Why 2022 Has Been Such a Terrible Year for Bond Funds

This could become bond funds’ worst year on record.

Bond fund investors may have known that 2022 wasn’t going to be pretty, but the losses they are facing this year are still striking.

The declines across fixed-income funds were extended in recent weeks after the August Consumer Price Index report came in hotter than expected, and the Federal Reserve followed up with an unprecedented third straight 0.75-percentage-point increase in the federal-funds rate.

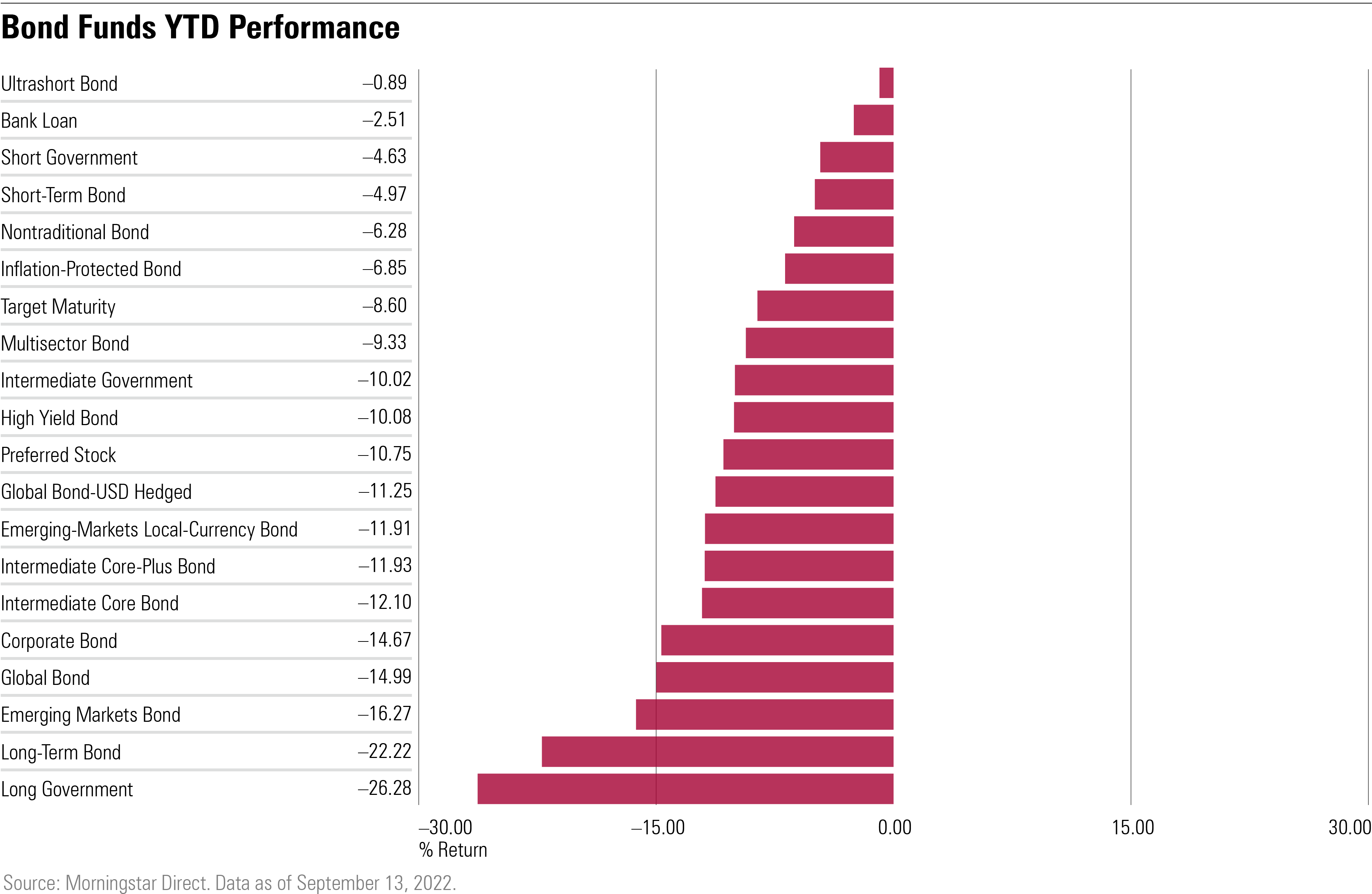

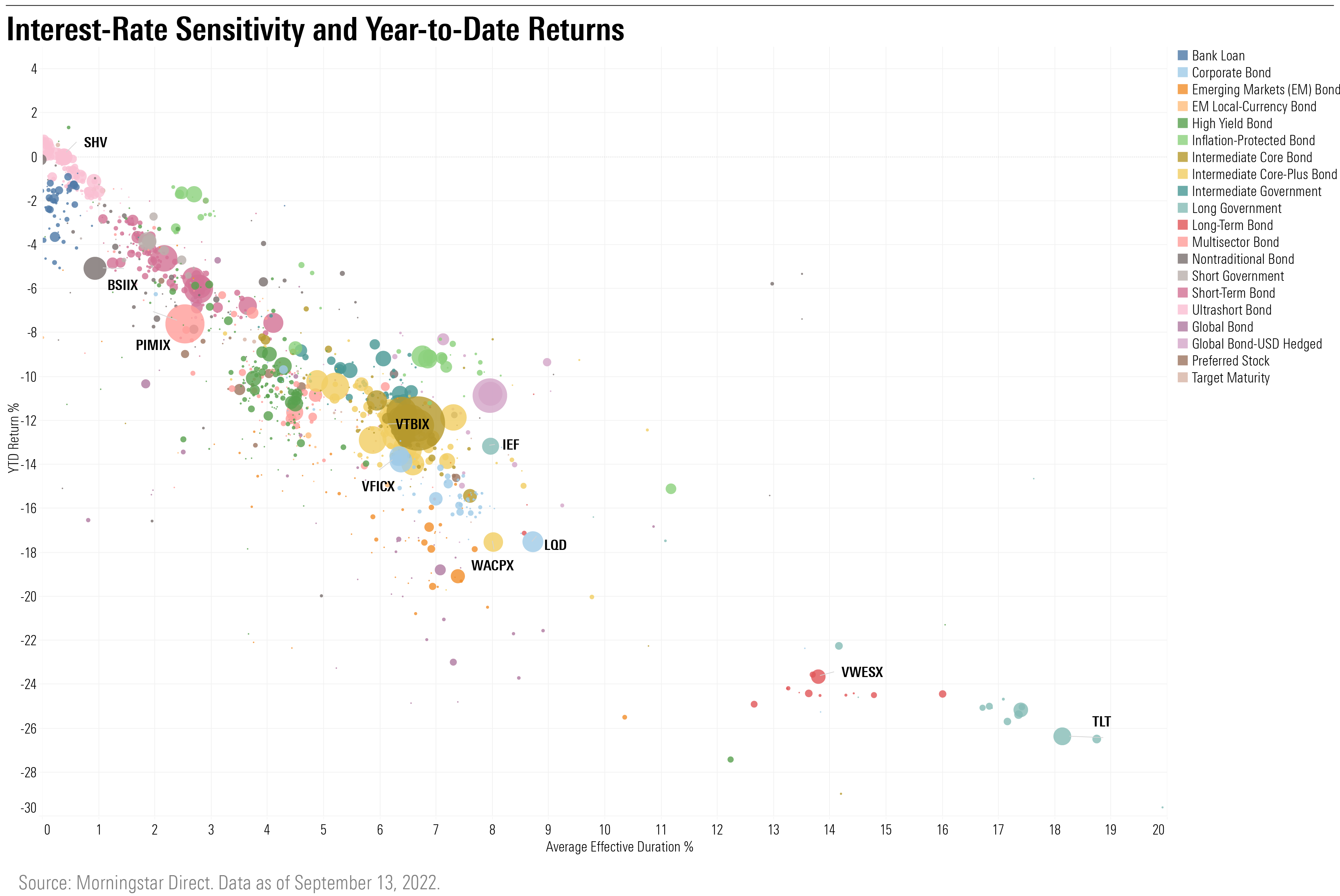

Hardest hit have been funds focused on long-term bonds, those due in 10 years or more, which are the most sensitive to changes in interest rates.

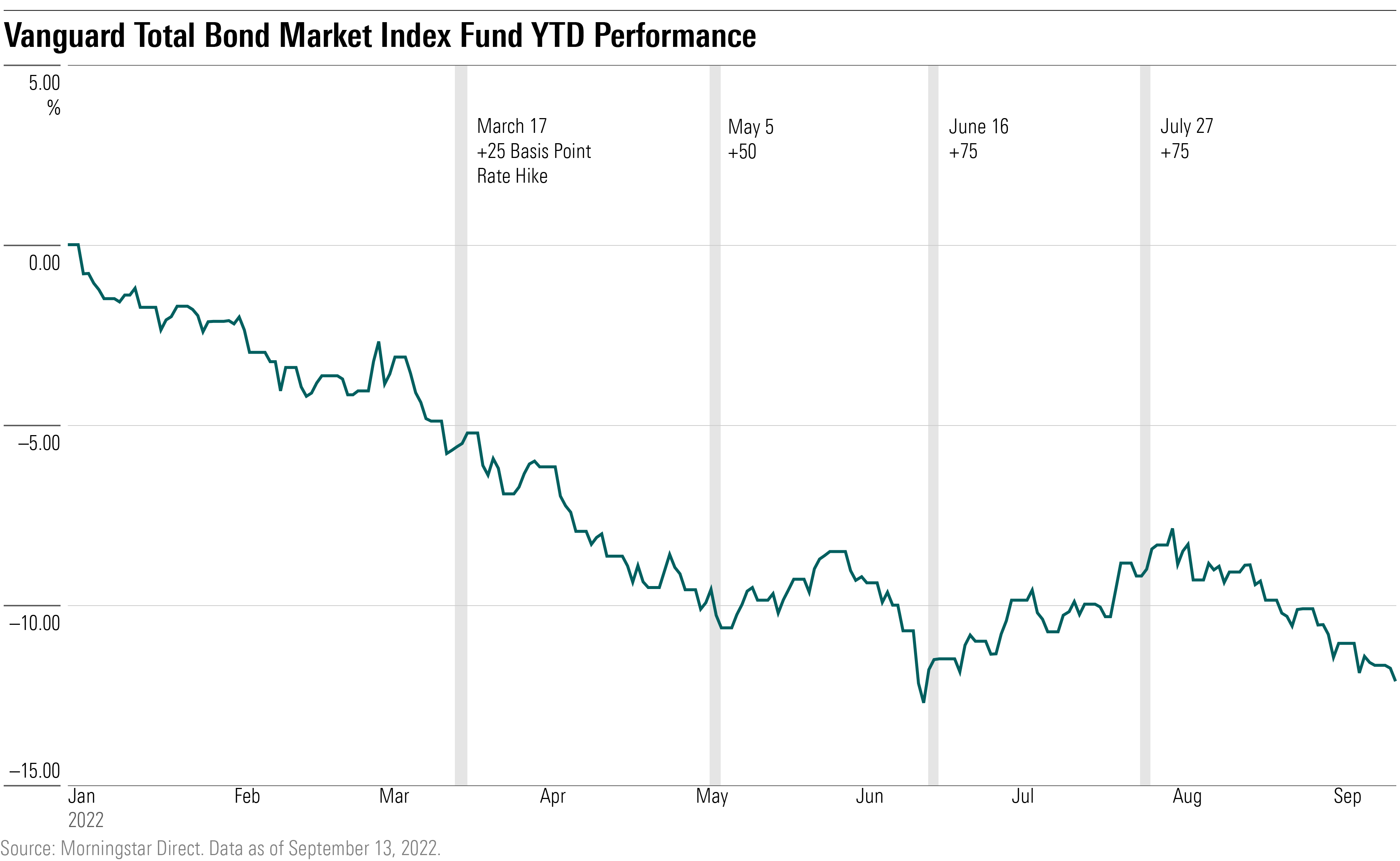

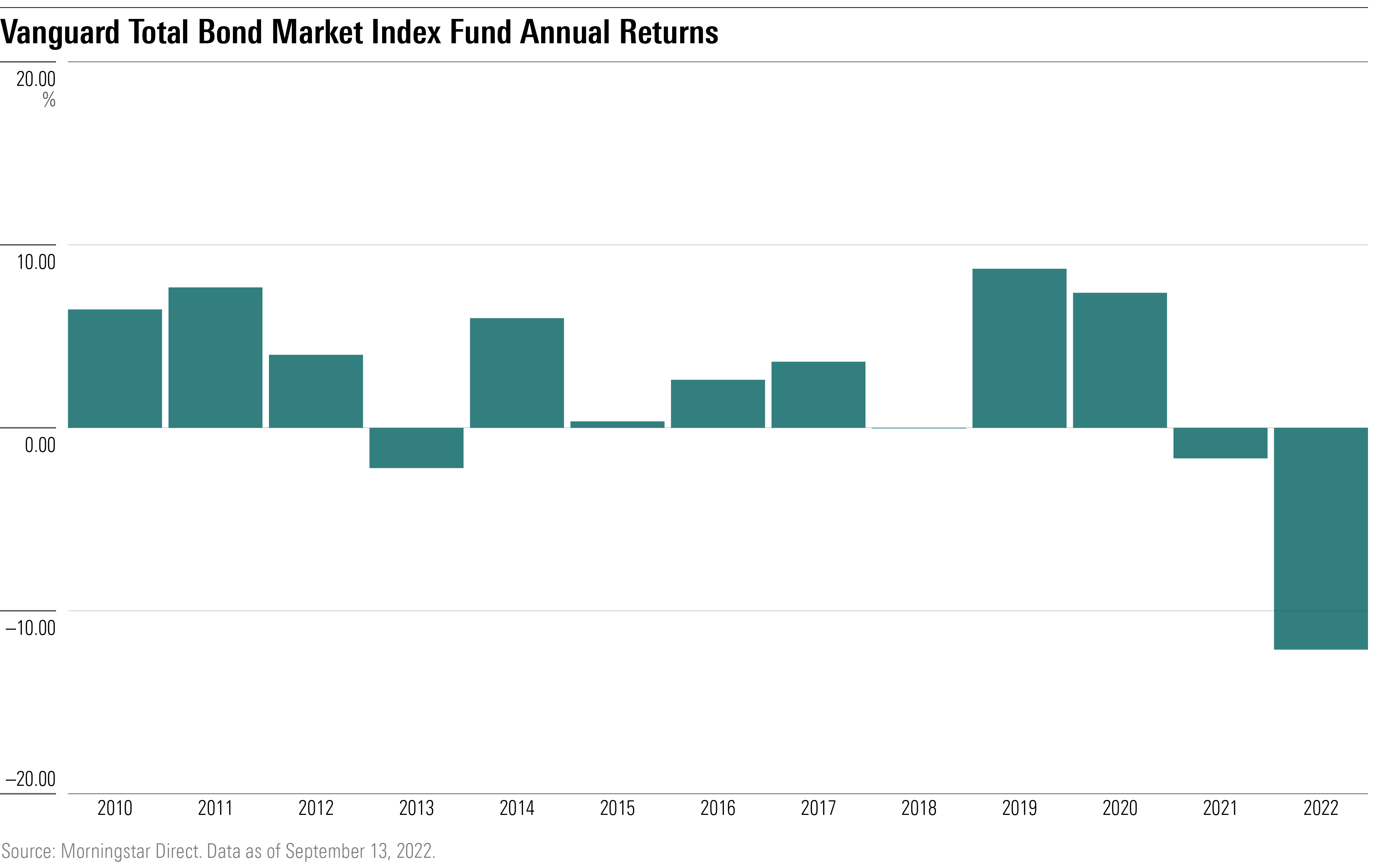

This has added up to big losses for investors. For example, the largest U.S. bond fund strategy, the $514.5 billion Vanguard Total Bond Market Index VBMFX is down 12.12% through Sept. 13, putting it on track for its worst year since its inception in 1986.

In fact, 2022 may be on its way to the record books for more than just the size of the losses. This could be the first time on record that all types of bond funds have declined together in the same year. Every one of Morningstar’s 20 taxable bond categories is in negative territory for the year through Sept. 13. The last time losses were so widespread was in 2008, but government bonds still managed small gains this year.

“It’s been the most volatile bond market going back to the '90s,” says Morningstar senior manager research analyst Peter Marchese.

Why Are Bond Funds Losing Money?

From the start of this year, bond funds sold off as investors anticipated the Fed would need to boost interest rates for the first time in years to combat rising inflation. And as the Fed has followed through and raised interest rates multiple times, bond funds have piled up losses.

Bond yields and prices move in opposite directions. Higher interest rates makes the yields on current bonds less attractive.

“It was apparent going into the year that the Federal Reserve would have to address the inflation we were seeing,” says Alfonzo Bruno, associate portfolio manager for Morningstar Investment Management.

But there are some factors that would have been difficult to predict that have also hit the bond market, making the magnitude of the losses much greater. Inflation has stayed higher than expected through September, in part due to the war in Ukraine that has squeezed commodity and energy prices. And with the labor market tight and inflation stubbornly high, the Fed has signaled that it's inclined to keep raising rates into next year.

Long-Term Bond Funds Take a Beating

The most extreme losses have come from funds that invest in bonds with longer maturities, which make them the most sensitive to an increase in interest rates. For example, the $24.6 billion iShares 20+ Year Treasury Bond ETF TLT is down 26.4% through Sept. 13.

Emerging markets and global bond funds have also suffered thanks to rising rates, inflation increasing across the globe, and a strong U.S. dollar. The $15 billion iShares JP Morgan USD Emerging Markets Bond ETF EMB lost 19.1% through Sept. 13.

Ultrashort and bank-loan funds have been holding up the best, though they are showing declines. Longer durations, which means a bond is more sensitive to changes in interest rates, has hampered some inflation-protected bond funds. The $8.6 billion Fidelity Series 5+ Year Inflation-Protected Bond Index FSTDX carries a duration longer than they typical fund in its category is down 15%, more than the average drop for Treasury Inflation-Protected Securities funds of 6.9%.

High-yield bond funds have held up better than intermediate core and corporate bond funds, though they are still showing year-to-date losses of around 10%. The duration of high-yield funds is typically shorter than intermediate or core bond indexes, which has helped contain losses, says Bruno.

The double-digit price declines for most bond funds may make them more attractive investments now. Investors have purchased $37 billion this year in long-government bond funds, the largest inflows for any taxable-bond fund category. “Investors might be trying to time when bound funds will start to rebound,” says Marchese. “Managers also may start to tip-toe back into the high-yield market with yields looking attractive.”

Little Relief for Bond Investors

There have only been a few bright periods for bond funds this year. Vanguard Total Bond Market Index Fund gained in June, when some investors speculated inflation had peaked, and the Fed wouldn’t need to push rates higher.

“This optimism led investors to move into riskier assets at the start of the third quarter—stocks and high-yield bonds rallied—but another dismal inflation report sent bond prices down in August,” says Bruno.

The Vanguard fund has never posted two consecutive years of negative returns, and this year’s losses are much more extreme than those seen in other down years. Its biggest annual loss came in 1994 when it posted a 2.66% decline.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)