After anxiously watching long days and nights of tough negotiations, engineering and construction groups are hailing the enactment of a legislative package that averts a U.S. default on its financial obligations, sets caps on federal spending for the next two years and puts in place provisions aimed at speeding the federal review process for infrastructure projects.

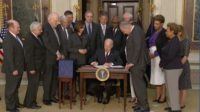

Without ceremony, President Joe Biden signed the Fiscal Responsibility Act on June 3, just two days before the projected default deadline. The measure won final congressional approval late on June 1 with Senate passage on a bipartisan 63-36 vote.

As industry and state officials study the legislation and prepare for its implementation, they see much to like, especially that it revises project permit rules and spares cuts in Infrastructure Investment and Jobs Act funding.

But officials see a tight federal funding environment ahead.

Inside and outside construction circles, there was widespread relief that Biden and House Speaker Kevin McCarthy (R-Calif.) had clinched a deal on the package, including its keystone: suspension of the U.S. debt limit until Jan. 1, 2025.

Steve Hall, American Council of Engineering Cos. executive vice president, said in an interview, "Having a deal on a debt freeze and avoiding the economic turmoil that could occur was a critical priority—not just for this industry, but for the entire business community."

Susan Howard, American Association of State Highway and Transportation Officials director of policy and government relations, said in an interview, "It is a huge and absolutely the right thing to do to get this deal done." She said enactment of the bill will prevent what could have been "catastrophic ripple effects throughout the economy and to all sorts of government programs."

Two-Year Spending Caps

The measure caps discretionary spending, but only for fiscal years 2024 and 2025 and with modest increases.

According to a summary from an administration source, the bill's 2024 nondefense funding—the category that includes most infrastructure and construction programs—is "roughly flat" with 2023 levels "when factoring in agreed-upon appropriations adjustments."

Those adjustments include some rescinded Internal Revenue Service funds that appropriators can use for other programs.

According to the Congressional Budget Office, defense discretionary funding will be limited to $886 billion in 2024, and to $895 billion for 2025.

Nondefense funding is limited to $704 billion for 2024, and $711 billion the following year, virtually even with 2024.

IIJA, Climate Act Protected

In another plus, funding under the $1.2-trillion infrastructure funding law, is protected from cuts, White House officials and industry officials say.

Michele Stanley, National Stone, Sand & Gravel Association vice president-government and regulatory affairs, said in comments emailed to ENR, "Most of the [infrastructure act] transportation funding was state formula funding, which comes from the Highway Trust Fund and is statutorily protected—like a lock box."

Howard says infrastructure act advance appropriations, which draw from the general fund, also are safe. State departments of transportation are grateful that the funding did not become part of negotiations over the debt ceiling bill, she says. "We'll have some relative stability," Howard says, although "we're entering a period of austere federal spending."

In addition, the new law protects clean energy funding and other climate provisions in the Inflation Reduction Act, which House Republicans had targeted in an earlier version of debt limit legislation.

State DOTs' Deadline Scramble

Still, as bill enactment drew near, state highway agencies were scrambling to ease impacts of one funding-related provision in the bill—a rescission of unobligated highway funds that states received in 2020 under the Coronavirus Response and Relief Supplemental Appropriations Act.

Under a use-it-or-lose-it provision, any of a state's highway funds from that 2020 measure that were still unobligated when the bill was enacted, would be taken from that state.

Howard says that when AASHTO heard several weeks ago that the cut was under discussion by debt-limit bill negotiators, "I think everybody kind of went on high alert that this could be coming."

State DOTs hustled to commit as much of their unobligated funds as possible. AASHTO said in its June 2 newsletter that as of May 30, the unobligated funding total was down to about $1.7 billion and had been expected to fall further in the few days before Biden signed the bill.

Permitting Provisions

Among other provisions drawing construction sector attention—and praise—are those that will affect federal project permitting. "Streamlining permitting is crucial to ensuring we make the most of available funding mechanisms," said Tom Smith, American Society of Civil Engineers executive director, in a statement,

Among other things, the new law requires that when multiple federal agencies are involved in a project's environmental review, one will be designated as lead agency and charged with overseeing it.

The statute also limits an infrastructure project environmental impact statement—required under the National Environmental Policy Act for major ones—to no more than 150 pages, or a maximum of 300 pages for a review of "extraordinary complexity." It also sets a two-year deadline to complete that review although extensions are allowed if certain criteria are met.

The infrastructure law also had project permitting provisions that include codifying President Donald Trump's executive order calling for "One Federal Decision" on project approvals. That provision applied only to transportation projects.

According to Stanley, although the infrastructure law had the One Federal Decision language, "the Biden administration didn't put any teeth in it."

In recent months, discussions stirred about a debt-limit bill, critics had stepped up pressure for permit reform, with most emphasis on oil and gas pipelines and other energy infrastructure projects.

The debt limit bill's provisions appear to apply to all types of projects that fall under NEPA, including transportation.

As industry and transportation officials study the new measure, there is some uncertainty about how new permitting rules will mesh with those in the infrastructure law. Officials will await agencies' guidance on implementing those provisions, but Stanley says the debt-limit measure supersedes the infrastructure law on permitting.

Fast Track for Mountain Valley Pipeline

The debt limit legislation also gives special consideration to fast track one high-profile energy project—the Mountain Valley Pipeline between West Virginia and Virginia, which has been a top priority of Senate Energy and Natural Resources Committee Chairman Joe Manchin (D-W.Va.)

The project is nearly complete but its still-outstanding construction permits continue to be challenged in court by opponents. Project approvals by the U.S. Army Corps of Engineers and Federal Energy Regulatory Commission, as well as by West Virginia, remain to be finalized.

Among the provisions is language directing the Secretary of the Army to "issue all permits or verifications necessary" within 21 days of the bill signing, to complete the pipeline's construction across federally regulated waters, and to allow operation and maintenance of the pipeline

The law also would block court review of federal or state permits or other actions related to building the project.

Environmental groups, which have long fought the project, sharply criticized the pipeline provisions. Sen. Tim Kaine (D-Va.) proposed a floor amendment to cut ppipeline language from the bill, but his proposal was defeated 69-30.

Some industry officials see the debt limit bill permit provisions as a positive step but indicate they will seek still more changes in project reviews, presumably in future legislation.

Kristen Swearingen, Associated Builders and Contractors vice president of legislative and political affairs, said in a statement, "ABC hopes that Congress will continue on this bipartisan path to provide additional reforms to the permitting process and remove more unnecessary and burdensome red tape that has hindered critical construction projects for decades."

Said Karen Harbert, American Gas Association president and CEO, in a statement, "This legislation starts the process towards true permitting reform, but there is still work to be done."

ACEC's Hall says that for now, with default dodged and the prospect of moving infrastructure projects faster through regulatory hoops, "this is a win."

Post a comment to this article

Report Abusive Comment