Heading into 2024, the price of oil has climbed by nearly 23 percent to US$86.47 per barrel as of April 8 as geopolitical risks continue to threaten supply. S&P Global Commodity Insights analysts are forecasting oil demand to grow by 1.7 million barrels per day (bpd) in 2024 followed by 1.08 million bpd in 2025.

Is now a good time to invest in oil stocks? Before answering that question, the Investing News Network (INN) takes a look at how the energy sector compares to the broader equities market and some of the trends shaping the oil market this year.

What’s trending in the oil market?

In the first three months of 2024, the market has seen oil prices heading higher on a number of trends, mainly production cutbacks by OPEC+, a group that includes the 13 countries in the Organization of the Petroleum Exporting Countries (OPEC) and 10 other oil-producing countries, and the ongoing strife in the Middle East and Europe. Also at play is the impact of China's oil demand, the expected US Federal Reserve interest rate cuts and the growing market share of renewable energy sources.

OPEC production cuts continue to weigh on the market

Arguably the biggest factor influencing the oil market recently is and will continue to be OPEC+ production cuts.

In November 2023, OPEC+ members signed an agreement to lower crude oil production targets by an additional 2.2 million bpd through March 2024 in response to weaker crude oil prices. These cuts were on top of the existing voluntary cuts and lower production targets OPEC+ set at its June 2023 meeting. This month, OPEC+ members made another commitment to cut 2.2 million bpd of production for the second quarter of the year.

Speaking at a December interview, Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners, told INN that when it comes to the global oil market, OPEC+ “is very clearly in the driver's seat, where they are balancing the market by withdrawing further exports.”

OPEC+ cuts prompted the International Energy Agency (IEA) in part to cut its average 2024 oil supply estimate by 930,000 b/d to 102.86 million bpd. "Global crude oil inventories could remain below average levels in the near term after OPEC+ announced ... it will extend additional voluntary cuts through the second quarter," said the agency.

Middle East conflict

There are a number of major political conflicts and wars playing out across the globe that are bound to impact both oil production and transport, leading to higher prices for the commodity. Conflicts in the Middle East, responsible for a vast majority of global oil production, heavily influence this market.

For example, the launch of the Israel-Hamas war in the fall of 2023 spurred oil prices briefly to the US$90 level. Oil market watchers will definitely be looking for indications that the conflict may spread into other oil-producing nations in the Middle East.

Red Sea attacks on oil transport

Iranian-backed Houthi militant strikes on international tanker traffic in the Red Sea, a globally important maritime trade route, is another concern to watch out for this year. The brazen attacks, which began in November 2023, are forcing cargo companies to find alternative routes, negatively impacting shipping times and costs.

“While there are no immediate threats to oil supply, the conflict is a wake-up call about the lack of spare capacity,” said Christyan Malek, J.P. Morgan's Global Head of Energy Strategy and Head of EMEA Oil & Gas Equity Research, in a recent research report. “We believe this is an example of an emerging risk premium related to diminishing spare oil production capacity, and we expect short-term spikes to continue over the medium term while becoming more sustained.”

In mid-March, the increasing strife in the Red Sea was partially responsible for the IEA raising its 2024 oil demand forecast by 110,000 bpd to 1.3 million bpd. "In February alone, oil on water surged by 85 million barrels as repeated tanker attacks in the Red Sea diverted more cargoes around the Cape of Good Hope," the IEA said in its monthly report.

Russia-Ukraine war

Russia is the world’s second largest oil producing country, and the Great Bear’s war in Ukraine continues to have some influence over oil price movements in 2024.

On March 12, Ukrainian drone attacks on Russian oil refineries was partly responsible for a 2.6 percent hike and four-month high in Brent crude prices along with a 2.8 percent rise in West Texas Intermediate (WTI) crude oil prices. The jump was also due to withdrawals from US crude and gas stockpiles, showing an increase in demand.

Over the next week, Ukraine ramped up its drone attacks, with two of the largest strikes impacting 12 percent of Russia’s oil processing capacity, reported Bloomberg. The attacks have continued into April, as have price gains.

Interest rate cuts may support higher oil prices

Oil market participants are watching out for the US Federal Reserve to start its rate cut cycle. Lower interest rates typically breathe new life into a flagging economy, which in turn boosts oil prices.

On March 6, the price of WTI jumped 1.25 percent and Brent Crude hiked by 1.12 percent after Fed Chair Jerome Powell advised that rate cuts were on the horizon for 2024. The March 12 price jump could also be attributed to lower US inflation data that added support to the hope that the Federal Reserve will soon start lowering interest rates.

Most analysts are looking at June for the first interest rate cut in four years.

China's oil demand

As the world’s most populous country, China is unsurprisingly the world’s second largest consumer of oil and the largest net importer of the energy fuel. With well over half of its imports coming from OPEC member countries, Chinese demand can strongly influence the oil market.

Although China’s oil demand is forecast to slow this year as its economy struggles, the Asian nation is still expected to account for more than a quarter of new global oil demand.

Renewable energy gaining market share

Renewable energy sources are increasingly taking up a larger share of the overall energy mix; however oil and gas continue to represent the largest share of the pie.

Another consideration is that internal combustion engine vehicles still dominate the global vehicle market compared to EVs. In fact, EV sales growth has been on the decline in 2023 and into 2024 as they still remain an economic luxury for the general consumer concerned with not only the price, but also the lack of charging infrastructure.

“While an increasing number of firms are focused on renewable energy projects, the primary investment opportunities in the energy sector today are with more traditional participants such as oil and natural gas companies,” said Rob Haworth, senior investment strategy director at US Bank (NYSE:USB) Wealth Management.

His firm’s report highlights that the US Energy Information Administration is projecting global oil consumption to reach 102.4 million bpd in 2024 compared to 101 million bpd in 2023.

For its part, J.P. Morgan Research anticipates oil demand hitting 106.9 million bpd by 2030 as energy consumption in developing nations rises alongside global population growth.

Is now a good time to invest in oil stocks?

A widening gap between oil demand and supply is expected to materialize as early as 2025, which would likely boost oil prices, according to J.P. Morgan's research report.

J.P. Morgan, a subsidiary of JP Morgan Chase (NYSE:JPM), is looking to a possible 1.1 million bpd deficit in the global oil market in 2025, which could widen to a 7.1 million bpd gap by 2030. This imbalance could send oil prices spiking as high as US$150 per barrel over the near to medium term and US$100 per barrel over the long term. If oil prices continue to rise, the research firm sees energy stocks outperforming the broader equities market.

“We are turning bullish now as we envisage an emerging supply-demand gap beyond 2025, coupled with strengthening bottom-up sector fundamentals,” J.P. Morgan's Malek said.

US Bank's Haworth is also bullish on oil stocks.

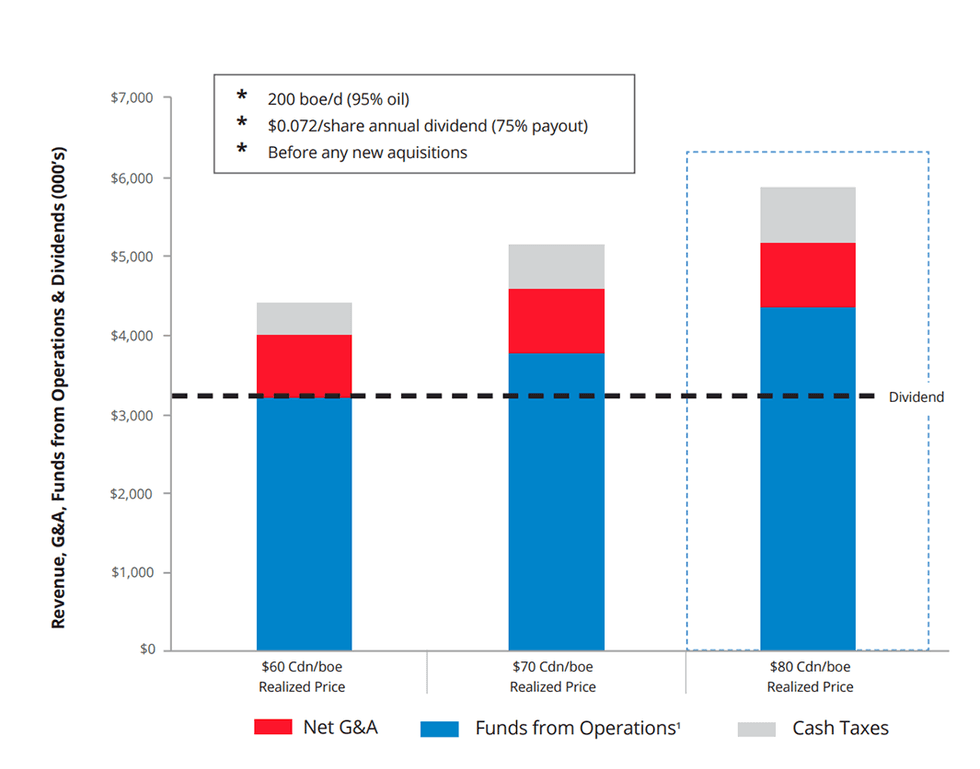

“Many exploration and production companies have productive oil wells and should be able to generate solid profit margins,” he explained. “Since many companies tend to return capital to shareholders in the form of dividend payouts, their stocks represent an opportunity for income-orientated investors.”

Halliburton fleet arriving on site

Halliburton fleet arriving on site