- India

- International

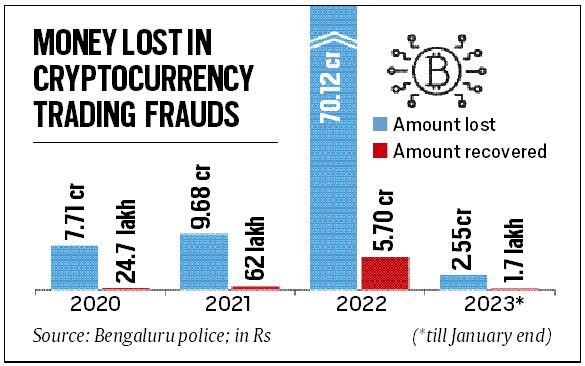

IT capital Bengaluru scammed of Rs 70 crore in crypto-trading frauds in 2022

Criminal Investigation Department (CID) Superintendent of Police Suman D Pennekar blamed the success of these frauds on lack of awareness on cryptocurrency trading.

Bengaluru police said cases related to cryptocurrency are hard to crack because of the modus operandi. (Representational/File)

Bengaluru police said cases related to cryptocurrency are hard to crack because of the modus operandi. (Representational/File)On October 10 last year, a 28-year-old software engineer received a WhatsApp message from “Lilly”. The “accidental” text was followed by conversations spanning nearly three weeks, during which she expressed her desire to visit India and learn more about the techie’s family. Since he had mentioned a financial problem, Lilly offered a solution — buy cryptocurrency and invest it on a portal she traded on. He invested Rs 3.5 lakh. Over the next two months, he took loans from three banks and made his girlfriend avail a loan of Rs 25 lakh. It was only when he lost a whopping Rs 59 lakh that the Bengaluru resident realised he had been conned.

The couple are among the many victims of cryptocurrency trading scams in Bengaluru. According to estimates, of the Rs 274 crore lost to cybercrimes in the city in 2022, Rs 70 crore (almost 25 per cent) alone was lost to frauds related to cryptocurrency trading, an increase of 624 per cent from the previous year.

According to data released by KuCoin, a global cryptocurrency exchange, in August last year, India had an estimated 115 million cryptocurrency investors.

Bengaluru police said cases related to cryptocurrency are hard to crack because of the modus operandi.

An officer attached to the cybercrime police station said, “These scams are usually carried out via advertisements on social media, including Instagram and Facebook. Because scammers offer very attractive returns in a matter of minutes, people fall into their trap quite easily.”

Explaining the scam, the officer continued, “These are pig butchering or romance scams where the scammers initiate a conversation with potential victims through social media or other platforms. Once they establish a degree of trust, they encourage their victims to invest in cryptocurrency trading. Claiming to have insider tips, they guarantee good returns. The scammers ask the victims to download a seemingly authentic application or go to a website — both controlled by them — to make the investment in cryptocurrency. Once a good amount has been invested by the victims, the transactions disappear on the blockchain [a system in which records of cryptocurrency payments are maintained across several linked computers] since the platforms are fake.”

The Federal Bureau of Investigation (FBI) in the United States has called the scam “a fraud that is heavily scripted and contact intensive”.

“Like phishing messages we receive on our mobile phones, cryptocurrency scam messages too are directed towards investors and sent out in bulk. Some even fall prey to these scams. Social media is a great tool to target vulnerable citizens to invest their money,” said a cybercrime police officer.

Another victim of fraudulent cryptocurrency trading was a 23-year-old Bengaluru resident, who saw the profile of a “certified cryptocurrency trader” on Instagram. When the youth contacted the scammer, he was shown investment plans that guaranteed to double his investment in just 20-30 minutes. The victim invested Rs 5,000 immediately. A few minutes later, he received a WhatsApp message informing him that he had made Rs 10,400 on his investment. But there was a catch — he would need to pay taxes and other charges to withdraw his “profit”. In just two days, he lost Rs 78,543 to fraudsters.

Criminal Investigation Department (CID) Superintendent of Police Suman D Pennekar blamed the success of these frauds on lack of awareness on cryptocurrency trading.

Another officer said, “During lockdown, many people wanted to invest in cryptocurrencies and stocks. Many chose cryptocurrency over stocks since the returns were higher. The problem started when people started investing in third-party applications rather than exchanges and lost their money.”

In March 2021, Elon Musk, the current CEO of Twitter, created ripples when he announced that a Tesla could be paid for in Bitcoins. A Bitcoin that cost about Rs 17.72 lakh in December 2020 shot up to Rs 44.54 lakh by March. Such was Musk’s influence, that many across the globe started investing in the virtual currency.

Vineet Kumar, founder and president of Cyber Peace Foundation, a cyber security firm, said, “There is less awareness but high demand for cryptocurrency trade in India. When the Indian stock market crashed during the lockdown, people did not know where to invest. Cryptocurrencies were thriving at that point. There were advertisements everywhere promoting cryptocurrencies on social media. The returns were attractive and the time for the returns was very less.”

On the challenges faced in investigating such cases, Joint Commissioner of Police (Crime) S D Sharanappa said, “Anonymity is a huge challenge (for investigators) when it comes to cybercrime. The fake SIM cards, bank accounts and the use of VPN (virtual private network) make it more complex. The public needs to do some research before trading on cryptocurrency platforms.”

Last April, the Central Crime Branch (CCB) arrested four cybercriminals. Sharing the case details, Sharanappa said, “The accused had created about 900 WhatsApp groups. Their own people pretended to be customers who had received good returns. In a matter of three months, the firm collected Rs 20 crore in the name of investment in ‘Helium’, a new cryptocurrency. One fine day, they removed their application from Google Play Store and shut down all the WhatsApp groups to siphon the money.”

According to recent Reserve Bank of India data, based on the date of occurrence of frauds, the total number of frauds in the banking system during April-September 2022-23 were 1,915, involving an amount of Rs 305 crore. The number of frauds in various banking operations based on the date of reporting stood at 5,406, involving Rs 19,485 crore during the first six months of the current fiscal.

Apr 26: Latest News

- 01

- 02

- 03

- 04

- 05