from January and rates crossed US$100 per barrel in the following month before touching US$140 per barrel in early March. Prices have since receded and are now around US$106 per barrel. According to PPAC, India imported 212.2 million tonnes (MT) of crude oil in 2021-22, up from 196.5 MT in the previous year. This was, however, lower than pre-pandemic imports of 227 MT in 2019-20. The spending on oil imports in 2019-20 was US$101.4 billion. The imported crude oil is turned into value-added products like petrol and diesel at oil refineries, before being sold to automobiles and other users. The nation consumed 202.7 MT of petroleum products in 2021-22, up from 194.3 MT in the previous fiscal, but lower than pre-pandemic 214.1 MT demand in 2019-20. Import of petroleum products in 2021-22 fiscal was 40.2 million tonnes worth US$24.2 billion. On the other hand, 61.8 MT of petroleum products were also exported for US$42.3 billion. India had spent US$62.2 billion on the import of 196.5 MT of crude oil in the previous 2020-21 fiscal, when global oil prices remained subdued in the wake of the COVID-19 pandemic. According to PPAC, India’s oil import dependence was 85 percent in 2019-20, which declined marginally to 84.4 percent` in the following year before climbing to 85.5 percent in 2021-22.

Jet fuel should be under GST, states should cut VAT: Scindia

22 April: Civil aviation minister Jyotiraditya

Scindia said a dozen states that have not reduced VAT (Value Added Tax) on jet fuel are being nudged to lower levies, and backed bringing the commodity under the GST (Goods and Services Tax) umbrella. Indian carriers have been grappling with high aviation turbine fuel as several opposition-ruled states maintain high VAT, ranging between 20 percent and 30 percent.

Uttarakhand to provide 3 LPG cylinders to BPL women

22 April: In a bid to promote the use of gas cylinders and prevent the adverse effects of burning wood or coal for cooking, the State Minister of Department of Food, Civil Supplies and Consumer Affairs, Rekha Arya, announced that "at least three free-of-cost cylinders will be provided to BPL women". Officials of the department have been directed to make a proposal to fix the budget and also identify the locations where availability of cylinders needs to be on priority. Several women still rely on fuelwood for cooking in the state's villages. This often leads to chronic health issues among them. And not just LPG (liquefied petroleum gas) cylinders, fortified salt will also be available for consumers at ration shops.

India’s RIL buys at least 15 million barrels of Russian oil

22 April: Reliance Industries Ltd

(RIL), operator of the world’s biggest oil refining complex, has ordered at least 15 million barrels of Russian oil since Russia invaded Ukraine in February, traders said. RIL has bought an average 5 million barrels a month for the June quarter, the sources said. Before the Ukraine war, Indian refiners, including Reliance, rarely bought Russian oil owing to high freight costs. Indian refiners have snapped up the cheap barrels as India, the world’s third-biggest oil importer and consumer, is hit hard by high oil prices. India imports about 85 percent of its 5 million barrels per day oil needs. Refinitiv’s tanker flow data shows a supply of about 8 million barrels of Russian oil, mainly Urals, at the Reliance-operated Sikka port in western India, for arrival between 5 April and 9 May. RIL is scheduled to received its first parcel of Russia’s ESPO oil in early May, the Refinitiv data shows. RIL operates two refineries at the Jamnagar complex in western India that can process about 1.4 million barrels per day (bpd) of oil daily.

India keen to boost oil imports from Brazil: Oil Minister

21 April: India, the world’s third biggest oil importer and consumer, is

looking at boosting oil purchases from Brazil, Oil Minister Hardeep Singh Puri said after a meeting with Brazilian Energy Minister Bento Albuquerque. Currently India imports only a fraction of its oil imports from Brazil. At present, Indian companies Bharat Petroleum Corporation (BPCL) and Oil and Natural Gas Corporation (ONGC) have made investment in Brazil’s oil and gas exploration sector. India wants to import oil from Brazil under "long-term special contracts". Brazil, which is ramping up its oil output by 10 percent to 3.3 million barrels per day, is willing to meeting Indian demand for oil, Albuquerque said. India, which meets about 84 percent of its oil needs through imports, is looking at ways to cut its import bill including stepping up use of bio-fuels.

India’s FY22 crude oil production fell 2.6 percent to 29.69 MT

20 April: India’s crude oil production fell by 2.6 percent year-on-year (Y-o-Y) to 29.69 million tonnes (MT) in the last fiscal year, ended March 2022, against 30.49 MT in FY21 largely due to lower production by Oil and Natural Gas Corporation (ONGC). The output in FY22 was lower by 11.67 percent compared to the target for the said year. Production during March was 25.26 lakh tonnes (lt), indicating a decline of 12.49 percent than the target for the month as well as lower by 3.37 percent than the production in March 2021, the Ministry of Petroleum and Natural Gas (MoPNG) said. Crude oil production by ONGC in the nomination block during March 2022 was 16.82 lt, which is 12.62 percent lower than the target for March and 1.84 percent lower when compared with production of March 2021. Overall crude oil production by the PSU oil explorer in FY22 was 19.45 MT — which is 13.82 percent and 3.62 percent lower than target for the period and production during corresponding period of last year, respectively. Indian refineries processed 2.23 MT on crude oil during March, which is marginally higher than the target for the month and 6.44 percent higher than the output in March 2021. Overall the refineries processed 241.70 MT, which is 0.97 percent and 8.99 percent higher than target for the period and production during corresponding period of last year, respectively, on account of a rebound in economic and industrial activity.

National: Gas

Vedanta invites bids for natural gas from Barmer field

25 April: Vedanta plans to auction 0.10 million metric standard cubic meters a day of natural gas on 12 May. The supplies will start no later than 1 June and end on 31 May 2023. Vedanta has the pricing and marketing freedom for the gas it produces from the Barmer field. The floor rate has been fixed as one dollar above the domestic formula price that the government publishes every April and October. The current formula price is US$6.1 per million metric British thermal units (mmBtu). The sale price is to be calculated as the lower of Platts West India Marker plus one dollar or 16.67 percent of the average Brent price plus a premium that bidders would quote. Platts West India Marker is the liquefied natural gas (LNG) price assessment for spot physical cargoes of delivered ex-ship into ports in India and the Middle East region. Vedanta has developed Raageshwari Gas Terminal to process and evacuate natural gas produced from its Barmer field. The terminal is connected by the Barmer-Pali pipeline of GSPL India Gasnet Limited to GSPL’s high-pressure Gujarat grid, which is further well connected to the national gas grid, as per the auction document.

RIL to auction 12 mmscmd gas from MJ Field

25 April: Reliance Industries Ltd

(RIL) will shortly call bids for 12 million metric standard cubic metres per day (mmscmd) of gas from its MJ field in the eastern offshore Krishna Godavari D6 block. The MJ field is the third and the last set of discoveries that RIL is developing in the KGD6 block. MJ-1 is estimated to hold a minimum of 0.988 trillion cubic feet (Tcf) of contingent resources. The MJ field also has oil deposits that will be produced using the floating production storage and offloading (FPSO) system.

Fitch Ratings trims India’s gas consumption growth to 5 percent on high prices

20 April: Fitch Ratings cut its India gas consumption outlook for the current fiscal to a growth of 5 percent as the recent spike in domestic gas prices and high LNG rates would slow the shift to the environment-friendly fuel. The government more than doubled the price of gas from domestic fields to US$6.1 per million metric British thermal units (mmBtu) for the six-month period beginning 1 April. Domestic gas production meets roughly half of the current consumption, while the remaining is imported in the form of liquefied natural gas (LNG). Fitch said state gas utility GAIL (India) Ltd’s earnings from its natural gas marketing segment are likely to increase due to the recent rise in spot LNG prices to levels much higher than the long-term contracted LNG from US (United States). GAIL generally hedges most of its volume and price risk on near-term deliveries of US LNG to reduce volatility and generate positive return. Its supply of LNG from the US is linked to Henry Hub (HH) prices, which are lower than current spot LNG rates, which are trading above US$30 mmBtu. Fitch recently revised its title transfer facility (TTF) gas price assumptions to US$20 per mmBtu for 2022 and US$10 in 2023, reflecting the impact of geopolitical risks on demand and supply of hydrocarbons.

National: Coal

Haryana coal block buried in books for over 15 years

26 April: For 16 years after allotment, Haryana’s coal block remained buried in the books, as everyone from the state and Central governments to bureaucrats, power department, and Haryana Power Generation Corporation Limited (HPGCL) was unaware that the state could be not just power surplus, but also coal surplus on account of having its own mines. Had the governments acted in time, Haryana would have started getting coal linkage from 2018 onwards. In August 2006, the Coal Ministry had allocated the Mara-II-Mahan block with 955 million tonnes of reserves to the HPGCL and the Delhi government jointly. The block could not be development for want of forest clearance from the Environment Ministry on account of amended laws and rules. The 53-square-kilometre coal block has a coal-bearing area of 30 sq km. In 2009, the two neighbouring states made a joint venture in Yamuna Coal Company (YCCPL) with equal stakes for the HPGCL and Indraprastha Power Generation Corporation Limited (IPGCL). Later, the IGPCL walked out of the deal and the sole rights came to the HPGCL. The provisional geological report of Ranchi’s Central Mine Planning and Design Institute in Jharkhand suggests that the coal block had an estimated 955 million tonne or reserves with coal quality varying from grade A to G. In 2013, Haryana claimed that its power department had initiated the process of appointing consultants for exploiting these coal reserves. The total coal consumption in the HPGCL’s thermal power stations at Panipat, Yamunanagar, and Hisar is about 48,000 metric tonnes a day when operating at the rated capacity.

India staring at power outage in multiple states amid coal crisis

23 April: Amidst rising power demand in the country due to a continued heat wave, India is staring at an electricity crisis accentuated due to a coal shortage at over 150 power plants. The coal stock position at the Central Election Authority (CEA) supervised 173 power plants stood at 21.93 million tonnes (MT), which, according to a Nomura report, is less than the regulatory requirement of 66.32 MT as on 21 April. Media reports have suggested that coal inventories had dipped to the lowest since 2014 at the beginning of the financial year to nine days as against the Centre’s mandated 24 days' worth of stocks. While on one hand, the CEA daily coal report said that

coal stock at 81 out of the 150 government owned power plants is critical, on the other is the increased power demand -- from 106.6 billion units (BU) in 2019, it increased to 124.2 BU in 2021 to 132 BU in 2022. States such as Punjab, Uttar Pradesh, Maharashtra, Haryana, and Andhra Pradesh are witnessing power cuts amid low coal stocks. The Maharashtra government had declared that it is planning to import coal and acquire a coal mine from Chhattisgarh for power generation.

India’s big industrial states plan massive coal imports to stave off shortages

21 April. Three of India’s most industrialised states

plan to import 10.5 million tonnes (MT) of coal in coming months as officials scramble to arrest widespread power cuts, a move that could push global coal prices to new highs. The scale of the purchases and the decision to go back on a plan to cut coal imports underscore the severity of the India’s fuel crisis. Utilities' coal inventories are at the lowest pre-summer levels in at least nine years and electricity demand is seen rising at the fastest pace in at least 38 years. Maharashtra plans to import 8 MT for "blending purposes," while Gujarat will place orders for 1 MT, the states' energy officials told the federal government on 13 April. The Tamil Nadu government-run utility said the state was targeting importing 20 percent of its coal requirements, adding that it had already placed orders to import 1.5 MT. The move by India, the world’s second largest coal importer, could lead to a further increase in global prices, which are already trading near record highs due to fears of a supply crunch following the European Commission's decision to ban coal imports from Russia after its invasion of Ukraine. Coal miners in South Africa, Australia and Indonesia are likely to be the main beneficiaries of India’s buying spree, though those producers are already stretched by the recent spike in demand. India’s federal government has also asked the state governments of Karnataka, Uttar Pradesh, Madhya Pradesh, Punjab, and Haryana to import a total of 10 MT of coal. While Punjab has committed to import 625,000 tonnes, the other states have not detailed any plans. Maharashtra’s expected 8 MT of coal imports will be in addition to the 2 MT it had already ordered, for which delivery is expected on 8 May. India had previously asked state government-run utilities to import 4 percent of their coal requirements for blending, but subsequently suggested that imports be boosted to 10 percent of the quantity needed to address soaring power demand. Federal government-run NTPC Ltd, the country's top electricity producer, plans to boost coal imports to the highest level in eight years.

National: Power

Provide uninterrupted power supply in state: UP CM

26 April: Uttar Pradesh’s (UP) Chief Minister (CM) Yogi

Adityanath directed officials to provide uninterrupted power supply in the state. He said arrangements should also be made for additional (units of) electricity to maintain an uninterrupted power supply. Electricity is needed the most in the summer season, and hence uninterrupted power supply according to the roster should be maintained, the CM said. Problems arising out of transformer malfunction or damage of electricity wires should be immediately addressed, the CM said. The CM observed that snapping the power connection for non-payment of electricity bill is not the solution, and said a dialogue should be established with the consumer and he should be motivated to pay the bill. Better and effective systems should be evolved for collection of electricity bills, and women self-help groups should also be roped in for bill collection, the CM said. Smart meters should be installed timely in urban areas, he said. The CM said continuous coal availability should be made for electricity production, and for this, talks should be held regularly with the Centre. The work of laying electricity cables underground should be expedited in a time-bound manner, he said.

HC stays Centre’s order cutting Telangana discoms' access to power

26 April: In a relief to Telangana power distribution companies (discoms), the

Telangana high court (HC) stayed a central power ministry order prohibiting the discoms from procuring power from the electricity exchange citing non-payment of dues to wind and solar power generators in the state. The state discoms approached the HC stating that such steps affect their mission to supply uninterrupted power to domestic and industrial customers while challenging Centre’s unilateral intervention in a subject that is in the Concurrent List. The Centre’s counsel said that they were only asking for implementation of the power purchase agreements discoms had with power generators and sought time to get instructions. Justice G Radha Rani issued notices to the Union power ministry and its various entities, and sought replies within a month while staying the Centre’s order.

National: Non-Fossil Fuels/ Climate Change Trends

India to meet half of its energy needs from renewable by 2030: NITI Aayog member

25 April: India’s non-fossil energy capacity will reach 500 GW by 2030 and the country shall meet half of its energy requirements through renewable energy, reducing the carbon intensity of its economy by less than 45 percent, NITI Aayog member V. K. Saraswat said. He said that deep decarbonisation requires broad-based systems approach across a portfolio of options including clean energy carriers such as Hydrogen and Methanol and Renewables. He said that presently BioCNG, ethanol and methanol are alternative fuels available with India and in future green Hydrogen will be available through renewables, which will lead to a reduction in emissions by 40 percent.

UP health centres to have solar-powered fridges to keep Covid vaccines safe

24 April: A student from an engineering college in Uttar Pradesh

(UP)’s Kanpur has built a solar energy-run refrigerator which can be used to safeguard and prevent wastage of life-saving medicines and COVID-19 vaccines across rural hospitals and health centres operating in the state. The rampant wastage of COVID-19 vaccines will no longer remain a problem in health centres across UP where there is a shortage of electricity, since such centres will now be able to operate efficiently without the usage of electrical equipment. Samarjit Singh, a B.Tech third-year student of Axis College, Kanpur, has found a solution to shortage of electricity in health centres where solar-powered refrigerators can keep lifesaving medicines and vaccines safe. He said that solar energy, which plays a significant role in the protection of the environment, will now play a similar role in safeguarding lifesaving medicines in rural hospitals. Wherever there is a problem of electricity and other resources, refrigerators can operate with the help of solar energy in such areas. He said that this solar device is placed in a board and consists of a solar plate as well as a battery fitted to it. The solar-run refrigerator will run smoothly for nearly 12 hours upon charging the solar panel for a duration of four hours. This refrigerator has an additional battery, which will charge it even when the solar energy is discharged.

NTPC ties up with Delhi Jal Board to convert waste into energy

21 April: NTPC Ltd has partnered with Delhi Jal Board to convert sludge produced in latter’s sewage treatment plants into energy. In Delhi-NCR alone, Sewage Treatment Plants (STPs) produce up to 800 MT (million tonnes) of sludge per day. The disposal of the sludge is a major challenge as it contributes towards environmental pollution.

NTPC is taking various steps to make its energy portfolio greener and plans to have 60 GW capacity through renewable energy sources by 2032. The total installed capacity of the company is 68,881.68 MW.

International: Oil

Exxon makes three new oil discoveries in Guyana and boosts reserves

26 April: Exxon Mobil Corp said it found oil in three new wells drilled off the coastof Guyana, raising recoverable oil and gas potential from its discoveries to nearly 11 billion barrels. The discoveries continue a run of exploration successes that date to 2015, and lifts potential oil and gas volumes by nearly 1 billion barrels. Exxon and partners Hess Corp and CNOOC Ltd are responsible for almost all oil and gas output in the South American country. Guyana has emerged as a key source for Exxon’s future production, with 31 oil discoveries in its giant Stabroek block so far. It and partners said they plan to pump 1.2 million barrels of oil and gas per day from the block by 2027. Exxon discovered hydrocarbon-bearing sandstone at Barreleye-1, Patwa-1, and Lukanani-1 wells, it said. The new findings are located southeast of its existing Liza and Payara oil developments, Exxon's first and third projects in Guyana.

US decides to limit leasing in Alaska Petroleum Reserve

26 April: The US Interior Department has issued a

decision to limit roughly half the National Petroleum Reserve-Alaska to oil and gas leasing. The decision rolls back an approach taken by the prior Trump administration, and it drew criticism from Alaska’s US senators. The reserve covers about 36,000 square miles (92,000 square kilometers) on Alaska's North Slope. Under the decision, about 18,000 square miles (48,000 square kilometers) would be open to oil and gas leasing. That includes some lands closest to existing leases centered on the Greater Mooses Tooth and Bear Tooth units and the Umiat field, the decision states. Plans advanced during the Trump administration would have allowed for oil and gas leasing on about 29,000 square miles (75,000 square kilometers).

Guyana gets US$106 million from Exxon for oil from newest offshore platform

24 April: Guyana sold its first share of crude oil from the country’s newest offshore production facility to Exxon Mobil for about US$106 million, the government said. One of South America’s poorest nations, Guyana plans to use proceeds from oil in the short term to build roads, bridges, houses, gas-fired power plants, and solar energy projects. The second platform is set to reach its full 220,000 barrel per day (bpd) capacity in the third quarter. The 1-million-barrel cargo of the new crude, called Unity Gold, was sold through a competitive bidding process that Exxon won with a bid of US$106 per barrel, according to the Guyana Ministry of Natural Resources.

International: Gas

EU countries mull deal on emergency rules to fill gas storage

25 April: European Union

(EU) countries will debate a possible deal to share out the costs of buying gas to fill storage and build a supply buffer ahead of next winter, according to a draft document. EU countries are negotiating proposed rules that would require them to fill their gas storage to at least 90 percent of capacity by 1 November each year from 2023 and 80 percent this year - an attempt to reduce the leverage of Russia, which supplies around 40 percent of EU gas. The proposal had worried some states with gas storage, including Hungary, Austria, and the Netherlands, which feared their companies would be forced to buy large volumes of gas at near-record prices, whilst those in countries with little or no storage would not.

Russian gas flows to Europe stable as gas nominations for Slovakia rise

25 April: Daily nominations for Russian gas deliveries to Slovakia via Ukraine rose, while flows eastbound into Poland from Germany through the Russia-EU Yamal pipeline and direct flows from Russia to Germany via Nord Stream 1 remained stable. Daily nominations for Russian gas deliveries to Slovakia through Ukraine via the Velke Kapusany border point were around 545,006 megawatt hours (MWh) per day, versus 381,789 MWh per day, data from Slovakian operator TSO Eustream showed. Russian gas producer Gazprom said it was supplying natural gas to Europe via Ukraine on Monday in line with European consumers’ requests, which had increased from the previous day. Eastbound gas flows via the Yamal-Europe pipeline from Germany to Poland, were little changed from the previous 24 hours data from the Gascade pipeline operator showed.

Italy’s Eni signs Congo Republic LNG deal

21 April: Italy’s Eni has signed a deal to increase gas supplies from the Congo Republic by more than 4.5 billion cubic meters (bcm) a year, the energy group said. The deal is the latest Italian move to reduce dependence on Russian gas, with Foreign Minister Luigi Di Maio and Ecology Transition Minister Roberto Cingolani leading an Italian delegation to Angola and the Congo Republic this week to line up LNG (liquefied natural gas) contracts. The new partnership with the Congo Republic has "great growth potential" in the short and medium term, Di Maio said. Italy obtains 40 percent of its gas imports from Russia and has made the diversification of its energy sources a priority since Russia’s invasion of Ukraine triggered Western sanctions that have raised the threat of disruption to supplies. Under the Congo agreement, development of a LNG project involving Eni will be stepped up so that production can begin in 2023. It will have capacity of 4.5 bcm when fully operational, Eni said. Italy signed a separate deal for between 1 bcm and 1.5 bcm of gas a year from Angola. Italy has also signed similar deals with Algeria and Egypt in an effort to replace the 29 bcm of gas it receives from Russia’s Gazprom every year. Ecology Transition Minister Cingolani said that the government aims to reach independence from Russian gas imports by the second half of 2023.

International: Coal

Global coal plant capacity edges up in 2021, hitting climate

25 April: The global capacity of power plants fired by coal, the fossil fuel that emits the most carbon dioxide when burned, rose nearly 1 percent last year as the world recovered from the COVID-19 pandemic, according to a research report by a US (United States) environmental group. The Global Energy Monitor (GEM)

report found that global coal plant capacity grew 18.2 gigawatt (GW) to about 2,100 GW or about 0.87 percent. Scientists and activists have urged the world to move off coal to cleaner energy sources such as solar and wind power and in some cases, nuclear power. Last year's surge in new coal plants of about 25.2 GW in China, the world's top climate polluter, nearly offset coal plant closures in the rest of the world of 25.6 GW, the report said. China has pledged to bring greenhouse gas emissions to a peak "before 2030" and achieve carbon neutrality by 2060. But its recent focus has shifted towards energy security, following disruptive power cuts and geopolitical uncertainties since Russia's invasion of Ukraine. Countries like Germany have also been reconsidering using more coal to replace Russian natural gas. Despite last year’s capacity rise, the capacity of global coal plants being built in 2021 fell from 525 GW in 2020 to 457 GW, a decrease of 13 percent, the report said.

China’s overseas coal ban sees 15 projects cancelled: Research

22 April: China’s decision to ban overseas coal financing ended 15 power projects in the planning stages with a capacity of around 12.8 gigawatt (GW), and could also stop another 37 GW of capacity currently in the pre-construction phase, new research showed. President Xi Jinping announced to the United Nations General Assembly in September that China, the world's biggest energy consumer, would end overseas coal projects as part of its contribution to the global effort to cut climate-warming greenhouse gas emissions. The new guidelines indicate that more than a third of all new coal power projects outside of China and India will now be scrapped.

International: Power

Vietnam eyes doubling of power generation capacity by 2030

26 April: Vietnam wants to nearly double its total installed power generation capacity to 146,000 megawatt (MW) by 2030, and prioritise development of renewable sources and reducing its coal dependency, its government said. The latest draft of its power development plan will restrict development of coal-fired power plants and be open to other fuel sources, including hydrogen and ammonia, the government said. Vietnam, a regional manufacturing powerhouse, is the largest power generator in Southeast Asia, with total installed generation capacity of 76,620 MW at the end of 2021, according to utility EVN.

Power costs drive Spanish industrial prices to new record high in March

25 April: Spanish industrial production prices rose at a record annual rate for the sixth straight month in March, pushed up by soaring energy costs, data from the National Statistics Institute (INE) showed. Prices rose 46.6 percent, the fastest pace since the data series began in January 1976, led by a 134.6 percent increase in energy costs when compared to the same month last year.

Russia’s invasion of Ukraine has exerted additional pressure on power costs in Europe as the bloc’s countries look for options to reduce their dependence on Russian gas.

Myanmar plans energy investments as cities struggle with daily power outages

21 April: Myanmar’s junta government plans to increase investment in the energy sector, seeking to

shore up the supply of power as the country grapples with lengthy daily blackouts, its Information Minister Maung Maung Ohn said. The outages have compounded economic woes faced by ordinary citizens still reeling from the turmoil that has ensued since the military seized power last year.

Mexico’s electricity sector rankled by doubt and legal chaos

20 April: President Andrés Manuel López Obrador’s

efforts to reshape Mexico’s electricity sector to favor the power company have spurred hundreds of lawsuits and sown a level of uncertainty that businesspeople say is costing jobs and private investment. The president’s party succeeded in reforming the electrical industry law last year, but the lower chamber of Mexico’s congress infuriated López Obrador when lawmakers voted down a constitutional reform of the sector pushed by the president. The big power companies have remained silent, unwilling to risk their investments.

International: Non-Fossil Fuels/ Climate Change Trends

Indonesia’s Pertamina aims to double geothermal capacity

25 April: Indonesia’s state energy firm

PT Pertamina aims to double its geothermal capacity by around 2027-2028, which might cost an estimated US$4 billion, as the country tries to reduce its dependency on fossil fuels, CEO (Chief Executive Officer) Nicke Widyawati said. The Indonesian government is keen to tap into its geothermal resources which have the potential to generate more than 28 gigawatt (GW) of power. Energy Ministry data shows the country has only reached 2.28 GW of installed capacity as of last year. Developing geothermal energy is part of the government’s strategy to increase the proportion of renewables in the country's energy mix to 23 percent by 2025 from around 12 percent currently. Indonesia, which is currently among the ten biggest greenhouse gas emitters in the world, also aims to reach net-zero emissions by 2060. Pertamina plans to double its geothermal capacity from around 700 MW currently. To accelerate development, Pertamina plans to build about 210 MW of its targeted additional capacity through investment in a Binary Organic Rankine Cycle (ORC) plant which costs less and can be developed quicker, as it utilises unused brine from existing geothermal wells that is otherwise typically reinjected into the earth.

Israel’s Econergy to take stake in 460 MW solar portfolio in Greece

25 April: Israel’s Econergy Renewable Energy Ltd said that it has struck

an agreement with Greek peer Terna Energy to develop and build a 460 MW solar portfolio in Greece. Under the terms, the Israeli renewables developer will acquire a 49 percent stake in a Greek company that owns two firms that are currently working on a pair of solar projects -- one of 240 MW and the other of 220 MW. The two solar farms will be located in the Kilkis region of Greece. Econergy expects the projects to reach ready-to-build stage by the third quarter of 2023, so construction works could commence in the following quarter. Construction and commissioning are expected to wrap up by the end of 2024, Econergy said.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV