Closing Bell: ASX rallies hard as RBA holds rates; Bonza drama continues with court ruling

News

News

The Aussie stock market rallied hard on Tuesday, up over +1%, as the RBA decided to hold interest rates right where they are at 4.35% – as expected.

But the RBA didn’t slam the door shut on the possibility of bumping them up in the future, saying it was keeping a close eye on things, especially rent, petrol prices and the tight jobs market.

“Higher petrol prices, the legislated end of energy rebates and stronger recent data will lift headline inflation in the near term,” said RBA’s post meeting statement.

“Tight rental market conditions across the capital cities will likely contribute to ongoing high advertised rent growth, which will in turn keep CPI rents inflation elevated.”

RBA governor Michele Bullock is fronting the media at the time of writing, where she’s giving more colour on what’s been cooking in the boardroom meeting.

As it stands, traders are now betting on another rate hike before the year’s up, but most pundits say we might actually see the first rate cut come December or early next year.

On a separate note, retail sales figures took a tumble again, dropping by 0.4% compared to the previous three months, according to ABS data today. This marks the fifth time in six quarters that sales have headed south.

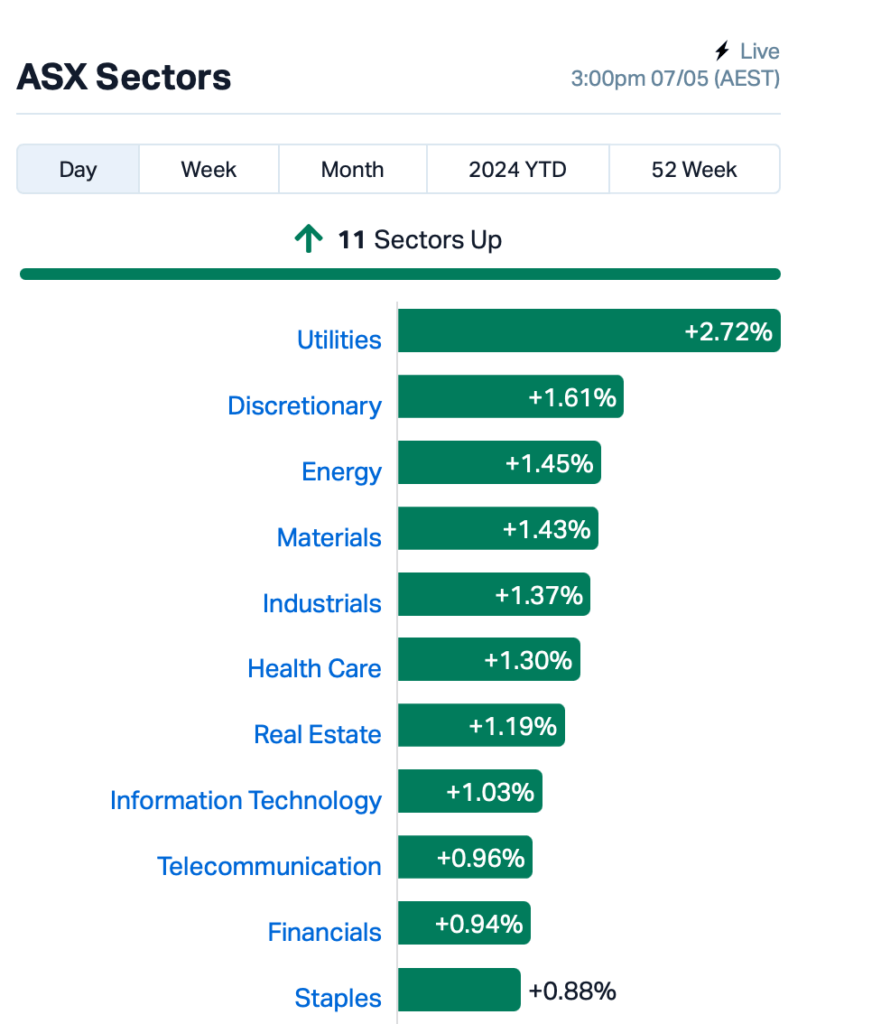

To the ASX, it’s a sea of green as Utilities and Discretionary led all sectors.

The Financials sector whipsawed after ANZ Bank (ASX:ANZ) fell almost -1%.

ANZ dropped news that it was rolling out a $2 billion share buyback, even though its cash profit took a 7% dip to $3.55 billion for the latest six months. ANZ is also upping its interim dividend to 83¢ per share, a 2¢ bump from last year.

Gold stocks closed mainly higher, with the ASX All Ordinaries Gold (XGD) rising by +1.6%.

The Aussie dollar is now trading above US66c after some dovish comments from a bunch of Fed officials overnight.

Meanwhile, unlisted budget airline Bonza is likely to remain stuck on the tarmac until at least next week after a Federal Court hearing in Sydney today was told that 57,993 travellers were left high and dry due to the airline’s collapse.

Justice Elizabeth Cheeseman ruled that those passengers will now be included in the airline’s list of contingent creditors, along with 323 employees and 120 trade creditors.

Bonza is currently in the hands of bankrupt administrator Hall Chadwick, which took over after Bonza’s fleet of Boeing 737 Max 8 aircraft were repossessed over unpaid leases.

The fingers are now pointing to Bonza’s US private equity backers, 777 Partners, which was apparently responsible for paying the leases.

There’s a fresh lawsuit filed by Leadenhall Capital from London who is throwing punches at 777 Partners, accusing it of pulling a fast one by borrowing cash using assets that it didn’t actually own, and double pledging assets.

777 Partners was co-founded by convicted cocaine trafficker, Joshua Wander.

Most Asian stock markets managed to inch up on Tuesday, taking cues from the positive vibes on Wall Street.

Everyone seems to be feeling hopeful that the Fed Reserve might start trimming interest rates before long.

The overall picture for regional stocks is looking pretty good lately, and we’re seeing some of the longest streaks of gains since February, thanks in part to strong performances from Japanese, Korean, and Australian markets.

“In Asia you have higher growth and earnings potential compared to what you have in the US, valuations in Asia are a lot cheaper …” Ray Sharma-Ong over at abrdn Plc said in a Bloomberg TV interview.

Crude prices meanwhile sneaked up slightly higher after Israel’s war cabinet unanimously rejected Hamas’ call for cease-fire, calling it “far from Israel’s necessary demands”.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OAR | OAR Resources Ltd | 0.002 | 100% | 586,469 | $3,153,311 |

| ADY | Admiralty Resources. | 0.012 | 50% | 2,444,376 | $13,035,792 |

| PEC | Perpetual Res Ltd | 0.013 | 44% | 14,568,571 | $5,760,265 |

| FGL | Frugl Group Limited | 0.110 | 41% | 214,727 | $7,746,829 |

| CHK | Cohiba Min Ltd | 0.004 | 33% | 5,795,012 | $10,764,733 |

| LSR | Lodestar Minerals | 0.002 | 33% | 300,000 | $3,035,096 |

| ODE | Odessa Minerals Ltd | 0.004 | 33% | 1,895,971 | $3,129,848 |

| OZZ | OZZ Resources | 0.041 | 32% | 102,646 | $2,868,434 |

| TTT | Titomic Limited | 0.082 | 32% | 16,819,857 | $62,659,423 |

| M4M | Macro Metals Limited | 0.027 | 29% | 38,424,837 | $67,873,402 |

| CGO | CPT Global Limited | 0.120 | 26% | 122,457 | $3,980,250 |

| TGH | Terragen | 0.025 | 25% | 200,000 | $7,381,623 |

| 1AG | Alterra Limited | 0.005 | 25% | 34,050 | $3,448,586 |

| BUR | Burleyminerals | 0.065 | 25% | 503,211 | $6,779,289 |

| CCO | The Calmer Co Int | 0.005 | 25% | 20,330,985 | $5,443,519 |

| ME1 | Melodiol Glb Health | 0.003 | 25% | 387,389 | $1,426,974 |

| TEM | Tempest Minerals | 0.010 | 25% | 745,520 | $4,152,995 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 386,069 | $3,142,791 |

| EMT | Emetals Limited | 0.006 | 20% | 1,667,100 | $4,250,000 |

| HXL | Hexima | 0.012 | 20% | 205,000 | $1,670,396 |

| LNR | Lanthanein Resources | 0.006 | 20% | 1,192,736 | $9,774,545 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 75,000 | $5,034,435 |

| CHW | Chilwaminerals | 0.650 | 18% | 326,662 | $25,231,251 |

| EMU | EMU NL | 0.026 | 18% | 11,400 | $1,484,845 |

| NME | Nex Metals Explorat | 0.020 | 18% | 41,278 | $5,993,053 |

The winners table on Tuesday has been dominated by diggers and explorers without a lot of news to back it up, other than some fairly hefty moves among certain commodities over the past week or so.

Cohiba Minerals (ASX:CHK) announced yesterday that a strategic review of the Olympic Domain project, which the company says “adjoins one of the biggest IOCG discoveries”, has “confirmed strong prospectivity for IOCG mineralisation which warrants further investigation”.

Macro Metals (ASX:M4M), which owns 100% of the Agbaja Iron and Steel project located in Kogi State in the Republic of Nigeria, was on the move again today. Aside from a positive quarterly activities and cashflow report from about a week ago, we’re not seeing anything as yet that substantiates today’s fresh burst from M4M.

One company with news was Westar Resources (ASX:WSR), climbing on Tuesday after delivering some great finds from the Mindoolah Mining Centre, where stockpile grab samples have returned assays up to 40.7g/t Au and 214g/t Ag, with other samples testing at 13.6, 12.3, 9.4, 6.9, 5.8g/t Au. The company is also reporting a 1.7g/t Au and 16.1g/t Ag rock chip sample from quartz vein in the Mindoolah Main Reef open pit, and says that a systematic stockpile and open pit sampling program is planned for the site.

Antilles Gold (ASX:AAU) was moving on news that results of the Scoping Study for the first stage of the proposed Nueva Sabana gold-copper mine in Cuba are in, showing that the deposit has a small 3g/t gold cap, an underlying copper-gold zone, and a deeper sulphide copper zone that is open at depth at 150m, and could potentially transition into the El Pilar porphyry copper deposit which is offset to the south.

Brazilian Critical Minerals (ASX:BCM) was up after announcing “outstanding magnetic REO (Nd, Pr, Dy, Tb) recoveries” averaging 68% overall, with world class recoveries averaging 69% NdPr and 48% DyTb from a bulk sample analysed at ANSTO1 confirmed at the company’s Ema rare earth project.

Titomic (ASX:TTT) has announced that it has completed the strategic sale of a custom Titomic Kinetic Fusion System (TKF System) to US-based Triton Systems, which counts as one of its lead consumers as the US Homeland Security sector, among other far less spooky applications for its tech.

ikeGPS Group (ASX:IKE) says 5 new IKE PoleForeman subscription agreements are being put in place with major US electric utilities, with an expected Total Contract Value (TCV) of ~NZ$4m, and Annual Recurring Revenue (ARR) of NZ$1.3M. Since the launch of this next-gen product in late 2023, the company has added TCV of more than NZ$12m, representing ~NZ$4m of ARR.

Gold 50 (ASX:G50) is s progressing its high-potential projects in America’s southwest, particularly in Arizona at its Golconda Project and in Nevada at its White Caps project. It was well up today after announcing an extraordinary general meeting. There appears to be a company change of name underway. Erm… extraordinary stuff. Guess you’d best stay tuned for that one.

SKS Technologies (ASX:SKS) secured several major contracts for a range of electrical and communications infrastructure projects at the Australian Defence Force’s RAAF Base Tindal in the Northern Territory. The combined value of the projects is approximately $11 million.

And Recce Pharmaceuticals (ASX:RCE) revealed that China has formally granted a new Patent Family 2 for Recce’s anti-infectives “Copolymer and Method for Treatment of Bacterial Infection, with expiry of 2035. This is the final of Recce’s wholly owned patents granted for Family 2, with the company now patent-protected in all major pharmaceutical markets globally.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Name | Price | % Change | Volume | Market Cap | |

|---|---|---|---|---|---|

| APC | Aust Potash Ltd | 0.002 | -63% | 198,928,483 | $16,000,758 |

| AXP | AXP Energy Ltd | 0.001 | -50% | 791,019 | $11,649,361 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | 127,939 | $3,264,346 |

| MRD | Mount Ridley Mines | 0.001 | -33% | 1,781,382 | $11,677,324 |

| PUA | Peak Minerals Ltd | 0.002 | -33% | 1,711,000 | $3,124,130 |

| VPR | Volt Power Group | 0.001 | -33% | 720,000 | $16,074,312 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 707,628 | $7,356,542 |

| IEC | Intra Energy Corp | 0.002 | -25% | 4,491,000 | $3,381,563 |

| TX3 | Trinex Minerals Ltd | 0.003 | -25% | 2,172,510 | $6,979,637 |

| AVC | Auctus Invest Grp | 0.460 | -23% | 5,000 | $45,319,045 |

| MPK | Many Peaks Minerals | 0.130 | -21% | 609,070 | $7,307,046 |

| SVG | Savannah Goldfields | 0.028 | -20% | 118,565 | $9,837,972 |

| ROG | Red Sky Energy. | 0.004 | -20% | 257,296 | $27,111,136 |

| SAN | Sagalio Energy Ltd | 0.004 | -20% | 52,000 | $1,023,301 |

| SHO | Sportshero Ltd | 0.004 | -20% | 7,070,783 | $3,089,164 |

| VML | Vital Metals Limited | 0.004 | -20% | 18,099,284 | $29,475,335 |

| SNS | Sensen Networks Ltd | 0.022 | -19% | 646,140 | $20,914,296 |

| AFA | ASF Group Limited | 0.040 | -18% | 16,000 | $38,827,479 |

| HOR | Horseshoe Metals Ltd | 0.009 | -18% | 774,490 | $7,125,565 |

| PFT | Pure Foods Tas Ltd | 0.035 | -17% | 3,788 | $4,632,378 |

| AHN | Athena Resources | 0.003 | -17% | 67,091 | $3,211,403 |

| BCK | Brockman Mining Ltd | 0.020 | -17% | 52,804 | $222,725,571 |

| GSM | Golden State Mining | 0.010 | -17% | 1,115,552 | $3,352,448 |

| ICR | Intelicare Holdings | 0.010 | -17% | 5,000 | $2,817,894 |

| IVX | Invion Ltd | 0.005 | -17% | 107,127 | $38,547,193 |

Helix Resources (ASX:HLX) was down ahead of an investor webinar on Thursday, at which newly-minted Managing Director, Dr Kylie Prendergast and Chair, Mr Mike Rosenstreich, are set to provide an update on how things are going at the company’s exploration progress on its Cobar tenements and an entitlements offer to raise $2.3 million which is currently underway.

Adavale Resources (ASX:ADD) has acquired a new exploration licence in South Australia over an uranium exploration opportunity between its existing Mundowdna and Lake Surprise project areas.

American West Metals (ASX:AW1) has identified several outstanding new copper targets at its Storm project on Somerset Island in Nunavut. Moving loop electromagnetic data also indicates that high-grade copper mineralisation at the Cyclone deposit likely extends in most direction.

Metallurgical testing at Brazilian Critical Minerals’ (ASX:BCM) Ema project in Brazil has returned rare earth recoveries averaging 68%, some of the highest ever recorded recoveries from an ionic clay-hosted deposit.

Brightstar Resources’ (ASX:BTR) notes that Linden Gold Alliance, which it is in the process of acquiring, has ramped up mining rates at the Second Fortune gold mine.

EZZ Life Science Holdings (ASX:EZZ) is rewarding shareholders with a 1.5c dividend for the half-year ended 31 December 2023. The company has seen strong performance from its health and wellness products with customer receipts for Q2 FY2024 up 57% over the previous corresponding quarter to $13.6m while third quarter receipts jumped up to $23.6m.

Golden Mine Resources (ASX:G88) has received a $358,825 research and development tax refund from the Australian Tax Office in relation to activities at its flagship Quicksilver nickel-cobalt project.

Legacy Minerals (ASX:LGM) is compiling a database of historical data over its Drake project that will help determine the forward exploration program with the company considering the appropriate use of airborne and ground geophysical surveys to provide comprehensive data across the project area.

Marmota (ASX:MEU) has unveiled plans to scale up drilling at its Junction Dam project in South Australia to infill its 5.4Mlb Saffron resource and test four priority targets across one of South Australia’s most attractive uranium exploration licences.

New World Resources (ASX:NWC) has secured a third rig to carry out reserve definition work at its Antler copper project, which already hosts a resource of 11.4Mt grading 4.1% copper equivalent.

Prospect Resources (ASX:PSC) is progressing acquisition of the Mumbezhi copper project in Zambia with the issue of 8.3 million shares priced at 12c each and 6.25 million unlisted options exercisable at 15c and expiring on 11 April 2027 to Orpheus Uranium. The company had initially reached the agreement in return for Orpheus withdrawing all legal claims to the exploration licence. It also grants the company ownership of all existing mining and geological data over the project, which is now being processed, catalogued and analysed.

White Cliff Minerals (ASX:WCN) has been granted all federal licences for its Radium point uranium-copper-gold-silver project in Canada, which will allow it to proceed with its summer field season. Initial work at Radium Point and Nunavut will include infield rock chip sampling, reconnaissance, and the airborne geophysical survey, which will then be followed maiden drilling. The company has also completed exploration drilling at its Reedy South gold project in WA’s Cue Goldfields region to test for strike and depth-extensions to existing inferred resources of 42,400oz of gold. Additionally, a geochemical campaign is nearing completion at the Lake Tay (Johnston) gold-lithium project and Diemals gold-copper-lithium-nickel project.

PharmAust (ASX:PAA) – pending an announcement in relation to the composition of the Board.

Manuka Resources (ASX:MKR) – pending an announcement in relation to a proposed capital raising.

Larvotto Resources (ASX:LRV) – pending the release of material results from a recent drilling program.

Wide Open Agriculture (ASX:WOA) – pending the release of an announcement regarding a capital raising.

At Stockhead, we tell it like it is. While Prospect Resources, White Cliff Minerals, Adavale Resources, American West Metals, Brightstar Resources, EZZ Life Science Holdings, Golden Mile Resources, Legacy Minerals, Marmota and New World Resources are Stockhead advertisers, they did not sponsor this article.