Mooners and Shakers: Bitcoin steady; Nasdaq set for crypto custody by end of Q2; Amazon has NFT plans?

Coinhead

Coinhead

Morning, Coinheads. Another week, another bunch of satoshis chopping up and down and all around? Likely, although Bitcoin is steady-ish around US$28k again for now.

The crypto regulatory environment is about as stable as a junkie on a mechanical bull (or an African mine), but there’s still positive adoption news bites around. And here are two that have come to our attention across the weekend…

You may or may not recall, or it may have slipped you by completely but last September, Nasdaq, owner of three big US stock exchanges, announced the creation of a new crypto-focused division called Nasdaq Digital Assets.

That was all well and good and caused a mild stir at the time, but it was quickly trampled into obscurity by FTX and SBF implosion news a month or so later.

Anyway, it’s still a thing and, as Bloomberg reports, it’s set to go ahead with a launch of its crypto-custody services for institutional investors by the end of quarter 2 this year – only a few months away.

That is, unless the US government finds a way to ban everything to do with crypto in America in the meantime.

The stock market exchange operator’s senior vice president and head of digital assets, Ira Auerbach, said the firm is currently working on building the infrastructure for the service as well as attaining the necessary regulatory approval from the New York Department of Financial Services.

Interesting take here from influencer/gem hunter/crypto commentator “Lady of Crypto”, though…

I see many celebrating this news, but you should be mad!

They're going after @binance & @coinbase but allowing the NASDAQ to open crypto custody services.

As the traditional finance gatekeepers are seizing control of crypto, why do we cheer them on? pic.twitter.com/mWdSYm8VqU

— Lady of Crypto (@LadyofCrypto1) March 26, 2023

Meanwhile, as New York-based crypto media firm CoinDesk reports, on Friday it received an email from an official Amazon account that seemed to confirm the e-commerce giant is making moves to incorporate NFTs into its business and possible web3 expansion on the whole.

There have been rumours that Amazon has been building an NFT marketplace, but nothing has been announced, although the email to CoinDesk hints at the potential existence of an NFT gallery on the platform along with NFT resale opportunities.

Amazon reportedly sent this NFT receipt to a CoinDesk employee who subscribed for amazon prime.

Confirmation of an upcoming NFT platform launch? 👀 pic.twitter.com/liFYFzCF8T

— Crypto Crib (@Crypto_Crib_) March 25, 2023

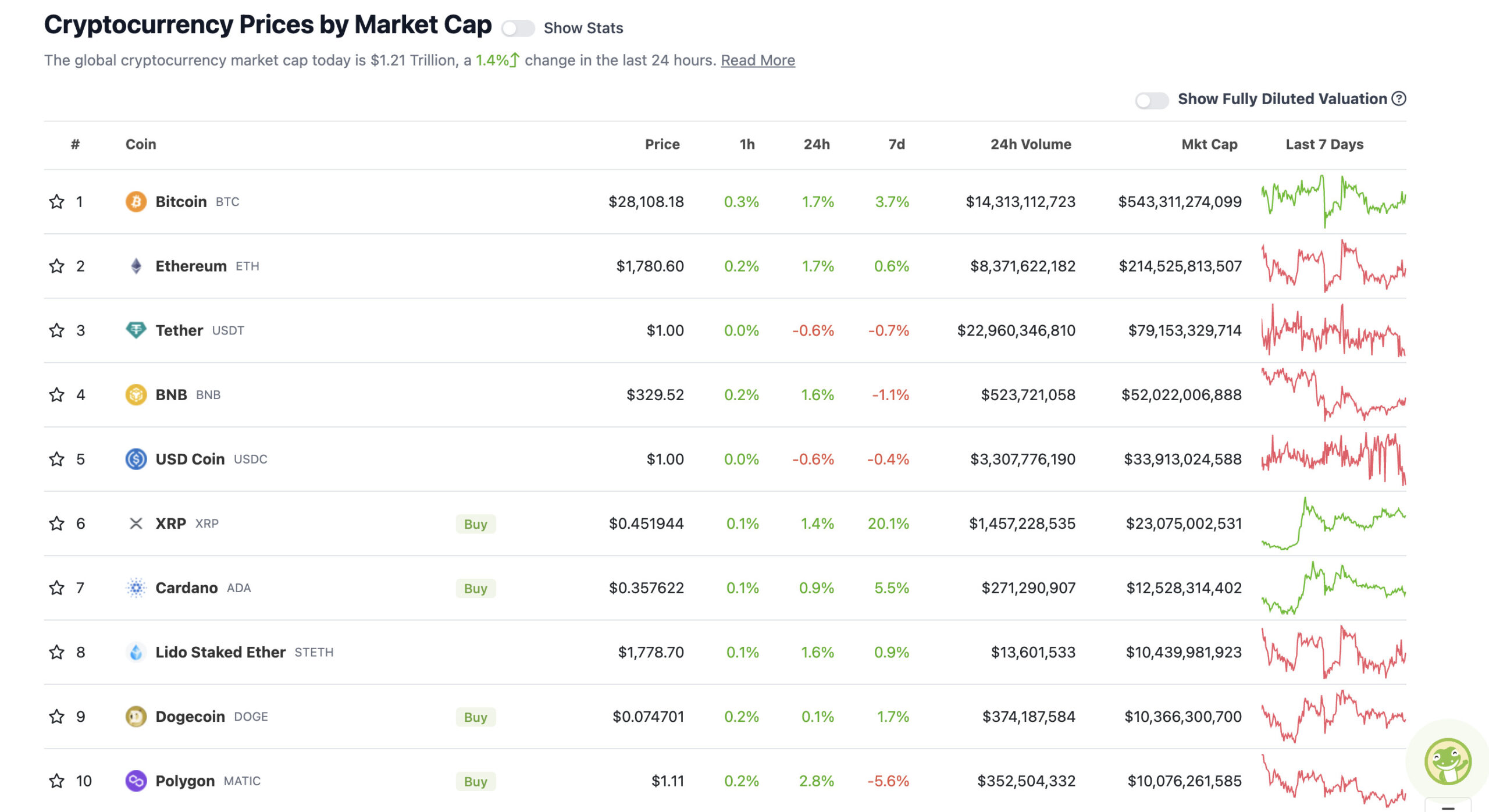

With the overall crypto market cap at US$1.21 trillion, up about 1.4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

After surging late last week, Bitcoin dipped a tad over the weekend but has been clawing its way back ever since.

Since we began compiling this roundup about an hour ago, it’s made it, yet again, to its $28k round-number checkpoint. Can it stay there or thereabouts? That’s up to a number of factors beyond most people’s control, of course. The SEC, Biden and pals, behind-the-scenes whales, black swans and white swans.

But, for the heck of it, let’s tap into some of the more positive Crypto Twitterings we’ve noticed over the past 24 to 48 hours or so.

Here’s chart watcher Rekt Capital, who reckons we’re less than a week away from confirming a new Bitcoin bull market…

Next Saturday, the #BTC Monthly Candle will have closed above the Macro Downtrend to confirm a new Bull Market$BTC #Crypto #Bitcoin pic.twitter.com/ZtMn0iS61u

— Rekt Capital (@rektcapital) March 25, 2023

Popular trader “Dave the Wave” meanwhile is pointing to Bitcoin’s weekly moving average convergence divergence (MACD).

He notes five times in BTC’s history where the MACD turned bullish before large, sustained rallies. Could this be a sixth?

The weekly #btc MACD.

If I were a betting man….😎 pic.twitter.com/Hm5UzNr3tT

— dave the wave🌊🌓 (@davthewave) March 24, 2023

Another US crypto trader, “Roman”, believes Bitcoin appears to be in, for the short term at least, a consolidation phase with a potential setup to continue an upwards trend…

$BTC H4

As previously stated, this looks like consolidation rather than exhaustion as there is no short set up.

Most of my TL is short on a whim. I stated it was far too early to be short even if we move down.

RSI/MACD is reset to continue upwards.#bitcoin #cryptocurrency pic.twitter.com/KvVJagsGJI

— Roman (@Roman_Trading) March 26, 2023

Sweeping a market-cap range of about US$8 billion to about US$430 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• Mask Network (MASK), (market cap: US$468 million) +13%

• Conflux (CFX), (mc: US$739 million) +12%

• Rocket Pool (RPL), (mc: US$813 million) +9%

• Stacks (STX), (mc: US$1.38 billion) +8%

• Render (RNDR), (mc: US$445 million) +6%

SLUMPERS

• Terra Luna Classic (LUNC), (market cap: US$739 million) -2%

• WhiteBIT Token (WBT), (mc: US$726 billion) -2%

• PAX Gold (PAXG), (mc: US$507 million) -1%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

“flexible token supply” 💀

— medved (@mattmedved) March 26, 2023

When the banking system is collapsing but you own #Bitcoin 😎 pic.twitter.com/0XRXXpQdQu

— Bitcoin Archive (@BTC_Archive) March 26, 2023

1/ A number of people asking me what I think about crypto in the context of the current banking crisis, regulatory fights, Balaji's bet, and so on – so here goes…

— Chris Burniske (@cburniske) March 26, 2023

#Bitcoin pic.twitter.com/8MIS5ZBnNt

— naiive (@naiivememe) March 26, 2023