Mooners and Shakers: Dogechain pumps 250% over past week; Is Bitcoin finally awake?

Coinhead

Coinhead

Bitcoin is stirring (possibly), Aptos is recovering, Bitboy is fuming, earnings calls are looming and Dogechain is wagging its tail. Welcome to another week in crypto.

We’ll start with Bitcoin and the endless speculation around what the hell it’s likely to do next, if anything at all.

The leading digital asset has become less volatile than both the Nasdaq and the S&P 500, it’s been reported by CNBC and others just lately – the first time that’s happened since 2020, apparently.

2 year #Bitcoin chart pic.twitter.com/UXyAIGojqs

— Sven Henrich (@NorthmanTrader) October 22, 2022

Is something about to give? Or is that something finally giving to your portfolio as we speak? Analysts have been calling for a significant break to the upside or downside for more than a week. BTC has made a bit of a move up over the past few hours, so let’s see what some expert chart watchers have been saying.

Van de Poppe is optimistic.

I do believe the bottom is in for #Bitcoin, despite the majority believing that we'll hit $14K or lower.

— Michaël van de Poppe (@CryptoMichNL) October 23, 2022

As is Kevin Svenson, possibly.

Seems like Crypto wants to see some upside#Bitcoin #Crypto

— Kevin Svenson (@KevinSvenson_) October 23, 2022

Meanwhile Credible Crypto is calling for a US$100k Bitcoin in 2023. Although he, erm, predicts a “blow-off top” there and then a worse bear market than the one we’re currently in. Jeepers.

Agreed, probably in 2025 methinks. First, new ATH in 2023- blow-off top 5th wave above 100k- followed by the largest bear market we have seen yet that is worse than the current one in both time and price- taking us to the 10-14k that everyone is waiting for now. $BTC https://t.co/bv0jvzOG2A

— CrediBULL Crypto (@CredibleCrypto) October 21, 2022

Lastly, Crypto Ed has his eyes on a “green week ahead” and “il Capo of Crypto” is sticking to his US$21k relief bounce outlook, followed by a dump back down to the US$14k-US$16k range.

#BTC

Green week ahead, preferably first closing the current CME gap.Still moving higher from the green box. For now rejected exactly at that horizontal. pic.twitter.com/4Gb7DzFbjL

— Ed_NL (@Crypto_Ed_NL) October 23, 2022

$BTC pic.twitter.com/jJTULq2OLD

— il Capo Of Crypto (@CryptoCapo_) October 22, 2022

Predictions, predictions, predictions. Whatever happens in the short term, here’s hoping Larry Lepard’s six-year vision for Bitcoin plays out.

So what’s coming up, though, that could shape the more immediate narrative? There are a few things. The US Federal Reserve’s next FOMC meeting is on November 2. To pivot or not to pivot? That is the question.

Another factor could be this week’s tech-stock earnings calls. On Tuesday, Microsoft and Google will announce how they’ve been faring in Q3, and Apple and Amazon will do the same on Thursday.

This will likely have some effect on stock market sentiment. And like it or not, crypto is still heavily correlated to the performance of tech stocks. Just something to watch out for.

In fact, while we’re on the subject of earnings calls, eToro market analyst Josh Gilbert just now shared these observations with Stockhead via email:

“US earnings season moves into full swing, with all the mega tech names reporting, including Apple, Amazon, Meta, Alphabet and Microsoft… Investors should expect volatility. These are four of the biggest companies on the S&P500, and their results will likely lead market performance for the week.

“Plenty of companies have cited the effects of the surging US dollar on earnings, and this could be a similar story. As a result, downgrades heading into Q4 will be heavily in focus, but many of these tech companies have so far shown they can navigate the murky waters. This leaves room for potential upside surprises, given low expectations and sentiment heavily depressed.”

Widely followed, loudmouth crypto content creator/influencer Bitboy has been ear-steamingly ranting and fuming on his YouTube channel just lately about the influential FTX crypto-exchange boss Sam Bankman-Fried (aka “SBF”).

The beef partly stems from a tweet Bankman-Fried made about FTX potentially delisting crypto assets that it might deem as securities.

Bitboy (aka Ben Armstrong) is a big supporter of not only XRP but Cardano (ADA), which he believes FTX and SBF is trying to nullify in the US.

🚨🚨 BREAKING NEWS 🚨🚨

According to Bitboy Crypto, there is an active campaign to deem #Cardano as a security in the USAFTX currently does not support ADA cryptocurrency and FTX founder has heavy influence over congress, even though FTX is not a US based company pic.twitter.com/fihfSnZsWR

— The Cryptoviser (@TheCryptoviser) October 21, 2022

SBF had posted a blog last week in which he broke down his preferred regulatory framework for the crypto industry, and it included a push for regulation using blacklists or blocklists – in which individuals may freely trade unless explicitly sanctioned.

SBF’s vision hasn’t gone down overly well with large parts of the crypto community – fans of decentralisation, decentralised finance and a libertarian view of the world.

Anyway, let’s skip to the juicy bit, which is Bitboy’s rant (including a crack at the Bankless podcast host Ryan Sean Adams). You can see some of it at the bottom of this fresh Twitter thread from SBF, which attempts to address much of the crypto community’s concerns.

18)While I don’t myself wear glasses, I’m excited to join our bespectacled brethren. It’s a huge honor to see the passion and intensity with which Bitboy regards me.

Maybe someday I’ll feel as strongly about something as he does about me.pic.twitter.com/dZykeECOir

— SBF (@SBF_FTX) October 23, 2022

Onto some daily price action.

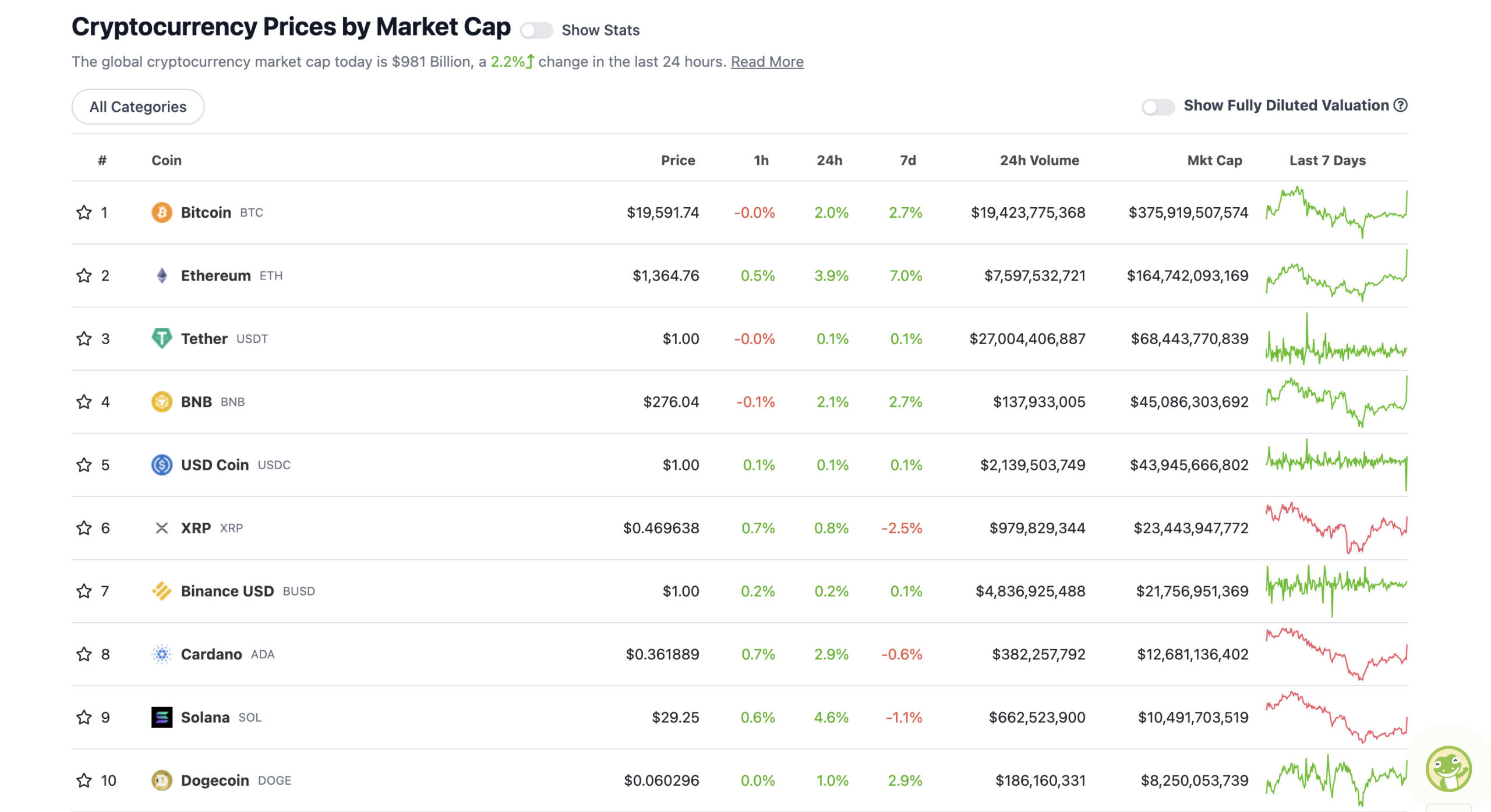

With the overall crypto market cap at US$981 billion, up roughly 2.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin made a push above US$19,600 about an hour ago at the time of writing. It’s heading towards the weekly close and if it can do that in the green, then perhaps we can get some bullish momentum happening for the week.

Vailshire Capital CEO Dr Jeff Ross wants a daily close above US$21k before becoming bullish again, though. Bit of work to achieve that at the time of writing.

Good news: I will become bullish on #bitcoin price action (for the first time since early April) if it closes and holds above $21k on the daily charts.

🐻➡️🐂❓

— Dr. Jeff Ross (aka “Dr. Bear”) (@VailshireCap) October 23, 2022

Other crypto major movements? Layer 1s Ethereum and Solana are the biggest top 10 altcoin movers over the past 24 hours.

There’s some excitement in the Ethereum community about ETH being on track to post its first month as a deflationary asset – 14 days in a row so far, apparently.

There's only ~1,750 ETH left before Ethereum wipes out all ETH issued since The Merge

Then we go deflationary

Buckle up

— sassal.eth 🦇🔊🕯️🌊 (@sassal0x) October 22, 2022

🔴PAY ATTENTION! Increase the Potential of Ethereum 😱#Ethereum is becoming more deflationary, during the last week its circulating supply has been reduced more than ever.

But how does it do it?

INSIDE THREAD 🧵⬇️

(1/6) pic.twitter.com/KCVJLifsbM

— Mundo Crypto Oficial (@MundoCrypto_ES) October 18, 2022

Sweeping a market-cap range of about US$6.9 billion to about US$413 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Klayton (KLAY),(market cap: US$575 million) +33%

• Token XChange (TKX), (mc: US$1.15 billion) +20%

• Aptos (APT), (mc: US$1.26 million) +10%

• Casper Network (CSPR), (mc: US$495 million) +9%

• Aave (AAVE), (mc: US$1.25 billion) +8%

DAILY SLUMPERS

• Chain (XCN), (market cap: US$1.25 billion) -3%

• Maker (MKR), (mc: US$873 million) -2%

• Quant (QNT), (mc: US$2.54 billion) -2%

• Huobi (HT), (mc: US$1.13 billion) -1%

• Chiliz (CHZ), (mc: US$986 million) -1%

Looking a lot further down the market cap list (no. 394 on CoinGecko’s list) is Dogechain (DC) and a short while ago it was leading the daily pumpers for all altcoins, with a near 40% 24-hour gain.

It’s currently up more than 250% across seven days.

What is it again?

Launched in August this year, Dogechain is an Ethereum-compatible smart contract network built using Polygon Edge and it’s being marketed as a “layer 2” network for Dogecoin (DOGE).

It’s essentially all about bringing smart-contract capabilities to the Dogecoin community and allows users to bridge DOGE onto the Dogechain network in order to access its applications – such as Uniswap-style AMMs (DogeSwap and DogeShrek) and maybe NFT/GameFi offerings in the future, among other protocols.

1/5

Shibes, the GREAT BURN vote proposal is up! 🔥Do you want the Dogechain foundation to burn 80% of the total supply and reduce the vesting period of Early Shibes airdrop from 48 to 6 months? YES/NO ✅ ❌

🗳 Full proposal overview and vote:

🌐 https://t.co/fruuRUq6ni pic.twitter.com/jAIb7HDb8o

— Dogechain💜 (Giving away a Tesla) (@DogechainFamily) October 22, 2022

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Psychology is fascinating. Every bear market you are given months to get Bitcoin at a fire sale, yet most rather wait for new all time highs.

— Charles Edwards (@caprioleio) October 23, 2022

Some more Bitboy hilarity…

Bitboy is known to be litigious, but I just couldn't help myself. I remixed it.https://t.co/hOzXCto6yn

(24hr NFT auction starts now👆) pic.twitter.com/vrEsgw1W5k— Jonathan Mann (@songadaymann) October 21, 2022

Sure I’m in

— Ben Armstrong (@Bitboy_Crypto) October 22, 2022

Credit to @musketon & @whiteflagtoys for this masterpiece 🫡

— Coin Bureau (@coinbureau) October 23, 2022

Lmaooooooooooo this is too perfect pic.twitter.com/AUWzAS8a1H

— 🇬🇧 IM 🇬🇧 (@TellYourSonThis) October 23, 2022