3 Fund Firms That Fall Short of ESG Best Practices

A peek behind the curtain of the Morningstar ESG Commitment Level.

Some fund firms have impressive cultures of investment oversight, but their environmental, social, and governance-related efforts fall short of the industry standard. Among this group are Ariel, Baird, and Vanguard.

Since Morningstar embarked on rating money managers’ commitment to ESG in 2020, it has become clearer what separates the leaders from the laggards. This is the final article in a series of four that seeks to delineate those differences by profiling firms from each tier of the Morningstar ESG Commitment Level—Leader, Advanced, Basic, and Low.

Falling Short

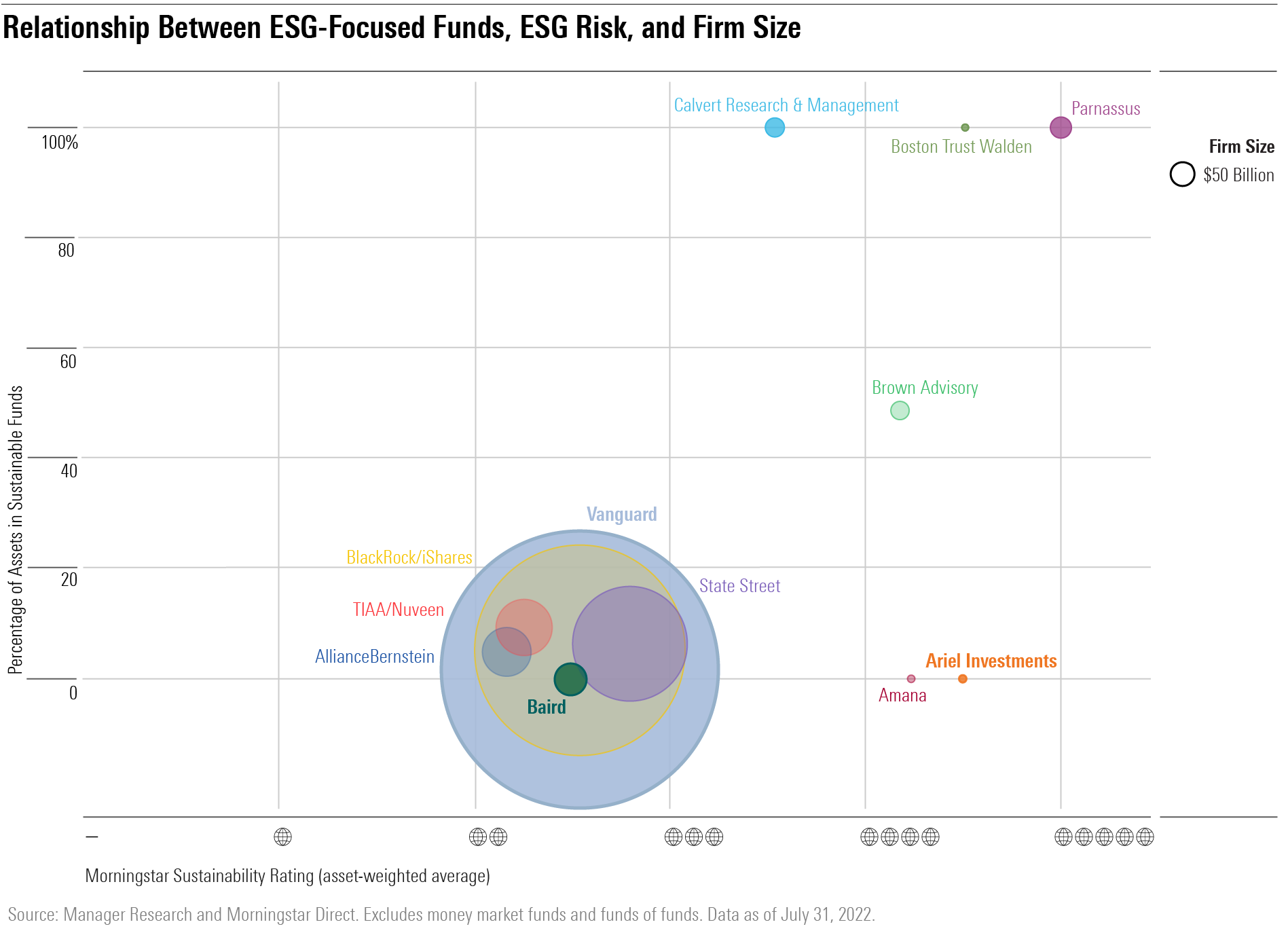

The exhibit below shows how Ariel, Baird, and Vanguard—three firms that earn ESG Commitment Levels of Low—stack up versus the other nine firms this series profiles. The chart below includes total firm assets, percentage of assets in ESG-focused funds (as defined and classified by Morningstar), and asset-weighted average Morningstar Sustainability Rating (a peer-relative measure of ESG risk).

Although it’s a small sample size, the scatterplot reflects the variety of the U.S. ESG marketplace, which includes large, diversified asset managers as well as pure-play ESG firms. Besides Amana, the three asset managers with Low ESG Commitment Levels have the lowest share of assets in ESG funds. Neither Ariel nor Baird offer any ESG-focused funds, and although Vanguard offers more than 20 ESG-focused funds, they account for less than 1% of the firm’s assets. Even without targeting a sustainable mandate, some funds’ processes lead to lower levels of ESG risk. On this measure, Ariel outranks many peers with higher ESG Commitment Levels, including AllianceBernstein, TIAA/Nuveen, and Amana—three firms that receive ESG Commitment Levels of Advanced.

Pockets of ESG Strength but Still Lagging

Ariel, Baird, and Vanguard have made less progress on ESG efforts than peers, underpinning their Low ESG Commitment Levels. Of the three, Vanguard was the first to sign the UN-supported Principles for Responsible Investing in 2014, but that was nearly a decade after Leader firms such as Calvert and Boston Trust Walden. Vanguard also launched its first socially responsible fund—Vanguard FTSE Social Index VFTNX—nearly 20 years ago, but ESG-focused funds constitute a tiny portion of its overall assets, and ESG principles similarly play a small, supporting role in the firm’s overall culture. The three firms have taken steps to identify and avoid ESG risks to the extent that they are financially material, but in practice this has had little effect on portfolios.

In keeping with this light touch approach to ESG integration, these firms’ ESG resources don’t stand out. For example, Baird uses some third-party ESG risk data but has just one ESG-focused analyst on its fixed-income team. Meanwhile, Vanguard just created its ESG product development team in late 2020; the firm has also grown its investment stewardship team that votes proxies, but it is still playing catch-up on measures such as publicly disclosing its rationale behind proxy votes.

Active ownership is a key area of weakness for all three firms. Despite its influence, Vanguard is reluctant to back key ESG initiatives. The firm’s proxy-voting policy has a medium level of detail on environmental and social priorities, and it supported roughly half of key ESG resolutions in 2021. Ariel also supported just over half of 2021′s key ESG resolutions and has vague voting guidelines. More than 95% of Baird’s assets are in fixed-income funds, which limits its ability to engage in active ownership.

Ariel

ESG principles are not at the forefront of Ariel’s value-focused investment philosophy, but diversity, equity, and inclusion are woven into the firm’s DNA. When John Rogers founded Ariel in 1983, it became the first African American-owned fund shop in America, and it remains a registered minority-owned business today. The firm also advocates for diversity beyond its four walls; it publishes the annual Ariel-Schwab Black Investor Survey, which studies the saving and investing behaviors of Black and white Americans. Still, these principles have little impact on the firm’s investment process and portfolios.

Baird

Like Ariel, ESG considerations are not central to Baird’s investment process, yet culture plays a big role in the firm’s success. Baird has been named to Fortune’s 100 Best Companies to Work For list for 17 consecutive years, and investment team turnover has consistently been extremely low. These admirable cultural elements contribute directly to Baird’s Morningstar Parent rating of High.

Vanguard

Vanguard’s long-standing industry leadership in low-cost investing accounts for its High Morningstar Parent rating. Putting clients first led the firm to receive the inaugural U.S. Morningstar Award for Investing Excellence for Exemplary Stewardship in 2019. Through its relationship with external subadvisors like Wellington Management and Baillie Gifford, Vanguard now has bonified ESG-focused strategies such as Vanguard Baillie Gifford Global Positive Impact Stock VBPIX. However, its internal ESG efforts still have a long way to go. Setting up a global ESG product team and bolstering its engagement-focused investment stewardship team are steps in the right direction. Still, Vanguard’s support of key ESG resolutions falls short of influential competitors like BlackRock, which also has considerable assets in non-ESG index-tracking strategies. The firm also recently started to publish its rationale behind proxy votes; while this is an improvement, it comes a few years after more advanced peers such as Legal & General.

ESG Risk and Impact

The three firms have diverse offerings that cater to different investor preferences in terms of ESG risk and impact. While these metrics are not a formal input to the Morningstar ESG Commitment Level methodology, they complement one another.

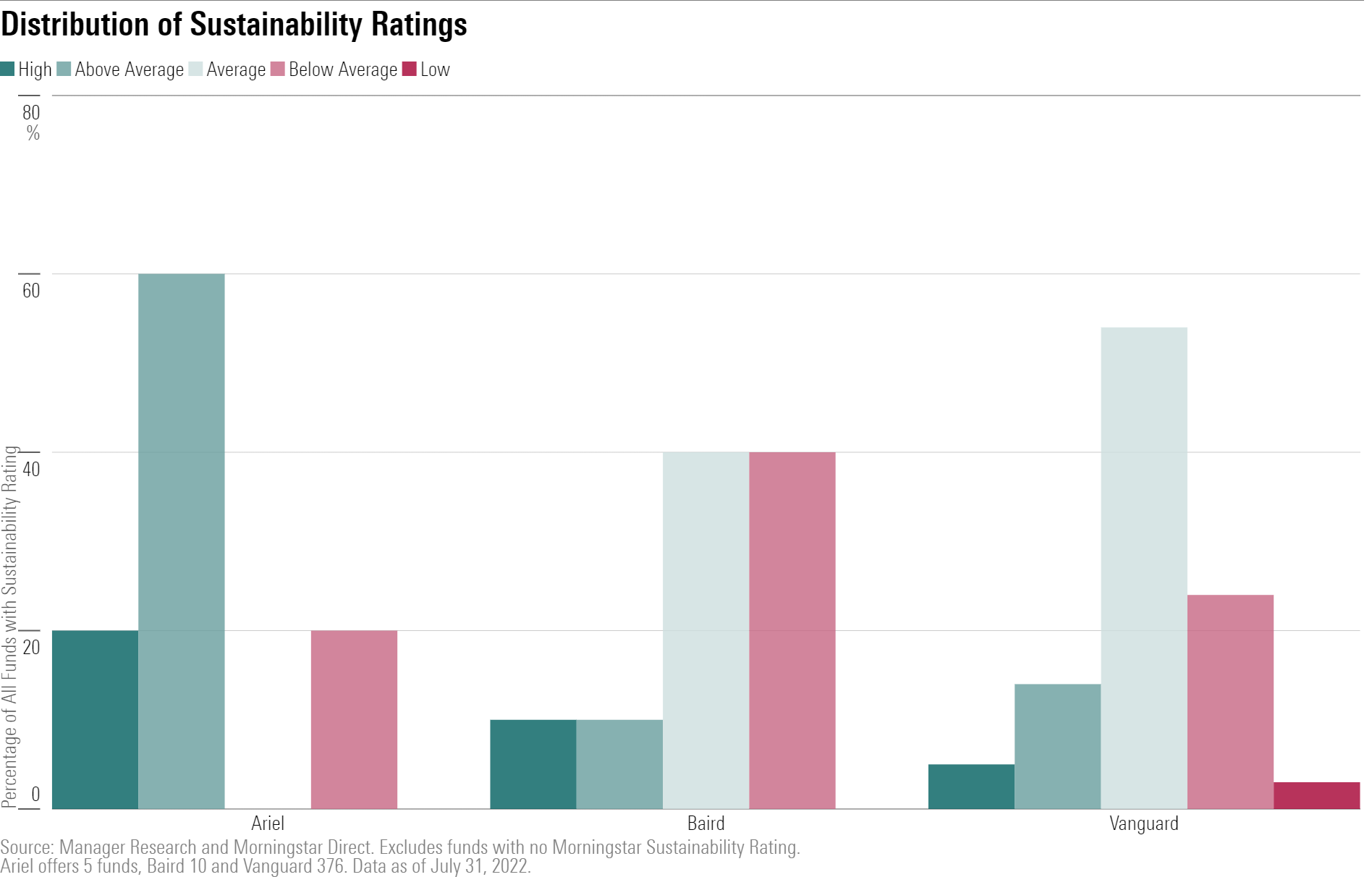

As shown in the exhibit above, Ariel’s investment process leads to low levels of ESG risk, and 80% of its strategies earn High or Above Average Morningstar Sustainability Ratings (5 or 4 globes, respectively). Meanwhile, 40% of Baird’s funds receive a Below Average Sustainability Rating, and Vanguard’s lineup skews toward Below Average and Low.

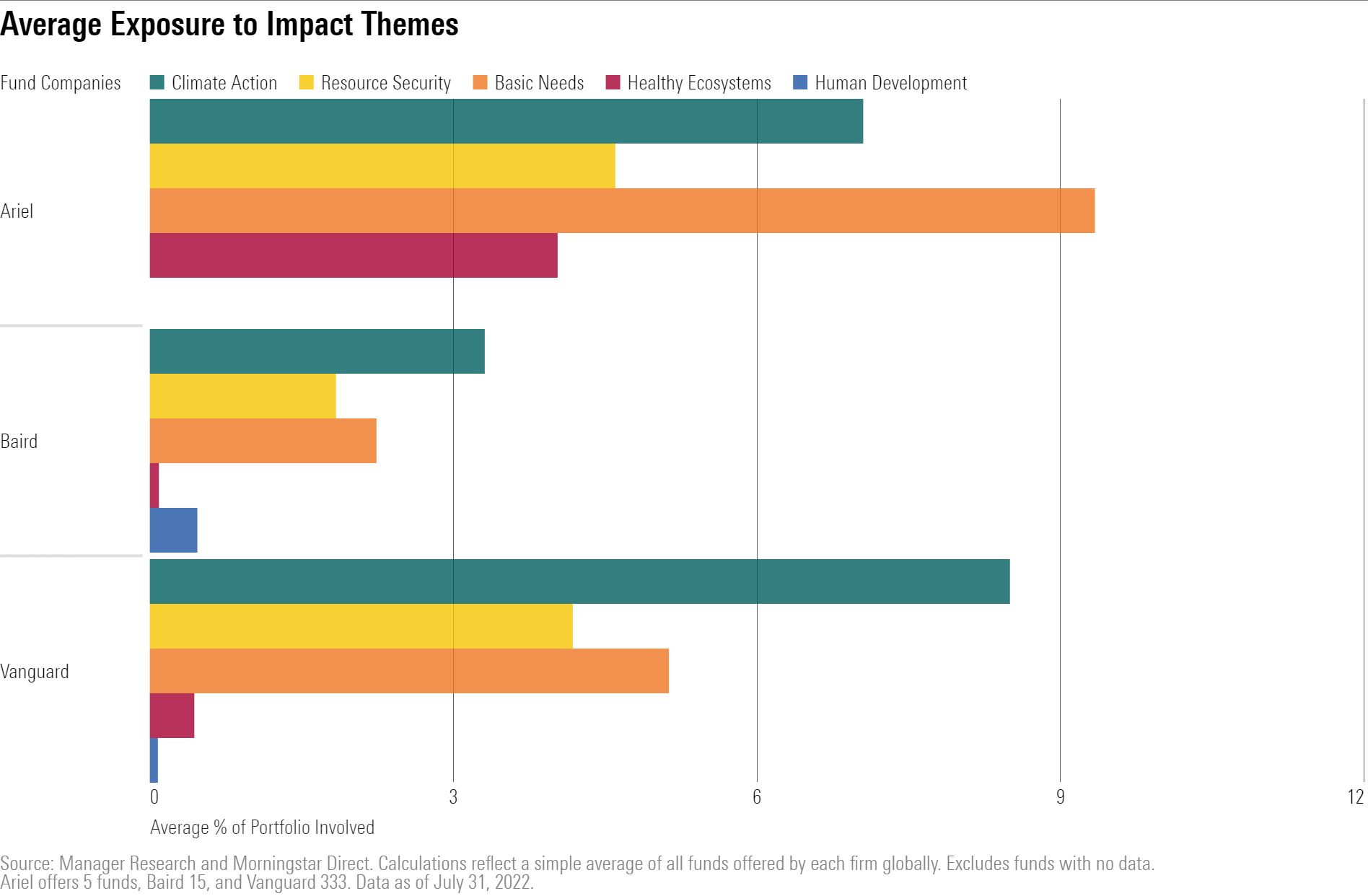

While ESG risk weighs the effect ESG factors might have on a business’s success, impact measures a company’s contribution to positive societal change. Morningstar Sustainalytics’ Impact Metrics calculate the percentage of a given company’s revenues that are associated with one of five impact themes, and the Morningstar Portfolio Impact Metrics aggregate those revenue exposures to the fund level.

Although Ariel doesn’t offer sustainability-themed funds, Ariel Global AGLYX invests in many healthcare companies with high exposure to the Basic Needs impact theme. For example, Gilead Sciences GILD and Bristol-Myers Squibb BMY, which develop treatments for major and neglected diseases, are among the top holdings.

These three firms have impressive cultures, but when it comes to ESG, they have a long way to go.

Raj Modi contributed to this story.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)