According to a Monday filing, the judge overseeing the case of the bankrupt Bitcoin miner Core Scientific approved the transfer of about $20 million worth of the company’s equipment to its exclusive energy negotiator, Priority Power Management. The miner stopped paying PPM in May 2022, and the energy negotiator alleged it is owed about $30 million.

Court Approves Transfer of $20 Million Worth of Core Scientific’s Equipment

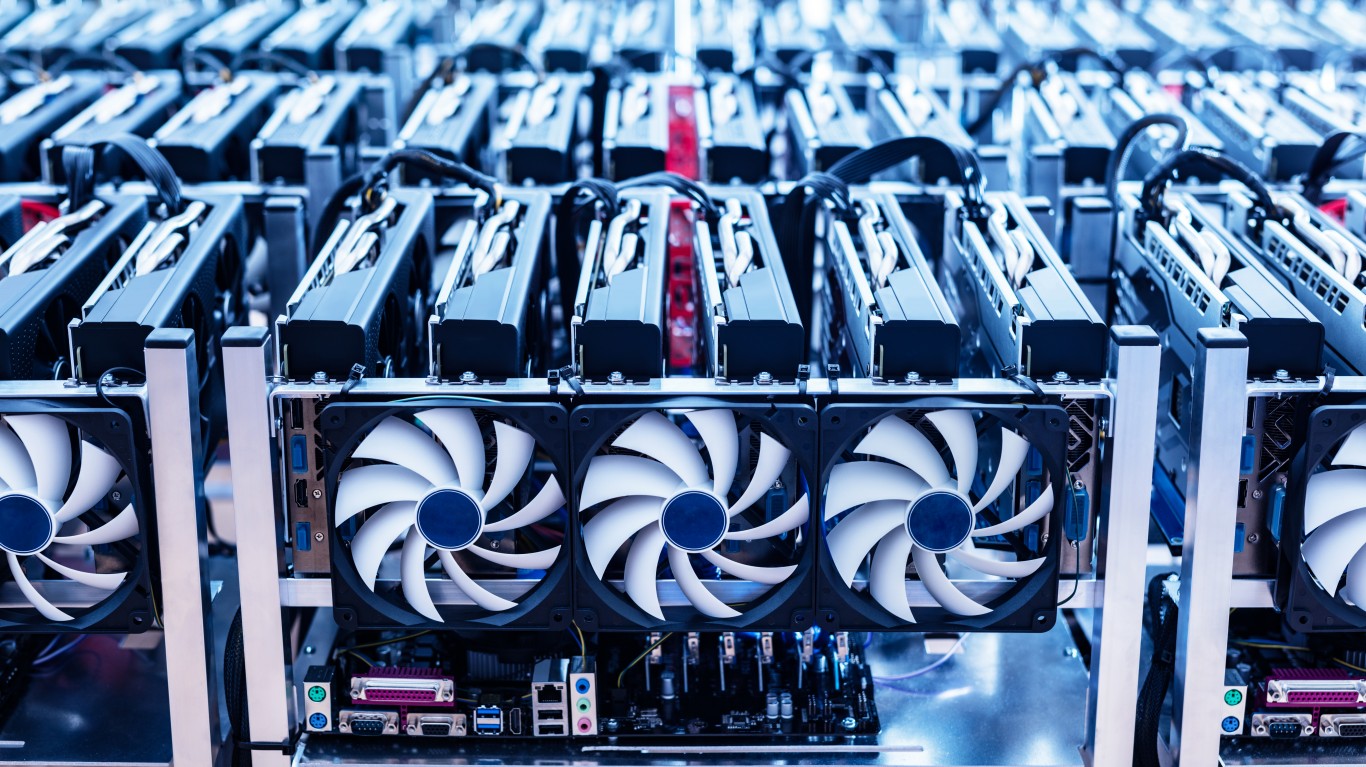

According to a filing from March 20th, the bankrupt Bitcoin Miner Core Scientific is to transfer the ownership of equipment worth about $20 million to its exclusive energy negotiator, Priority Power Management. The two companies entered into a partnership in 2021 but by May 2022, “after it became clear that the Facilities would not receive the anticipated power load, Core stopped making payments for various services and goods provided by PPM to Core under the Construction Agreement”.

As a result, a dispute emerged that was resolved, according to another court filing, “after extensive and good faith negotiations” it was agreed that PPM is to have a claim worth $20,800,674. Today’s approval of the transfer of Core Scientific’s equipment resolves the claim.

As a result of the “crypto winter” that plagued the industry throughout 2022, Core Scientific warned of bankruptcy and revealed it would be unable to pay some of its bills already in late October. By late December, the warnings materialized and the embattled Bitcoin miner filed for chapter 11 protection.

Bitcoin Miners Get Respite After a Grueling Year

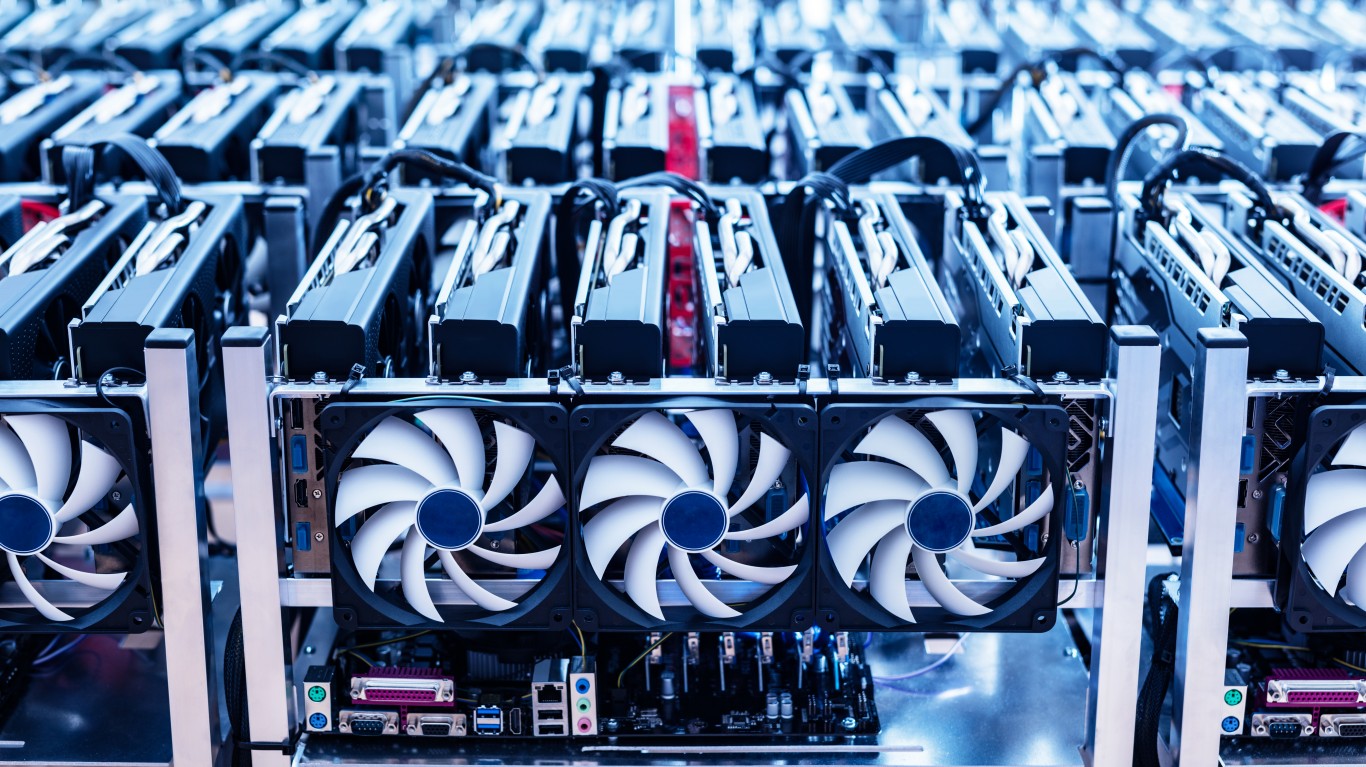

The previous year proved a perfect storm for Bitcoin miners who, at the same time, faced skyrocketing energy prices, and plunging digital asset values. Indeed, by late December, public miners reported they were forced to sell nearly 100% of their mined cryptocurrency. The start of 2023, however, finally brought respite.

January proved to be one of the best for Bitcoin in a decade and offered a notable rally throughout the industry. While the upturned was somewhat stifled by aggressive regulatory actions in February, the world’s largest cryptocurrency soared to over $28,000—a high not seen since last June—as investors started seeking refuge from the ongoing banking crisis of confidence.

Bitcoin miners are also, seemingly getting some legal protections in the US, albeit at the state level. In late February, Montana passed a bill protecting miners from discriminatory energy prices and bans imposed by local administrations. Just weeks later, Missouri voted in favor of a similar bill guaranteeing the right to mine both at home, and in an industrial setting.

This article originally appeared on The Tokenist

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.