Business News›Tech›Newsletters›Morning Dispatch›Exclusive: Startups under I-T scanner again; payments startups & processing charges

Morning Dispatch Morning Dispatch |

Exclusive: Startups under I-T scanner again; payments startups & processing charges

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

Indian startups are under scrutiny from the income-tax department over the funding that they have raised. This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ NCLT refuses to stay Byju’s Friday EGM

■ Honasa Consumer launches Gen Z brand 'Staze'

■ Inside Karnataka’s GCC policy

Over the past few weeks, a number of startups have been served income tax notices over funding that they raised. These notices and subsequent tax demands have mostly been sent to fintech firms, multiple people familiar with the matter said.

Driving the news: Earlier this week, the founder of a fintech startup received a notice requiring him to furnish the balance sheet of investors who invested capital into his company in the financial year 2023. “We submitted all of these documents along with the Permanent Account Number cards (of the investors) but have still been served with a tax demand,” he said.

The fintech startup, registered with the Department for Promotion of Industry and Internal Trade (DPIIT), has been asked to pay Rs 37 crore towards tax, and a penalty on the Rs 40 crore raised from venture capital investors.

Under scanner:

Know the rules: Under Section 68 of the Income Tax Act, if a company is unable to satisfactorily explain the nature and source of its funding, authorities are permitted to tax the capital raised along with income earned by the startup in the relevant year.

Equally, such tax demands are closed if the company offers a satisfactory explanation and furnishes the requisite documentation.

Zoom in: Some companies facing tax demands claim they have furnished relevant shareholder agreements for assessment. Moreover, if an affected startup decides to appeal against the tax demands, it has to first deposit 20% of the overall tax demand with the government.

“This will eat into our cash reserves and will hurt our working capital requirements,” said a startup founder, speaking on the condition of anonymity.

Lack of direct revenue generation and the high cost of operations are becoming a drag on the balance sheets of digital payments startups, despite rising business volumes due to the wide-scale adoption of digital payments.

Driving the news: The issue has only become worse due to zero MDR (merchant discount rate) paid to payment service providers on Unified Payments Interface (UPI). “This is a major cost for payments companies, so no matter how much you grow in terms of total payment volume, your expenses shoot up accordingly, which impacts profitability,” said a top executive at a payments company.

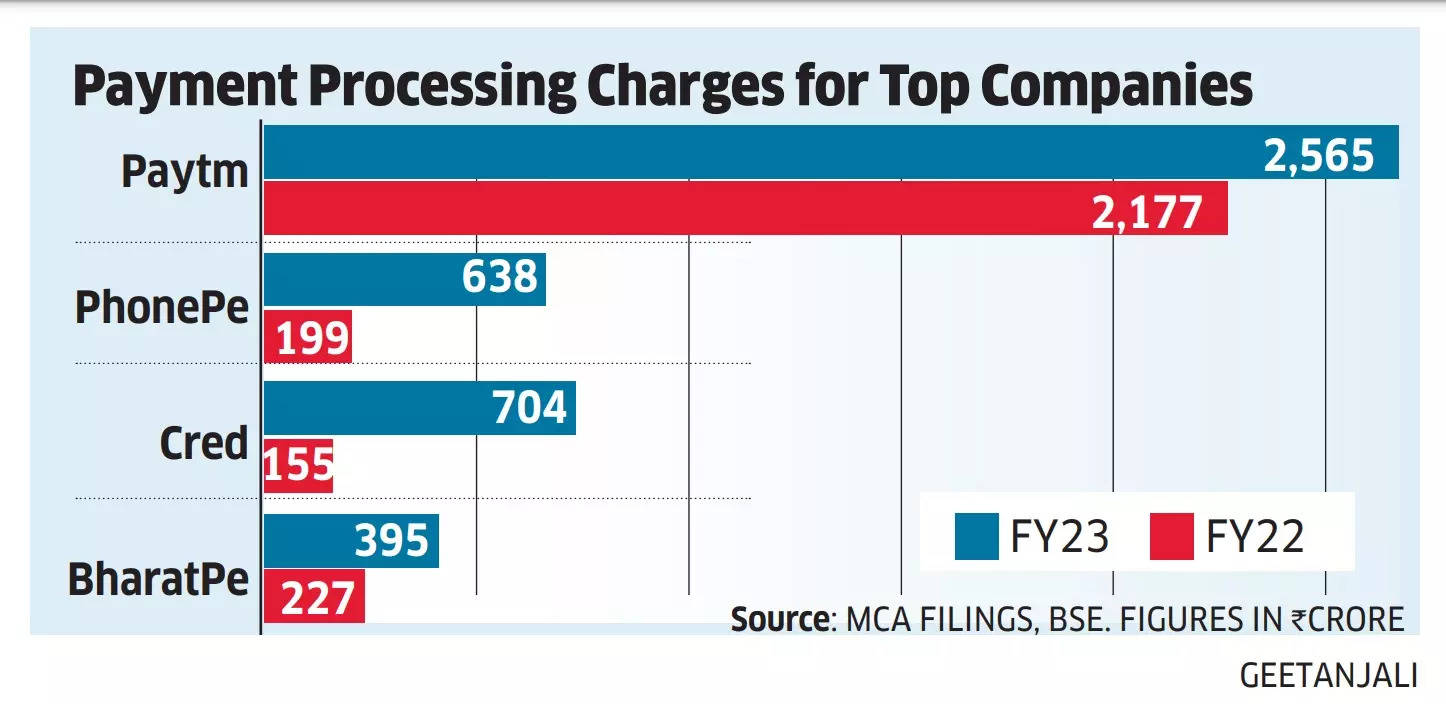

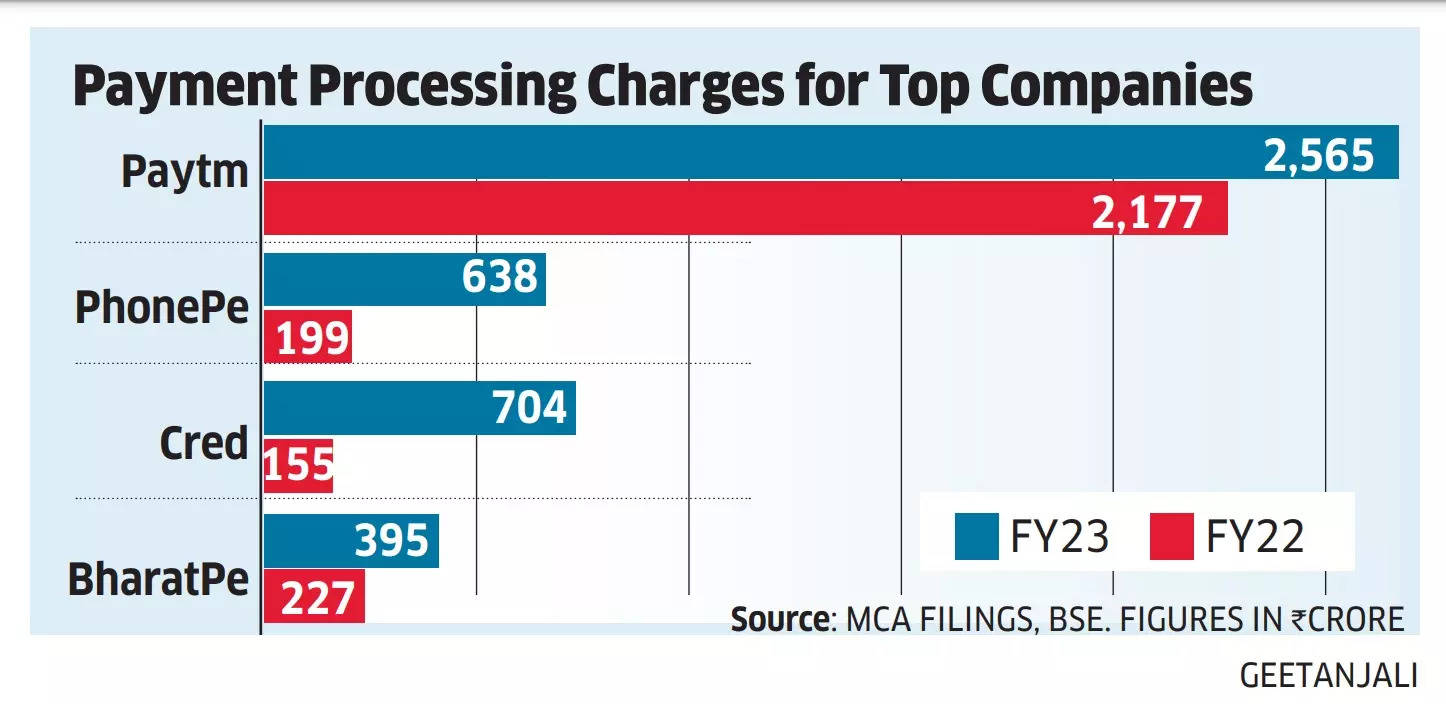

Tell me more: While PhonePe’s overall transaction volumes skyrocketed in recent years, its payment processing charges spiked too. In FY23, PhonePe spent Rs 638 crore in processing expenditure, up three times from Rs 199 crore a year ago.

For BharatPe, the transaction processing charges for FY23 stood at Rs 395 crore, up 74% from Rs 227 crore a year earlier, financials sourced from Tofler show.

Paytm reported processing charges of Rs 2,565 crore till December of fiscal 2024, up almost 18% from Rs 2,177 crore a year ago.

Also read | Fintech is making global payments its business

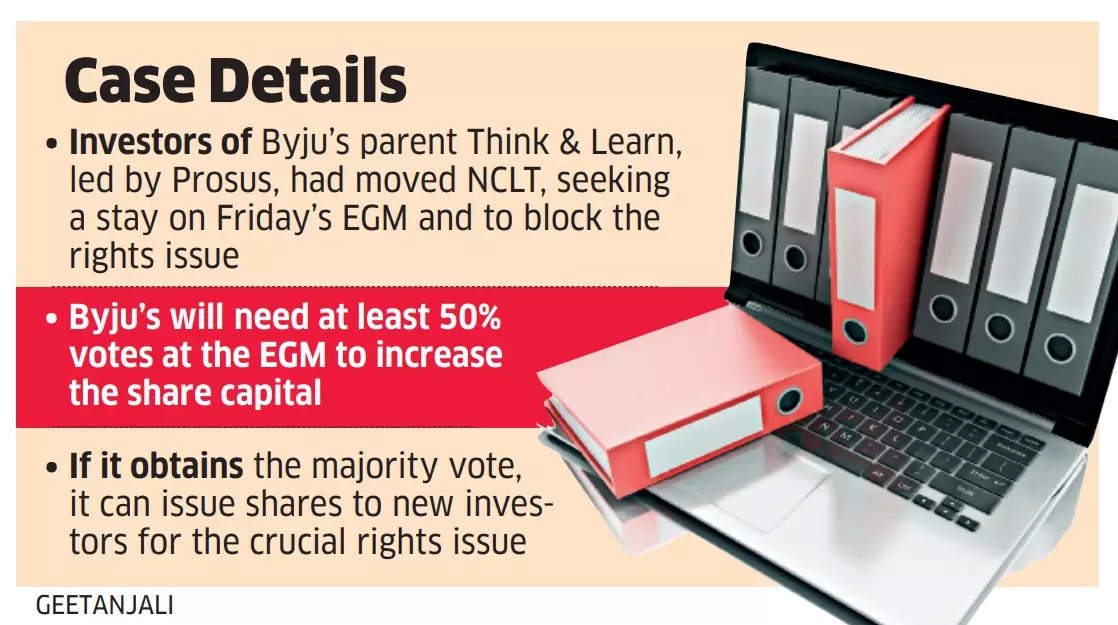

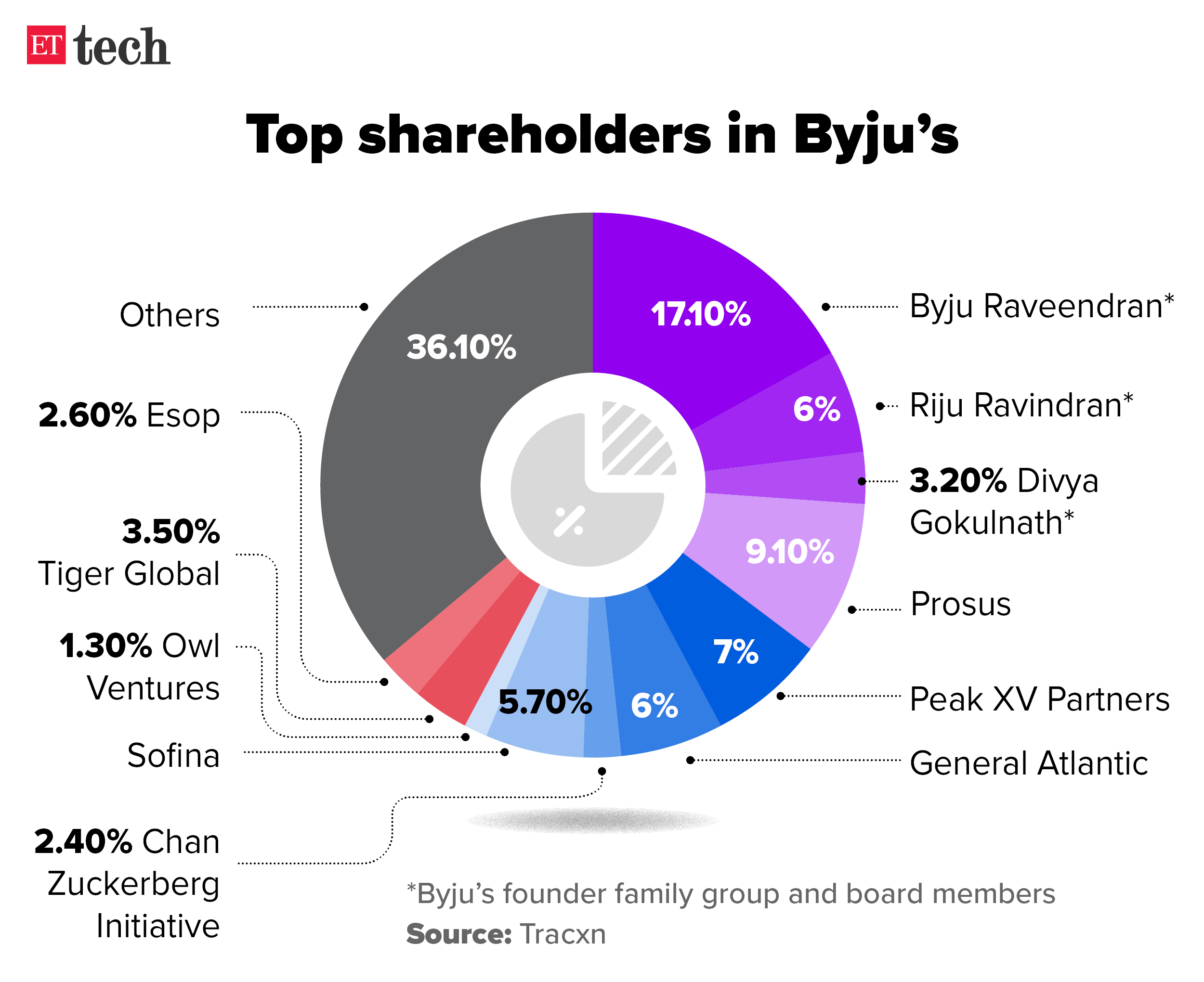

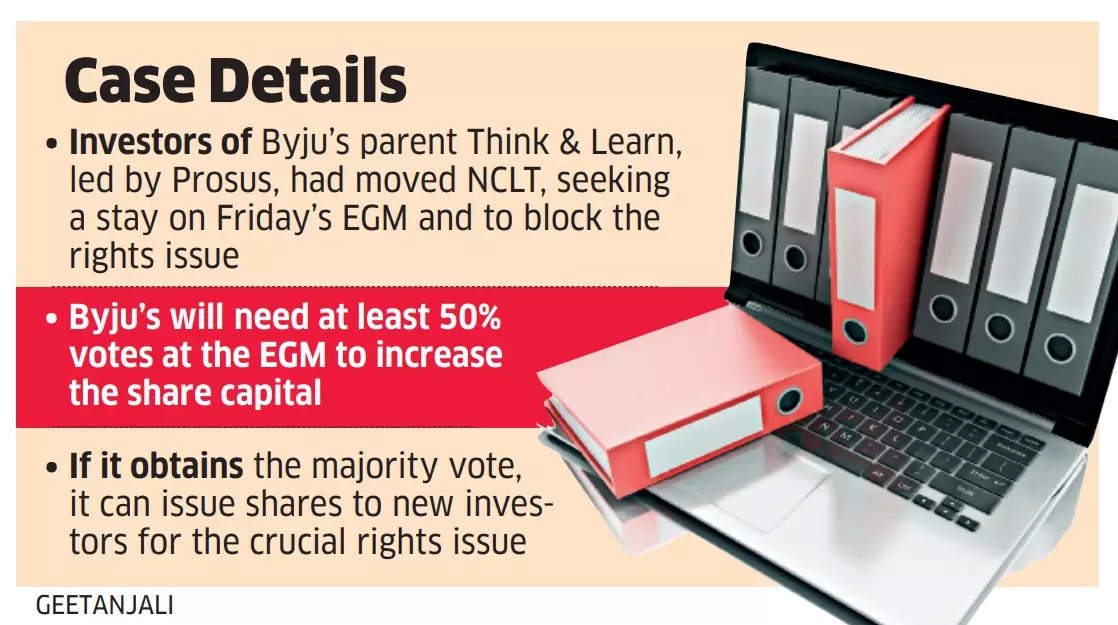

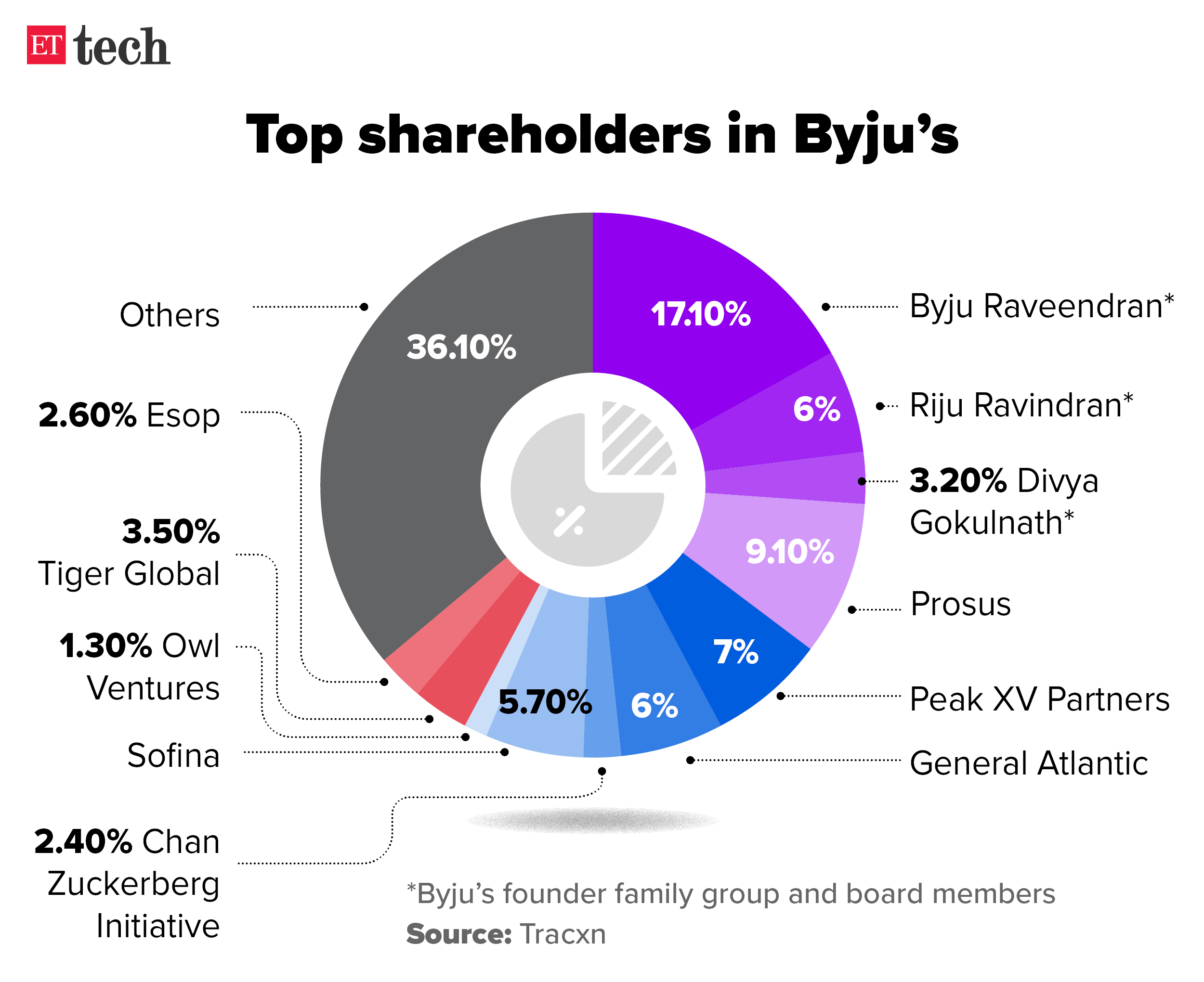

The National Company Law Tribunal (NCLT), Bengaluru, on Thursday refused to stay the extraordinary general meeting (EGM) called by Byju’s on Friday to increase the authorised share capital to account for its $200-million rights issue. The company needs new capital desperately to manage daily operations and clear pending dues.

Decoding the issue: Four investors — led by Prosus — moved the NCLT, seeking a stay on the planned EGM to effectively block the rights issue. The matter will now be heard on April 4.

The tribunal also directed Byju’s to share its captable registry sought by investors, which the company said would be made available immediately.

What happens now? Byju’s will need at least 50% votes at the EGM to increase its share capital. If it obtains the majority vote, it can issue shares to new investors for the crucial rights issue.

This is of significance as lawyers appearing for the investors said that once new shares are issued, it cannot be reversed and thus pleaded for a stay on the EGM.

High court update: Meanwhile, the Karnataka High Court extended the interim stay on the outcomes of a February EGM called by investors who demanded the ouster of CEO Byju Raveendran and a change of board at parent firm Think & Learn. The court will now hear this matter after two months. Raveendran had told employees in February that he remains the CEO and there are no changes in the composition of the board.

Also Read | Exclusive: Chaudhry unlikely to return to steer Byju's-owned Aakash Institute

Honasa Consumer’s cofounder and CEO Varun Alagh

Honasa Consumer’s cofounder and CEO Varun Alagh

Honasa Consumer, the parent company of beauty and personal care (BPC) brand Mamaearth, has entered the colour cosmetics space with a new brand ‘Staze’, targeted at 18 to 24-year-olds.

Details: Staze is the seventh brand in Honasa Consumer’s portfolio after Mamaearth (its largest), The Derma Co, Aqualogica, Ayuga, Dr Sheth’s and Bblunt.

The company will sell products such as lipsticks, kajal pens, foundations, compacts and eyeliners under the new brand. Staze has eight categories with 40 stock-keeping units (SKUs).

Founder speak: Honasa Consumer cofounder and CEO Varun Alagh told ET that the new brand will compete with the likes of L'oreal-owned cosmetics brand Maybelline and Hindustan Unilever’s Lakme on price points. Staze will have an average unit price of Rs 300-350, similar to Maybelline and Lakme, he said.

Karnataka GCC policy: industry suggests investment in tier-II cities: As Karnataka readies a policy to boost Global Capability Centres (GCC), the first draft of which is expected in June, top executives told us that the policy should include investment in the growth of infrastructure in tier 2 cities through initiatives like Beyond Bengaluru.

SAP sees 10-15% revenue growth from GenAI: SAP, Europe’s biggest technology company by market capitalisation, aims to quadruple generative artificial intelligence (AI) use cases by year end, its chief AI officer Philipp Herzig told us. He added that the potential revenue increase is likely “in the ballpark of 10-15% because of our code generation capabilities. I think that's a number that we see.”

BillDesk reports slight growth in revenue, fall in profit in FY23: Payments major BillDesk has reported a slight increase in operational revenue to Rs 2,678 crore for FY23, from Rs 2,442 crore a year earlier. However, the company’s net profit dropped to Rs 141.9 crore for the second consecutive year from Rs 149.6 crore a year ago and Rs 245 crore in FY21.

■ Meet the designer behind Neuralink’s surgical robot (Wired)

■ OpenAI’s app store draws investors and students seeking artificial aids (FT)

■ AI is moving faster than attempts to regulate it. Here’s how companies are coping (WSJ)

Also in this letter:

■ NCLT refuses to stay Byju’s Friday EGM

■ Honasa Consumer launches Gen Z brand 'Staze'

■ Inside Karnataka’s GCC policy

Exclusive: I-T issues notice to new-age firms over recent VC funding

Over the past few weeks, a number of startups have been served income tax notices over funding that they raised. These notices and subsequent tax demands have mostly been sent to fintech firms, multiple people familiar with the matter said.

Driving the news: Earlier this week, the founder of a fintech startup received a notice requiring him to furnish the balance sheet of investors who invested capital into his company in the financial year 2023. “We submitted all of these documents along with the Permanent Account Number cards (of the investors) but have still been served with a tax demand,” he said.

The fintech startup, registered with the Department for Promotion of Industry and Internal Trade (DPIIT), has been asked to pay Rs 37 crore towards tax, and a penalty on the Rs 40 crore raised from venture capital investors.

Under scanner:

- A number of startups under scrutiny

- Queries raised on fund infusion

- Sec 68 of I-T Act mandates seeking explanation on funding source

- Startups say this is leading to unnecessary harassment

- I-T dept says cases closed if explanation found satisfactory

- Startups registered with DPIIT also served tax notices. Typically, these do not face such scrutiny

Know the rules: Under Section 68 of the Income Tax Act, if a company is unable to satisfactorily explain the nature and source of its funding, authorities are permitted to tax the capital raised along with income earned by the startup in the relevant year.

Equally, such tax demands are closed if the company offers a satisfactory explanation and furnishes the requisite documentation.

Zoom in: Some companies facing tax demands claim they have furnished relevant shareholder agreements for assessment. Moreover, if an affected startup decides to appeal against the tax demands, it has to first deposit 20% of the overall tax demand with the government.

“This will eat into our cash reserves and will hurt our working capital requirements,” said a startup founder, speaking on the condition of anonymity.

Processing charges a drag on fast-growing Indian payments startups

Lack of direct revenue generation and the high cost of operations are becoming a drag on the balance sheets of digital payments startups, despite rising business volumes due to the wide-scale adoption of digital payments.

Driving the news: The issue has only become worse due to zero MDR (merchant discount rate) paid to payment service providers on Unified Payments Interface (UPI). “This is a major cost for payments companies, so no matter how much you grow in terms of total payment volume, your expenses shoot up accordingly, which impacts profitability,” said a top executive at a payments company.

Tell me more: While PhonePe’s overall transaction volumes skyrocketed in recent years, its payment processing charges spiked too. In FY23, PhonePe spent Rs 638 crore in processing expenditure, up three times from Rs 199 crore a year ago.

For BharatPe, the transaction processing charges for FY23 stood at Rs 395 crore, up 74% from Rs 227 crore a year earlier, financials sourced from Tofler show.

Paytm reported processing charges of Rs 2,565 crore till December of fiscal 2024, up almost 18% from Rs 2,177 crore a year ago.

Also read | Fintech is making global payments its business

NCLT refuses to stay Byju’s Friday EGM for $200-million rights issue

The National Company Law Tribunal (NCLT), Bengaluru, on Thursday refused to stay the extraordinary general meeting (EGM) called by Byju’s on Friday to increase the authorised share capital to account for its $200-million rights issue. The company needs new capital desperately to manage daily operations and clear pending dues.

Decoding the issue: Four investors — led by Prosus — moved the NCLT, seeking a stay on the planned EGM to effectively block the rights issue. The matter will now be heard on April 4.

The tribunal also directed Byju’s to share its captable registry sought by investors, which the company said would be made available immediately.

What happens now? Byju’s will need at least 50% votes at the EGM to increase its share capital. If it obtains the majority vote, it can issue shares to new investors for the crucial rights issue.

This is of significance as lawyers appearing for the investors said that once new shares are issued, it cannot be reversed and thus pleaded for a stay on the EGM.

High court update: Meanwhile, the Karnataka High Court extended the interim stay on the outcomes of a February EGM called by investors who demanded the ouster of CEO Byju Raveendran and a change of board at parent firm Think & Learn. The court will now hear this matter after two months. Raveendran had told employees in February that he remains the CEO and there are no changes in the composition of the board.

Also Read | Exclusive: Chaudhry unlikely to return to steer Byju's-owned Aakash Institute

Honasa Consumer targets Gen Z with colour cosmetics brand Staze

Honasa Consumer, the parent company of beauty and personal care (BPC) brand Mamaearth, has entered the colour cosmetics space with a new brand ‘Staze’, targeted at 18 to 24-year-olds.

Details: Staze is the seventh brand in Honasa Consumer’s portfolio after Mamaearth (its largest), The Derma Co, Aqualogica, Ayuga, Dr Sheth’s and Bblunt.

The company will sell products such as lipsticks, kajal pens, foundations, compacts and eyeliners under the new brand. Staze has eight categories with 40 stock-keeping units (SKUs).

Founder speak: Honasa Consumer cofounder and CEO Varun Alagh told ET that the new brand will compete with the likes of L'oreal-owned cosmetics brand Maybelline and Hindustan Unilever’s Lakme on price points. Staze will have an average unit price of Rs 300-350, similar to Maybelline and Lakme, he said.

Other Top Stories By Our Reporters

Karnataka GCC policy: industry suggests investment in tier-II cities: As Karnataka readies a policy to boost Global Capability Centres (GCC), the first draft of which is expected in June, top executives told us that the policy should include investment in the growth of infrastructure in tier 2 cities through initiatives like Beyond Bengaluru.

SAP sees 10-15% revenue growth from GenAI: SAP, Europe’s biggest technology company by market capitalisation, aims to quadruple generative artificial intelligence (AI) use cases by year end, its chief AI officer Philipp Herzig told us. He added that the potential revenue increase is likely “in the ballpark of 10-15% because of our code generation capabilities. I think that's a number that we see.”

BillDesk reports slight growth in revenue, fall in profit in FY23: Payments major BillDesk has reported a slight increase in operational revenue to Rs 2,678 crore for FY23, from Rs 2,442 crore a year earlier. However, the company’s net profit dropped to Rs 141.9 crore for the second consecutive year from Rs 149.6 crore a year ago and Rs 245 crore in FY21.

Global Picks We Are Reading

■ Meet the designer behind Neuralink’s surgical robot (Wired)

■ OpenAI’s app store draws investors and students seeking artificial aids (FT)

■ AI is moving faster than attempts to regulate it. Here’s how companies are coping (WSJ)

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.