Mooners and Shakers: Famed investor Stanley Druckenmiller hints at crypto ‘renaissance’; Bitcoin rises as DXY falls

Coinhead

Coinhead

The tug-of-war between markets and the US dollar continues to interest crypto traders, with Bitcoin reclaiming US$19,500 again as the US Dollar Index (DXY) takes a breather. Meanwhile big-shot US investor Stanley Druckenmiller thinks a crypto ‘renaissance’ could be on the cards.

For now at least, the all-conquering US dollar seems to have topped, having finally been rejected up near 115. At the time of writing it’s had a Bitcoin-pleasing stumble back down near 112, while the leading crypto asset has bounced back up with about a US$1,000 gain from this time yesterday, bringing a fair chunk of the crypto market cautiously along with it.

That’s all well and good, but we’ll see what the monthly close for the OG crypto asset brings in roughly a day’s time. Bitcoin charters seem to think holding the sort of level BTC is at now is significant.

Let’s check in with a prominent Crypto Twitter-posting analyst, Justin Bennett, who’s been posting some pretty gloomy stuff lately. What’s he reading in the B-shaped tea leaves?

As long as $18,700 holds, this is my #Bitcoin playbook through October. 👇$BTC pic.twitter.com/sh1mtCv8Xj

— Justin Bennett (@JustinBennettFX) September 28, 2022

That’s quite a bit more positive than this column expected. It appears if the US dollar continues to falter in the short term, Bennett thinks that could help spur a Bitcoin rally back to slightly north of US$26,000.

Are we in for an “Uptober”? The Fed’s next party-pooping FOMC meeting isn’t until November 1-2, so it’s not out of the completely out of the question.

Not only did the $DXY confirm a bearish deviation from a 10-month level today, but it also closed back inside this channel from August.

Bullish for #stocks and #crypto.$BTC $ETH https://t.co/RhWp3CCqoL pic.twitter.com/R9NionXfBb

— Justin Bennett (@JustinBennettFX) September 28, 2022

Renowned US multi-billionaire investor Stanley Druckenmiller today delivered some harsh macroeconomic reality but also a potential crypto boost.

Speaking at CNBC’s Delivering Alpha conference on Wednesday, Druckenmiller said he thinks the US economy could face a “hard landing”, adding that he would be “stunned if we don’t have recession in 2023”.

Despite this, though, the Duquesne Family Office Chairman and CEO indicated he believes the crypto industry could see a bounce even as the global economic situation moves further up a crap-filled creek with no paddle in sight.

If further trust in central banks is lost, Druckenmiller said, it could even be the right conditions for a crypto “renaissance”.

“I could see cryptocurrency having a big role in a renaissance because people just aren’t going to trust the central banks,” was the exact quote.

Onto some daily price action and other happenings.

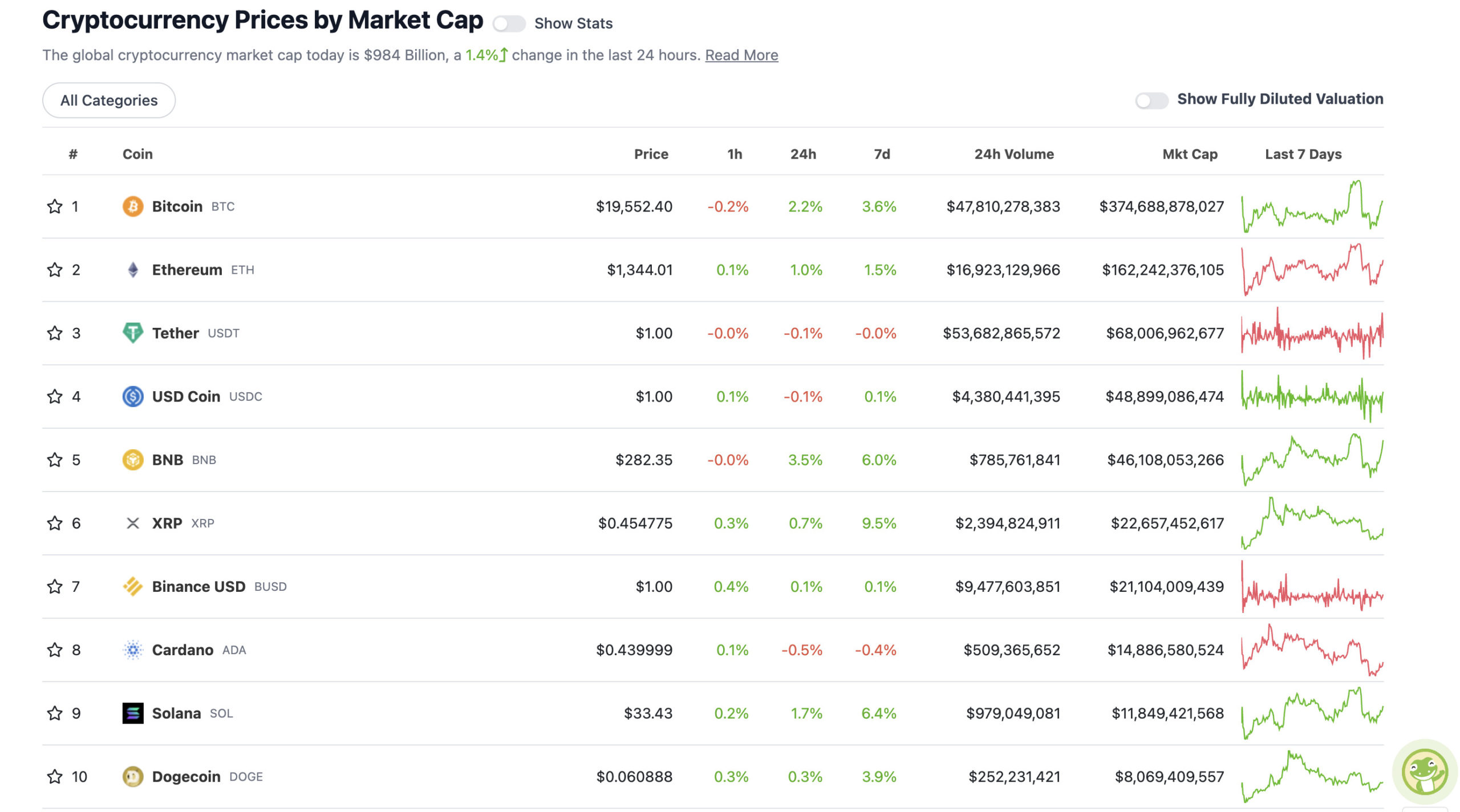

With the overall crypto market cap at US$984 billion and up about 1.4% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Another factor that might have something to do with Bitcoin and crypto’s price-slide arrest and mild about-face is the news from the Bank of England that it’s pausing it’s tightening policy to start purchasing government bonds again.

This is being seen as a bit of a WTF moment in this current economic climate. Here are some quick Crypto Twitter takes…

The Bank of England, the world's 8th oldest bank, the bank that served as the model for most of the world's central banks, today acknowledged that the only way pension funds will remain solvent is if the bank debases its currency to buy government debt. Can you see it yet? #BTC

— Stack Hodler (@stackhodler) September 28, 2022

Wait so the UK is just going to turn on the money printer again with 10% inflation?

— NICO⚡️ (@BITVOLT7) September 28, 2022

Today, with the swift reversal of the Bank of England, has shown why the current financial systems are terrible.

They are terrible for all of us, and massively for a big majority of the society.

That's why I'm even more bullish on crypto and #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) September 28, 2022

Sweeping a market-cap range of about US$7.4 billion to about US$400 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Helium (HNT), (market cap: US$676 million) +11%

• Synthetix Network (SNX), (mc: US$587 million) +9%

• Kava (KAVA), (mc: US$448 million) +6%

• Ethereum Name Service (ENS), (mc: US$409 million) +2%

• Chain (XCN), (mc: US$1.6 billion) +2%

DAILY SLUMPERS

• Evmos (EVMOS), (market cap: US$548 million) -6%

• Cosmos Hub (ATOM), (mc: US$3.8 billion) -5%

• IOTA (MIOTA), (mc: US$825 million) -4%

• Chainlink (LINK), (mc: US$3.85 billion) -4%

• STEPN (GMT), (mc: US$404 million) -3%

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

BOE starts QE while also raising interest rates. 😂

Credibility = Lost

— Benjamin Cowen (@intocryptoverse) September 28, 2022

Now looks like an excellent time to sell all your pounds for dollars.

I imagine they want us all on the dollar.

Then they crash the dollar and move us all on to a tyrannical CBDC to save the global economy and of course the climate too…

— Layah Heilpern (@LayahHeilpern) September 28, 2022

#Chainlink announces staking to be starting in December.

Price jumps towards $8.50.

I think accumulation between $6-8 is still an opportunity of a lifetime.

— Michaël van de Poppe (@CryptoMichNL) September 28, 2022

Someone just paid $4.4 million for a Cryptopunk

What would you buy with $4.4 million?

— NFT Update (@NFTupdate) September 28, 2022

#bitcoin miners selling again… c'mon man! pic.twitter.com/vMPhxxpzO1

— Lark Davis (@TheCryptoLark) September 29, 2022

Retweet this and follow me and I’ll randomly choose 10 people to access beta.

This post has not been approved by my social team but sometimes you gotta YOLO. https://t.co/EYEeAEBmVz

— Kieran.eth ♊️ (@KieranWarwick) September 28, 2022