- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Balkan Mining and Minerals Quarterly Activities Report December 2022

Lithium portfolio continues to grow in Canada by consolidating land interests in Ontario to a total ~79kms2 and securing new prospects in Quebec covering ~22km2. Balkan Mining is poised for growth during 2023 with exploration programs planned across the entire portfolio. Key strategic and operational milestones were achieved during the period, outlined below.

Balkan Mining and Minerals Ltd (ASX: BMM; “Balkan Mining” or “the Company”) provides the Company’s quarterly activities report for three months ending 31 December 2022 (“Quarter”). Following the diversification strategy via the strategic earn-in agreement on the Gorge Lithium exploration project located in the Georgia Lake Area, Thunder Bay North Mining District of Ontario, Canada (the “Gorge Lithium Project” or “Gorge Project”), Balkan Mining continued to solidify its interest in prospective projects across both Ontario, with Tango and Arrel and also Quebec, with Corvette North and Corvette Northwest. Field work carried out during the Quarter included mapping and sampling at Gorge and Tango, airborne geophysics at Tango and channel sampling at Gorge which returned Li2O values reaching 1.8m @3.75% (see announcement 16 December 2022), following on from the sampling grades returned at 5.75% and 6.80% Li2O during the September Quarter (see announcement 28 September 2022).

Highlights

- Highly experienced mining executive Karl Simich agreed to join the Board as a Director, tasked with a particular focus on strategy, corporate development and growth.

- Two projects, Corvette North and Corvette Northwest, covering ~22km2 and situated in the emerging lithium district of James Bay in Quebec, were staked by the Company.

- The Gorge lithium project (situated in the Georgia Lake Area, Ontario) returned high-grade lithium assays from channel samples taken at the Koshman and Nelson pegmatite showings, including 1.8m @ 3.75% Li2O confirming the significant potential of the project.

- 5 new additional claims totalling ~22km2 were included into the Gorge lithium Project area. The new claims increased the Gorge Project land size to ~43.0km2.

- Balkan Mining secured an exclusive option to acquire 100% of the Tango Lithium Project located in the Georgia Lake Area, Ontario, covering ~9km2.

- Initial mapping identified a new pegmatite field at Tango lithium Project.

- Heliborne geomagnetic survey completed over the Tango lithium project.

- The Arrel lithium project was acquired, covering a further ~27km2 in the Georgia Lake lithium district, situated in between the Company’s Gorge and Tango projects, further solidifying the Company’s strong presence in the region. Balkan Mining and Minerals,

Managing Director, Ross Cotton commented: “Our CY22 finished in a great way with the transformative acquisitions of Tango, Arrel, Corvette North and Northwest and the doubling of the Gorge land position to 43km2. Additionally, with Karl Simich agreeing to join the board and taking an active role in the strategy and development of Balkan Mining and its assets is something that we believe will help to deliver significant value for shareholders in 2023 and beyond”.

Highly experienced mining executive Mr Karl Simich agreed to join the Board as a Director, with a particular focus on strategy and development. Mr Simich’s tenure will begin on the satisfactory completion of the resolutions to be considered at the Company’s General Meeting of shareholders being held on Monday, February 13.

Click here for the full ASX Release

This article includes content from Balkan Mining and Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Balkan Mining and Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Balkan Mining and Minerals

You've come to the right place to know Balkan Mining and Minerals. At INN our Mission is to arm you with knowledge and connect you with investing opportunities! Ready for the next step? Download the FREE Investor Kit TODAY to get the institutional investor details!

Overview

The recent boom in electric vehicle (EV) adoption and green technologies has seen global demand for lithium skyrocket. Analysts believe EV penetration could reach 35% by 2030, which means lithium production will need to quadruple between 2020 and 2030 to satisfy this growing demand.

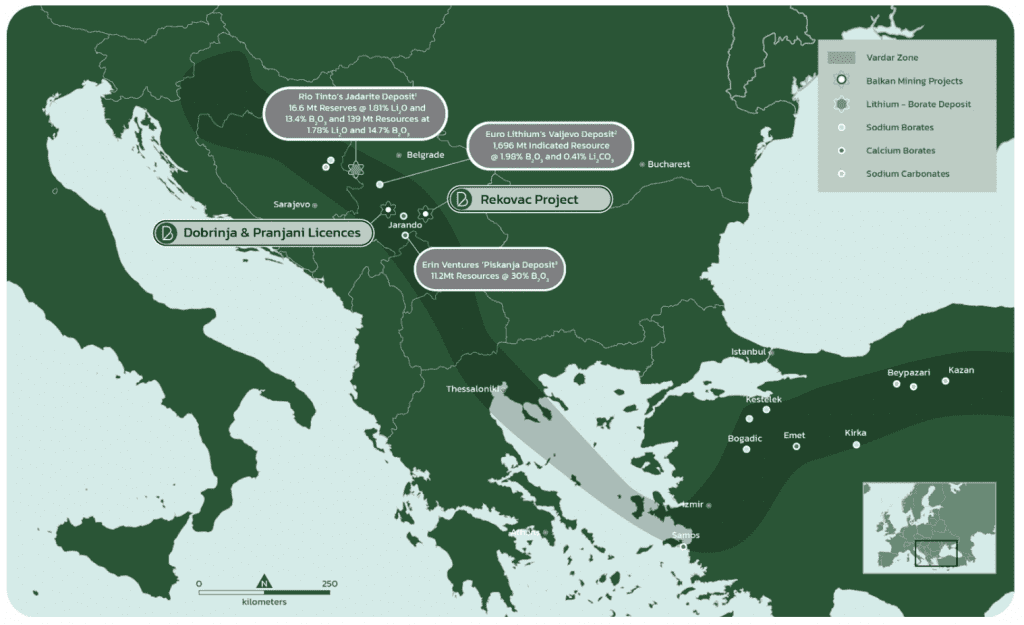

Lithium production is often associated with countries like Chile, Australia and Argentina — but strategic policy shifts in the European Union have led Europe to look inward for essential battery metals, placing the spotlight directly on the Balkan states. While the Balkan states, which includes Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Kosovo, Montenegro, North Macedonia, Romania, Serbia and Slovenia, are best known for historic gold production — recent lithium discoveries in Serbia have renewed interest in this region.

Balkan Mining and Minerals (ASX:BMM) is focused on an early-stage exploration through the full development of lithium and boron mining in the Balkan region. The company is committed to building an ethical resource portfolio backed by strategic partnerships and guided by an experienced board and management with regional expertise.

The Balkan states, and Serbia in particular, are well-endowed with many minerals and have attracted a surge in foreign investors for the exploration of mining operations. Serbia's Vardar zone is an emerging tier 1 lithium-borate jurisdiction. Balkan Mining and Minerals is well-positioned to capture the growth of the European lithium and boron supply chain.

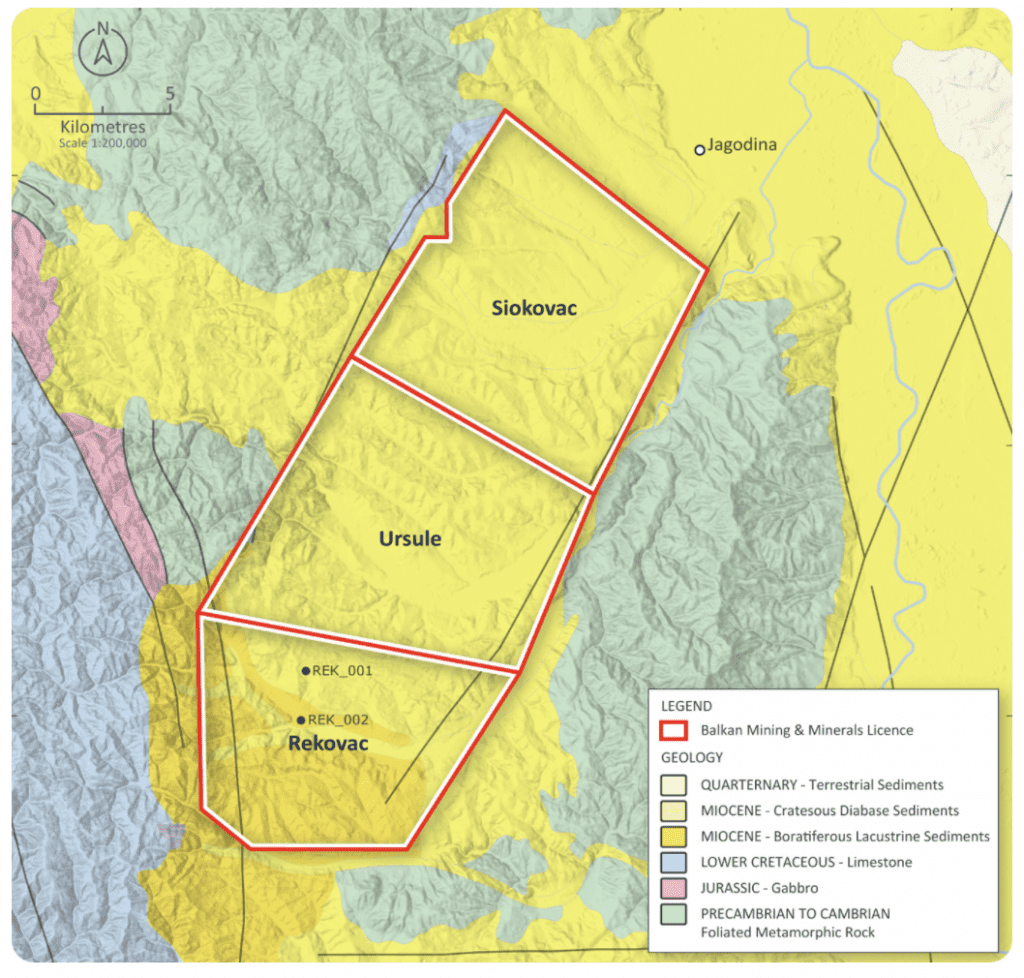

Balkan Mining and Minerals' flagship Rekovac lithium-borate project demonstrated two successful diamond drill holes discovering preserved lithium and borate mineralization. The company recently completed its surface mapping program. With the success of the initial drilling and exploration, Balkan is well-positioned to commence its drill program in late September 2021.

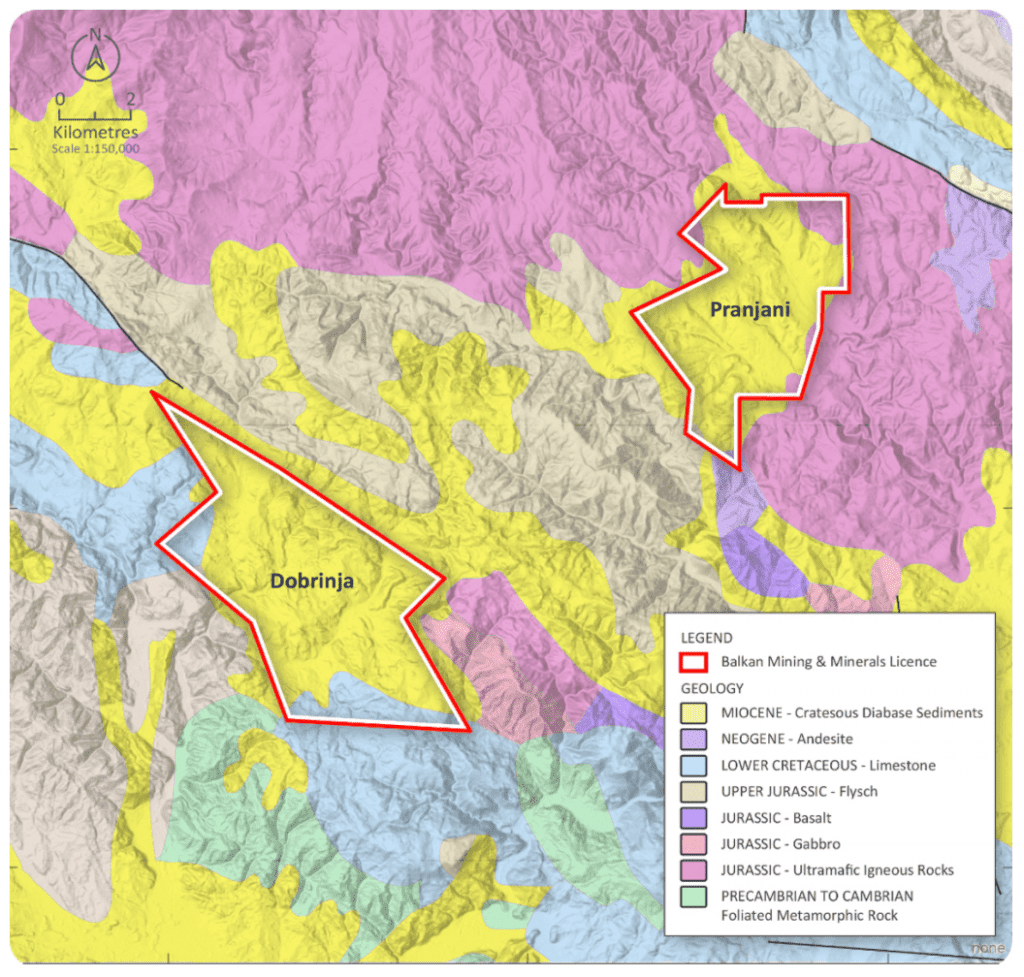

The company continues to expand its reach across Serbia with four new exploration permits recently granted. The Ursule and Siokovac licenses provide expansion of Rekovac and span nearly 200 square kilometers. The Dobrinja and Pranjani licenses provide access to Western Serbia with favorable lacustrine strata for hosting lithium and boron.

"It's the right region, it's the right commodity and the right capital structure with the right investors… the key thing to add to that is what differentiates this particular lithium project from many of the other … lithium companies, at least listed in Australia, is the borate angle… So that makes these types of things extremely economic and extremely easy to mine and process," commented Ross Cotton, managing director.

Balkan Mining and Minerals is backed by Sandfire Resources (ASX:SFR). The company's current market cap is AU$36 million with 45 million shares on issue.

The leadership of Balkan Mining and Minerals includes a highly commercial board with decades of experience. Sean Murray serves as chairman and brings executive experience from Rio Tinto and expertise in industrial minerals. General Manager Dejan Jovanovic is the Balkan region expert with over 15 years of experience as a geologist. The company has a strong combination of experience and expertise to be a leader in the lithium and boron space.

Company Highlights

- Balkan Mining and Minerals is a publicly-listed exploration and development company focused on lithium and boron mining in the Balkan region.

- The Rekovac project has demonstrated promising results in its early exploration phase and is on track for additional explorations and assessments within the Ursule and Siokovac licensed areas.

- The Cacak project provides new access to underexplored areas of the Vardar Zone, an emerging tier 1 lithium-borate jurisdiction. The company is looking to expand beyond the Rekovac project and region.

- The company is backed by leaders in the space and has performed well since its IPO. An experienced board and regional management expertise equip Balkan Mining and Mineral to be a leader in the lithium-borate space and are in the right space at the right time.

Key Projects

Rekovac Lithium-Borate Project

The flagship Rekovac lithium-borate project is located in the world-class Vardar Zone in Serbia, an emerging tier 1 lithium-borate jurisdiction. The project has easy access to the motorway and modern rail corridor, thus providing a solid infrastructure to Central and Western Europe.

The first two diamond drill holes (1,238 meters) revealed preserved lithium and borate mineralization at both sites. The second drill hole (REK-002) intercepted over 171 meters with over 10,000 ppm of B2O3 and up to 969 ppm Li2O from 35 meters including 49.6 meters with over 20,000 ppm of B2O3 and up to 624 ppm Li2O from 51.5 meters.

The success of the initial drilling and exploration has provided a solid foundation to explore additional areas of Rekovac as well as two additional adjacent areas under the Ursule and Siokovac licenses. The recently completed surface mapping of the entire Rekovac area has identified five dominating sedimentary formations. The samples will be sent to a laboratory for mineral phase determination using the X-ray diffraction method.

Balkan Mining and Minerals plans to measure magnetic properties over the entire diamond drill core. In addition to measuring magnetic susceptibility, the company will measure the bulk density of samples selected from the drill core. These two parameters will guide geophysics surveys across high-priority areas and ultimately define and commence new drilling programs.

Cacak Project

The Cacak project comprises the Dobrinja and Pranjani license and is located in Western Serbia about 90 kilometers south-southwest of Belgrade, the capital of Serbia. A database study conducted by the Yugoslav Geological Survey identified favorable lacustrine strata for hosting lithium and boron.

The project is in its early exploration phase and will focus on target generation using regional geophysics, geological mapping, and surface sampling. Upon completion of the initial assessment, drill testing of the target locations will be conducted. The licensed areas are within the Vardar Zone and present the company with another location for extracting lithium and boron minerals.

Management Team

Ross Cotton – Managing Director

Ross Cotton has over 15 years of experience in the securities and mining industries and has been instrumental in both the financing and management of mining and resource companies globally.Cottons' experience in investment banking and equity capital markets has provided him with detailed experience in corporate transaction management and execution. In these roles, Cotton has been integral in the recapitalization and restructuring of companies, including managing of initial public offerings and reverse takeovers. In addition to a number of managerial roles with ASX listed companies, Cotton has also provided corporate advisory services to listed companies on strategy, acquisitions as well as financing via both debt and equity for a number of years.Cotton currently manages a private mining strategy and finance consulting business and utilizes his networks established in investment banking, mining and management to provide solutions for the effective implementation of business strategies and management solutions.

Sean Murray – Non-executive Chairperson

Sean Murray has an Honors degree in modern languages and a post-graduate Master's Degree in Business Management and Economics from the Manchester Business School, part of the University of Manchester Institute of Science and Technology, in the United Kingdom. Murray has more than 40 years of experience worldwide in the chemicals and mining industries, including non-ferrous metals and minerals and industrial minerals. His successful executive management career includes senior roles with Australian Mining and Smelting (CRA), Pasminco Europe and Pasminco Inc and Rio Tinto plc where he became Managing Director of Borax Europe and then Deputy Chief Executive, Rio Tinto Borax in the 1990s and early 2000s.

Murray has also served on the boards of Rio Tinto operating companies either as president or as an executive director in the USA (California), Argentina, France, Germany, Holland, Spain and Italy. He has been a Vice-President of the European Zinc Institute (The Hague), and an Industry Advisor on non-ferrous metals and minerals to the UK government at the International Lead Zinc Study Group, (United Nations). He was a vice-president of the Industrial Minerals Association and president of the European Borates Association in Brussels where he became involved in Public Relations and Sustainable Development.

Since 2005, Murray has provided consulting services on marketing, planning and strategy to the industrial minerals sector in Europe, Australia and the Americas and has held non-executive directorships on the boards of AIM and ASX listed copper, gold, tungsten, potash and fluorspar companies including, Fluormin plc (formerly LSE:FLOR and Potash Minerals Ltd (formerly (ASX:POK)). He was a senior partner in a New York based LLP developing minerals businesses in the former Soviet Union. Murray is fluent in a number of European languages including German and Spanish.

Murray has British and Irish citizenship and lives in Surrey in the United Kingdom.

Luke Martino – Non-executive Director

Luke Martino is a Fellow of the Institute of Chartered Accountants in Australia and the Australian Institute of Company Directors, having worked for over 30 years with major accounting firms, where he held senior leadership positions and Board memberships including Lead Partner of Deloitte's Growth Solutions practice in Perth until 2007 when he left to establish boutique corporate advisory and accounting firm, Indian Ocean Advisory Group.

Martino has extensive experience in mining and resources, property and hospitality industries and is a specialist in corporate and growth consulting.

Martino currently acts as a Chairman of Jadar Resources Limited (ASX: JDR) and is also Executive Director of Indian Ocean Consulting Group Pty Ltd. Martino's previous roles have included acting as Non-Executive Director of Skin Elements Ltd (ASX: SKN), Pan Asia Corporation Limited (ASX: PZC), Non-Executive Chairman and Director of Central Asia Resources Limited (ASX: CVR) and former Company Secretary of Blackgold International Holdings Limited (ASX: BGG).

Milos Bosnjakovic – Non-executive Director

Milos Bosnjakovic is a lawyer by profession with strong links and experience in the Balkan countries of the former Yugoslavia Republics, Australia and New Zealand. He has been involved in the resources industry in Australia and the Balkans for almost 20 years and has considerable corporate experience within the industry.

Bosnjakovic is a dual national of Australia and Bosnia and Herzegovina and was also the co-founder of ASX-listed Sultan Corporation Limited which became Balamara Resources Limited, which held the Monty Zinc Project in Montenegro. Milos was co-founder of ASX-listed Adriatic Metals PLC (ASX: ADT) and his previous roles have also included acting as Non-Executive Director and Country Manager of Adriatic Metals PLC.

Dejan Jovanovic – General Manager

Dejan Jovanovic is a geologist with more than 15 years of experience in managing complex exploration projects and mineral deposit evaluation. He is a well-rounded exploration professional with significant commodity experience including lithium, borates, base and precious metals. Jovanovic implemented and encouraged the highest standards of technical and operational excellence across multiple project support groups. He has held numerous positions throughout his career including notable roles with Rio Tinto (Serbia) where he worked on Rio Tinto's Jadar lithium-borate deposit; senior exploration roles with Lithium Li Ltd / Pan Global Resources Inc. serving as a key leadership capacity for exploration programs in the Balkans. Jovanovic has also acted as an exploration management consultant to various clients including European Lithium and General Manager Exploration for Jadar Resources Limited (ASX:JDR).

Jovanovic holds a Master of Science in Economic and Exploration Geology from the University of Belgrade, and a member of the Professional Geological Societies (QP), and a fellow of the European Federation Geologist (CP in accordance with the JORC Code).

Harry Spindler – Company Secretary

Harry Spindler is an experienced corporate professional with a broad range of corporate governance and capital markets experience, having held various company secretary positions and been involved with several public company listings, merger and acquisition transactions and capital raisings for ASX-listed companies across a diverse range of industries over the past 22 years.

Spindler is a member of the Institute of Chartered Accountants Australia and New Zealand and a member of the Financial Services Institute of Australia. Spindler began his career in corporate recovery and restructuring at one of Australia's leading independent financial advisory and restructuring providers Ferrier Hodgson (now KPMG) and has for the past 11 years working for a corporate advisory firm, Indian Ocean Consulting, through which he has advised a number of clients in a range of industries, as well as held positions as company secretary for a number of ASX-listed companies, including Sino Gas & Energy Holdings Ltd (ASX:SEH; ASX:300), an Australian energy company focused on developing gas assets in China.

Karl Simich - Director

As director, Karl Simich has a particular focus on strategy, corporate development and stakeholder relations. Prior to joining Balkan, Simich was the founder, managing director and CEO of Sandfire Resources for 15 years, overseeing the company's transformational growth from a junior micro-cap to a successful, global mid-tier producer. He oversaw the implementation of Sandfire's international expansion strategy, including the $1.865 billion acquisition of the MATSA copper operations in Spain. Simich has 36 years of experience with publicly listed mining and exploration companies. Throughout his career, Simich has overseen the financing and development of more than 10 mines in Australia, New Zealand and Africa.

Nenad Loncarevic – Senior Exploration Geologist

Nenad Loncarevic has 30 years of mineral exploration experience. He is highly experienced in target generation, project evaluation and exploration program implementation for gold, base metals and industrial minerals. Loncarevic possesses an outstanding knowledge of many deposit styles with particular strengths in polymetallic systems and sedimentary type deposits.

Prior to joining Balkan Mining and Minerals, Loncarevic held senior exploration roles with companies including Medgold Resources Corp. (TSXV:MED), Ultra Lithium (TSXV:ULI) & Dundee Precious Metals Inc. (TSX:DPM).

Loncarevic holds a Master of Science in Economic and Exploration Geology from the University of Belgrade.

Lithium Market Update: Q1 2024 in Review

Lithium prices remained subdued at the beginning of 2024, still well below highs set in late 2022 and 2023. Several factors, including oversupply and weak electric vehicle (EV) demand, united to keep prices muted over the 90 day period.

Despite a market glut keeping prices down, Fastmarkets is forecasting that lithium supply will increase by 30 percent by year’s end. However, lithium analysts did note that the current price environment could disrupt this fresh supply, as some producers may choose to reduce production or delay expansions.

“Furthermore, whilst Chinese production seems less prone to suffering delays — as seen with the ramp-up of domestic lepidolite and African spodumene projects, in most cases we expect new capacity to experience some start-up delays, contributing to supply-side risk,” a Januaryreport from the firm reads.

Production cuts could be a signal that the market has “bottomed,” resulting in some rebalancing later in the year.

January: Lithium market calm amid inventory saturation

Lithium oversupply from 2023 continued to saturate the market at the beginning of this year, keeping prices muted. Production in 2023 came in at 180,000 metric tons (MT) of contained lithium, 34,000 MT higher than 2022’s output.

“Indications were that inventory was quite strong both at the finished cell level and upstream with miners/brine producers,” Adam Megginson, price and data analyst at Benchmark Mineral Intelligence, told the Investing News Network (INN) via email. “As such, procurement activity on the spot market was fairly subdued. Buyers in Japan and South Korea opted to draw from inventory or volumes already being procured under contract rather than procure additional on the spot market.”

Trading activity was also muted in January as market participants anticipated the Spring Festival.

“Expectations were that demand and in turn prices would pick up afterwards,” explained Megginson. “This restocking activity didn't immediately materialize after the Spring Festival, which led to some gloomier sentiment in China.”

Notable deals from the first month of the year included two transactions by Chinese chemical and battery manufacturer Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460,HKEX:1772).

The first, between Ganfeng and Australia’s Pilbara Minerals (ASX:PLS), amended an existing offtake agreement, increasing short- and medium-term supply of spodumene concentrate. The revised agreement will see Pilbara supply Ganfeng with up to 310,000 MT annually in 2024, 2025 and 2026, compared to the previously allotted 160,000 MT.

“The long-term outlook for the industry remains incredibly exciting. Both Ganfeng and Pilbara Minerals remain focused on extending our respective positions as major, low-cost producers in the burgeoning lithium market,” said Dale Henderson, Pilbara Minerals' managing director and CEO, in the announcement.

Subsequently, Ganfeng penned asupply agreement with South Korea’s Hyundai Motor Group (KRX:005380). The deal — effective from January 1, 2024, through December 31, 2027 — will see Ganfeng supply an undisclosed amount of battery-grade lithium hydroxide to Hyundai.

February: Lithium producers react to market pressures

As downstream players sought deals amid low prices, producers began revising production tallies.

“We also began to see some supply response to the persistent lower price environment, with the announcement of delays to expansion plans and layoffs at some lithium producers or aspirants,” Megginson said. “I only expect this to palpably impact the supply picture in 12 to 18 months from now, as that is when these expansions were planned to ramp.”

In mid-January, Albemarle (NYSE:ALB) announced it was trimming capital expenditures for the year by US$500 million year-over-year.

"The actions we are taking allow us to advance near-term growth and preserve future opportunities as we navigate the dynamics of our key end-markets," CEO Kent Masterssaid. "The long-term fundamentals for our business are strong and we remain committed to operating in a safe and sustainable manner. As a market leader, Albemarle has access to world-class resources and industry-leading technology, along with a suite of organic projects to capture growth."

A few weeks later, the US-based company entered into a long-term partnership with BMW Group (ETR:BMW) to provide the automaker with battery-grade lithium for its high-performance EVs.

ASX-listed Liontown Resources (ASX:LTR,OTC Pink:LINRF), which plans to open its Kathleen Valley lithium project mid-year, noted the precarious lithium market in a January update.

“The recent material decline in spodumene prices has triggered significant reductions in short and medium-term lithium price forecasts,” it reads. “As a result, we have commenced a review of the planned expansion and associated ramp-up of Kathleen Valley to preserve capital and reduce the near-term funding requirements of the project.”

While the company reviewed potential ways to cut overall costs, it did note that there will be any changes to its plant capacity design, which has a planned capacity of 3 million MT per year and is currently under construction.

“As lithium projects struggle to stay above water, analysts also expect M&A activity to increase as major producers with positive cash flow try to find deals in the market while junior companies try to sell projects in a market where private capitals are scarcer than previous years," a February 12 report from S&P Global stated.

March: Evolving supply and demand factors support lithium prices

The beginning of March brought on some recovery in lithium prices as both carbonate and hydroxide made gains.

After starting the month at US$14,977.15 per MT, lithium carbonate registered a five month high of US$16,109.48 on March 14. Prices for lithium hydroxide also moved northward on the London Metal Exchange, hitting a Q1 high of US$13,425 per MT on March 11.

For Megginson, the move was in line with the forecasted balancing analysts expect to see in the 2024 lithium market.

“We forecast a fairly balanced market in 2024,” the Benchmark price and data analyst said. “While the low price environment has caused some project expansions to be pushed back slightly and some of the marginal, higher cost supply has come offline — this has been mostly counterbalanced with larger producers producing more.”

He went on to outline the factors that likely brought on the momentary price rally.

“On the demand side, cathode producers in China announced that they would substantially increase production in March, some by as much as 30 percent month-over-month — albeit compared to a very low level in February as Spring Festival was taking place,” Megginson said.

The drivers on the supply side were a little more nuanced.

“Environmental inspections at lepidolite producers in Jiangxi province led to some concerns about supply from the region,” Megginson explained. “Transgressions were found in terms of the handling of lithium slag and some participants thought that supply could become constricted. In the end the impact of these inspections was relatively limited with two companies being told to take action, with the remainder recommencing normal production (as of April 5).”

Megginson went on to note that there are now “rumblings” that brine producers in the same region could undergo similar environmental inspections.

“Although downstream demand is ticking up notably at the moment, ample supply overall is likely to limit the extent of price rises in the short term,” he concluded.

In addition to price spikes, March also saw some major developments for US-focused Lithium Americas (TSX:LAC,NYSE:LAC).

The company, which is developing its Thacker Pass project in Nevada, received conditional commitment for a US$2.26 billion loan from the US Department of Energy under the Advanced Technology Vehicles Manufacturing Loan Program.

The loan is earmarked for financing the construction of the processing facilities at Thacker Pass, which Lithium Americas states has the largest known measured and indicated lithium resource in North America.

The strategic investment is designed to further strengthen the North American battery metals supply chain.

“The United States has an incredible opportunity to lead the next chapter of global electrification in a way that both strengthens our battery supply chains and ensures that the economic benefits are directed toward American workers, companies and communities,” Jonathan Evans, president and CEO of Lithium Americas, stated.

What factors will move the lithium market in 2024?

Towards the end of Q1 there was more significant news for the lithium market.

Chile, a key player in the global lithium market, unveiled the full details of its comprehensive plan to enhance lithium production and attract investment. The country explained that operations and projects in its Atacama and Maricunga salt flats will need to be majority controlled by its state operators, which will hold a 50 percent plus one share stake.

Chile also announced that it had opened up over two dozen salt flats in the country for private investment.

The new lithium policy aims to promote sustainable development while ensuring fair participation among industry stakeholders. Chile intends to streamline the permitting process for lithium projects, encouraging greater investment and boosting production. Additionally, the government plans to establish a lithium consortium to oversee research and development initiatives, facilitating technological advancements in lithium extraction and processing.

“The goal of the national strategy is to boost Chile’s lithium production, which is currently expected to rise by 20 percent to 270,000 tonnes in 2024 from 225,000 tonnes in 2023,” Fastmarkets Analyst Jordan Roberts wrote. “Low production costs in the country mean producers have been facing less pressure from the recent weakness in lithium prices.”

Megginson advises watching output from Africa.

“Although the quality of material is more variable than comparable material from for example Australia, and the continent still makes up a small proportion of overall global supply, supply of hard rock lithium concentrates from Africa is growing rapidly, especially from Zimbabwe and Namibia,” he said. “Currently, Chinese converters are responsible for the majority of the projects that are at more advanced stages. It is worth noting that many of these projects are not economical when lithium chemicals prices are significantly below RMB 150/kg.”

Lastly, Megginson is also monitoring sales activity.

“We have seen an increasing number of public auctions and pre-auctions for spodumene concentrate,” he said. “This is definitely something to look out for and I expect to see more auctions for the remainder of the year, and some similar auctions taking place for lithium chemicals as well.”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Top 7 Lithium Stocks of 2024

Unlike the fluctuations observed in 2023, the lithium market in Q1 2024 exhibited greater stability.Lithium carbonate prices, which began the quarter at US$13,377.44 per ton, concluded around US$14,874.31, reflecting an 11 percent increase.

Market oversupply prompted some lithium producers to trim 2024 output targets in hopes that some of the excess would be absorbed in the market.

Spending for project expansions and new developments was also put on the back burner to allow the market to rebalance.

“We believe we are approaching the bottom of the market, considering the industry is moving fairly deep into the cost curve. This is likely to support lithium prices as producers consider further production cuts to balance the market and stem further losses,’ a January report from Fastmarkets read.

Despite some of the challenges the lithium market faced in Q1, the companies profiled below all saw significant gains in 2023. The TSX, TSXV and ASX list was generated using TradingView’s stock screener and data was gathered on April 10. The NYSE and NASDAQ was list was compiled on April 16, 2024. All top lithium stocks had market caps above $10 million in their respective currencies when data was gathered.

1. Lithium Americas (NYSE:LAC)

Year-to-date gains: 1.49 percent; market cap: US$1.05 billion; share price: US$6.48

Lithium Americas is presently progressing its portfolio of lithium projects, including Caucharí-Olaroz and Pastos Grandes in Argentina, and Thacker Pass in Nevada, USA.

Thacker Pass is considered to have the largest known lithium reserve in the United States and the third largest globally, making it. Key resource in the US ramp up of a domestic lithium supply chain.

In mid-March the lithium company secured a US$2.26 billion loan from the US Department of Energy (DoE) to advance the Thacker Pass project.

“The United States has an incredible opportunity to lead the next chapter of global electrification in a way that both strengthens our battery supply chains and ensures that the economic benefits are directed toward American workers, companies and communities,” said Jonathan Evans, president and CEO of Lithium Americas. “The ATVM Loan … is a significant milestone for Thacker Pass, which will help meet the growing domestic need for lithium chemicals and strengthen our nation’s security.”

The DoE loan is the second large investment into Thacker Pass in the last year. In January 2023, General Motors (NYSE:GM) announced a significant investment of US$650 million in Lithium Americas for the Thacker Pass development.

The funding is the largest publicly disclosed investment by an automaker in a company focused on battery raw materials production. As part of the agreement, GM secured exclusive offtake rights to 100 percent of the lithium production from Phase 1 for a period of up to 15 years, with a right of first offer on Phase 2 production.

1. Century Lithium (TSXV:LCE)

Year-to-date gain: 78 percent; market cap: C$131.49 million; current share price C$0.89

US-focused Century Lithium is currently advancing its Clayton Valley lithium project in West-Central Nevada. The company is also completing the pilot testing phase at its lithium extraction facility in the state's Amargosa Valley.

Century Lithium began the year trading in the C$0.48 range and rose to a quarterly high of C$0.80 on March 27.

While the company made no announcements in Q1, some of its positive momentum may have resulted from two press releases from December 2023. The first provides an update on the company’s ongoing feasibility study for Clayton Valley.

“This comprehensive study covers all areas of the lithium extraction process from shallow surface mining of lithium-bearing clay to on-site production of battery-grade lithium carbonate,” the statement reads. “Target production for the study follows that of the project’s earlier Pre-Feasibility Study, which was based on a mill feed of 15,000 tonnes per day and average annual output of 27,000 tonnes per year of lithium carbonate equivalent.”

The second December announcement provides an overview of work at the extraction facility. During testwork at the pilot plant, the company achieved increased lithium grades with an average grade of 7.5 grams per liter lithium.

“This increase in concentration was attributed to the integration of Koch Technology Solutions Li-ProTM equipment into the direct lithium extraction area,” the company said at the time.

2. Lithium Chile (TSXV:LITH)

Year-to-date gain: 50.94 percent; market cap: C$164.97 million; current share price: C$0.80

South America-focused Lithium Chile owns several lithium land packages in Chile and Argentina. Presently, the explorer is working to delineate the deposit at its Salar de Arizaro property in Argentina.

Company shares initially trended down, but ultimately rose 32 percent between January 1 and the end of February.

On February 28, the company released “favorable” results from a new drill hole completed on the northeastern side of Salar de Arizaro, calling them an important step in its roadmap. Hole ARDDH-08 was drilled to a depth of 606 meters, encountering a brine-rich sandy formation at 200 meters. Samples were sent to Alex Stewart Laboratory in Jujuy, Argentina, revealing lithium grades of 180 milligrams per liter at 50 meters and 690 milligrams per liter at 200 meters.

In early March, Lithium Chile penned a farm-In agreement with European mining company Eramet (EPA:ERA). The agreement aims to expedite exploration efforts on four of Lithium Chile's Chilean properties — Llamara, Aguilar, Rio Salado and Aquas Caliente — with a total land area exceeding 40,000 hectares

3. Power Metals (TSXV:PWM)

Year-to-date gain: 24 percent; market cap: C$55.22 million; current share price: C$0.35

Exploration company Power Metals holds a portfolio of diversified assets in Ontario and Quebec, Canada.

In late February, Power Metals commenced a winter drill program at its Case Lake property in Northeastern Ontario. The program was designed to expand and define lithium-cesium-tantalum mineralization, building on previous work by the company that revealed high-grade lithium and cesium mineralization.

Company shares traded flatly for most of Q1, locked in the C$0.27 range. Prices began to rise in mid-March and hit a three month high of C$0.43 on March 31. The 59 percent uptick coincided with news that Power Metals was acquiring the 7,000 hectare Pelletier project, which consists of 337 mineral claims in Northeast Ontario.

According to the company, the project features lithium-cesium-tantalum potential, with peraluminous S-type pegmatitic granites intruding into metasedimentary and amphibolite formations.

1. Prospect Resources (ASX:PSC)

Year-to-date gain: 46.07 percent; market cap: AU$40.31 million; current share price: AU$0.13

Africa-focused exploration company Prospect Resources holds a diversified portfolio of assets located in Zimbabwe, Zambia and Namibia. Its lithium properties — Omarur and Step Aside — are in Namibia and Zimbabwe, respectively.

Shares of Prospect were locked below AU$0.08 from January to mid-March, before rising to a Q1 high of AU$0.09 on March 25. The move occurred shortly after Prospect acquired a 60 percent residual interest in the Omarur property from Osino Resources (TSXV:OSI,OTCQX:OSIF) for US$75,000, taking Prospect’s stake to 100 percent.

Earlier in the quarter, Prospect announced the start of Phase 2 drilling at Omarur. The company said the program will consist of 70 rotary air blast and reverse-circulation drill holes across 4,250 metres.

2. Ioneer (ASX:INR)

Year-to-date gain: 33.33 percent; market cap: AU$432.96 million; current share price: AU$0.20

Emerging producer Ioneer owns the Rhyolite Ridge lithium-boron project in Nevada, US. According to the company, the project is considered the “sole lithium-boron deposit in North America.”

As part of the permitting process for Rhoylite Ridge, Ioneer completed and submitted an administrative draft environmental impact statement to the US Bureau of Land Management (BLM) in mid-January.

After slipping to a first quarter low of AU$0.10 on January 25, shares of Ioneer spent February and March slowly climbing, reaching a quarterly high of AU$0.17 on March 25. News that the BLM has reached a final decision continued to add tailwinds at the beginning of the second quarter; the results of the review are expected in mid-April.

3. Pan Asia Metals (ASX:PAM)

Year-to-date gain: 28 percent; market cap: AU$26.85 million; current share price: AU$0.16

ASX-listed Pan Asia Metals is a mineral exploration company with a diverse portfolio of projects in Southeast Asia, particularly Thailand. Specialising in critical metals such as lithium, tantalum and rare earth elements, the company is also actively engaged in exploration activities in South America.

Shares of Pan Asia Metals rose to a Q1 high of AU$0.21 during the first week of January. The spike came when the company entered into three binding option agreements to secure ownership of the Dolores North, Dolores South, Pozon and Pink project areas, which together comprise the Tama Atacama lithium brine project in Chile; it also agreed to acquire the Ramatidas project area. In total, these assets span about 120,000 hectares.

“The Tama Atacama lithium project has the potential to be one of the largest lithium brine projects in the global peer group. Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied,” said Pan Asia Metals Managing Director Paul Lock.

Shares subsequently shed some of the positivity, spending the rest of the quarter rangebound below AU$0.17.

FAQs for investing in lithium

How much lithium is on Earth?

While we don't know how much total lithium is on Earth, the US Geological Survey estimates that global reserves stand at 22 billion MT. Of that, 9.2 billion MT are located in Chile, and 5.7 billion MT are in Australia.

Where is lithium mined?

Lithium is mined throughout the world, but the two countries that produce the most are Australia and Chile. Australia's lithium comes from primarily hard-rock deposits, while Chile's comes from lithium brines. Chile is part of the Lithium Triangle alongside Argentina and Bolivia, although those two countries have a lower annual output.

Rounding out the top five lithium-producing countries behind Australia and Chile are China, Argentina and Brazil.

What is lithium used for?

Lithium has a wide variety of applications. While the lithium-ion batteries that power electric vehicles, smartphones and other tech have been making waves, it is also used in pharmaceuticals, ceramics, grease, lubricants and heat-resistant glass. Still, it is largely the electric vehicle industry that is boosting demand.

Is lithium a good investment?

The lithium price has seen huge success over the past year, and many stocks are up alongside that. It's up to investors to decide if it's time to get in on the market, or if they’ll try to wait for a dip.

A wide variety of analysts are bullish on the market as electric vehicles continue to prosper, and lithium demand from that segment alone is expected to continue to rise. These experts believe the lithium story's strength will continue over the next decades as producers struggle to meet rapidly growing demand.

How to invest in lithium?

Unlike many commodities, investors cannot physically hold lithium due to its dangerous properties. However, those looking to get into the lithium market have many options when it comes to how to invest in lithium.

Lithium stocks like those mentioned above could be a good option for investors interested in the space. If you’re looking to diversify instead of focusing on one stock, there is the Global X Lithium & Battery Tech ETF (NYSE:LIT), an exchange-traded fund (ETF) focused on the metal. Experienced investors can also look at lithium futures.

How to buy lithium stocks?

Lithium stocks can be found globally on various exchanges. Through the use of a broker or an investing service such as an app, investors can purchase individual stocks and ETFs that match their investing outlook.

Before buying a lithium stock, potential investors should take time to research the companies they’re considering; they should also decide how many shares will be purchased, and what price they are willing to pay. With many options on the market, it's critical to complete due diligence before making any investment decisions.

It's also important for investors to keep their goals in mind when choosing their investing method. There are many factors to consider when choosing a broker, as well as when looking at investing apps — a few of these include the broker or app's reputation, their fee structure and investment style.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Century Lithium is a client of the Investing News Network. This article is not paid-for content.

Top 7 Canadian Lithium Stocks of 2024

After a tumultuous 2023 that saw prices for lithium carbonate shed 80 percent, Q1 2024 was much less volatile.

Starting the year at US$13,377.44 per metric ton, lithium carbonate prices ended the three month period in the US$14,874,31 range, up 11 percent. Strong electric vehicle sales in January helped sustain lithium prices into February.

Prices began climbing at the end of the month and through March, reaching a Q1 high of US$16,109. The rally came on the back of optimism that lithium demand for batteries and energy storage is locked in an “irreversible” growth trend.

"If lithium prices can stabilize between 80,000 and 150,000 yuan, leaving upstream and downstream (companies) along the industry chain certain profit, it might be the best development environment for the whole industry," Li Liangbin, chair of Ganfeng Lithium (OTC Pink:GNENF,HKEX:SZSE:002460), told Reuters.

That currently converts to about US$11,050 to US$20,725.

Against that backdrop, a number of Canada-listed lithium companies saw share price growth during Q1. This list was created on April 10, 2024, using TradingView‘s stock screener, and all data was current at that time. Only companies with market caps above C$10 million for the TSX and TSXV and above C$5 million for the CSE are included.

TSX and TSXV lithium stocks

1. Century Lithium (TSXV:LCE)

Year-to-date gain: 78 percent; market cap: C$131.49 million; current share price C$0.89

US-focused Century Lithium is currently advancing its Clayton Valley lithium project in West-Central Nevada. The company is also completing the pilot testing phase at its lithium extraction facility in the state's Amargosa Valley.

Century Lithium began the year trading in the C$0.48 range and rose to a quarterly high of C$0.80 on March 27.

While the company made no announcements in Q1, some of its positive momentum may have resulted from two press releases from December 2023. The first provides an update on the company’s ongoing feasibility study for Clayton Valley.

“This comprehensive study covers all areas of the lithium extraction process from shallow surface mining of lithium-bearing clay to on-site production of battery-grade lithium carbonate,” the statement reads. “Target production for the study follows that of the project’s earlier Pre-Feasibility Study, which was based on a mill feed of 15,000 tonnes per day and average annual output of 27,000 tonnes per year of lithium carbonate equivalent.”

The second December announcement provides an overview of work at the extraction facility. During testwork at the pilot plant, the company achieved increased lithium grades with an average grade of 7.5 grams per liter lithium.

“This increase in concentration was attributed to the integration of Koch Technology Solutions Li-ProTM equipment into the direct lithium extraction area,” the company said at the time.

2. Lithium Chile (TSXV:LITH)

Year-to-date gain: 50.94 percent; market cap: C$164.97 million; current share price: C$0.80

South America-focused Lithium Chile owns several lithium land packages in Chile and Argentina. Presently, the explorer is working to delineate the deposit at its Salar de Arizaro property in Argentina.

Company shares initially trended down, but ultimately rose 32 percent between January 1 and the end of February.

On February 28, the company released “favorable” results from a new drill hole completed on the northeastern side of Salar de Arizaro, calling them an important step in its roadmap. Hole ARDDH-08 was drilled to a depth of 606 meters, encountering a brine-rich sandy formation at 200 meters. Samples were sent to Alex Stewart Laboratory in Jujuy, Argentina, revealing lithium grades of 180 milligrams per liter at 50 meters and 690 milligrams per liter at 200 meters.

In early March, Lithium Chile penned a farm-In agreement with European mining company Eramet (EPA:ERA). The agreement aims to expedite exploration efforts on four of Lithium Chile's Chilean properties — Llamara, Aguilar, Rio Salado and Aquas Caliente — with a total land area exceeding 40,000 hectares

3. Power Metals (TSXV:PWM)

Year-to-date gain: 24 percent; market cap: C$55.22 million; current share price: C$0.35

Exploration company Power Metals holds a portfolio of diversified assets in Ontario and Quebec, Canada.

In late February, Power Metals commenced a winter drill program at its Case Lake property in Northeastern Ontario. The program was designed to expand and define lithium-cesium-tantalum mineralization, building on previous work by the company that revealed high-grade lithium and cesium mineralization.

Company shares traded flatly for most of Q1, locked in the C$0.27 range. Prices began to rise in mid-March and hit a three month high of C$0.43 on March 31. The 59 percent uptick coincided with news that Power Metals was acquiring the 7,000 hectare Pelletier project, which consists of 337 mineral claims in Northeast Ontario.

According to the company, the project features lithium-cesium-tantalum potential, with peraluminous S-type pegmatitic granites intruding into metasedimentary and amphibolite formations.

4. Q2 Metals (TSXV:QTWO)

Year-to-date gain: 24 percent; market cap: C$27.71 million; current share price: C$0.31

Exploration firm Q2 Metals is exploring its flagship Mia lithium property in the Eeyou Istchee James Bay region of Québec, Canada. The property contains the Mia trend, which spans over 10 kilometers. Also included in Q2's portfolio is the Stellar lithium property, comprising 77 claims and located 6 kilometers north of the Mia property.

Company shares were trading below C$0.20 for most of January and February. On February 27, Q2 rose rapidly, climbing from C$0.19 on February 26 to the C$0.45 level to end the month.

The share price growth corresponded with the the completion of a winter drill program.

“The winter drill program at the Mia Property has confirmed the spodumene mineralized pegmatite at the western end of the Mia Trend,” Neil McCallum, Q2's vice president of exploration, said at the time. “The drilling has successfully evaluated a large portion of the Mia Trend that had been explored at the surface.”

Days later, Q2 reported the acquisition of the 11,374 hectare Cisco lithium property, also located in the Eeyou Istchee James Bay region. The upward trend continued, and shares reached a Q1 high of C$0.51 on March 4.

5. Volt Lithium (TSXV:VLT)

Year-to-date gain: 23.91 percent; market cap: C$37.14 million; current share price: C$0.28

Volt Lithium is a lithium development and technology company aiming to become a premier North American lithium producer utilizing its unique technology to extract lithium from oilfield brines.

In late January, Volt made its first announcement of 2024, highlighting its success in producing 99.5 percent battery-grade lithium carbonate. The achievement happened at the company’s demonstration plant in Calgary, Alberta.

Commenting on the milestone, CEO Alex Wylie expressed his excitement. “The Volt team continues to advance our DLE capabilities at our demonstration plant and showcased our ability to transform oilfield brine into a commercially saleable grade of lithium carbonate," he said. “Bringing the full-cycle process in-house greatly reduces the cost to produce lithium carbonate, which is expected to enhance margins and position Volt as a low-cost operator.”

The cost savings were reiterated in late February, when the company announced a 64 percent reduction in full-cycle direct lithium extraction operating costs at the Calgary-based demonstration plant.

Volt's share price marked a Q1 high of C$0.27 on March 12.

CSE lithium stocks

1. Foremost Lithium (CSE:FAT)

Year-to-date gain: 18.69 percent; market cap: C$19.17 million; current share price: C$4

Foremost Lithium is an exploration company with hard-rock lithium properties in Snow Lake, Manitoba, and Lac Simard South, Québec. Included in the company’s portfolio is the Winston gold-silver property in New Mexico, US.

In January, Foremost received its third C$300,000 grant from the Manitoba Mineral Development Fund. The funds have been earmarked for continued exploration and drilling at the Snow Lake property.

Throughout the first quarter, Foremost released several updates, including the receipt of a multi-year work permit for the Jean Lake lithium-gold project in Manitoba, the start of a drill program at the Zoro lithium property in the Snow Lake region and the of filing an application for C$10 million from Canada’s Critical Minerals Infrastructure Fund.

Shares of the company hit a high for the first quarter of C$4.51 in late February, when Foremost released promising intercepts from the Zoro property drill program.

“The presence of spodumene and the length of pegmatite encountered in multiple holes, highlighted by over 32-meters of spodumene-bearing pegmatite hit in one hole, are very positive in terms of the potential for our maiden resource to now grow in significant scale,” Jason Barnard, president and CEO of Foremost Lithium, said in a February 27 statement.

“As drilling progresses, the focus will continue to build resource to the south of Dyke 1, a promising new uncharted area, which has confirmed spodumene pegmatite as drilling progresses.”

2. Quantum Battery Metals (CSE:QBAT)

Year-to-date gain: 5.56 percent; market cap: C$6.9 million; current share price: C$0.19

Exploration company Quantum Battery Metals is focused on identifying lithium and cobalt deposits in Canada.

In mid-January, the company announced it was actively looking to “acquire additional properties to expand on its portfolio to help address the world's shortage in technology metals.”

The statement continues, “There is an increasing demand for metals as the world is transitioning to a low-carbon economy and global conflicts continue to arise that require massive amounts of metals for producing batteries, clean energy technologies, and national defense applications.”

Subsequently, Quantum submitted a letter of intent to acquire the Copper Coffer property in Newfoundland, Canada.

Company shares reached a Q1 high of C$0.20 on March 17, and ended the three month session in the same range.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Century Lithium is a client of the Investing News Network. This article is not paid-for content.

Top 4 ASX Lithium Stocks of 2024

In contrast to the volatility of 2023, Q1 2024 saw a more stable lithium market. Prices for lithium carbonate started the period at US$13,377.44 per tonne and finished at US$14,874.31, marking an 11 percent increase.

Strong electric vehicle sales in January helped support prices for the important battery metal, which continued to rise through February and March, reaching a quarterly high of US$16,109. This rally was fueled by reports from China indicating a sustained growth trend in lithium demand for batteries and energy storage technology.

Here the Investing News Network looks at the top four ASX-listed lithium companies by year-to-date gains. The list below was generated using TradingView’s stock screener on April 10, 2024, and includes companies that had market caps above AU$10 million at that time. Read on to learn more about their activities over the past year.

1. Prospect Resources (ASX:PSC)

Year-to-date gain: 46.07 percent; market cap: AU$40.31 million; current share price: AU$0.13

Africa-focused exploration company Prospect Resources holds a diversified portfolio of assets located in Zimbabwe, Zambia and Namibia. Its lithium properties — Omarur and Step Aside — are in Namibia and Zimbabwe, respectively.

Shares of Prospect were locked below AU$0.08 from January to mid-March, before rising to a Q1 high of AU$0.09 on March 25. The move occurred shortly after Prospect acquired a 60 percent residual interest in the Omarur property from Osino Resources (TSXV:OSI,OTCQX:OSIF) for US$75,000, taking Prospect’s stake to 100 percent.

Earlier in the quarter, Prospect announced the start of Phase 2 drilling at Omarur. The company said the program will consist of 70 rotary air blast and reverse-circulation drill holes across 4,250 metres.

2. Ioneer (ASX:INR)

Year-to-date gain: 33.33 percent; market cap: AU$432.96 million; current share price: AU$0.20

Emerging producer Ioneer owns the Rhyolite Ridge lithium-boron project in Nevada, US. According to the company, the project is considered the “sole lithium-boron deposit in North America.”

As part of the permitting process for Rhoylite Ridge, Ioneer completed and submitted an administrative draft environmental impact statement to the US Bureau of Land Management (BLM) in mid-January.

After slipping to a first quarter low of AU$0.10 on January 25, shares of Ioneer spent February and March slowly climbing, reaching a quarterly high of AU$0.17 on March 25. News that the BLM has reached a final decision continued to add tailwinds at the beginning of the second quarter; the results of the review are expected in mid-April.

3. Pan Asia Metals (ASX:PAM)

Year-to-date gain: 28 percent; market cap: AU$26.85 million; current share price: AU$0.16

ASX-listed Pan Asia Metals is a mineral exploration company with a diverse portfolio of projects in Southeast Asia, particularly Thailand. Specialising in critical metals such as lithium, tantalum and rare earth elements, the company is also actively engaged in exploration activities in South America.

Shares of Pan Asia Metals rose to a Q1 high of AU$0.21 during the first week of January. The spike came when the company entered into three binding option agreements to secure ownership of the Dolores North, Dolores South, Pozon and Pink project areas, which together comprise the Tama Atacama lithium brine project in Chile; it also agreed to acquire the Ramatidas project area. In total, these assets span about 120,000 hectares.

“The Tama Atacama lithium project has the potential to be one of the largest lithium brine projects in the global peer group. Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied,” said Pan Asia Metals Managing Director Paul Lock.

Shares subsequently shed some of the positivity, spending the rest of the quarter rangebound below AU$0.17.

4. Mineral Resources (ASX:MIN)

Year-to-date gain: 2.45 percent; market cap: AU$13.81 billion; current share price: AU$71.61

Diversified miner Mineral Resources holds a portfolio of assets in Australia, including lithium and iron ore projects.

Following a share price slump early in the year's first quarter, the company began to rebound in mid-January. On February 21, shares rose to AU$67.69 following the release of Mineral Resources' latest financial results.

The half-year reporting period, which ended on December 31, 2023, saw the company's lithium operations perform well, benefiting from higher lithium prices and increased production volumes.

Shares marked a Q1 high of AU$70.98 at the end of March, when Mineral Resources announced plans to develop a lithium-processing hub in Western Australia's Goldfields region. It aims to capitalise on lithium-ion battery demand.

Plans for the hub include the construction of a lithium hydroxide and carbonate plant, as well as associated infrastructure to support the production of battery-grade lithium chemicals.

FAQs for investing in lithium

What is lithium?

Lithium is the lightest metal on the periodic table, and it is used in a wide variety of applications, including lithium-ion batteries, pharmaceuticals and industrial applications like glass and steel.

How do lithium-ion batteries work?

Rechargeable lithium-ion batteries work by using the flow of lithium ions in the battery's cell to power a device.

A lithium-ion battery has one or more cells, depending on the amount of energy storage it is capable of, and each cell has a positive electrode and negative electrode with an electrolyte separating them. When the battery is in use, lithium ions flow from the negative electrode to the positive electrode, running out of power once all have transferred. When the battery is charging, ions flow the opposite way.

Where is lithium mined?

Lithium is mined from two types of deposits, hard rock and evaporated brines. Most of the world's lithium production comes out of Australia, which hosts the Greenbushes hard-rock lithium mine. The next-largest producing country is Chile, which like Argentina and Bolivia is located in South America's Lithium Triangle. Lithium in this famed area comes from evaporated brines, including the Salar de Atacama. Lithium can also be found in sedimentary deposits, but currently none are producing.

Where is lithium found in Australia?

Australia is the world’s top producer of lithium, and the country’s lithium mines are all located in Western Australia except for one, which is Core Lithium’s (ASX:CXO,OTC Pink:CXOXF) Finniss mine in the Northern Territory. Western Australia accounts for around half of global lithium production, and the state is looking to become a hub for critical elements.

Who owns lithium mines in Australia?

Several companies own lithium mines in Australia, including some of the biggest ASX lithium stocks. In addition to the entities discussed above, others include: Pilbara Minerals (ASX:PLS,OTC Pink:PILBF) with its Pilgangoora operations; Arcadium Lithium with the Mount Cattlin mine; Jiangxi Ganfeng Lithium (HKEX:0358), which owns the Mount Marion mine alongside Mineral Resources (ASX:MIN,OTC Pink:MALRF); and Tianqi Lithium (SZSE:002466), which is a partial owner of Greenbushes via its stake in operator Talison Lithium.

Who is Australia’s largest lithium producer?

Australia’s largest lithium producer is Albemarle, which has interests in both the Greenbushes and Wodgina hard-rock lithium mines. Greenbushes is the world’s largest lithium mine, and Albemarle holds 49 percent ownership of operator Talison Lithium’s parent company. Albermarle also has 60 percent ownership of Mineral Resources’ Wodgina mine, and owns the Kemerton lithium production facility as part of a 60/40 joint venture with Mineral Resources.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Georgia Williams, currently hold no direct investment interest in any company mentioned in this article.

RecycLiCo Grants Stock Options

RecycLiCo Battery Materials Inc. (“RecycLiCo” or the “Company”), TSX.V: AMY, OTCQB: AMYZF, FSE: ID4, has granted an aggregate of 3,000,000 stock options to Kurt Lageschulte, director pursuant to the Company's omnibus equity incentive plan. The stock options have an exercise price of $0.16 per share and an expiry date of April 12, 2029.

About RecycLiCo

RecycLiCo Battery Materials Inc. is a battery materials company specializing in sustainable lithium-ion battery recycling and materials production. RecycLiCo has developed advanced technologies that efficiently recover battery-grade materials from lithium-ion batteries, addressing the global demand for environmentally friendly solutions in energy storage. With minimal processing steps and up to 99% extraction of lithium, cobalt, nickel, and manganese, the patented, closed-loop hydrometallurgical process turns lithium-ion battery waste into battery-grade cathode precursor, lithium hydroxide, and lithium carbonate for direct integration into the re-manufacturing of new lithium-ion batteries.

For more information, please contact:

Teresa Piorun

Senior Corporate Secretary

Telephone: 778-574-4444

Email: InvestorServices@RecycLiCo.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. Forward–looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurate or true. Investors should not place undue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

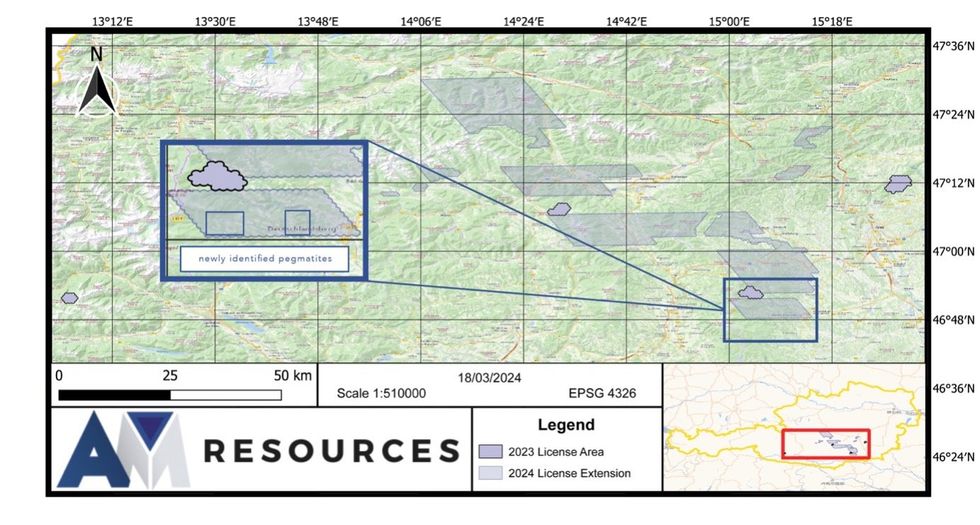

AM Resources Identifies 26 New Pegmatites for a Total of 187 Pegmatites on its 1,500 km² Land Package in Austria

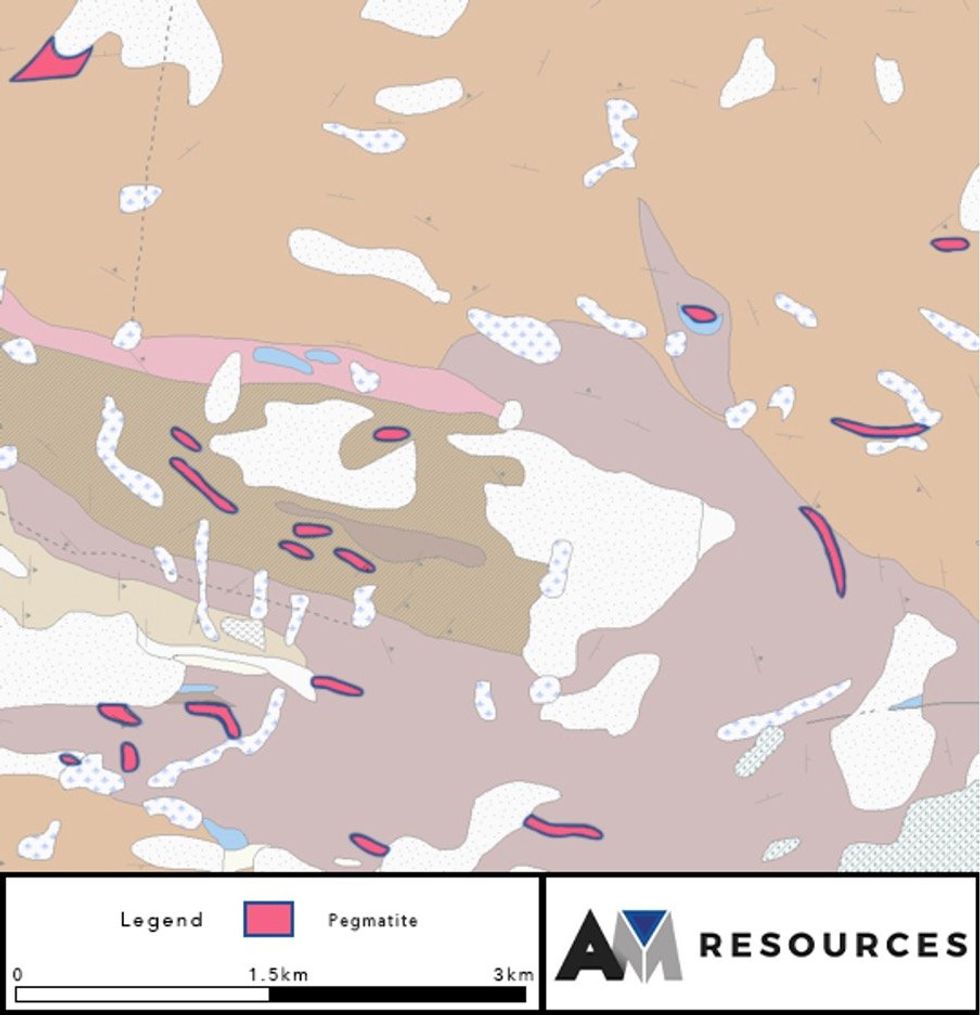

AM Resources Corporation (“AM Resources” or the “Company”) (TSXV: AMR) (Frankfurt: 76A), a dynamic junior mining company focused on the exploration and development of high-potential pegmatite lithium deposits, is pleased to announce the discovery of 26 new pegmatites as a result of its ongoing compilation of government databases since it acquired its 1,500 km2 land package (see press release dated March 21, 2024). AM Resources has now identified a total of 187 pegmatites, consolidating its strategic position in one of Austria’s most prospective lithium areas.

- Recently announced 1,500 km2 land package gives AM Resources control over a large area of the Austrian Pegmatite Belt.

- Ongoing compilation of government data resulted in the discovery of 26 additional pegmatites across two groups, with sizes ranging from 102 metres to 887 metres.

- Many pegmatites are strategically located within mica schists, indicating favorable conditions for lithium-bearing minerals.

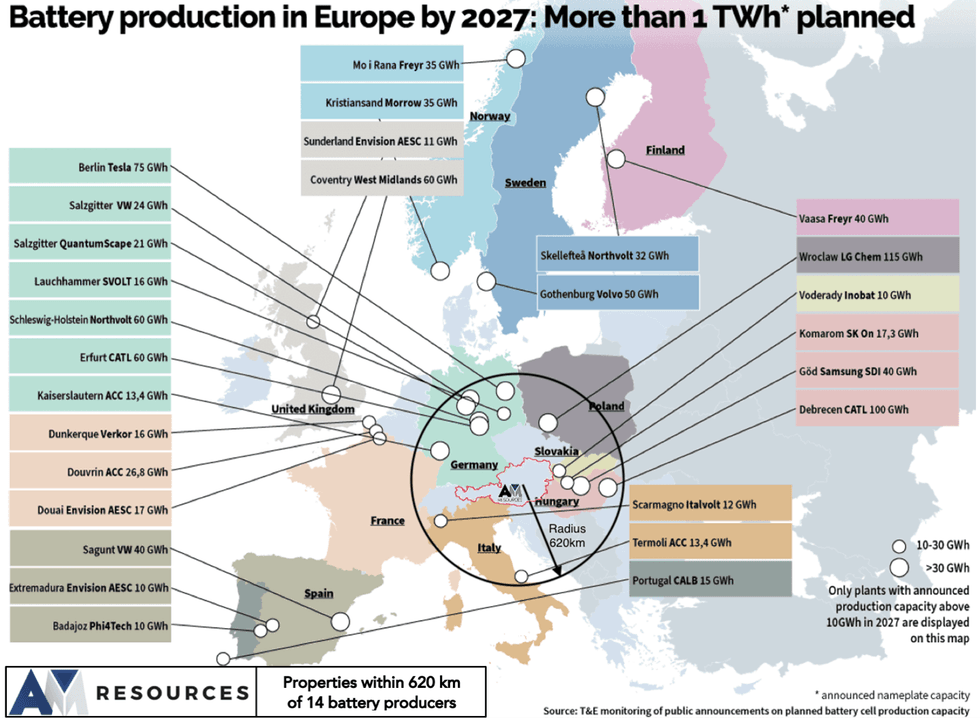

- Latest discoveries continue to reinforce AM Resources' position in the Austrian Pegmatite Belt, located within proximity to European battery manufacturers.

AM Resources’ 1,500 km2 land package

First Group

The Company has identified 8 large pegmatites with lengths varying between 329 metres and 887 metres, with the most extensive pegmatite measuring an impressive 281 metres in width.

Second Group

An additional 18 pegmatites ranging from 102 metres to 560 metres in length were discovered, with the thickest pegmatite reaching 195 metres in width. This group's diversity in size and shape adds to the prospectivity of AM Resources’ holdings. Many of these pegmatites are located within mica schists, a geological setting favorable for the presence of lithium-bearing minerals.

David Grondin, CEO of AM Resources commented: “Since the acquisition, we've been compiling the data available to us in preparation for our upcoming exploration program scheduled for June. We are very pleased with the number and size of the pegmatites found so far. Once we finish compiling the data, we'll have a better picture of the work that needs to be done to fully evaluate the lithium potential of our properties.”

Location, Location, Location

Qualified Person

Technical information related in this news release has been reviewed and verified by Jean Lafleur, P. Geo., of PJLEXPL Inc., a registered geologist with the Ordre des Géologues du Québec (OGQ #833) and is a qualified person (QP) as defined by NI 43-101. Mr. Lafleur is independent from the Company and has reviewed and approved the disclosure of the AM Resources geological information.

About AM Resources

AM Resources Corporation (TSXV: AMR) is a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits. With a strategic portfolio of assets and a commitment to responsible resource development, the Company is dedicated to creating long-term value for its stakeholders while adhering to the highest standards of corporate governance and sustainability.

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AM Resources to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “estimates”, “intends”, “anticipates” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. AM Resources does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

David Grondin

AM Resources Corporation

President and Chief Executive Officer

1-514-583-3490

Latest News

Balkan Mining and Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.