In October 2022, the Financial Action Task Force ("FATF") indicated that the Cayman Islands must take more action in the area of prosecution for money laundering crimes before the FATF may consider the removal of the Cayman Islands from the list of countries under increased monitoring.

Since then, Cayman authorities have prosecuted (or are gearing up to prosecute) persons connected to the proceeds of crime.

One example of this is the recent case involving two high-profile financial services professionals, one of whom was the former head of a fund administration business.

Some of the convictions of the former fund administration boss included the following:

- Transferring criminal property, contrary to section 133 of the Proceeds of Crime Law 2008, whereas it was alleged that he transferred criminal property, knowing or suspecting it to represent, in whole or in part, the proceeds of crime

- Entering an arrangement, contrary to section 134 (1) of the Proceeds of Crime Law 2008, whereas it was alleged that he entered into or became concerned in an arrangement with another person, which he knew or suspected, facilitated the retention, use or control of criminal property by or on behalf of another person

A local lawyer was convicted in the same case for false accounting, contrary to section 255 (1) (b) of the Penal Code (2013 Revision), whereas the lawyer, along with the fund administrator, was said to have allegedly furnished information for the purposes of an audit, dishonestly, and with a view to gain for themselves or with intent to cause loss to an organisation.

With these convictions in hand, Cayman may be perceived as one step closer to meeting requirements in connection with the 2023 FATF compliance deadline.

To further demonstrate Cayman's commitment against activities involving the proceeds of crime, the Cayman Legislature plans to introduce harsher penalties and sentences for illegal gambling activities, according to provisions of a draft Bill to amend the Gambling Act.

Concerning proceeds that may be derived from illegal gambling activity (designated as a medium-high risk in Cayman's national money laundering risk assessment), this is particularly hard to catch because persons involved in the activity may find a way to conceal or disguise the source of the gambling proceeds by purchasing assets, including real estate, then reselling them at a gain, and later depositing the sale proceeds into a bank account as "legitimate" funds.

If Cayman authorities can successfully prosecute illegal gambling activities (some of which may involve money laundering elements) before the FATF compliance deadline in 2023, this might be seen by the FATF as evidence of further progress by the Cayman Islands to satisfy the FATF's requirements.

Notwithstanding that the FATF may positively receive these efforts, other concerns may introduce challenges for Cayman authorities to achieve a final 2023 FATF de-listing.

One concern is the virtual assets' space, including the virtual and virtual asset service providers.

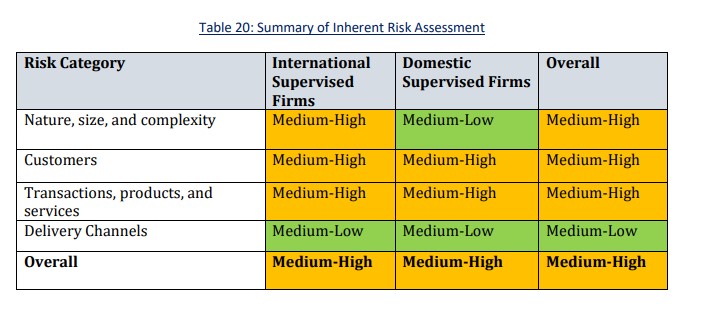

For example, in Cayman's national money laundering risk assessment, virtual assets and virtual asset service providers received a medium-high risk rating (see below from the national risk assessment).

Regarding this medium-high risk assessment, the national risk assessment stated the following about virtual assets and virtual asset service providers:

VAs are vulnerable to abuse by criminals. They can help disguise the origin of illegally obtained funds or be used to fund terrorist activities. VAs are secured, digital representations of value or contractual rights that use a form of distributed ledger technology and can be transferred, stored or traded electronically. Criminals may transfer, integrate and layer illicit funds into VAs, and then back to fiat currency, to obfuscate the original source and purpose of the asset. Virtual asset service providers ("VASPs") are key gatekeepers in maintaining the integrity of the digital financial system, as they act on behalf of other persons to facilitate the safe custody, exchange or investment of VAs.

Depending on how this space develops globally (with particular attention being paid to the FTX controversy), the risk of VAs and VASPS in the Cayman Islands may need to be reassessed, mainly if they include complex structures like FTX.

An analysis of such complex structures is essential because the FATF Recommendations require any structure to be evaluated as a part of the customer risk factor assessment, especially where "the ownership structure of the company appears unusual or excessively complex given the nature of the company's business."

The complexity of the structure of FTX (which included a maze of companies established in Delaware, Antigua, Cyprus, Germany, Malta, BVI, Singapore, Canada, and The Bahamas), for example, may have initially concealed some of the issues surrounding FTX, including those raised in John J. Ray III's declaration to the United States Bankruptcy Court for the District of Delaware that there were many defects "in internal controls, regulatory compliance, human resources and systems integrity."

In addition to the above, Mr Ray noted the following in his declaration:

In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas.

Although FTX is not a Cayman entity, these observations may warrant Cayman authorities taking a deeper look into the virtual asset space in the Cayman Islands to determine whether any structures here are overly complex or if anything may have been missed during the national risk assessment. Further analysis may determine that the space's current medium-high risk assessment is accurate or that the evaluation is closer to high risk.

In addition to further analysis of structures, Cayman authorities may need to reassess any vulnerabilities of the parties advising these structures.

For example, Cayman's national risk assessment describes the inherent risk of the legal profession as medium-high, saying, "The inherent vulnerabilities of the legal profession must be seen in the context of the jurisdictional vulnerabilities facing the Cayman Islands."

The national risk assessment continued:

These have been identified as being the risk that the Cayman Islands' financial system could be used as a conduit for the proceeds of financial crime generally, and fraud, bribery and corruption, tax evasion, and drug trafficking specifically. These threats are usually predicated upon the commission of crimes abroad and the decision to funnel those proceeds through structures, transactions, and accounts in the Cayman Islands. The most significant danger for the legal community is the direct participation of firms in that movement of funds through their involvement in such transactions and or the usage of their accounts.

The national risk assessment concluded in this area, saying:

Whilst it is acknowledged that Domestic Supervised Firms have a much smaller share of the legal sector’s RFB clients in terms of absolute numbers, these firms do provide higher risk services, engage in cross-border activity, and engage with higher risk clients such as UHNWIs/HNWIs, PEPS and foreign UBOs. In conclusion, the overall inherent ML/TF/PF risk for firms of attorneys-at-law conducting RFB in the Cayman Islands is considered to be medium-high, due to the materiality of the International Supervised Firms relative to Domestic Supervised Firms.

This medium-high risk assessment, however, does not appear to include any reference or analysis of the possible risk posed to the legal profession by persons practicing Cayman Islands' law outside the jurisdiction without possessing a Cayman Islands' legal practice certificate. A further assessment in this area may lead to identifying other vulnerabilities, which could change the current national risk assessment from medium-high.

By addressing and resolving these and other vulnerabilities and stepping up prosecutions and enforcement action, Cayman may be well on its way to being removed in 2023 from the FATF list of countries under increased monitoring.

0°C

0°C

![[iStock:Kar-Tr]](https://loopnewslive.blob.core.windows.net/liveimage/sites/default/files/styles/popular_big/public/2022-07/9260a4829dedbb2a4b04119268d18754friends-friendship-istock.jpg)

Facebook

Facebook

Twitter

Twitter

Instagram

Instagram