By Jeff Weniger, CFA

Head of Equity Strategy

It’s good when the unemployment rate is low, right? Of course it is. The problem is that super-low unemployment often comes at the end of the good times, not the beginning.

It’s a bit counterintuitive. Intuition would say that abundant jobs should probably be good for returns on capital. The problem is that sub-4% unemployment rates often indicate an economy that has run too hot. Even a backup of half a point from such extreme lows is often enough to identify a recession. We only have a sample size of four, but that is what happened in 1957, 1968, 2000 and 2020 (figure 1).

Figure 1: If the Unemployment Rate Rises a Half Point from Sub-4%, Recession Probability Rises

The last three unemployment reports came in at 3.6%, and for all I know, maybe the next ones will tick even lower.

But what if they don’t?

After all, I cannot just look the other way on a string of hiring freezes or outright layoffs that were recently announced at Tesla, Salesforce, Uber, Snap, Facebook-parent Meta, Instacart, Coinbase, Gemini and Microsoft, among others. To be fair, hiring plans at Fidelity, Ford, Subway and JP Morgan indicate that there are big-name firms actively recruiting right now too.

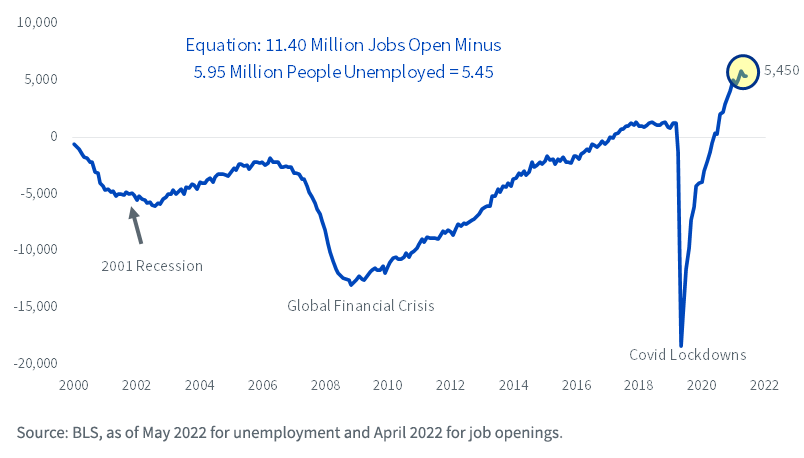

The summer kicked off with the much-anticipated Job Openings and Labor Turnover Survey (JOLTS), which reported—again—more than 11 million job postings in the U.S. Subtract from it the number of unemployed, and the result is off the charts (figure 2). However, take out a microscope and note that it may have peaked this spring. Inflection points matter.

Figure 2: U.S. Job Openings Minus Number of People Unemployed

The 390,000 jobs created in May amounted to a solid report, a sigh of relief for a country battling stubbornly high gas prices and $7 Cheerios. Many on the Street, myself included, were bracing for disappointment that did not come to pass.

There are some positive portents that could give the system a little electricity.

For one, China let millions of people finally leave their apartments. For shuttered factories, that means activity has gone from zero to normal with the flip of a switch. Not a moment too soon for the disaster that persists in the global supply chain.

OPEC had also been increasing oil supply by an extra 400,000 barrels per day with each passing month, but the cartel recently announced that it would goose that figure to an extra 650,000 barrels per day. That is much needed considering the $6–$7 per gallon drivers are paying for gasoline in our most populous state, California. Where I am, Illinois, the dreaded “6-handle” has hit many gas stations.

But OPEC’s supply boost may be too little, too late.

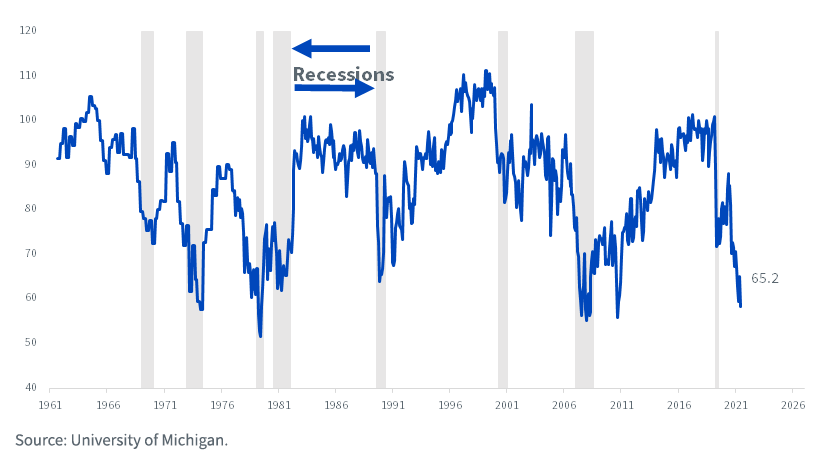

In four of the last five serious plunges in the Michigan Consumer Sentiment Index, the economy was either in or heading into a recession. It makes me think the next stop on unemployment is 4%, not 3%.

Figure 3: University of Michigan Consumer Sentiment Index

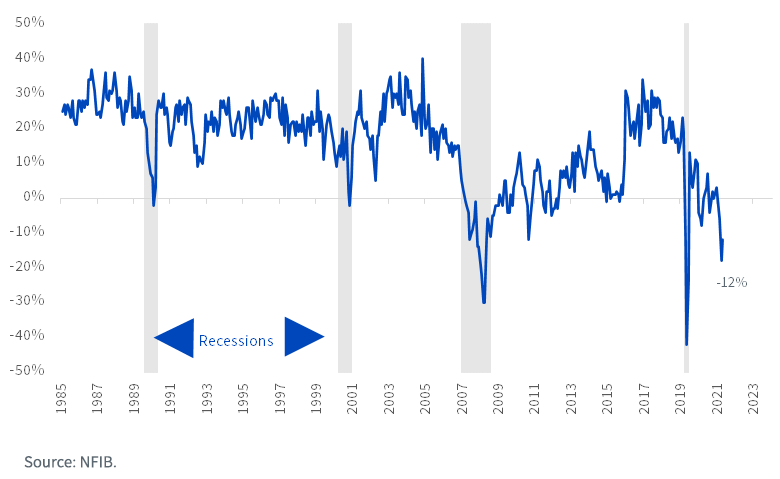

Here is another unnerving metric: the National Federation of Independent Business (NFIB) survey’s question about sales outlooks. The ranks of small businesses that anticipate their sales will decline in the next six months keep swelling.

Figure 4: NFIB Sales

This calls into question whether 3.6% unemployment is a “good” thing for what we are trying to do, which is make money in the stock market. Not if you are of the view that sub-4% unemployment means we are near the cliff’s edge.

Equity Positioning

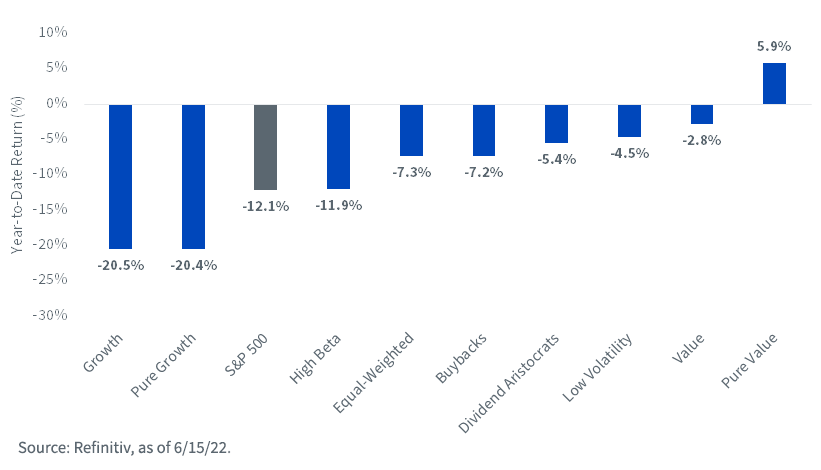

I think it’s safe to say that the market has been pricing in an economic slowdown and/or recession this entire year. Beneficiaries have been Indexes such as the S&P 500 High Dividend and the S&P 500 High Dividend Low Volatility, in sharp contrast to the opposite side of the coin: the S&P 500 Pure Growth (figure 5).

Figure 5: YTD Return, S&P 500 Factor Indexes

I suspect that these forces will remain as key drivers, notably because I don’t think the Street is fully appreciating the risks that could be coming in both housing and the labor market. To the extent that the market needs to spend this summer, and maybe beyond, digesting some unpleasant surprises on these two fronts, it seems to me that a “stay the course” view makes the most sense.

That means low volatility and high dividend concepts instead of trying to be a hero in growth stock land.

Originally published by WisdomTree on June 21, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.