Business News›Tech›Newsletters›Tech Top 5›VSS says focus is on profits, not stock; wider mandate for Vision Fund India head

Daily Top 5 Daily Top 5 |

VSS says focus is on profits, not stock; wider mandate for Vision Fund India head

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

Paytm CEO Vijay Shekhar Sharma repeated to shareholders at the company’s annual general meeting on Friday that it was on track to be profitable by next September, and that his stock options wouldn’t vest until the share price crossed the IPO price of Rs 2,150. Sharma is under intense pressure to deliver on his promises, with three advisory firms calling for his ouster as CEO.

Also in this letter:

■ Vision Fund India head Sumer Juneja to also head Europe, ME

■ Nilekani’s Fundamentum raises $227 million second fund

■ CAs face investigation in Chinese loan apps case

At the company’s first annual general meeting (AGM), held virtually on Friday, Paytm parent One97 Communications (OCL) founder and chief executive Vijay Shekhar Sharma reiterated to shareholders that his employee stock options (Esops) will not vest until the company’s share price crosses its initial public offering (IPO) price.

He also reminded shareholders that the company was on track to turn profitable by September next year.

Taking stock: Some shareholders who spoke at Paytm's AGM expressed their dismay at Paytm’s falling stock price and the losses shareholders have incurred as a result.

Sharma replied that while the company’s profitability plays an important role in determining its share price, it is ultimately not in management’s control.

“Though a company’s profitability plays an important role, there are a lot of other sentiments that affect the share price. We are ensuring the company is trying to be profitable. I can promise you that. As they say, in due course, the stock price will take care of itself,” Sharma said.

Paytm’s stock has fallen consistently since November 2021 from its IPO price of Rs 2,150. Shares of OCL closed at Rs 771.85 apiece on Friday evening on BSE, down 1.86% from its previous close and nearly 70% down from the IPO price.

Unpopular CEO: On August 11 we reported that proxy advisory firm Institutional Investor Advisory Services India (IIAS) asked shareholders to vote against Sharma’s reappointment as the company’s chief executive officer and managing director. Two other advisory firms – InGovern and Stakeholders Empowerment Services (SES) – have also advised shareholders to do so.

SoftBank’s Vision Fund India head Sumer Juneja, who was elevated as its managing partner last year, will now oversee the company’s investments in Europe, the Middle East and Africa. Juneja will report to the fund’s outgoing CEO, Rajeev Misra.

Achievements: Juneja, who joined SoftBank in 2018 as partner and head of India from Northwest Venture Partners, is credited with setting up an India team, and diversifying SoftBank’s India beyond ecommerce and ride-hailing by backing startups in edtech, business-to-business, software-as-a-service and enterprise.

He has led SoftBank’s investments in startups such as Swiggy, Meesho and Eruditus, among others.

Tough times: Softbank’s Vision Fund has had a tough 2022, reporting a record $17 billion loss in the June quarter owing to plunging valuations of tech startups in its portfolio. The fund is also cutting down on its investments this year. Last year, during which Indian startups set funding records, the Japanese firm invested close to $3 billion in the country.

SoftBank has also seen a slew of departures from the senior ranks of its Vision Fund. Deep Nishar, a senior managing partner at the fund, recently left the firm.

Nandan Nilekani’s venture fund Fundamentum Partnership has raised its second fund with $227 million in capital, largely sourced from local entrepreneurs and their personal investment offices.

Nilekani, cofounder of Infosys and chairman of its board, set up Fundamentum in 2017 with Helion's Sanjeev Aggarwal. Its first fund was almost $100 million in size, and backed six startups, including unicorns such as PharmEasy and used car selling platform Spinny.

What’s the plan? Nilekani’s Fundamentum will continue to lead and co-lead series B and series C deals with the new fund, which is more than twice the size of its previous fund.

The new fund is also in talks with institutional investors and if those fructify the fund size may be increased to about $250 million.

Nilekani said the fund will continue to make concentrated bets and not take a ‘spray and pray’ approach to investing in startups.

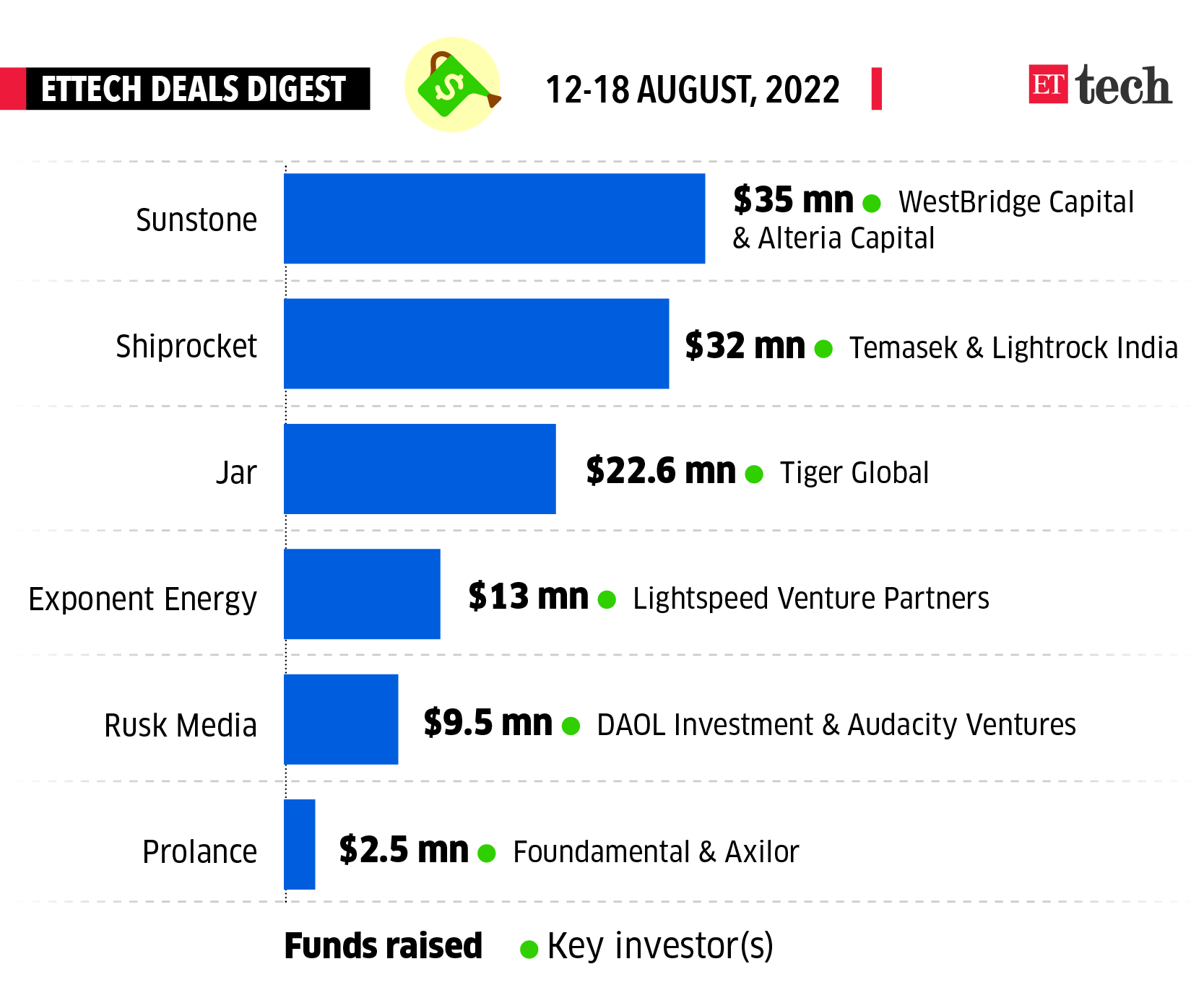

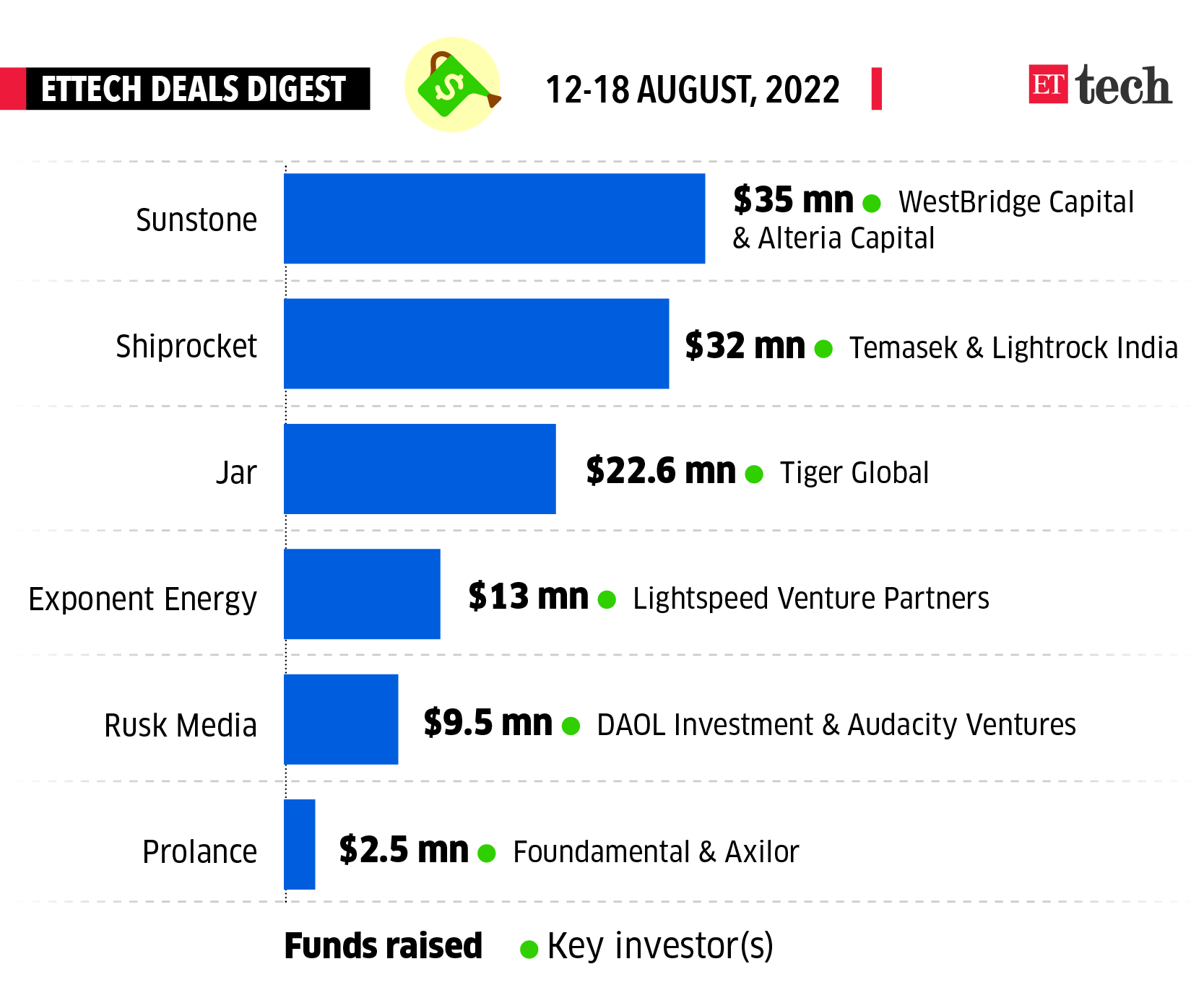

ETtech Deals Digest

Logistics aggregator Shiprocket becoming the 20th unicorn of the year was the only bright spot in a largely forgettable week for startups, with only a few managing to raise moderate amounts.

Here is a list of all startups that raised funds this week.

The Institute of Chartered Accountants of India (ICAI) is investigating several chartered accountants (CAs) for allegedly helping Chinese loan apps establish their businesses in India.

Driving the news: Some CAs apparently signed various statutory documents like incorporation forms and annual returns of these app companies without conducting proper diligence, according to people aware of the matter. Many Chinese app companies also submitted fake addresses in their incorporation form.

Statement: "The purview of investigation is to ascertain if there was any professional misconduct on the part of the chartered accountants. Further, the probe will also look into whether these professionals have signed or authored any false documents supplied by such shell companies,” said Debashis Mitra, president ICAI.

Earlier this year, the Registrar of Companies (ROC) and the Serious Fraud Investigation Office (SFIO) also launched a probe into several shell entities acting as a front for Chinese lenders in India, in violation of domestic laws.

Also read: China's cyber watchdog wants 'affectionate' ties with domestic internet firms.

Elon Musk is seeking documents from advertising technology firms to gain clarity about the accurate number of fake accounts on Twitter as he tries to walk away from the $44 billion deal, reported Reuters.

Details: Musk’s lawyers have subpoenaed Integral Ad Science (IAS) and DoubleVerify for their involvement in reviewing accounts or participation in calculating Twitter’s user base.

A judge had earlier ordered Twitter to give access to documents from its former executive Kavyon Beykpour — who Musk claimed was a key member of the team that calculates the number of spam accounts on the platform.

Musk and Twitter have been embroiled in a battle ever since the Tesla CEO said he was walking away from his takeover of the microblogging platform over its “misrepresentation” of fake accounts. The trial begins on October 17.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

Also in this letter:

■ Vision Fund India head Sumer Juneja to also head Europe, ME

■ Nilekani’s Fundamentum raises $227 million second fund

■ CAs face investigation in Chinese loan apps case

Stock price not in our control, focus is on profits, says Paytm CEO

At the company’s first annual general meeting (AGM), held virtually on Friday, Paytm parent One97 Communications (OCL) founder and chief executive Vijay Shekhar Sharma reiterated to shareholders that his employee stock options (Esops) will not vest until the company’s share price crosses its initial public offering (IPO) price.

He also reminded shareholders that the company was on track to turn profitable by September next year.

Taking stock: Some shareholders who spoke at Paytm's AGM expressed their dismay at Paytm’s falling stock price and the losses shareholders have incurred as a result.

Sharma replied that while the company’s profitability plays an important role in determining its share price, it is ultimately not in management’s control.

“Though a company’s profitability plays an important role, there are a lot of other sentiments that affect the share price. We are ensuring the company is trying to be profitable. I can promise you that. As they say, in due course, the stock price will take care of itself,” Sharma said.

Paytm’s stock has fallen consistently since November 2021 from its IPO price of Rs 2,150. Shares of OCL closed at Rs 771.85 apiece on Friday evening on BSE, down 1.86% from its previous close and nearly 70% down from the IPO price.

Unpopular CEO: On August 11 we reported that proxy advisory firm Institutional Investor Advisory Services India (IIAS) asked shareholders to vote against Sharma’s reappointment as the company’s chief executive officer and managing director. Two other advisory firms – InGovern and Stakeholders Empowerment Services (SES) – have also advised shareholders to do so.

SoftBank’s Vision Fund India head Sumer Juneja to also head Europe, Middle East

SoftBank’s Vision Fund India head Sumer Juneja, who was elevated as its managing partner last year, will now oversee the company’s investments in Europe, the Middle East and Africa. Juneja will report to the fund’s outgoing CEO, Rajeev Misra.

Achievements: Juneja, who joined SoftBank in 2018 as partner and head of India from Northwest Venture Partners, is credited with setting up an India team, and diversifying SoftBank’s India beyond ecommerce and ride-hailing by backing startups in edtech, business-to-business, software-as-a-service and enterprise.

He has led SoftBank’s investments in startups such as Swiggy, Meesho and Eruditus, among others.

Tough times: Softbank’s Vision Fund has had a tough 2022, reporting a record $17 billion loss in the June quarter owing to plunging valuations of tech startups in its portfolio. The fund is also cutting down on its investments this year. Last year, during which Indian startups set funding records, the Japanese firm invested close to $3 billion in the country.

SoftBank has also seen a slew of departures from the senior ranks of its Vision Fund. Deep Nishar, a senior managing partner at the fund, recently left the firm.

Tweet of the day

Nandan Nilekani’s Fundamentum raises $227 million second fund

Nandan Nilekani’s venture fund Fundamentum Partnership has raised its second fund with $227 million in capital, largely sourced from local entrepreneurs and their personal investment offices.

Nilekani, cofounder of Infosys and chairman of its board, set up Fundamentum in 2017 with Helion's Sanjeev Aggarwal. Its first fund was almost $100 million in size, and backed six startups, including unicorns such as PharmEasy and used car selling platform Spinny.

What’s the plan? Nilekani’s Fundamentum will continue to lead and co-lead series B and series C deals with the new fund, which is more than twice the size of its previous fund.

The new fund is also in talks with institutional investors and if those fructify the fund size may be increased to about $250 million.

Nilekani said the fund will continue to make concentrated bets and not take a ‘spray and pray’ approach to investing in startups.

ETtech Deals Digest

Logistics aggregator Shiprocket becoming the 20th unicorn of the year was the only bright spot in a largely forgettable week for startups, with only a few managing to raise moderate amounts.

Here is a list of all startups that raised funds this week.

CAs face investigation in Chinese loan apps case

The Institute of Chartered Accountants of India (ICAI) is investigating several chartered accountants (CAs) for allegedly helping Chinese loan apps establish their businesses in India.

Driving the news: Some CAs apparently signed various statutory documents like incorporation forms and annual returns of these app companies without conducting proper diligence, according to people aware of the matter. Many Chinese app companies also submitted fake addresses in their incorporation form.

Statement: "The purview of investigation is to ascertain if there was any professional misconduct on the part of the chartered accountants. Further, the probe will also look into whether these professionals have signed or authored any false documents supplied by such shell companies,” said Debashis Mitra, president ICAI.

Earlier this year, the Registrar of Companies (ROC) and the Serious Fraud Investigation Office (SFIO) also launched a probe into several shell entities acting as a front for Chinese lenders in India, in violation of domestic laws.

Also read: China's cyber watchdog wants 'affectionate' ties with domestic internet firms.

Musk seeks documents from ad tech firms in Twitter lawsuit

Elon Musk is seeking documents from advertising technology firms to gain clarity about the accurate number of fake accounts on Twitter as he tries to walk away from the $44 billion deal, reported Reuters.

Details: Musk’s lawyers have subpoenaed Integral Ad Science (IAS) and DoubleVerify for their involvement in reviewing accounts or participation in calculating Twitter’s user base.

A judge had earlier ordered Twitter to give access to documents from its former executive Kavyon Beykpour — who Musk claimed was a key member of the team that calculates the number of spam accounts on the platform.

Musk and Twitter have been embroiled in a battle ever since the Tesla CEO said he was walking away from his takeover of the microblogging platform over its “misrepresentation” of fake accounts. The trial begins on October 17.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Ruchir Vyas in New Delhi. Graphics and illustrations by Rahul Awasthi.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.